February 2024 Real Estate Market Update:

The pulse of the New Jersey real estate market is quickening with curiosity as buyers, sellers, and investors alike ask the all-important question: How’s the market now? Well, the answer lies not in mere speculation but in understanding current market dynamics such as inventory levels, mortgage interest rates, and historical trends. Let’s dive deeply into the numbers and predictions to see what the future may hold for the United States and here at the Jersey Shore.

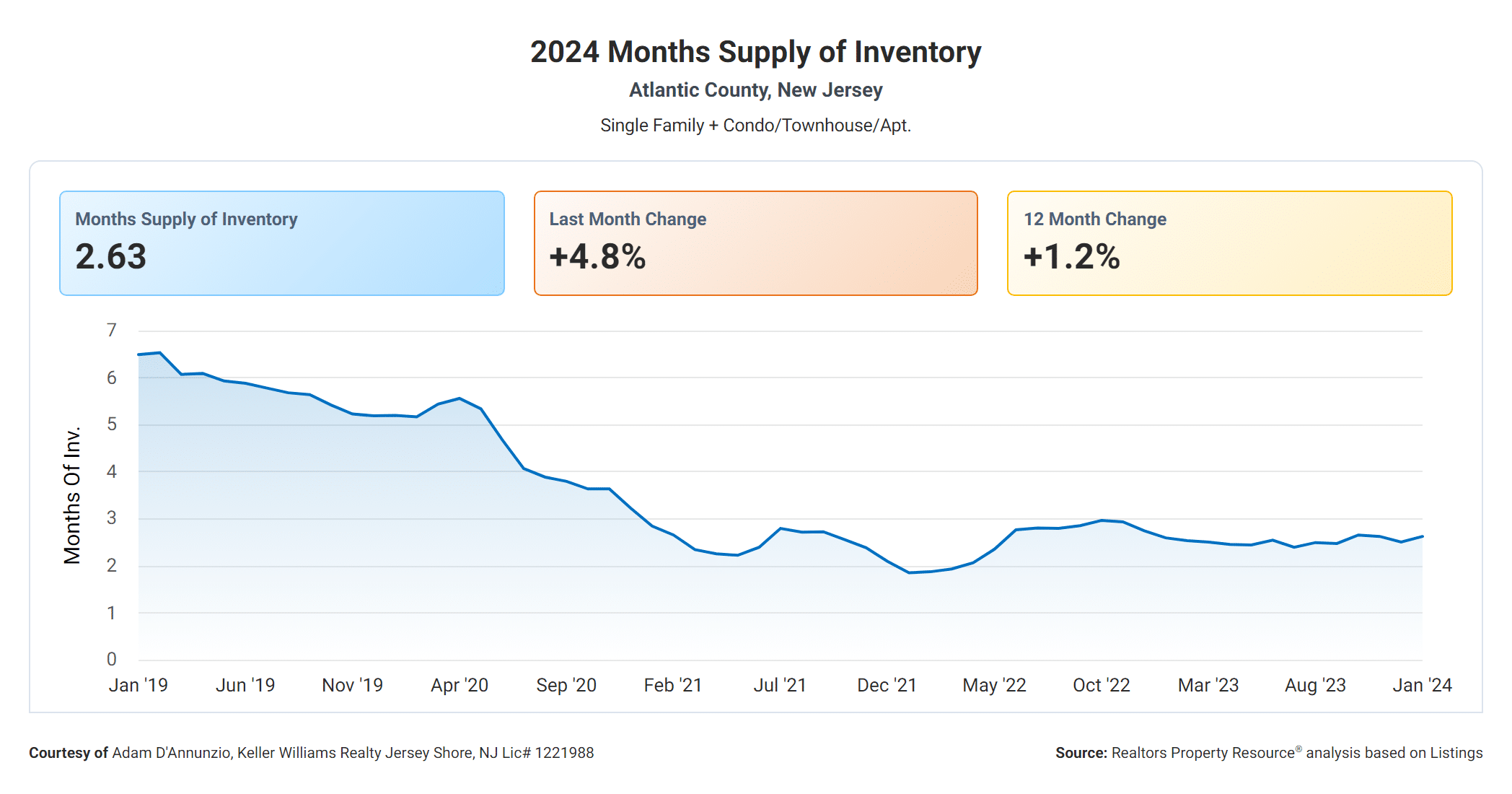

Low Inventory Levels: A Seller’s Market Remains

Year years starts with the continunation of consistently low housing inventory. As observed in Cape May and Atlantic Counties, there have been only slight fluctuations; we’re still above the stark shortage of 2021 yet markedly below what made for a “normal” market in 2019. This persistent lack of available homes continues to fuel a seller’s market.

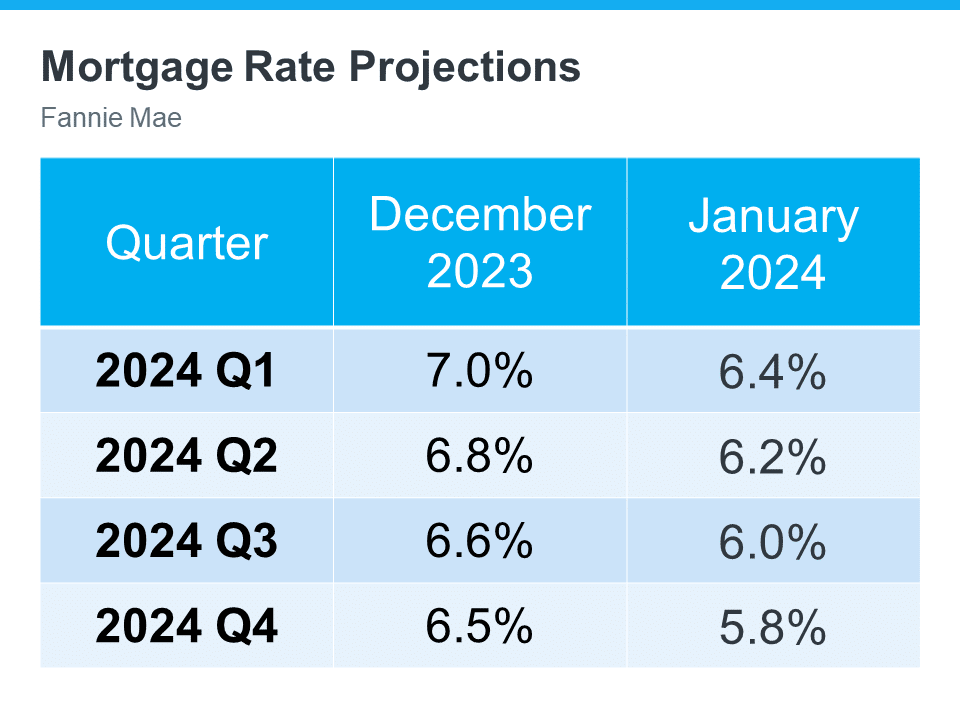

Mortgage Interest Rates: A Glimpse of Relief

Mortgage interest rates, having spiked to historic highs last fall, have dropped slightly recently and are projected to continue this downward trend throughout the year. Lower rates could spell good news for potential homebuyers in New Jersey and sellers looking for another home.

Price Projections: A Modest Rise Anticipated

Popular opinion often gravitates toward a sense of impending doom for house prices at the start of each year. Yet history has shown that more commonly, prices rise by year-end. Experts suggest we may witness this again in 2024, albeit at a slower pace, creating opportunities for growth without the frenzy.

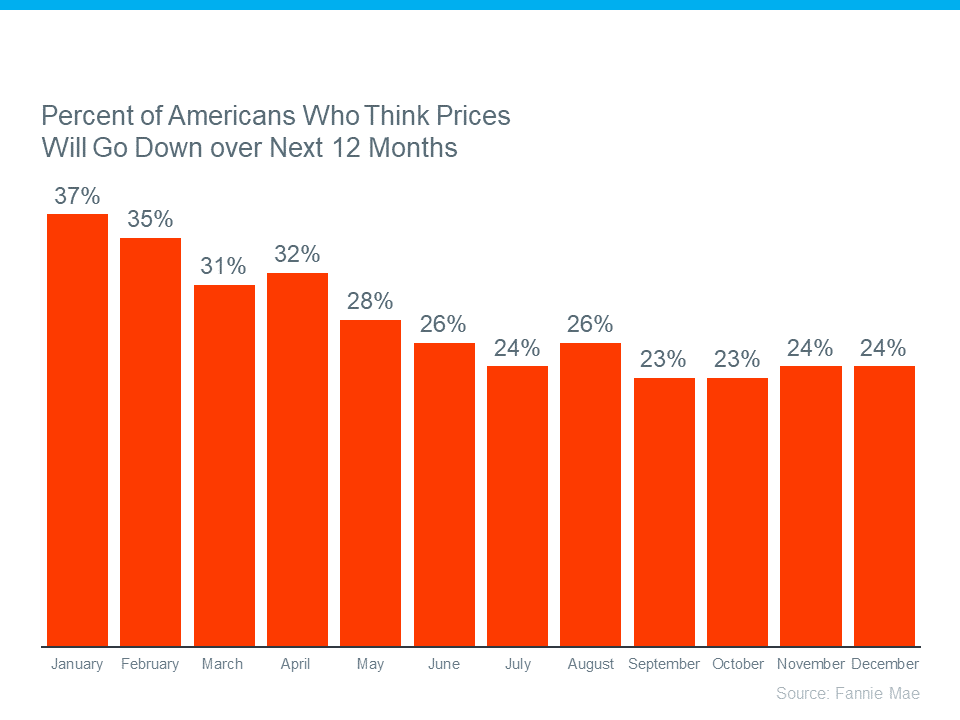

What Americans Think vs. Historical Data

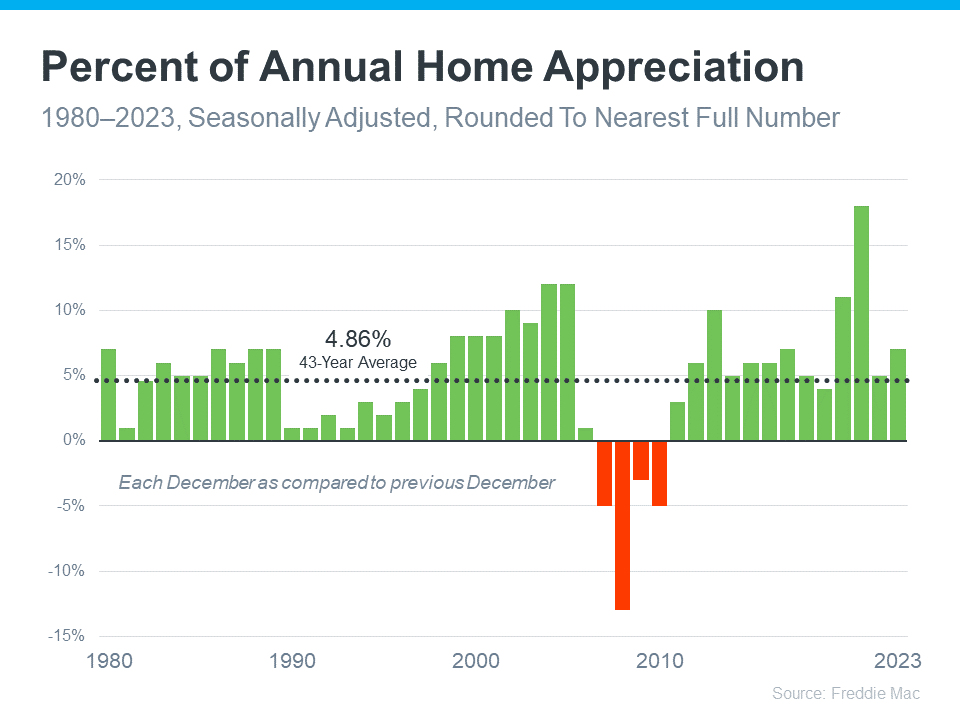

Consumer sentiment has fluctuated, with fewer Americans now expecting a decline in home prices. Regret looms for those who hesitated to buy in past years, missing out on formidable appreciation. However, a look back from 1980 reveals a significant narrative: home prices rarely fall. Across 43 years, we’ve seen an average appreciation of almost 5% annually, a ‘normal’ we are returning to post the wild climbs of recent times.

Reflecting on the past 30 years, prices have soared nearly 300%, with the last five years accounting for a 54% increase. Notably, the past year accounted for a 7% increase, highlighting the lucrative nature “time in market” vs “timing the market.”

Forecasts Revised: Economists and Expert Predictions

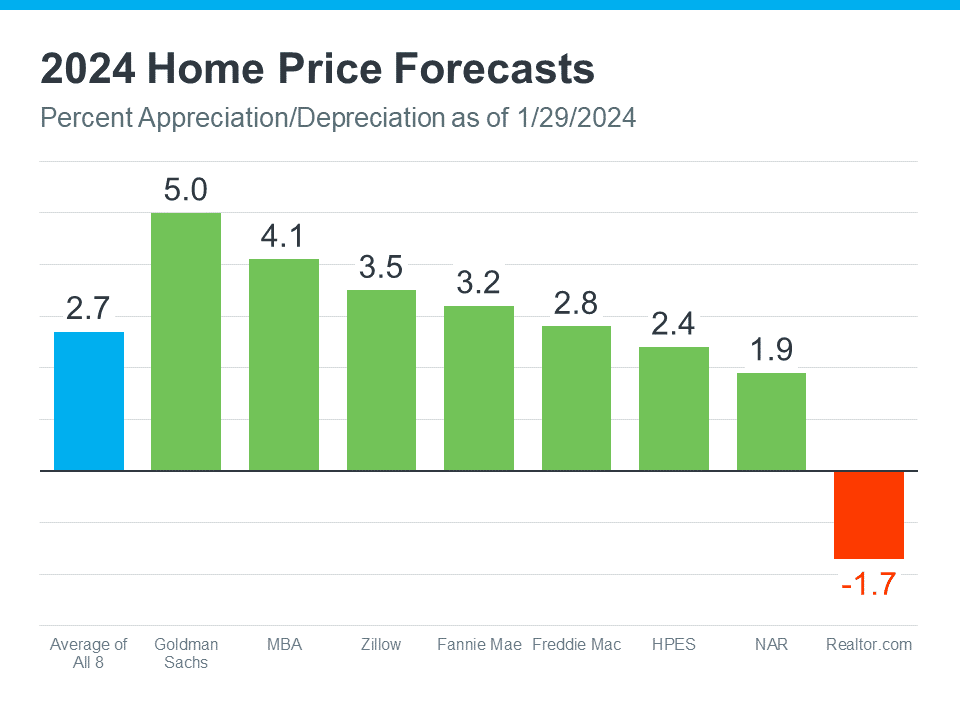

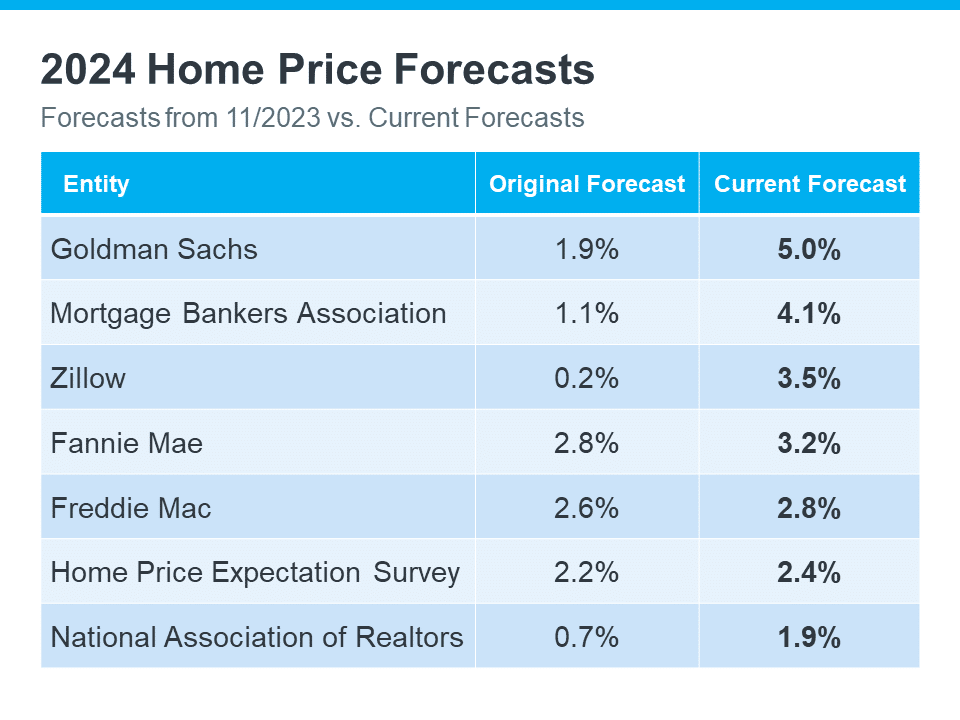

Early predictions for 2024 have already been adjusted as January arrived, with eminent institutions like Goldman Sachs and real estate stalwarts like Zillow and Realtor.com revising their forecasts to reflect a leaning towards appreciation rather than depreciation.

Despite one outlier, Realtor.com, expecting a price dip, consensus tilts towards a continued albeit more measured appreciation. This aligns with historical precedents that underscore rare instances of significant depreciation, usually linked to broad financial crises.

Mortgage Rate Rollercoaster: The Highs of 2022 and the Outlook for 2023

In a dramatic turn, 2023 witnessed spiking mortgage interest rates, which have since begun to retract. Should this trend persist, a more relaxed rate landscape could emerge in 2024, a welcome change for many.

Conclusion

New Jersey stands at a fascinating juncture in its real estate journey. With signs pointing to stable yet modest growth, a tempered market awaits. Inventory will remain a critical factor, while mortgage rates could be pivotal in shaping the market’s trajectory. As for prices, the trend towards incremental appreciation is the probable path, offering a stable ground for investment and homeownership decisions.

For real estate investors, local owners, and homebuyers alike, understanding these market signals and preparing for the modest growth anticipated could make for an educated decision.