When buying a home in Ocean City, NJ, understanding flood insurance is critical. This coastal community is prone to flood risks due to its proximity to the ocean and back bays, and many properties are located in flood zones where insurance is either required or strongly recommended. In this guide, we’ll cover everything you need to know about flood insurance, including the differences between FEMA’s National Flood Insurance Program (NFIP) and private market flood insurance, special surcharges, and important waiting periods.

Read our other post on FEMA flood insurance changes and watch video here.

What Is Flood Insurance and Why Is It Important in Ocean City, NJ?

Flood insurance protects homeowners from financial losses caused by flooding—something standard homeowners insurance won’t cover. In Ocean City, NJ, with its location near the coast, homes are particularly vulnerable to flood damage from storms, high tides, and rising sea levels. Lenders often require flood insurance for properties located in high-risk areas, but even homes in lower-risk zones can benefit from having this coverage.

FEMA Flood Insurance vs. Private Market Flood Insurance

When purchasing flood insurance, you typically have two options: the National Flood Insurance Program (NFIP), managed by FEMA, or private market flood insurance. Each option has distinct advantages and drawbacks depending on your situation.

FEMA’s National Flood Insurance Program (NFIP)

- Standard Coverage: The NFIP offers federally backed flood insurance with coverage limits of up to $250,000 for the structure of your home and $100,000 for its contents.

- Fixed Rates: FEMA flood insurance rates are set by the government and based on factors such as your home’s location, flood zone, and elevation. These rates are standardized, meaning they don’t vary from insurer to insurer.

- Accessibility: FEMA insurance is widely available and often required for homes in high-risk flood zones if you’re getting a mortgage.

- Limitations: NFIP policies have coverage limits that may not fully cover the cost to rebuild high-value homes. Additionally, NFIP doesn’t cover additional living expenses or loss of rental income if your home becomes uninhabitable.

Private Market Flood Insurance

- Higher Coverage Limits: Private flood insurance can offer higher coverage limits than the NFIP. This can be ideal for Ocean City homes with high market values that exceed FEMA’s coverage cap of $250,000.

- Customizable Policies: Private insurers may provide more flexible coverage options, including additional living expenses and rental income coverage, which FEMA policies do not cover.

- Competitive Pricing: Depending on your home’s location and risk factors, private flood insurance can sometimes be more cost-effective than FEMA policies. It’s worth shopping around to see if you can get a better rate.

- Variable Rates: Unlike FEMA, private insurers calculate rates based on their own risk models, which can vary significantly. This can lead to lower premiums for some properties, but higher premiums for others depending on the insurer’s risk assessment.

Understanding Flood Zones in Ocean City, NJ

Ocean City is divided into different flood zones that dictate your risk level and whether flood insurance is required:

- Zone AE: A high-risk zone where base flood elevations are determined. Homes in this zone are likely required to carry flood insurance if you have a mortgage.

- Zone VE: A coastal high hazard zone at even greater risk due to storm surges and wave action. Homes in Zone VE usually carry higher flood insurance premiums due to the increased risk.

- Zone X: These are areas of moderate or minimal risk. While flood insurance is not mandatory here, it’s still a smart investment, as floods can happen in low-risk areas too.

Flood Insurance Costs in Ocean City, NJ

The cost of flood insurance varies depending on factors such as your home’s flood zone, elevation, and the coverage amount you choose. Here are a few key elements that affect the price:

- Flood Zone: Homes in high-risk zones like AE and VE will have higher premiums than those in low-risk areas.

- Elevation: Homes elevated above the base flood elevation (BFE) may qualify for lower premiums.

- Owner-Occupied vs. Non-Owner Occupied: If you own a vacation home or rental property in Ocean City that is not your primary residence, there is an additional $250 annual surcharge for non-owner occupants under FEMA’s NFIP policies.

Waiting Period for Flood Insurance

It’s important to note that flood insurance typically has a 30-day waiting period before it becomes effective. This waiting period applies to new policies that are not required as part of a mortgage. If you’re buying a home with a mortgage and the lender requires flood insurance, the coverage will take effect immediately upon closing. However, if you’re purchasing flood insurance voluntarily for a home not subject to a mortgage, you’ll need to plan ahead, as the policy won’t take effect for 30 days after purchase.

How to Lower Your Flood Insurance Premiums

There are several strategies to reduce your flood insurance costs, whether you choose FEMA or private market insurance:

- Elevation Certificates: Getting an elevation certificate can help demonstrate that your home is built above the base flood elevation, potentially reducing your premiums.

- Flood Mitigation: Installing flood vents, elevating utilities, and other flood-proofing measures can lower your insurance rates.

- Compare Providers: Don’t be afraid to compare FEMA NFIP policies with private market options. Depending on your property’s specifics, a private insurer may offer better rates or more comprehensive coverage.

Why You Need Flood Insurance in Ocean City, NJ

For Ocean City homeowners, especially those in high-risk zones, flood insurance is often required by lenders. But even if you’re buying in a lower-risk zone, floods can happen anywhere, and the cost of flood repairs can be devastating without insurance. In fact, FEMA reports that just one inch of water can cause up to $25,000 in damage.

How to Purchase Flood Insurance in Ocean City, NJ

Most homeowners purchase flood insurance through FEMA’s NFIP, but private market policies are becoming more popular. To get started:

- Contact an insurance agent familiar with both FEMA and private flood insurance policies.

- Ask your real estate agent for local recommendations if you’re unsure of where to begin.

- If you’re buying a home, confirm with your lender if flood insurance is required as part of the mortgage process.

Flood Insurance Tips for Ocean City Homebuyers

- Know Your Zone: Check your flood zone to determine whether insurance is mandatory and what your potential premiums could be.

- Factor in Surcharges: Remember that if you’re buying a second home or rental property, you’ll be subject to the $250 surcharge under FEMA’s program.

- Plan for the Waiting Period: If you’re purchasing a home without a mortgage and flood insurance is not required, remember that there may be a 30-day waiting period before your policy becomes active. Be sure to buy flood insurance early to avoid gaps in coverage.

Conclusion

Flood insurance is a necessary safeguard when buying property in Ocean City, NJ. Whether you choose a FEMA policy or private market insurance, understanding your flood zone, knowing the costs, and planning for surcharges and waiting periods can help you protect your investment and enjoy peace of mind. For the best protection, explore both FEMA and private insurance options, and make sure your policy is tailored to your needs.

Contact a licensed insurance agent for specific insurance advice.

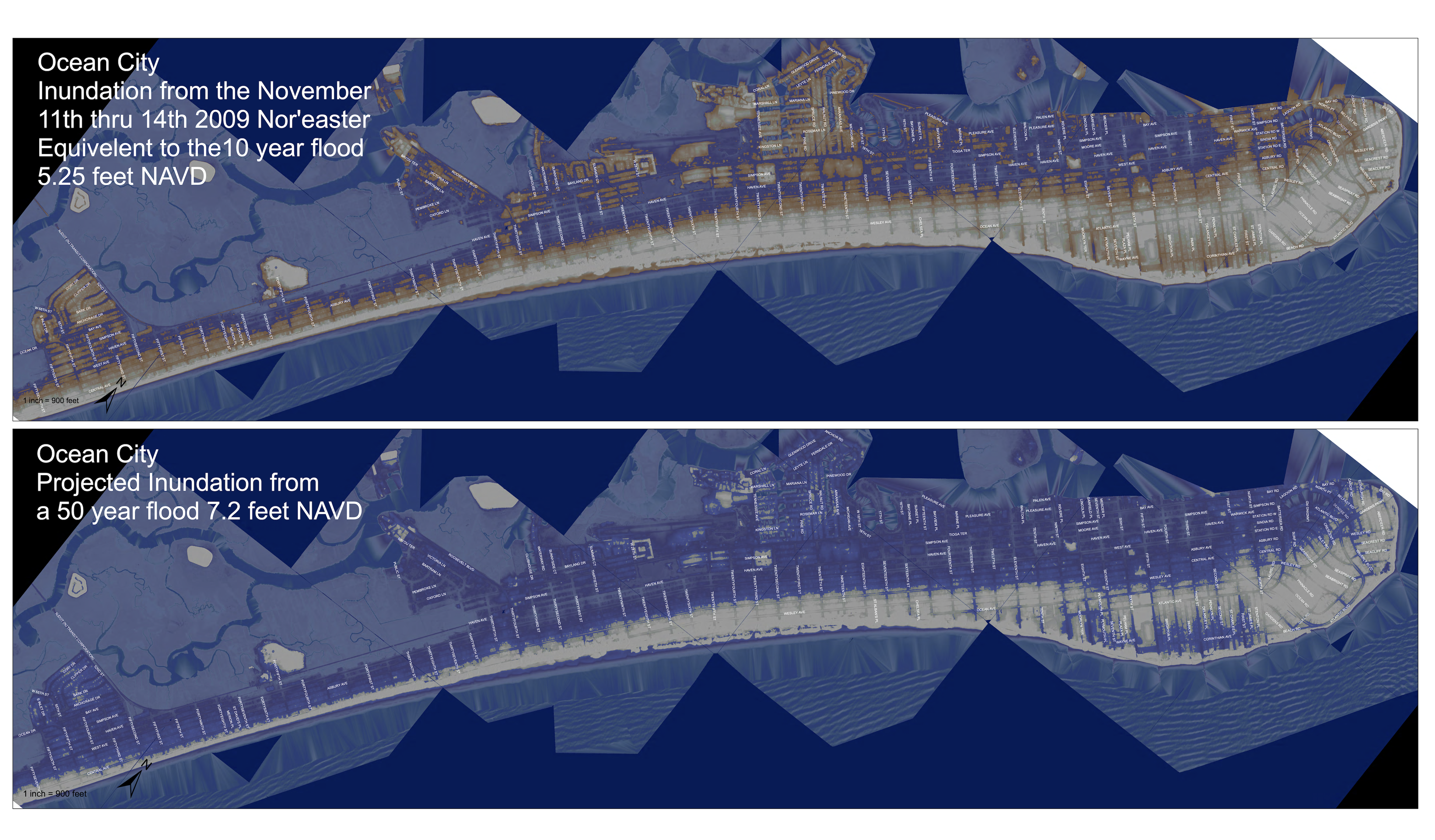

Ocean City 10 year and 50 year Tidal Flooding Heights. This is not a flood map. Provided by the City of Ocean City.