As we step into November, the South Jersey Shore real estate market is holding strong amidst shifting dynamics on both local and national levels. With key economic updates and recent election outcomes, here's what you need to know about the current market and what lies ahead.

National Highlights:

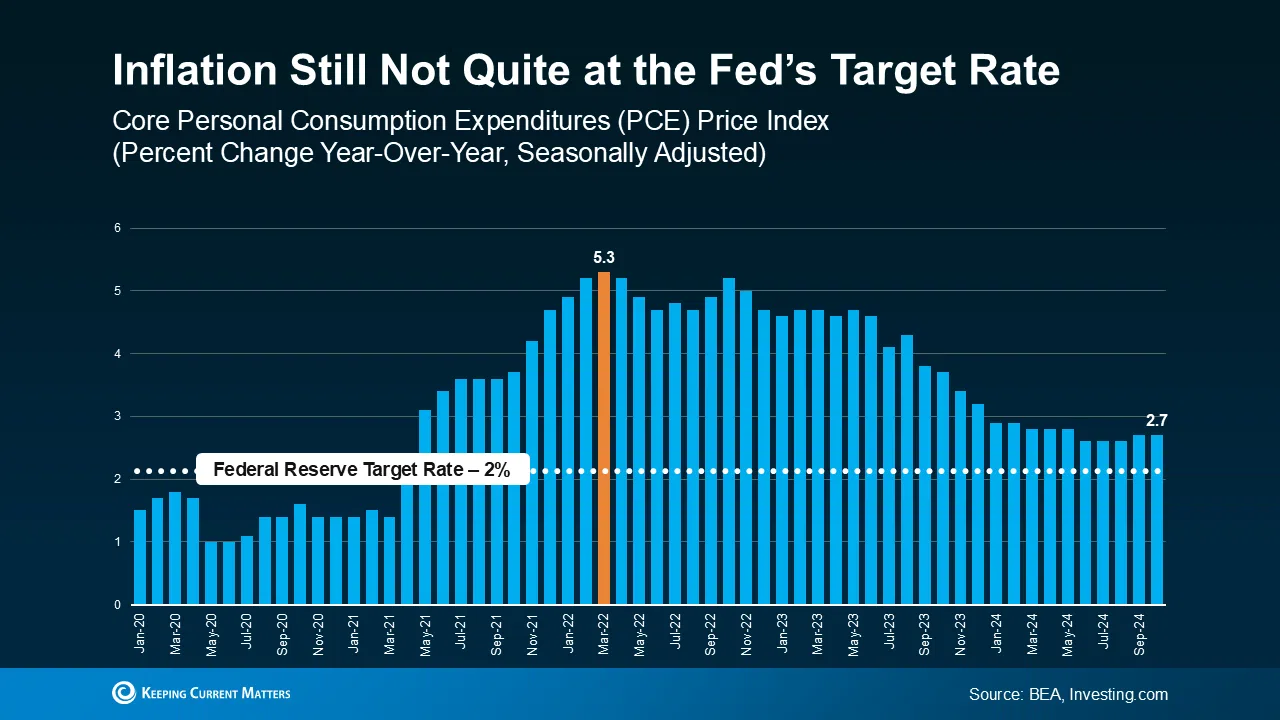

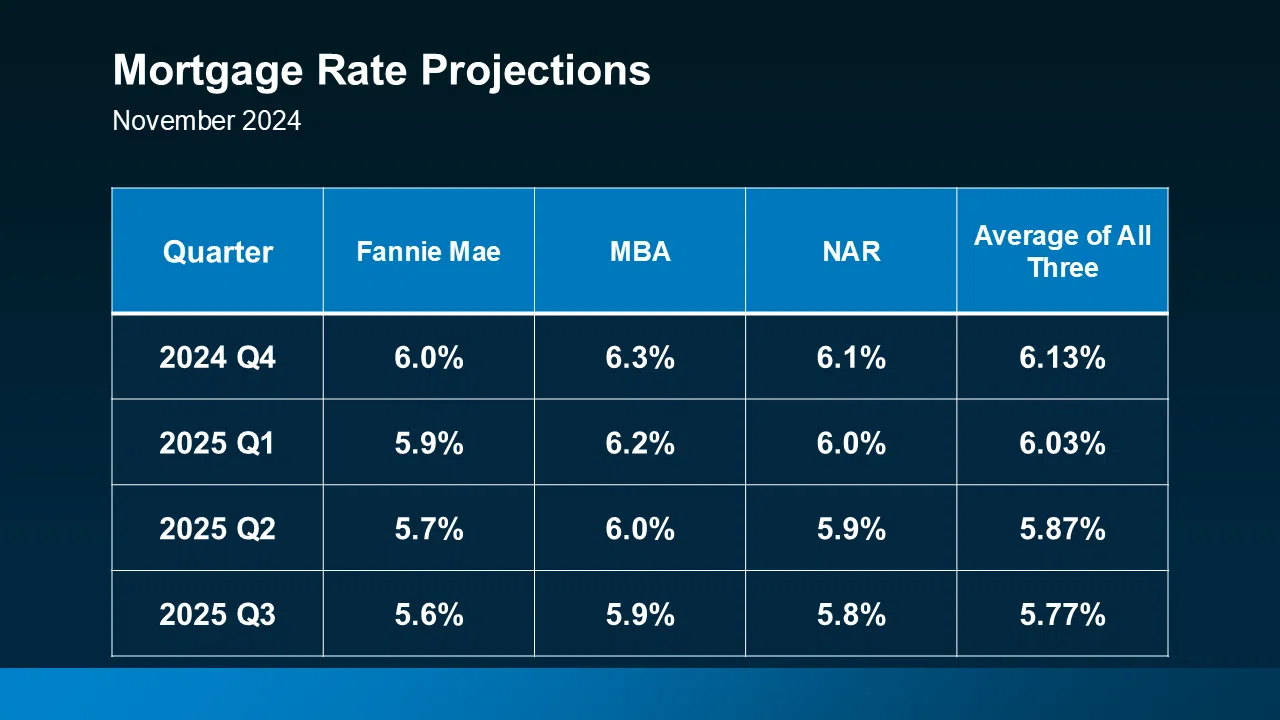

- Federal Reserve Action: On November 7th, the Fed announced a quarter-point rate reduction, signaling confidence in the economy. However, mortgage rates, currently hovering around 7%, are not expected to shift significantly in the short term, as lenders had anticipated this move. Experts predict a gradual decline heading into 2025.

- Election Impact: Donald Trump's presidential win has brought renewed optimism to the real estate and stock markets. This is very preliminary but could we see a potential rollback of loan-level pricing adjustments?—introduced under the Biden administration and affecting second-home buyers—could significantly boost demand in vacation markets like the Jersey Shore.

Local Market Overview:

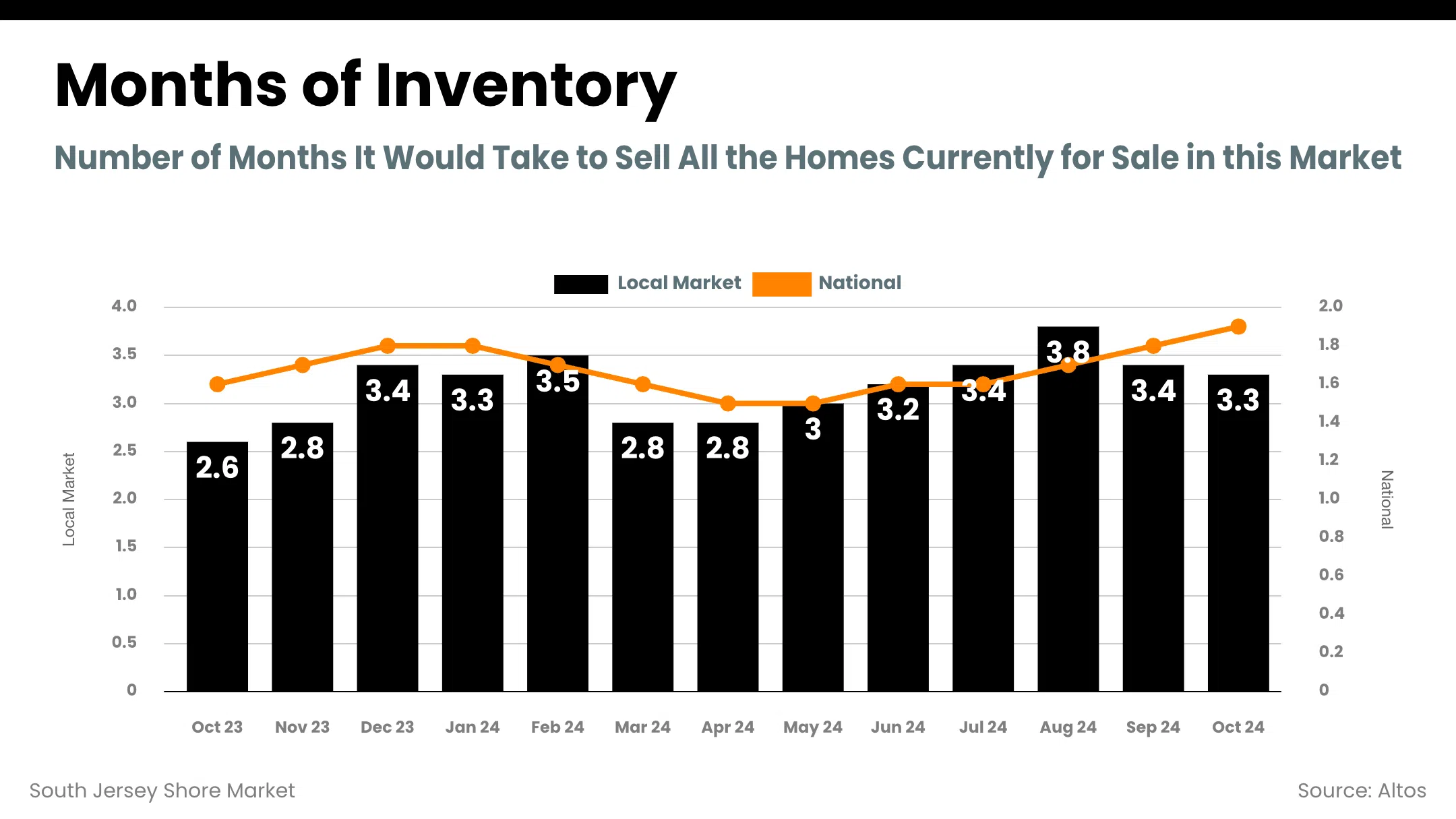

- Inventory Levels: Locally, months of inventory sit at 3.3 months, reflecting a seller's market. Nationally, inventory is even tighter at just 1.8 months. For sellers, this means reduced competition and strong opportunities to list.

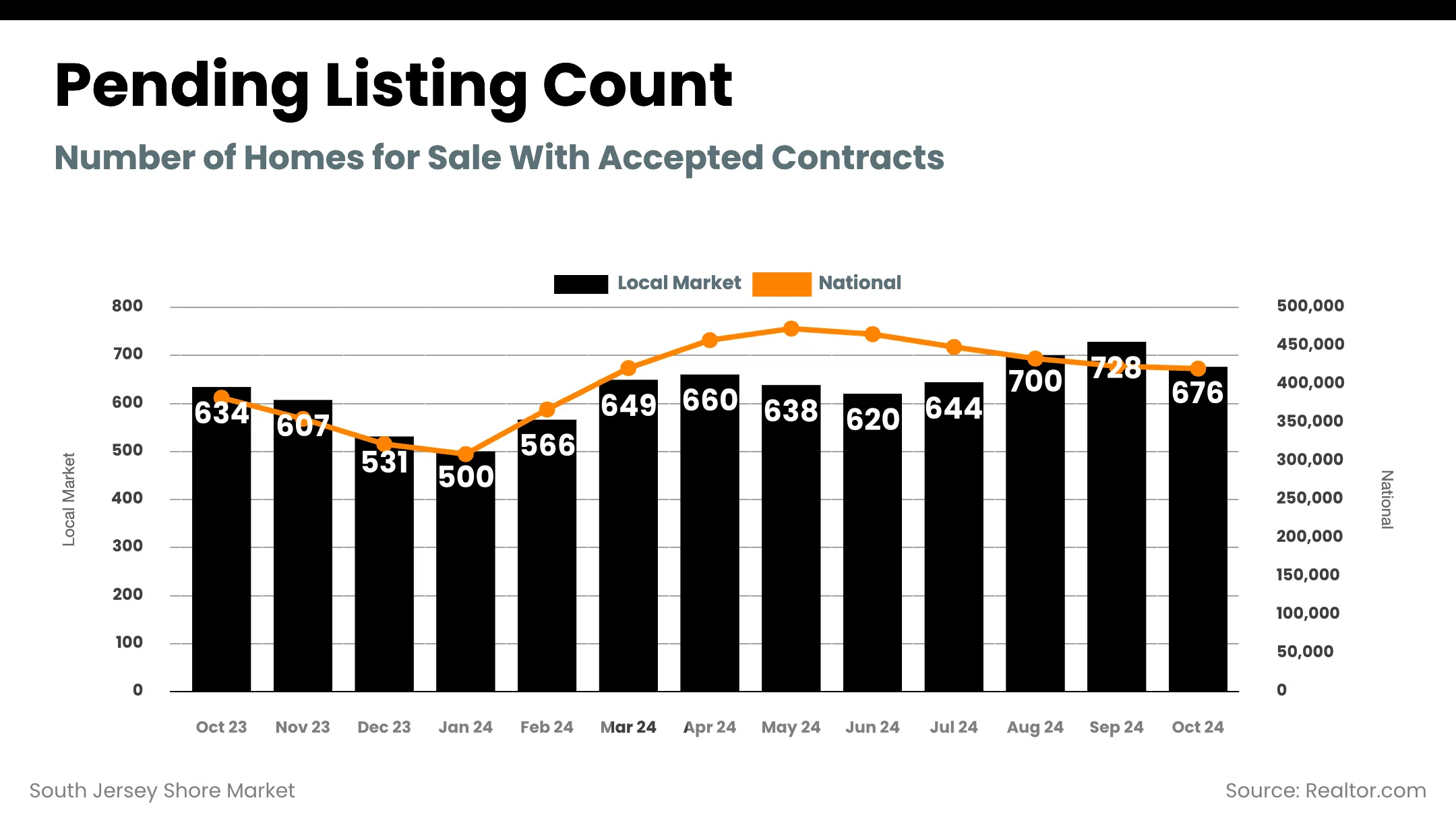

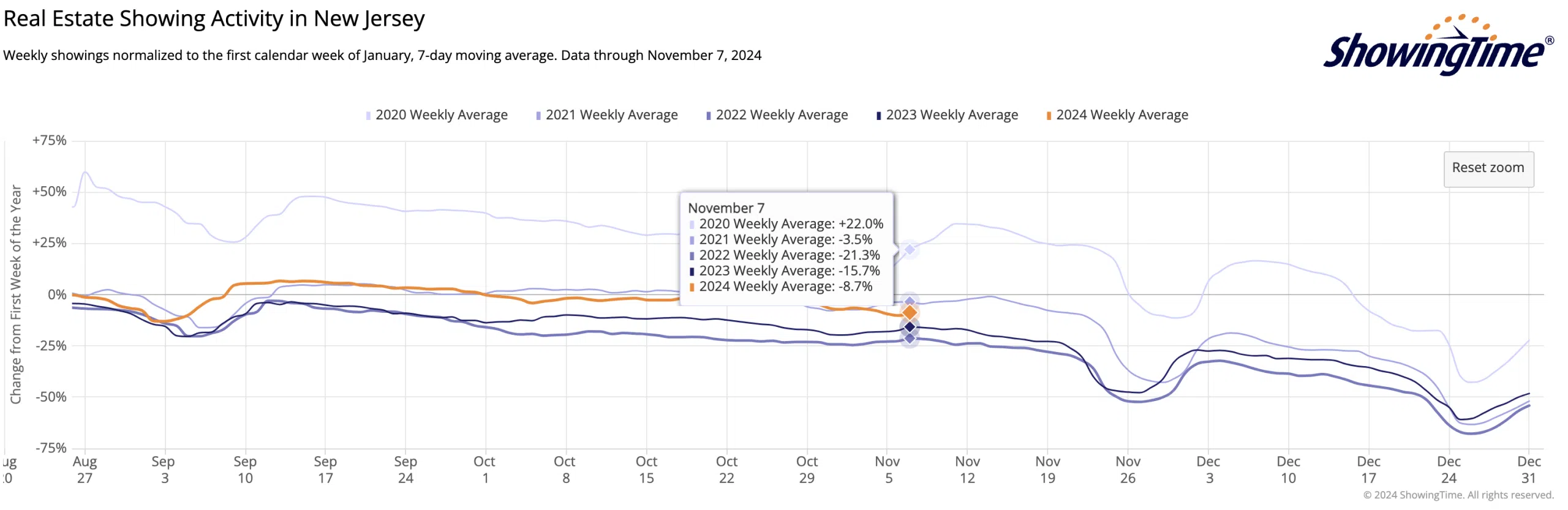

- Buyer Activity: Pending sales reached 676 homes in October, a slight seasonal dip from September's peak of 728, but still reflective of motivated buyers. Showings remain stable, down only 8.7% from January, significantly outperforming 2022’s 21.3% drop.

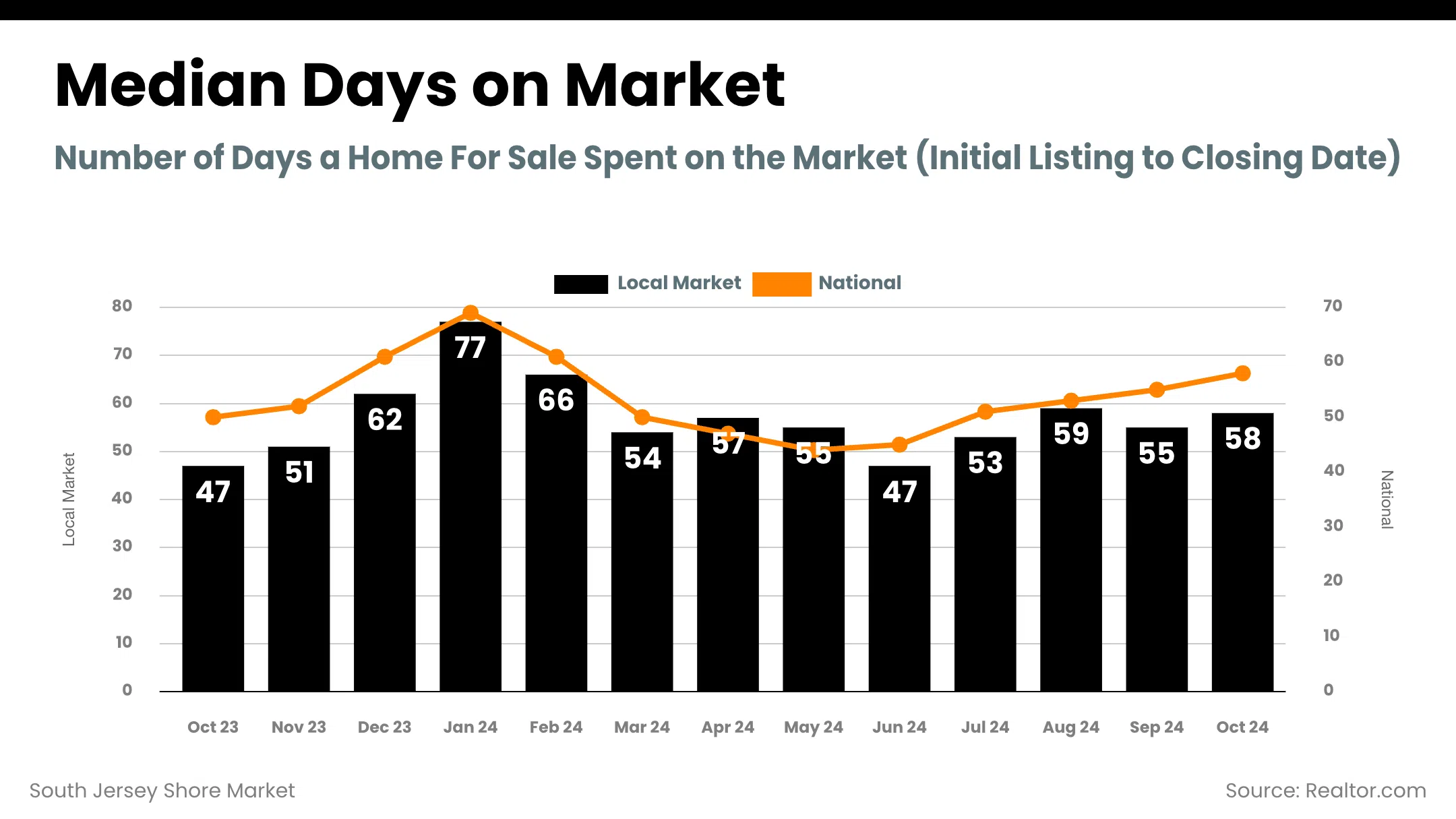

- Days on Market: Homes in South Jersey Shore are selling in a median of 58 days—just slightly above the national median of 55 days. Well-priced, move-in-ready properties continue to attract serious buyers.

Opportunities for Buyers and Sellers:

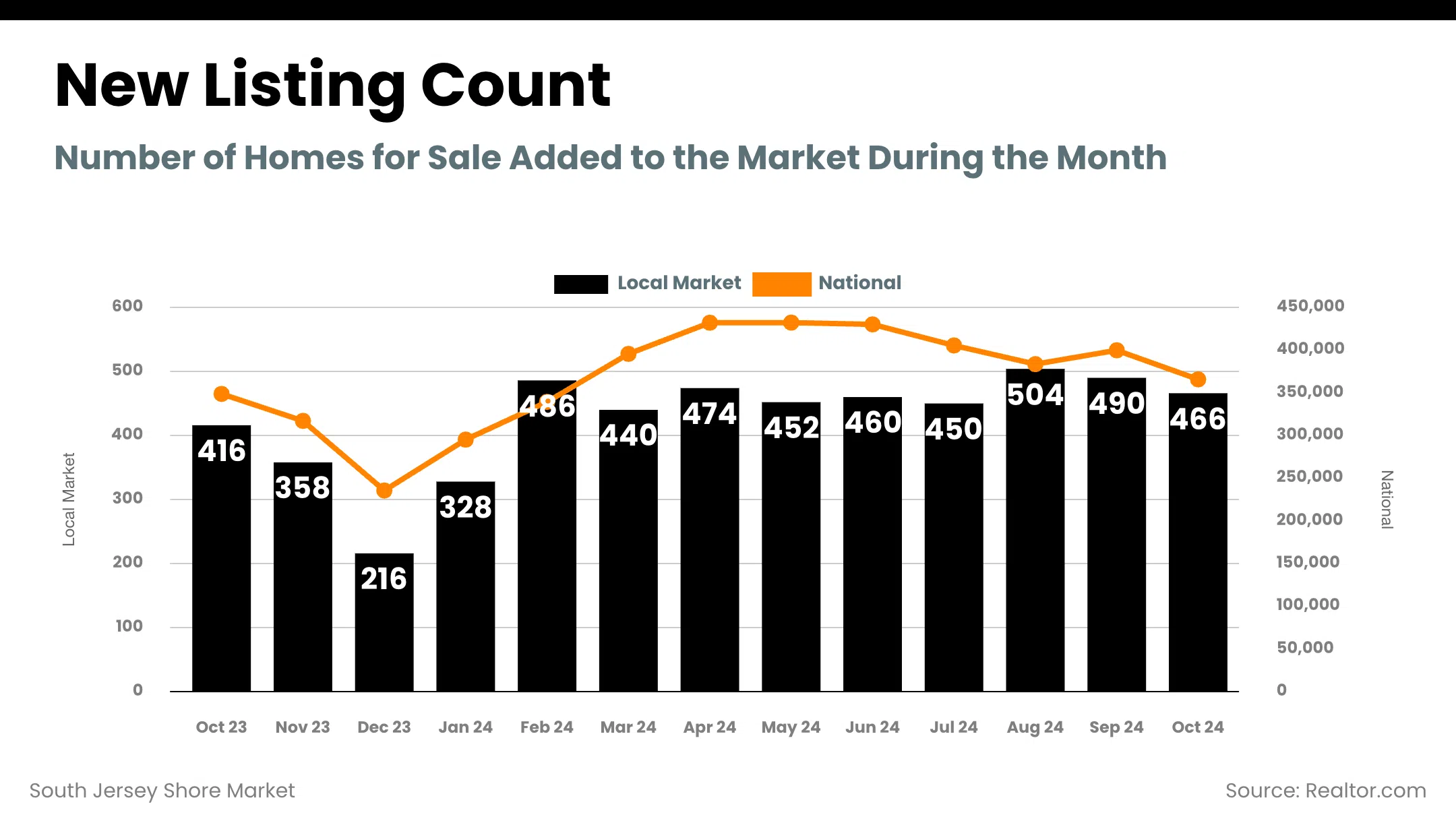

- For Sellers: Fewer new listings (466 in October) mean less competition. If your property is in good condition and priced correctly, now is an excellent time to list, as motivated buyers are still active.

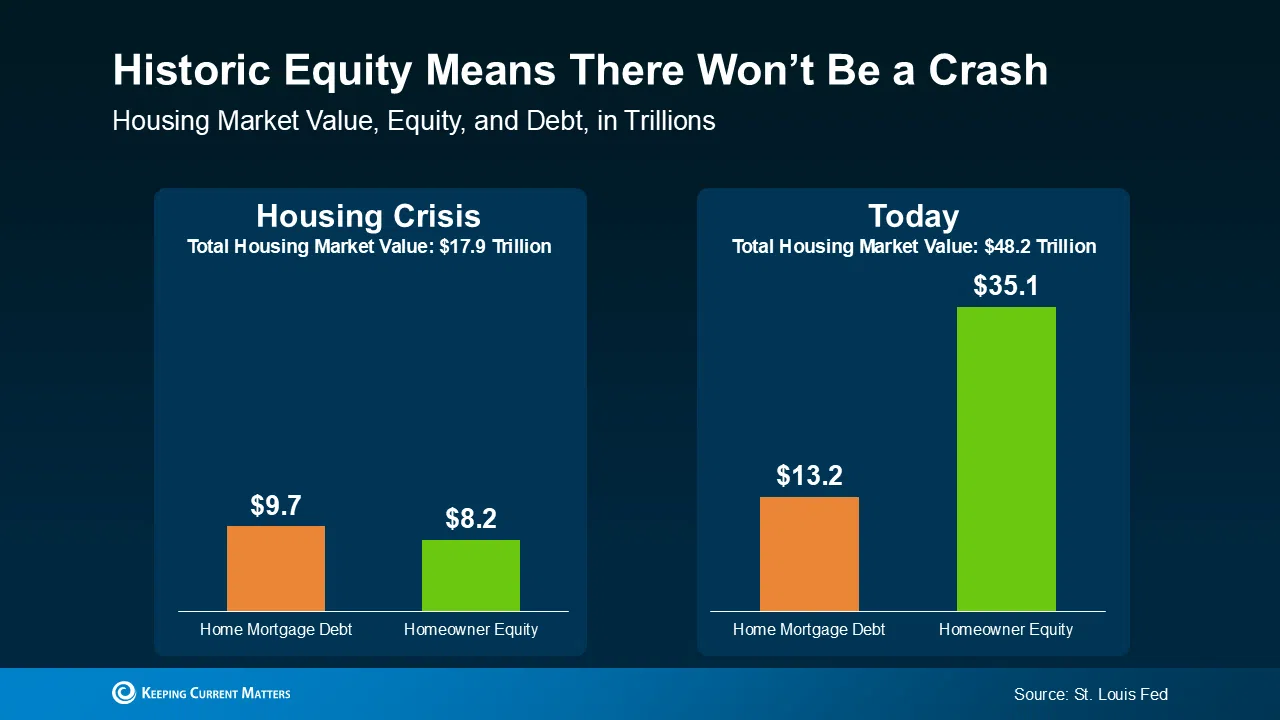

- For Buyers: With rates expected to gradually decline in 2025, waiting may improve affordability. However, delaying could also mean competing with increased demand and higher prices. Acting decisively now could help you secure a great property before the market heats up further.

Looking Ahead to 2025:

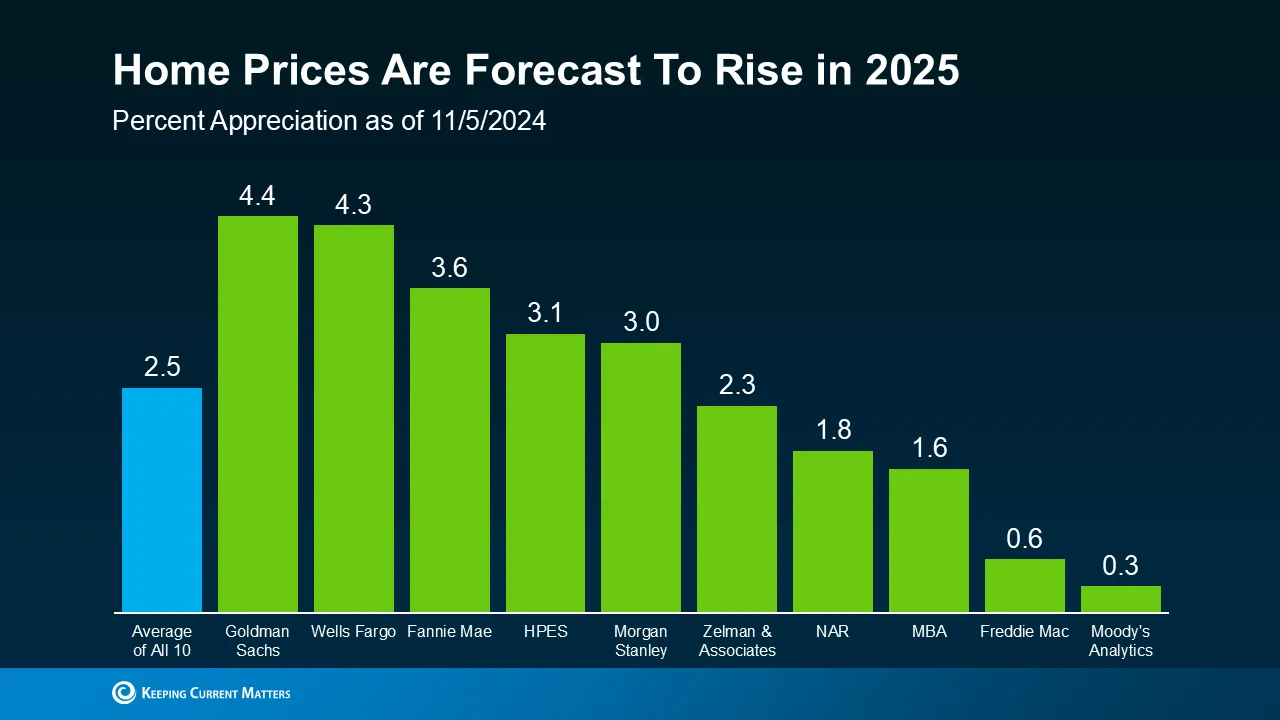

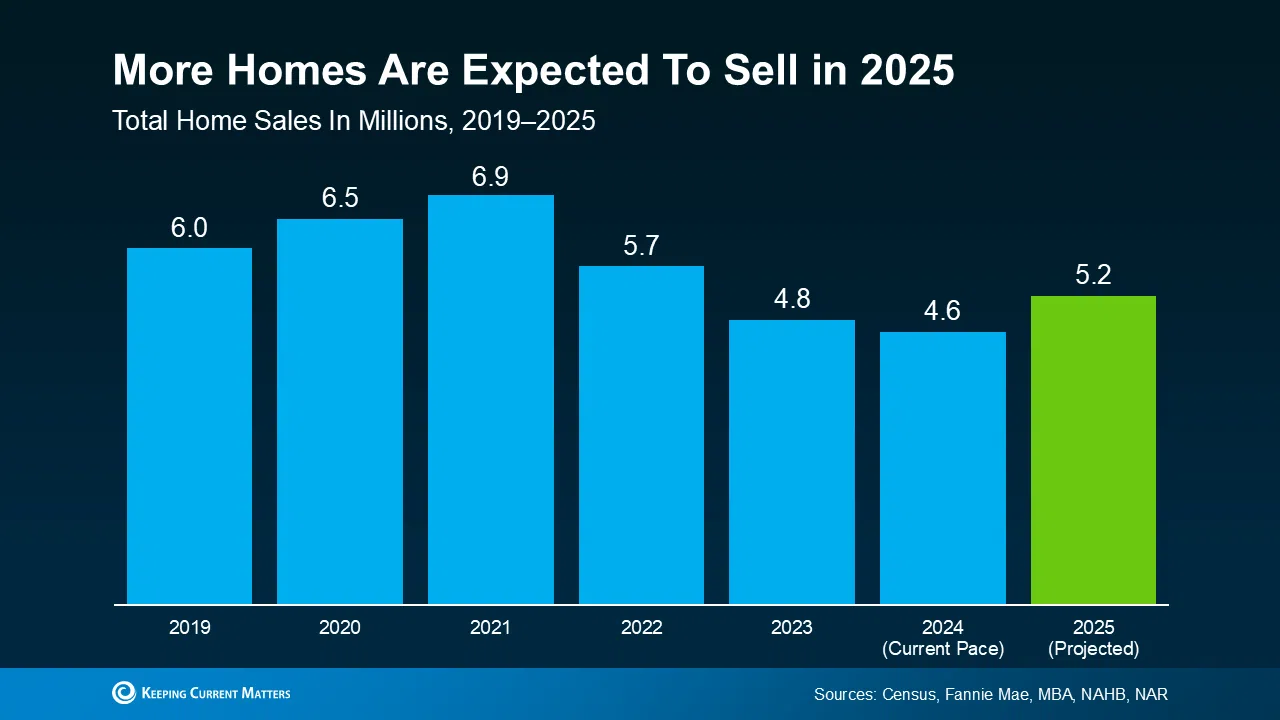

Mortgage rates are forecasted to drop to approximately 5.6%-5.9% by mid-2025, potentially spurring increased buyer demand. Nationally, home appreciation is expected to reach 2.5%, and total transactions are predicted to rise to 5.2 million—a promising recovery from 2024’s slower pace.

The Bottom Line:

The South Jersey Shore market remains competitive, with tight inventory and steady buyer activity. Whether you're considering buying, selling, or investing, now is the time to plan your next move.