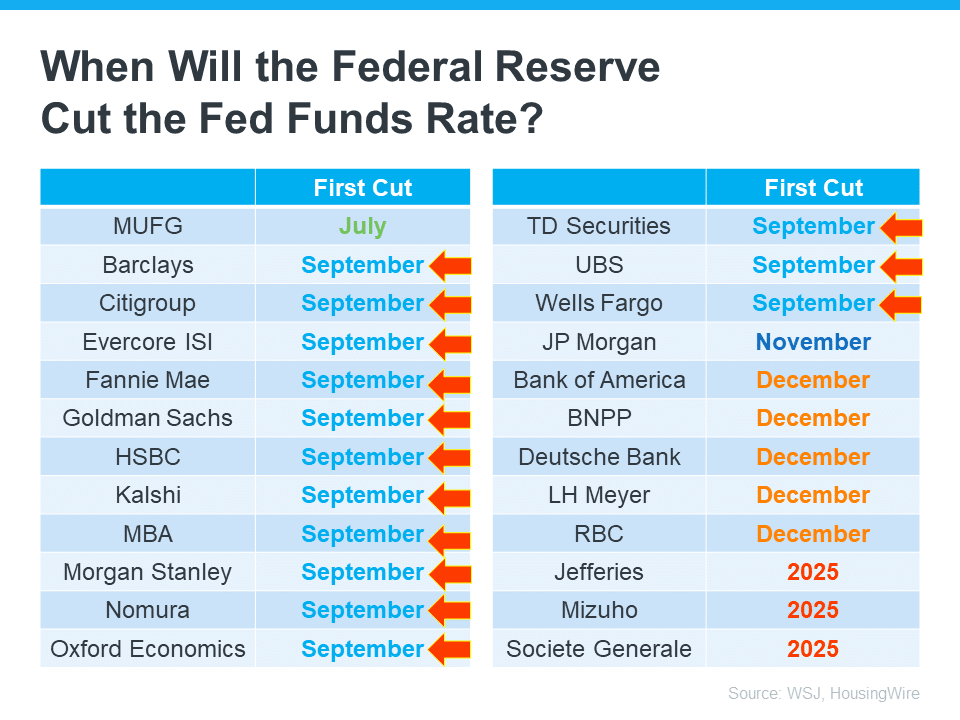

The market continues to show resilience! Despite a slight uptick in inventory levels, homes are still selling quickly and close to asking prices. Experts anticipate a potential 0.25% Fed rate decrease in September, which could further stimulate buyer activity.

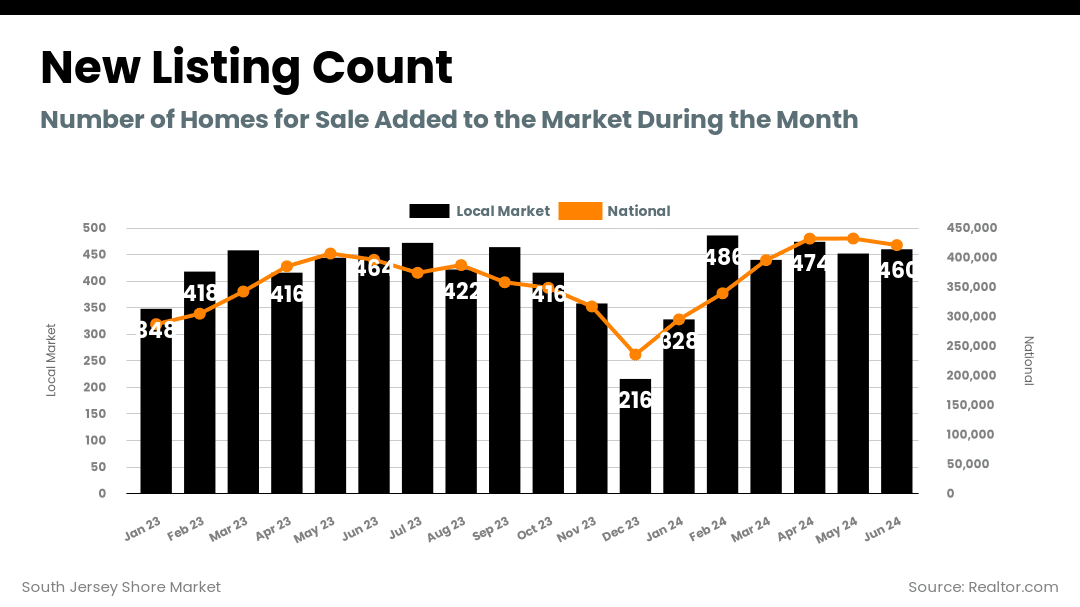

In this month's update, we explore how election years historically influence the real estate market and rates. We also compare the local market data for the first half of the year to the previous 2 years. At the shore, the spring market started late and spilled into the summer causing a competitive market at the start of the summer season.

Key insights include:

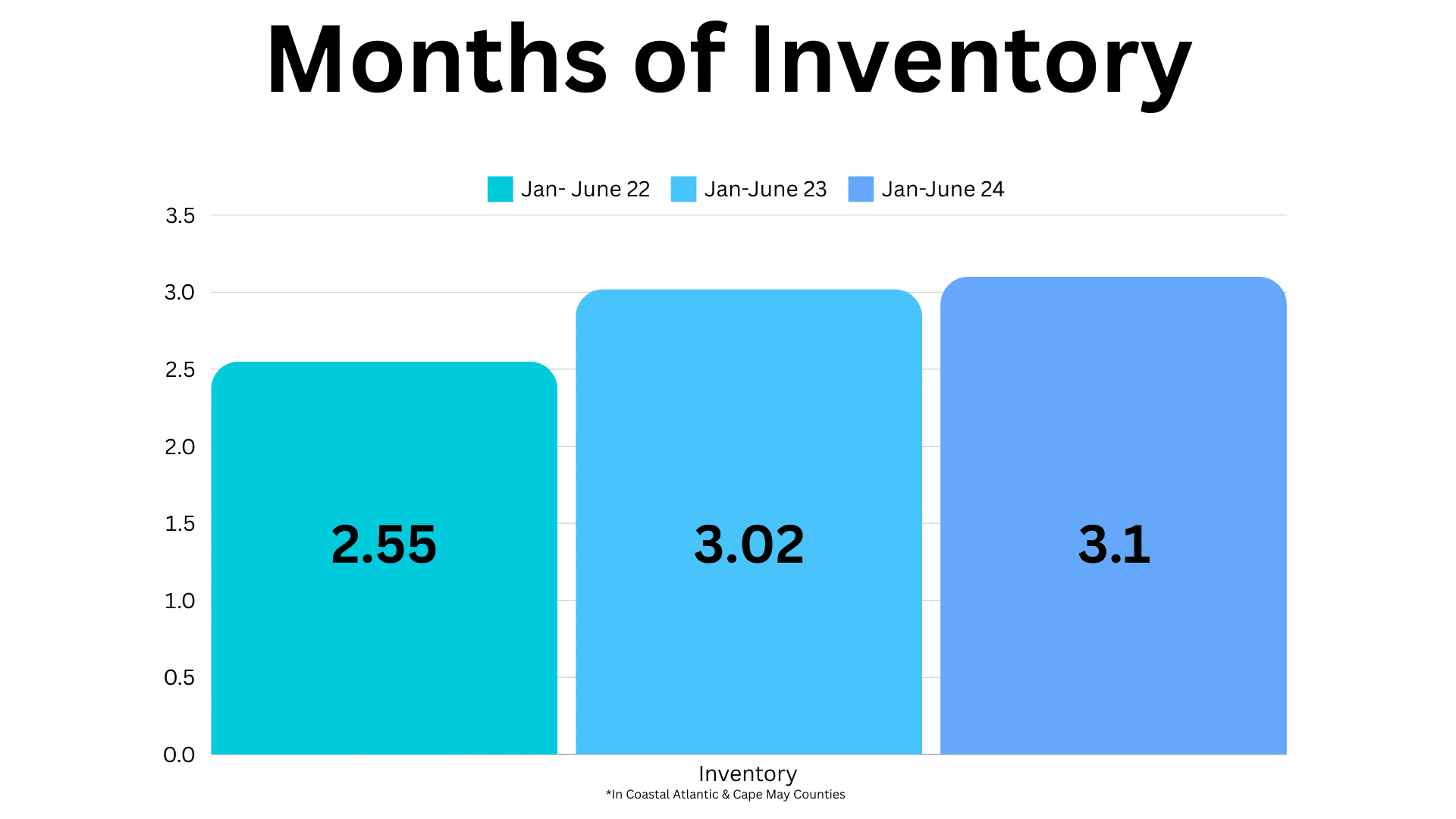

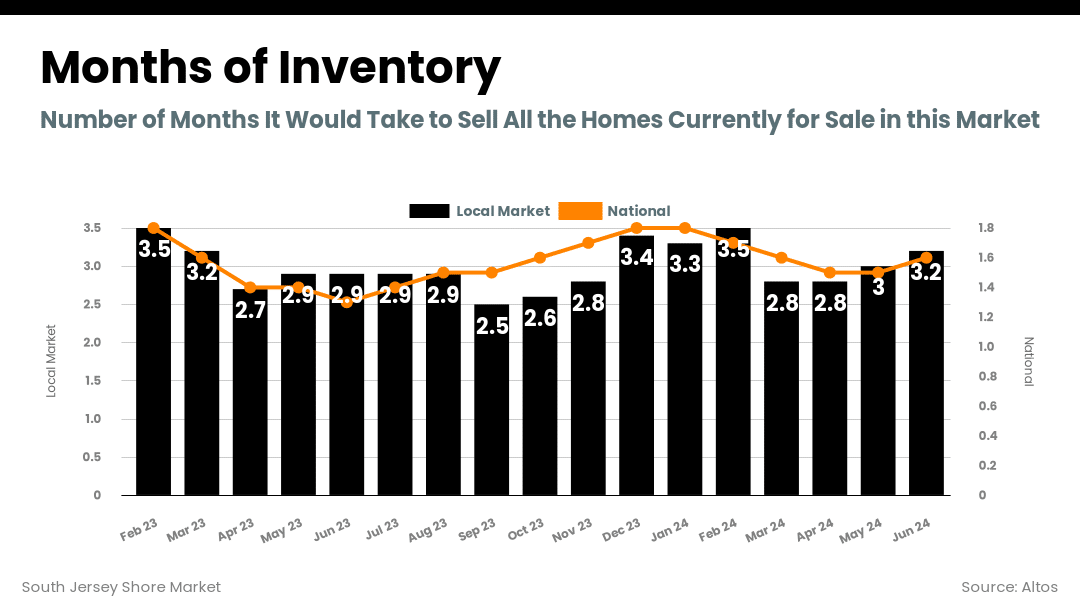

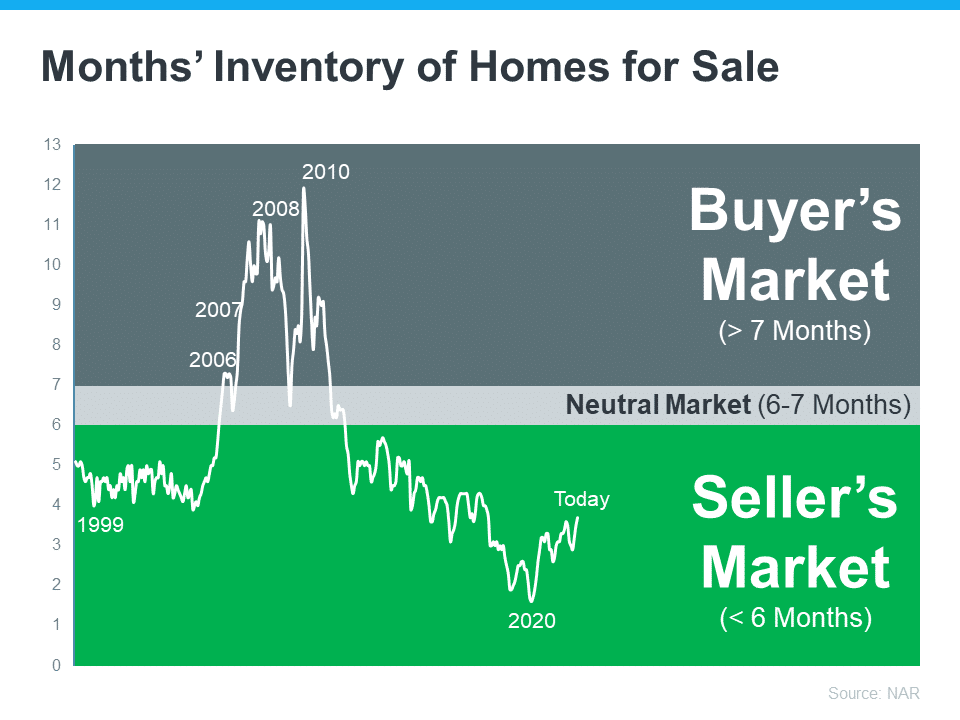

- Market Activity: The market has remained competitive, with low inventory and high buyer competition for properties both on the island and the mainland.

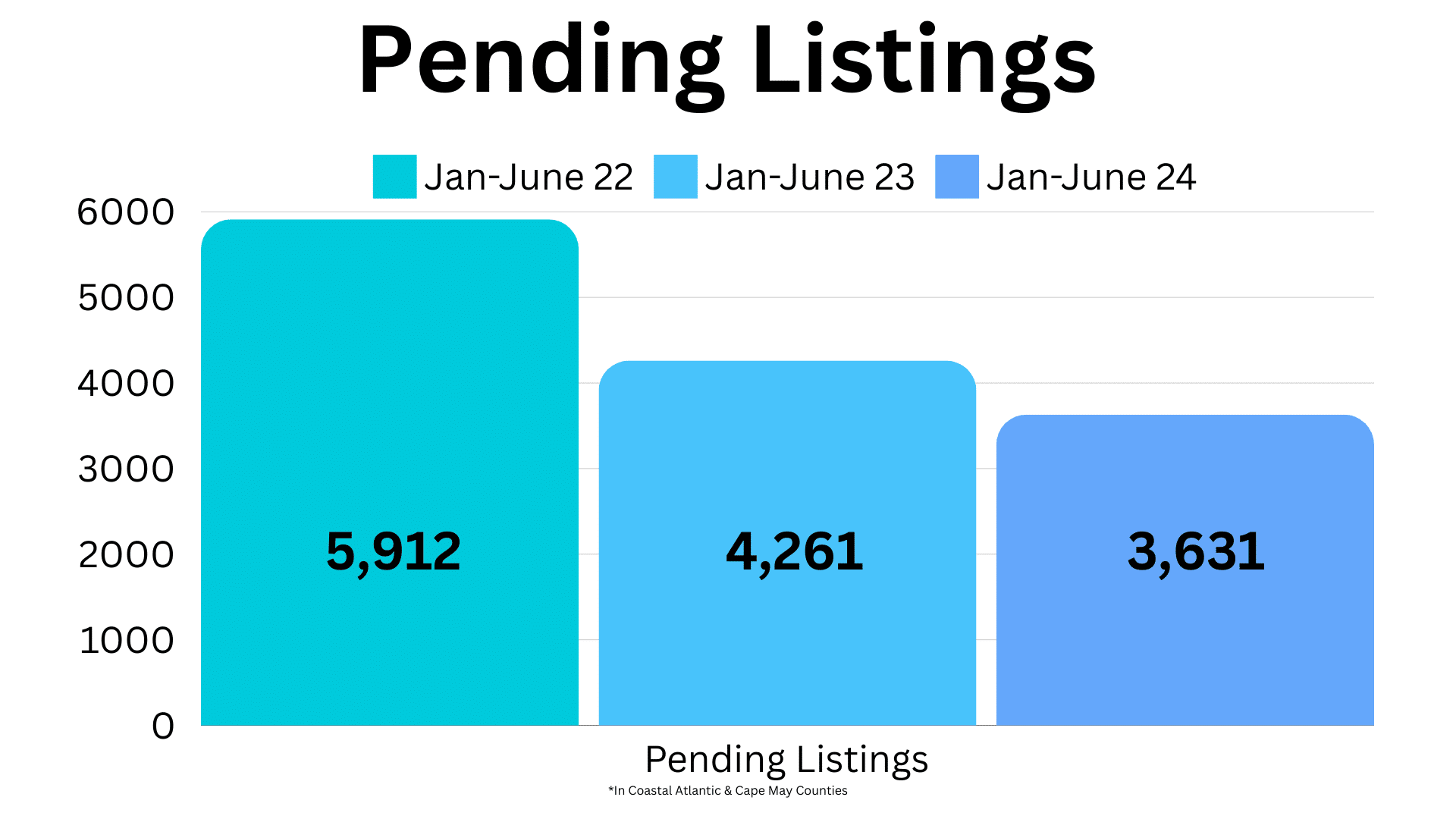

- Inventory Levels: Inventory has slightly increased compared to last year, but this is not due to more listings. Instead, there has been a decrease in the number of properties going under contract.

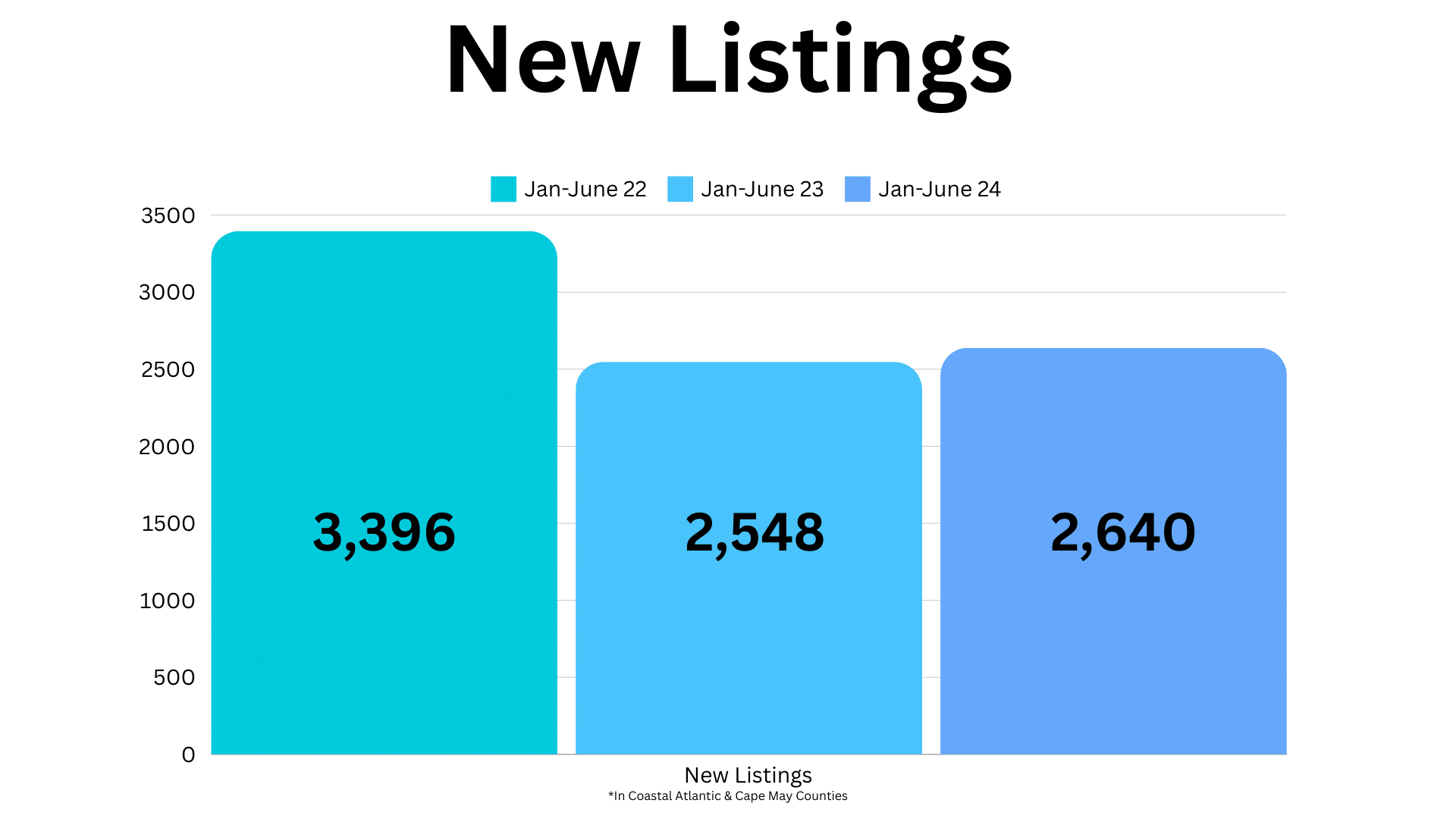

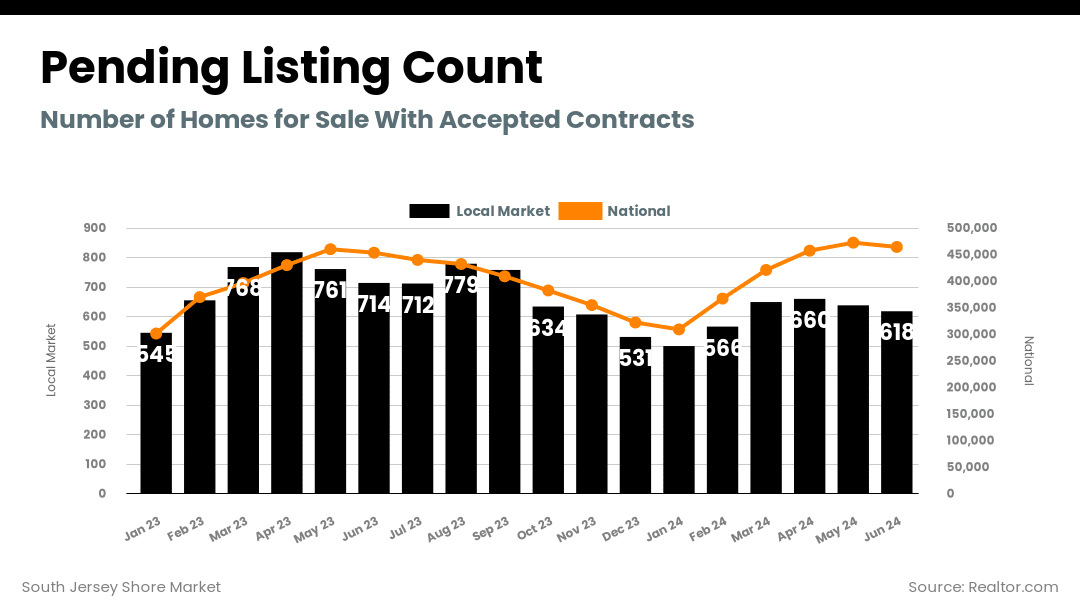

- Showings and Listings: Showings have picked up, aligning with trends from previous years. New listing counts are similar to last year, but pending listings are lower.

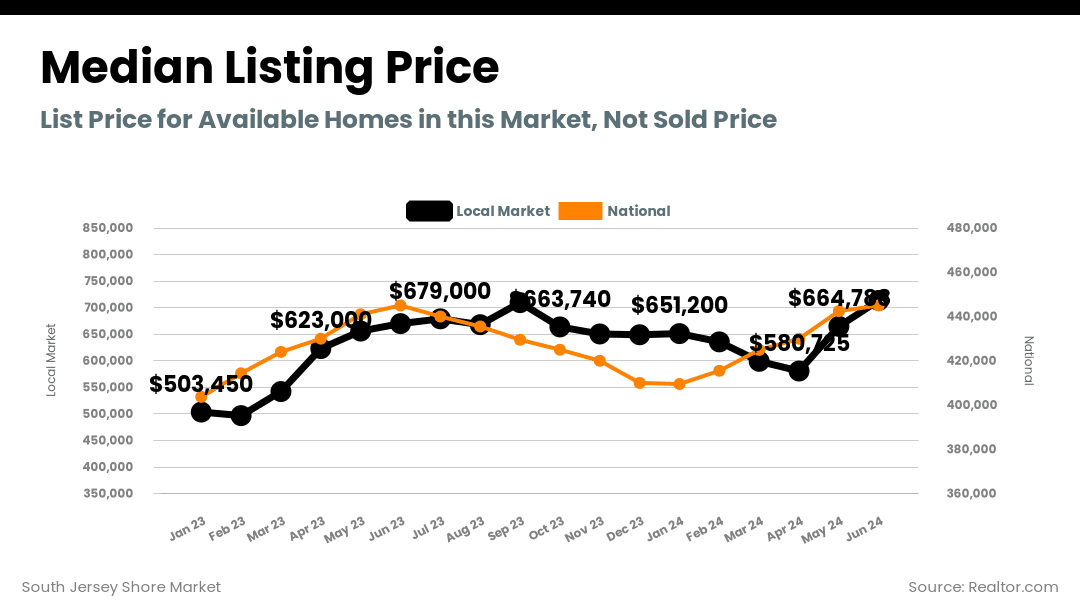

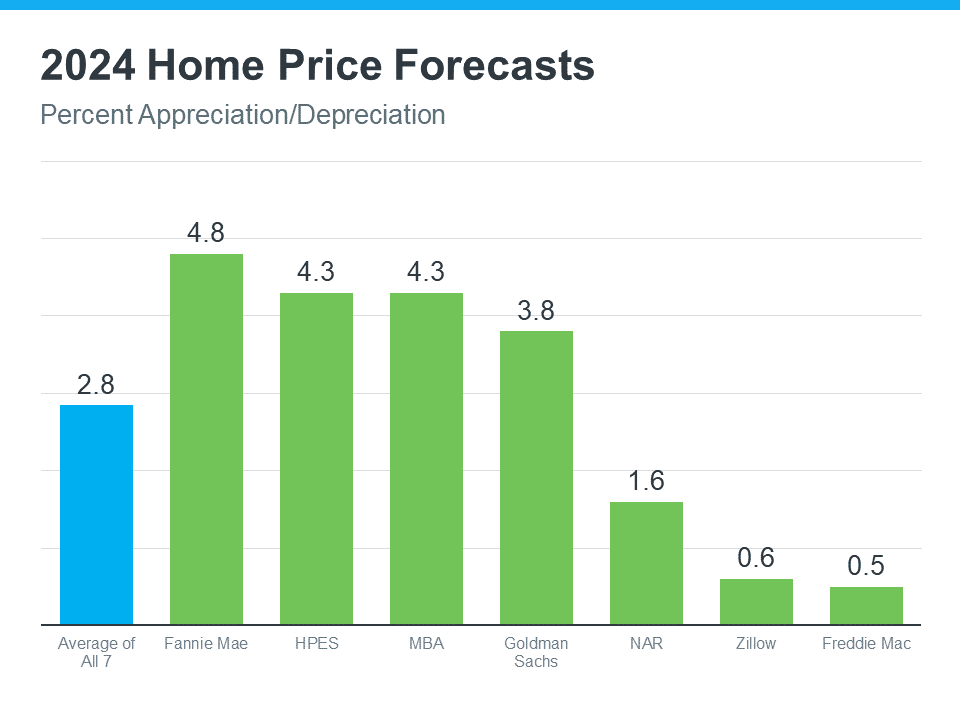

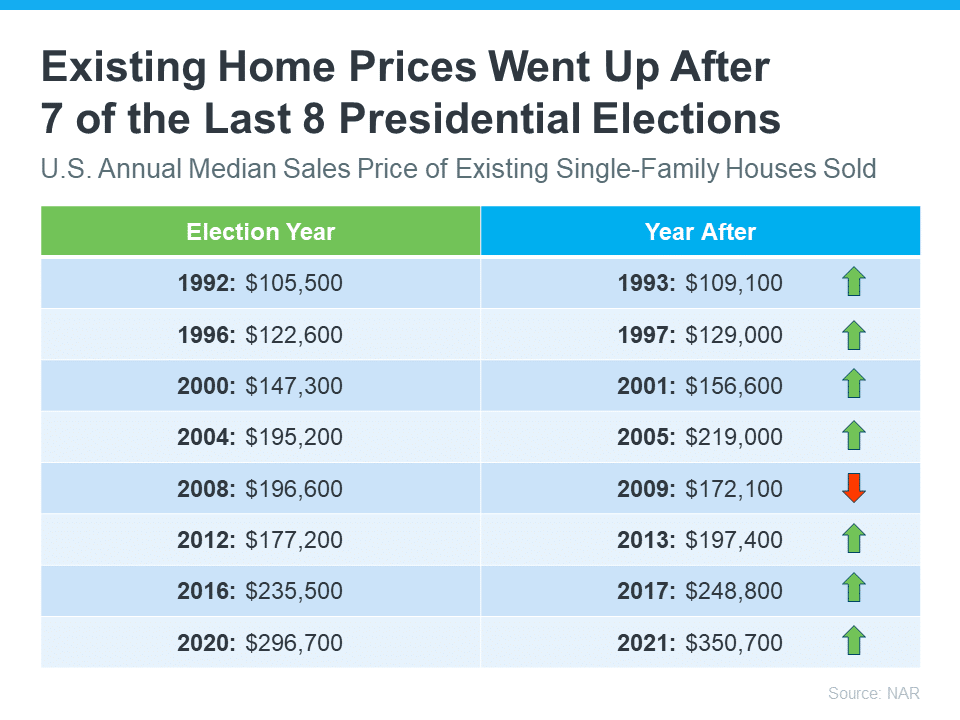

- Home Prices: Median home prices continue to rise, with experts predicting appreciation throughout 2024.

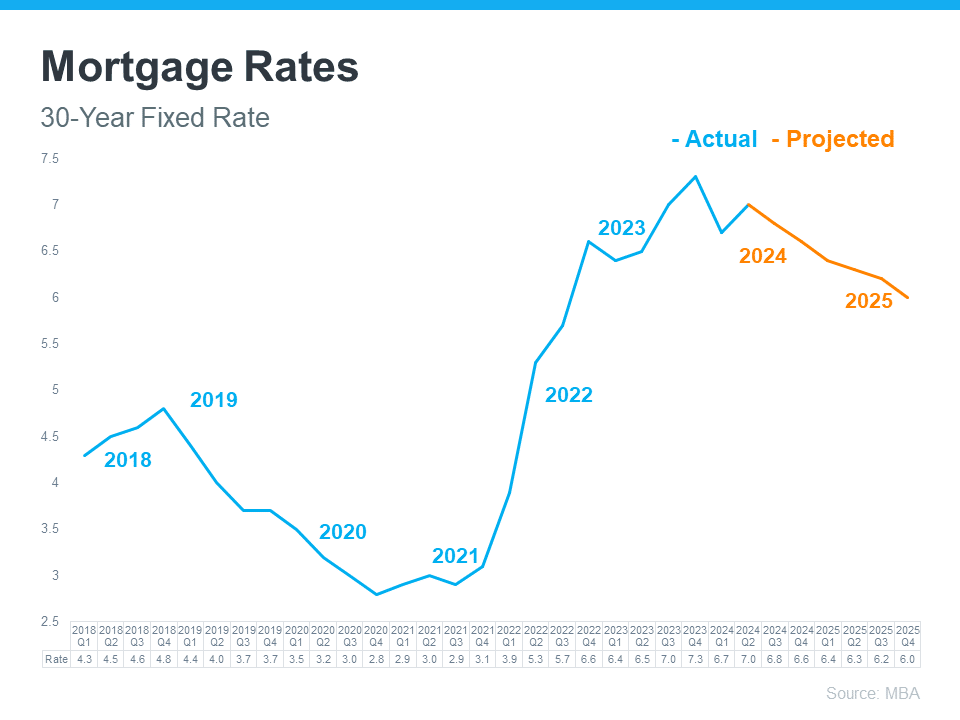

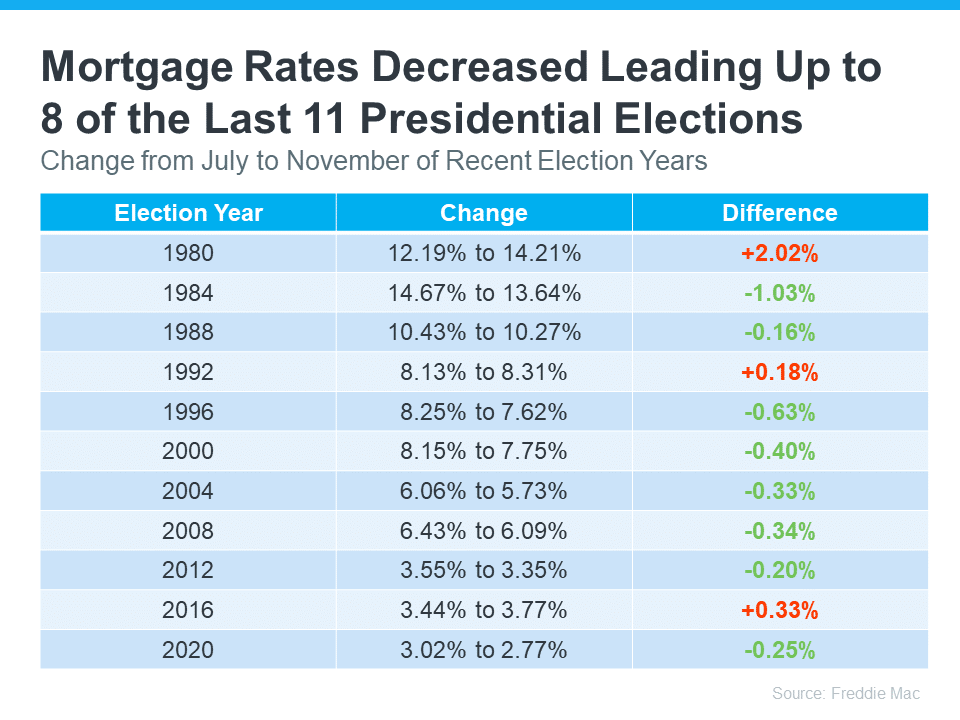

- Mortgage Rates: Interest rates have hovered around 7%, with possible decreases expected later in the year depending on Federal Reserve actions.

- Election Year Impact: Historical data suggests that election years do not typically have an immediate impact on the real estate market. Most past elections have seen stable or increased home sales and prices.

- New Regulations: Starting August 17, 2024, buyers in New Jersey will need to sign a representation agreement with their real estate agent before viewing homes. This is a significant change aimed at formalizing the buyer-agent relationship.