Key Market Highlights

- Inventory Levels: December 2024 ended with just over 3 months of inventory in Atlantic County and 3.5 months in Cape May County, far below the 5-6 months needed for a balanced market.

- Home Prices: Median prices continued to rise modestly, reflecting a stable upward trend.

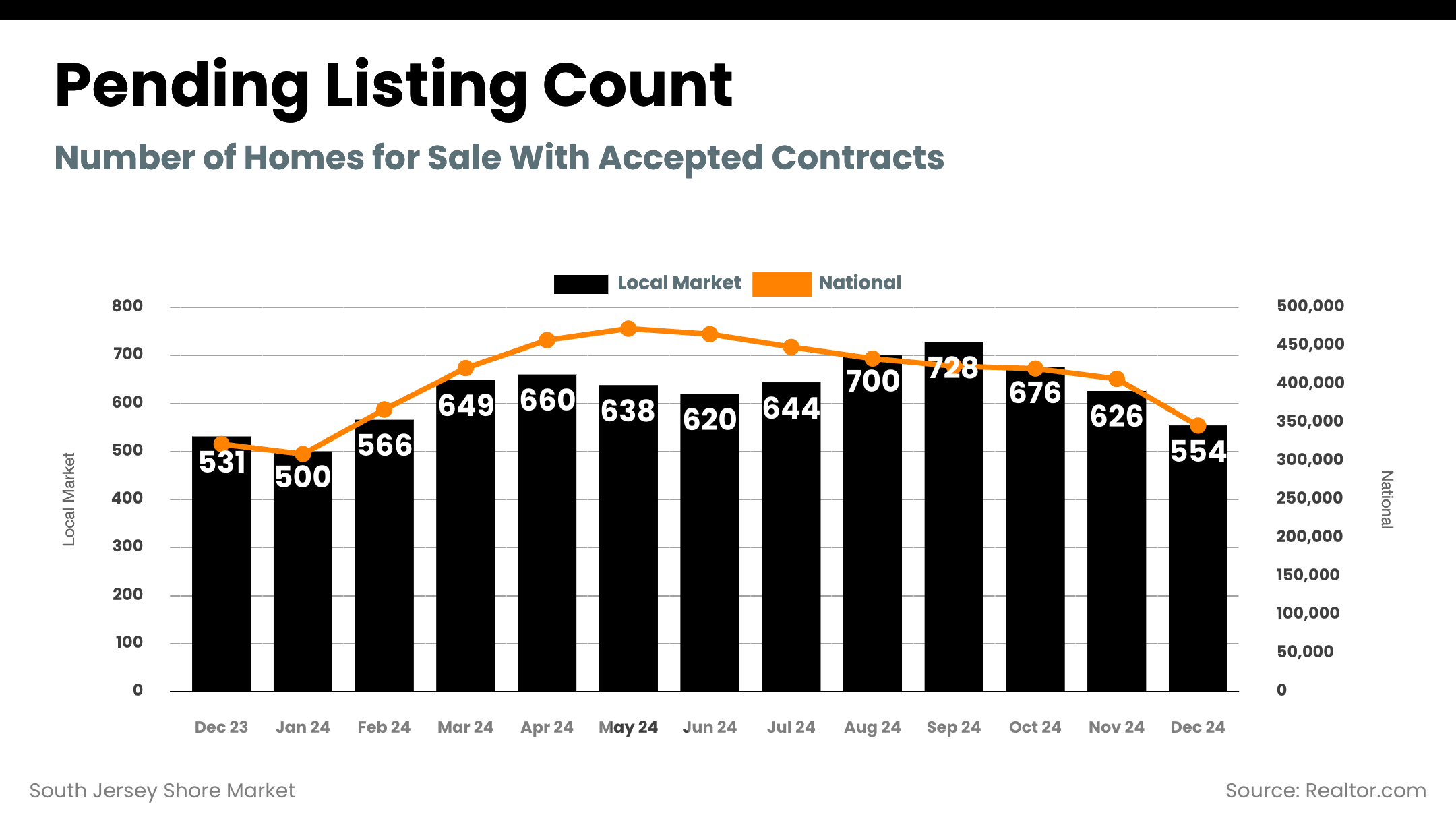

- Contract Activity: December 2024 saw more contracts signed compared to the previous year, a promising sign of market momentum.

- Mortgage Rates: Nationally, rates remain close to 7%, but demand persists despite higher borrowing costs.

1. Inventory Trends: Competition Remains Strong

The South Jersey Shore market is characterized by its tight inventory, with just over 3 months of supply in December 2024. This shortage continues to fuel competition, particularly in offshore areas where multiple-offer scenarios remain common.

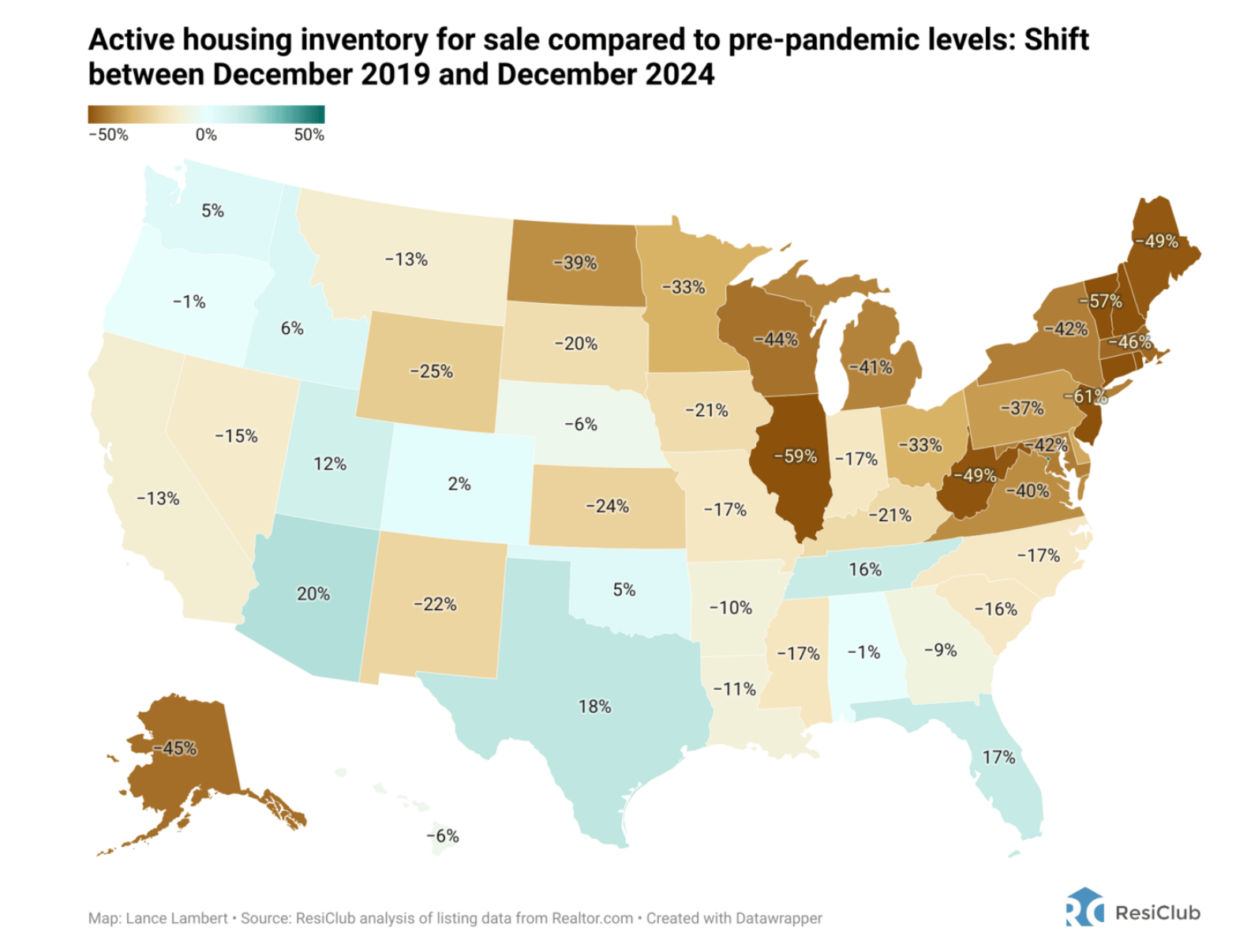

Seasonality also plays a role, with inventory peaking at the end of summer due to rental properties and then normalizing as closings catch up. Nationally, some states are seeing significant inventory increases, but New Jersey remains on the low end of the spectrum, maintaining a seller's market.

2. Home Prices: Modest Appreciation in 2025

Home prices across the Jersey Shore are expected to continue their steady appreciation in 2025, with most experts forecasting a 2–5% increase.

Key factors driving this growth include:

- Limited housing supply.

- Consistent demand for properties, particularly second homes and vacation rentals.

In December 2024, the list-to-sale price ratio remained strong, with most sellers receiving offers close to their asking prices.

3. Contract Activity: A Positive Start to 2025

One of the most encouraging trends from December 2024 is the increase in contracts signed compared to the same period in 2023. This uptick signals renewed buyer confidence despite higher borrowing costs.

Year-over-year trends show:

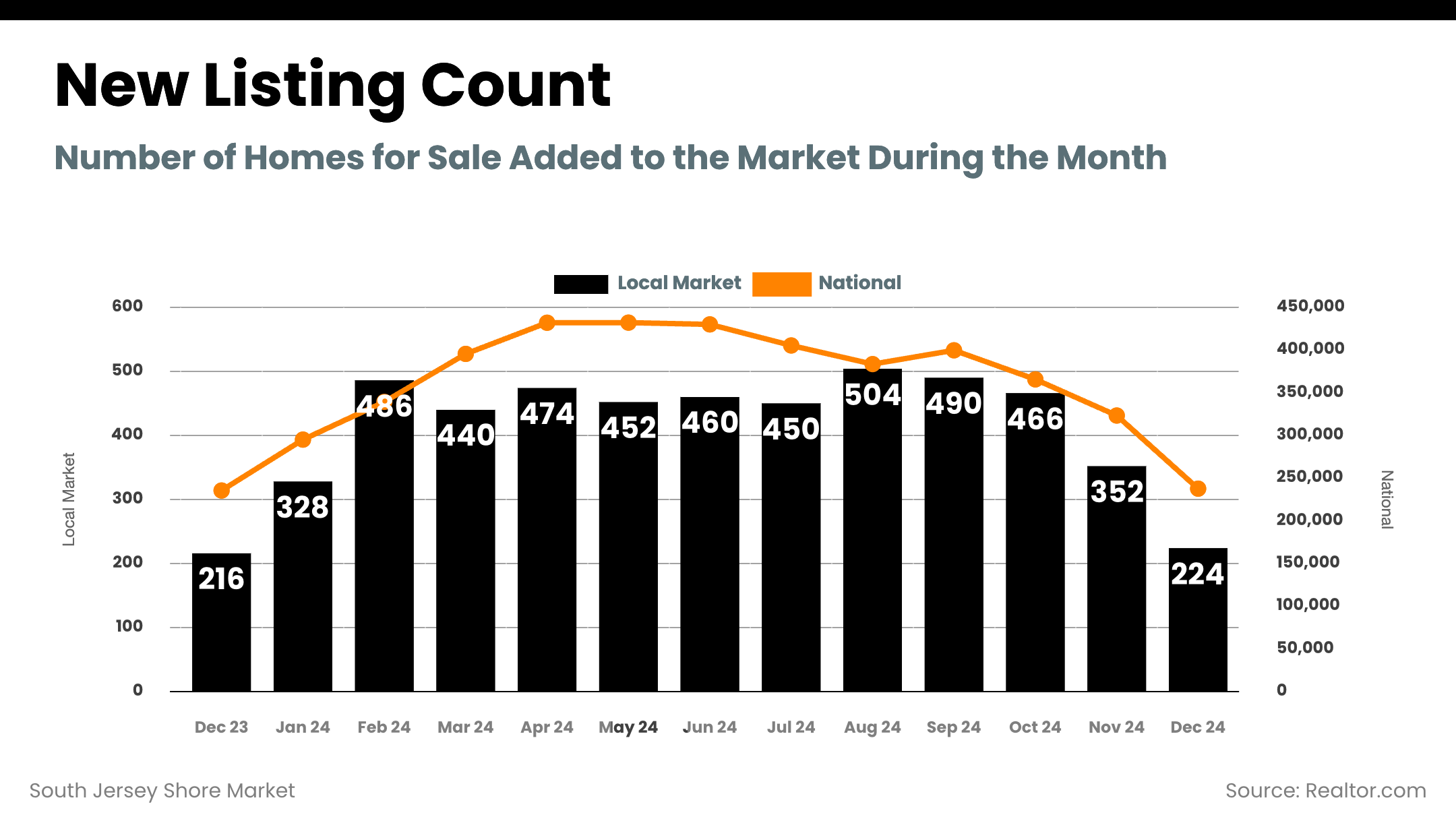

- More new listings: While inventory levels remain low, 2024 saw slightly more properties listed for sale compared to 2023.

- Fewer closed sales: A slight dip in closed sales contributed to the modest inventory increase.

4. Mortgage Rates and Their Impact

Nationally, mortgage rates remain close to 7%, impacting affordability. However, buyers continue to prioritize location and property features over rates, particularly in desirable markets like the Jersey Shore.

What This Means for Buyers:

- Act strategically and focus on properties that meet long-term needs.

- Consider locking in rates soon if inflation pressures ease later this year.

What This Means for Sellers:

- Highlight unique property features to stand out.

- Pricing competitively remains crucial to attract motivated buyers.

5. Predictions for 2025

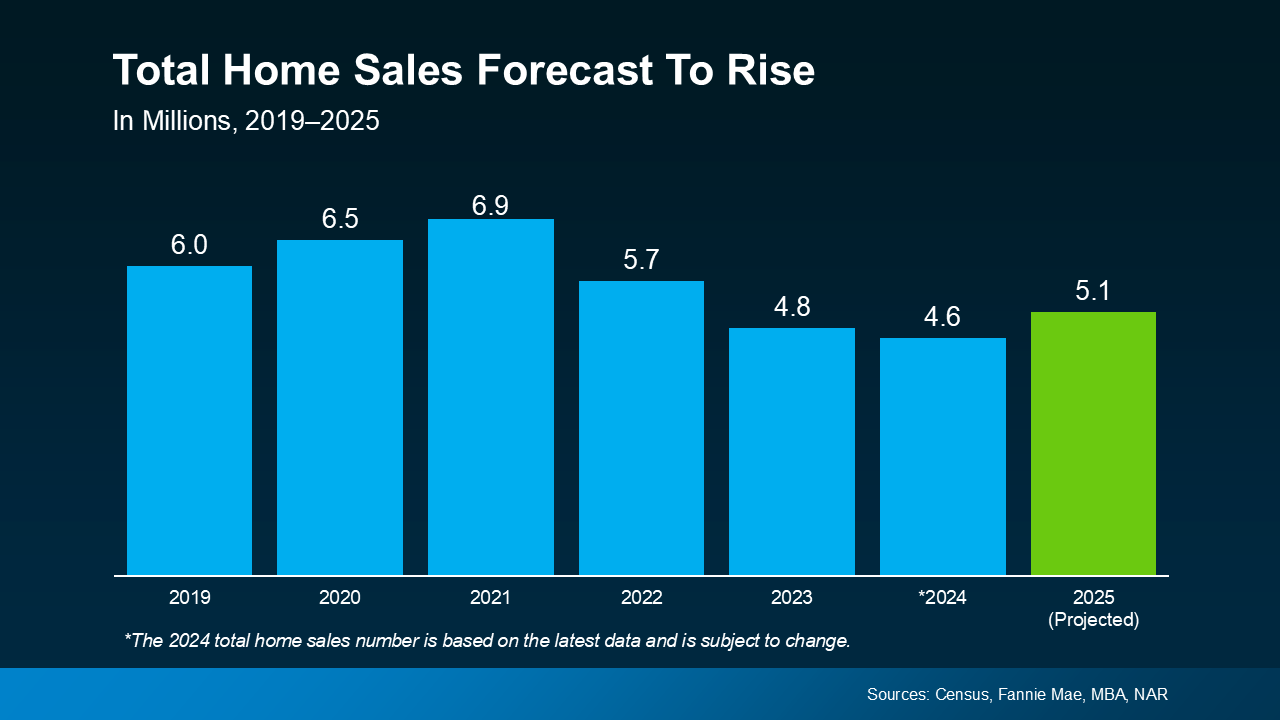

- Home Sales Rebound: After historically low sales in 2024, experts project over 5 million home sales nationally in 2025, aligning with pre-pandemic norms.

- Continued Demand: Vacation homes and investment properties will remain highly sought after in coastal markets.

- Stable Price Growth: Expect modest appreciation of 2–5%, driven by limited supply and steady demand.

Local Insights: The Jersey Shore Market Advantage

The Jersey Shore continues to attract buyers seeking lifestyle-driven purchases, from primary residences to second homes. Towns like Avalon, Cape May, Ocean City, Sea Isle City, Margate, The Wildwoods, and Brigantine stand out for their strong rental income potential and long-term appreciation.

For Buyers:

- Be mindful of HOA fees, flood insurance costs, and seasonal market dynamics.

- Focus on properties in high-demand locations to maximize long-term value.

For Sellers:

- Market your property’s rental potential to attract investors.

- Address seasonality by listing at a time when inventory is limited.