The real estate market is often as dynamic as it is unpredictable. As we move into May 2024, the New Jersey real estate landscape presents unique challenges and opportunities for real estate investors, homebuyers, and local residents. This blog post provides an in-depth analysis of current trends, interest rate impacts, and the future of the New Jersey real estate market.

A Slower Spring Market

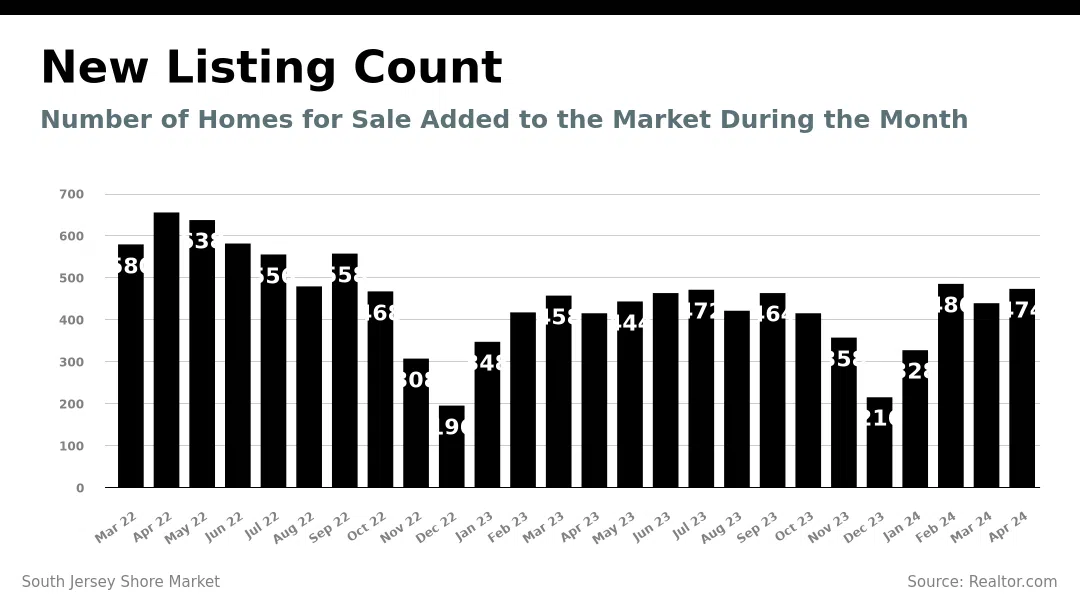

Over the past month, particularly this spring, the New Jersey real estate market has not experienced the usual uptick in activity typically associated with this time of year. Historically, spring is a bustling period for real estate transactions, but this year has defied expectations with fewer listings, contracts, and property sales.

Key Observations:

-

- Fewer Listings and Contracts: The number of new listings and properties going under contract has significantly decreased.

-

- Multiple Offers on Correctly Priced Properties: Despite the overall slowdown, properties that are priced correctly still receive multiple offers and sell quickly.

-

- Slower Market Compared to Previous Years: The market is much slower this year than last year, which was already slower than the previous year.

-

- Competitive Market in Specific Areas: The market remains extremely competitive offshore in the immediate towns just outside of the barrier islands at the South Jersey Shore. While the lower to average price points are still busy, the luxury market is experiencing a slower pace, with properties taking longer to sell.

Interest Rates: A Double-Edged Sword

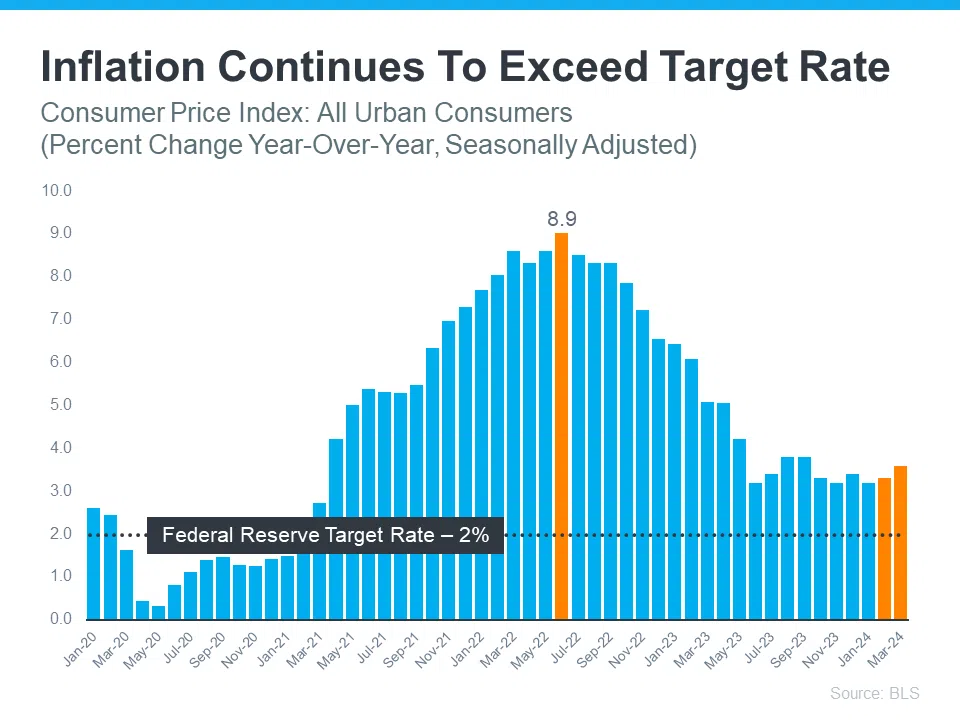

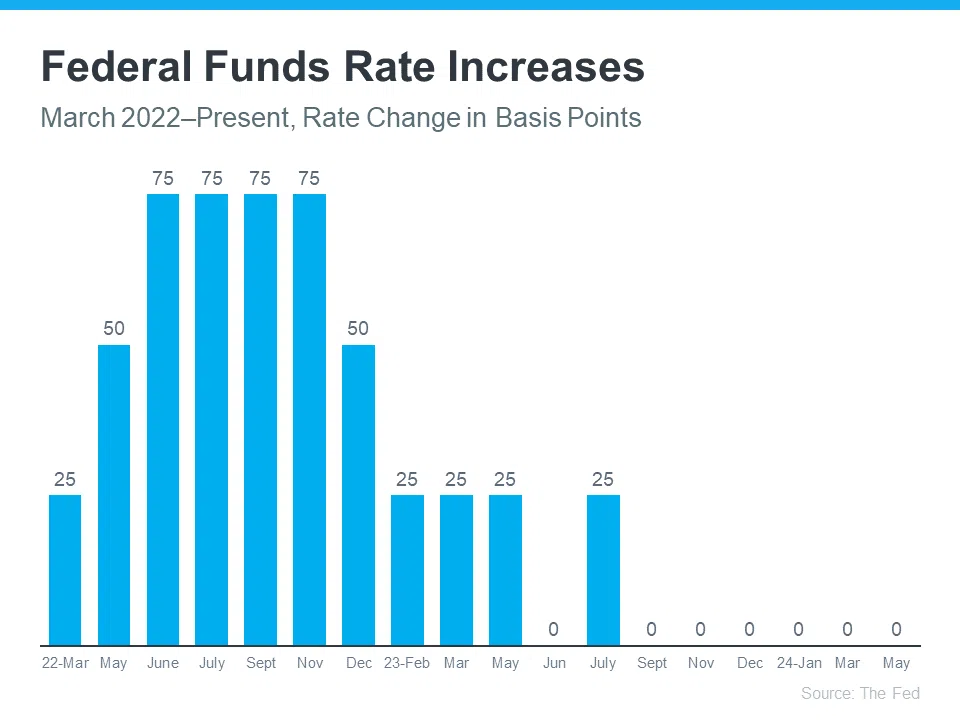

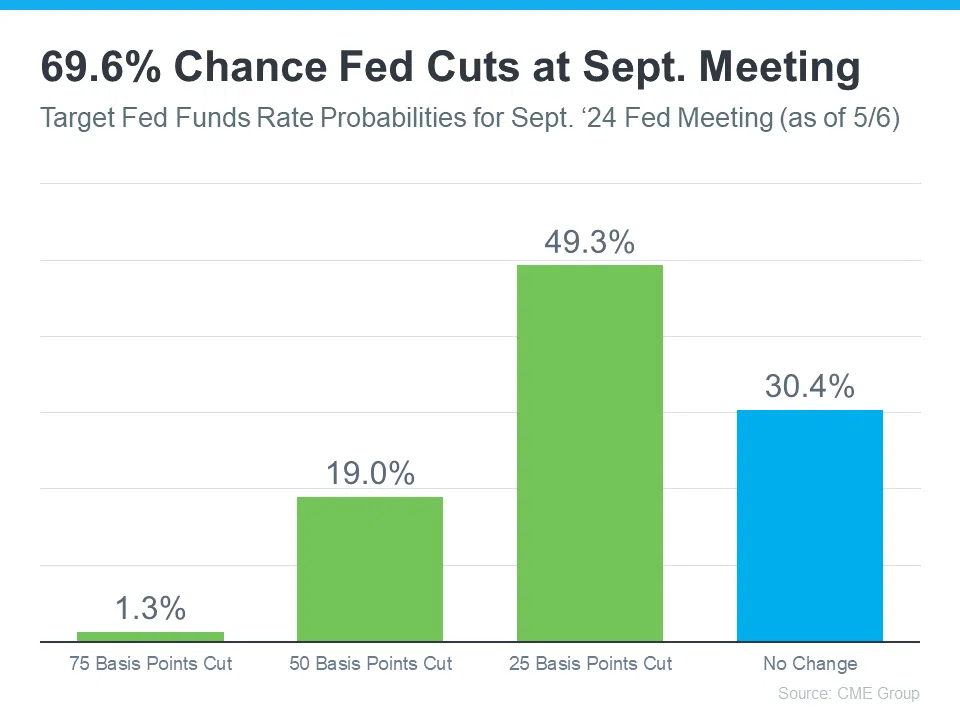

Much of the recent market news has centered around interest rates. After peaking in October 2023, rates have fluctuated but remain relatively high. The latest Federal Reserve decision in May 2024 resulted in no change, contrary to earlier predictions of rate declines by this time of year.

Current Interest Rate Scenario:

-

- Interest Rates Over 7%: Rates recently hit over 7% again but have slightly decreased since.

-

- Volatility: Interest rates continue to be volatile, moving up and down frequently.

-

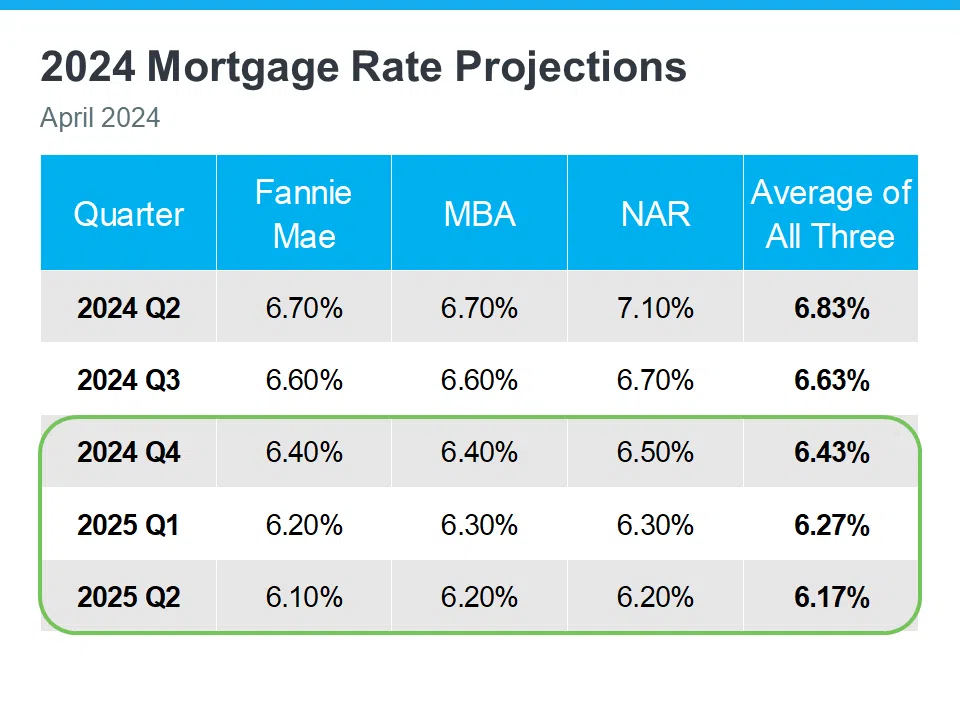

- Rate Predictions: Initial expert predictions for a decrease to the fives by the end of the year now seem unlikely. The best-case scenario is a reduction to the mid or low sixes, potentially after September.

Market Data Analysis

To better understand the current state of the market, let’s dive into some key metrics:

Home Sales:

-

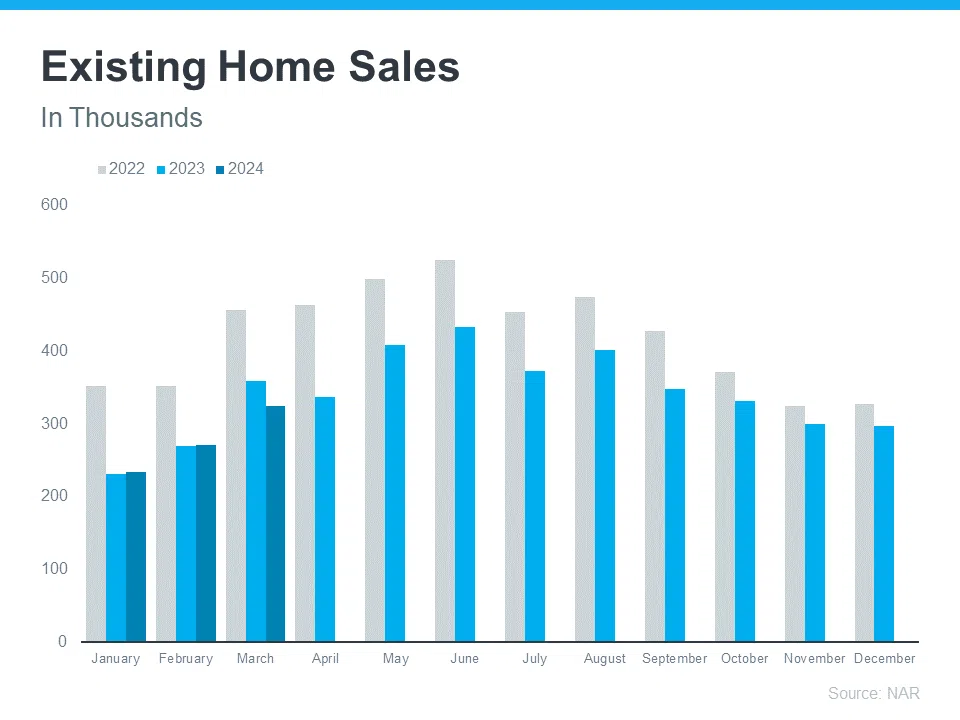

- Significant Decline: Home sales across the United States have significantly declined over the past two years. March 2024 recorded even lower sales than the previous year.

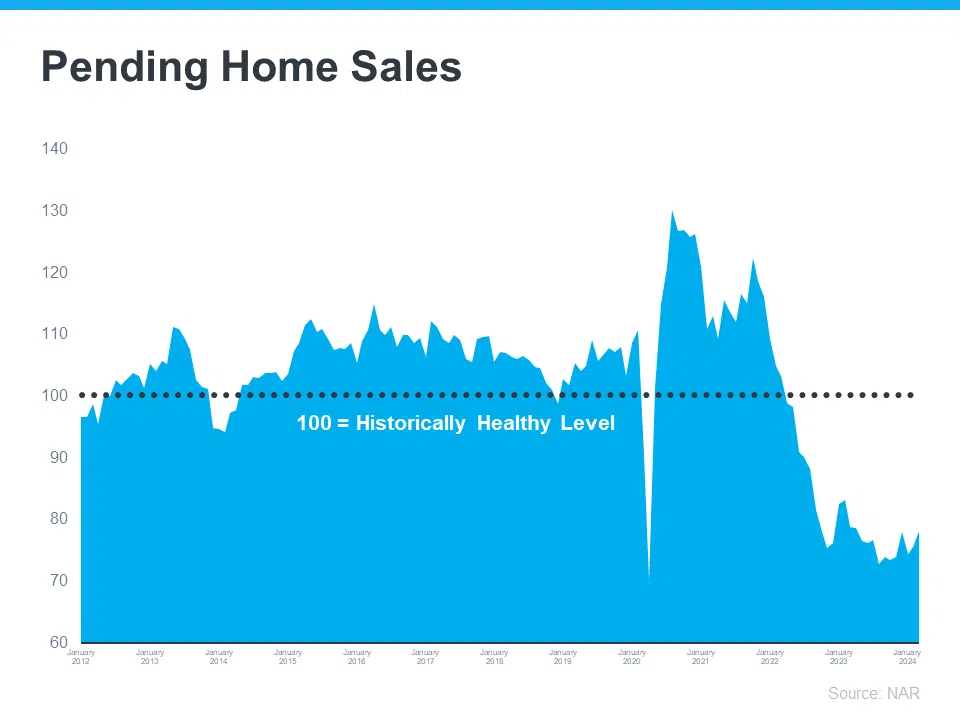

Pending Home Sales:

-

- Decreased Contracts: The number of homes under contract is significantly lower than in previous years, continuing a trend that has persisted for a couple of years.

Showings:

-

- Strong Buyer Interest: Despite fewer contracts and listings, the number of showings remains strong, indicating continued buyer interest. This suggests that well-priced listings are still performing well.

Local Market Insights: Atlantic and Cape May Counties

Atlantic County:

-

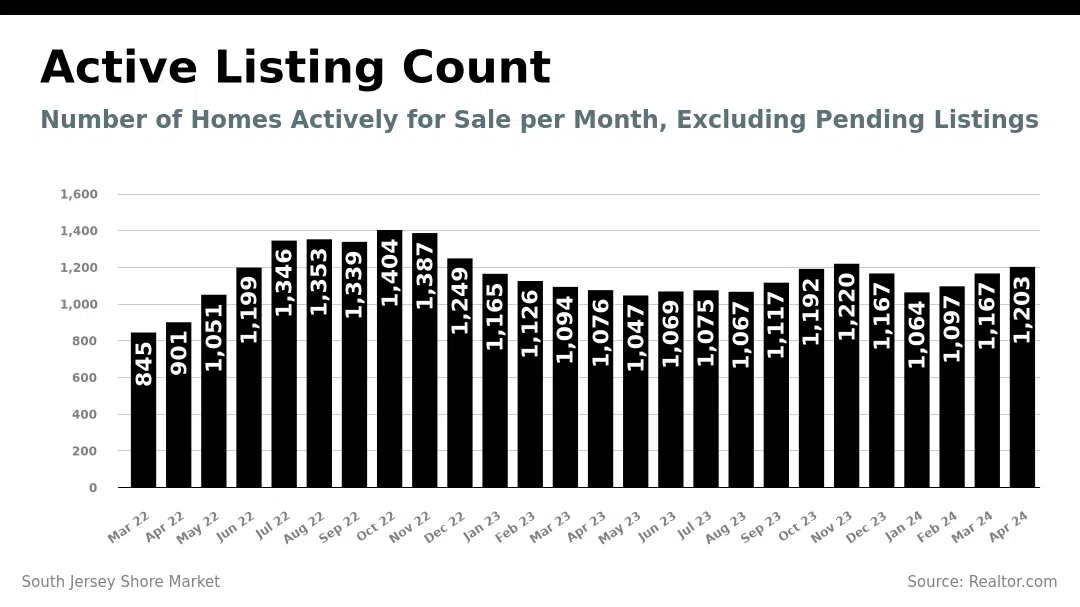

- Months of Inventory: The county is hovering around three months of inventory. A transition to a neutral market is anticipated if this number approaches four to five months, with five to six months indicating a definite neutral market moving towards a buyer’s market.

Cape May County:

-

- Inventory Increase: Inventory has ticked up slightly, approaching four months. Once it exceeds this point, the market is expected to shift more towards neutrality.

South Jersey Shore Barrier Islands:

-

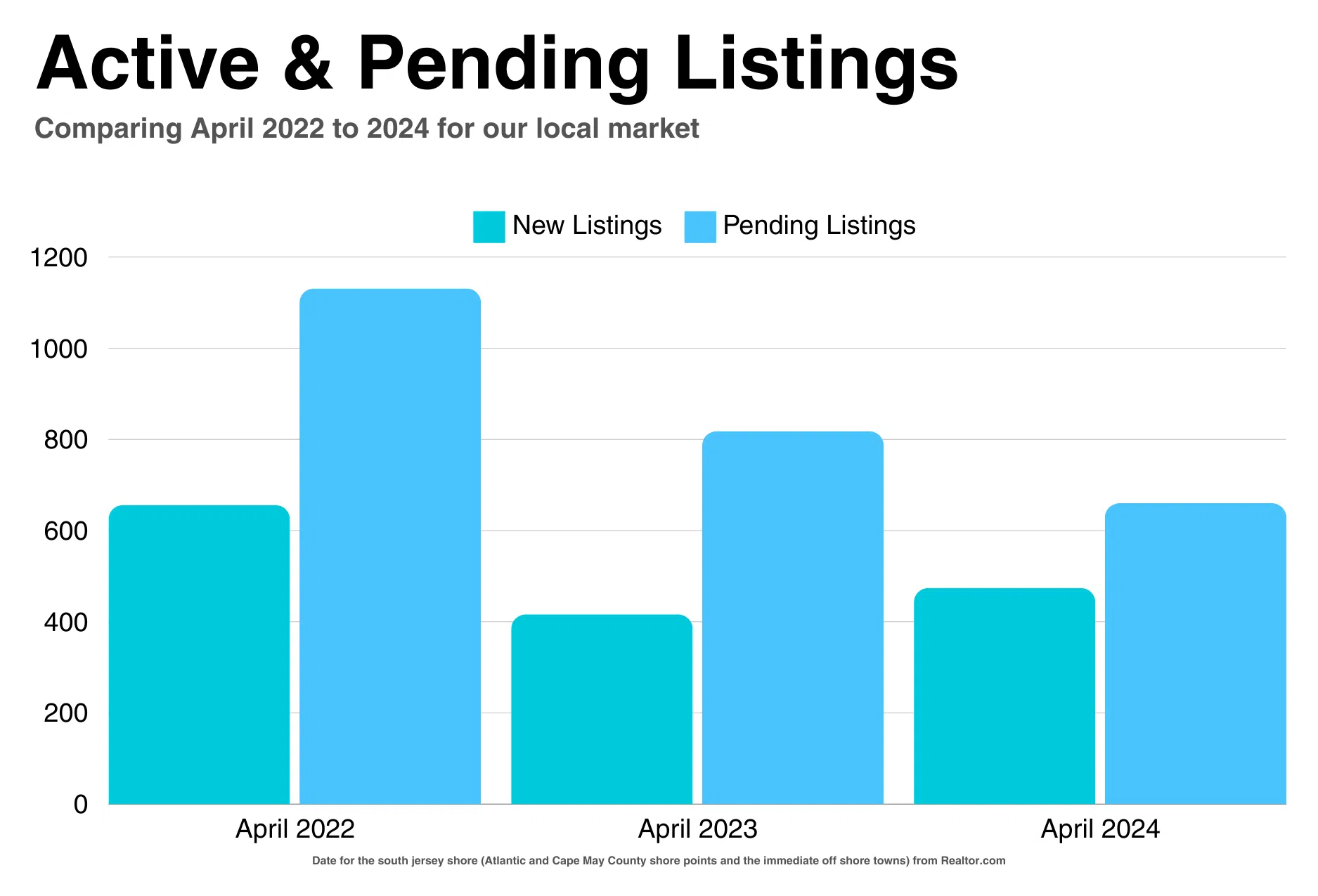

- New Listings: April 2024 saw a significant drop in new listings compared to previous years. Listings fell from approximately 650 in April 2022 to around 475 in April 2024.

-

- Under Contracts: Similarly, the number of properties going under contract has decreased from about 1100 in April 2022 to around 650 in April 2024.

The Impact of High Interest Rates

High interest rates have played a significant role in the current market dynamics. Many potential sellers are hesitant to put their homes on the market, resulting in fewer new listings. However, this hasn’t deterred buyers, who continue to face a competitive market with multiple offer situations.

Looking Ahead

As we move further into 2024, it will be crucial to monitor interest rate trends and inventory levels closely. While there is hope for a rate decrease later in the year, the overall market stability and buyer demand suggest that well-priced properties in good condition will continue to perform well.

Final Thoughts

The New Jersey real estate market in May 2024 presents a mixed bag of challenges and opportunities. While the market is slower than in previous years, competitive dynamics persist in certain areas and price points. High interest rates remain a critical factor influencing market behavior, and future rate adjustments will play a significant role in shaping the market landscape.

Whether you’re a real estate investor, homebuyer, or local resident, staying informed about these trends is essential. As always, if you have any questions or need personalized advice, feel free to reach out. I serve the South Jersey Shore area and have referral partners across the country and even international destinations. Let’s navigate this market together and make informed decisions for a successful real estate journey.