Key Market Trends

The latest data highlights important shifts in mortgage rates, inventory levels, and home prices that are shaping the real estate landscape.

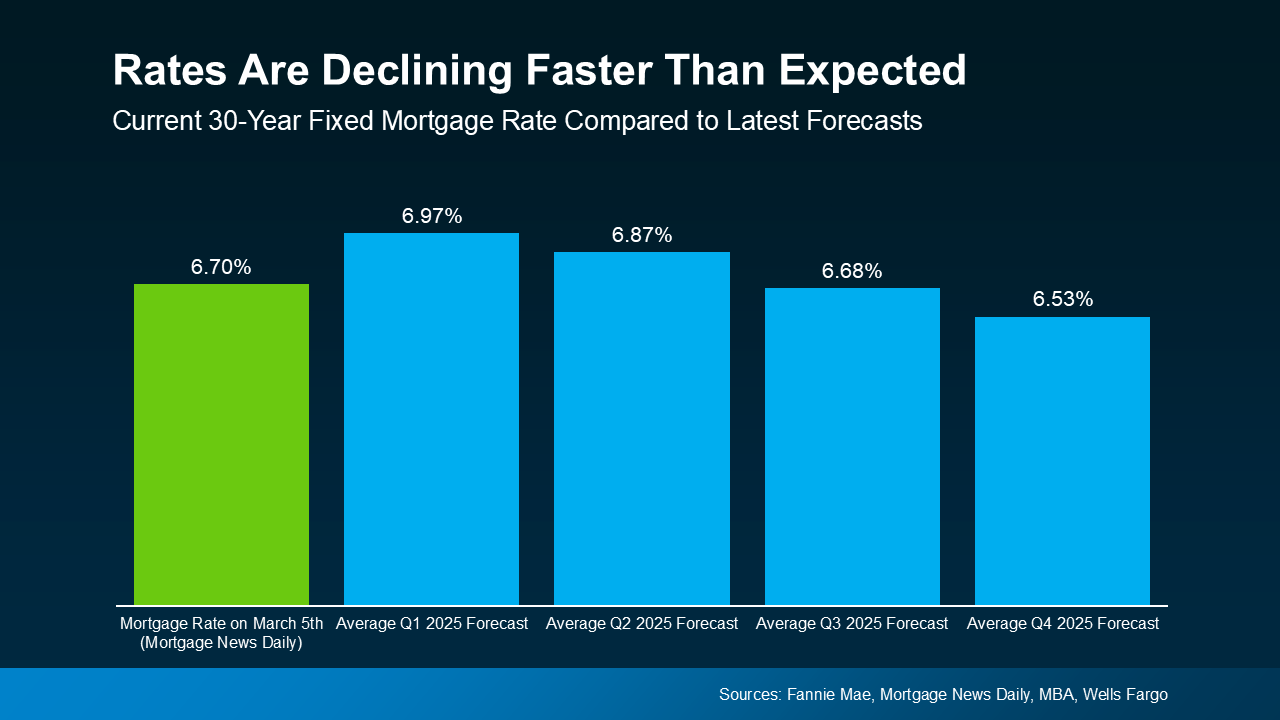

1. Mortgage Rate Trends – Where Are Rates Headed?

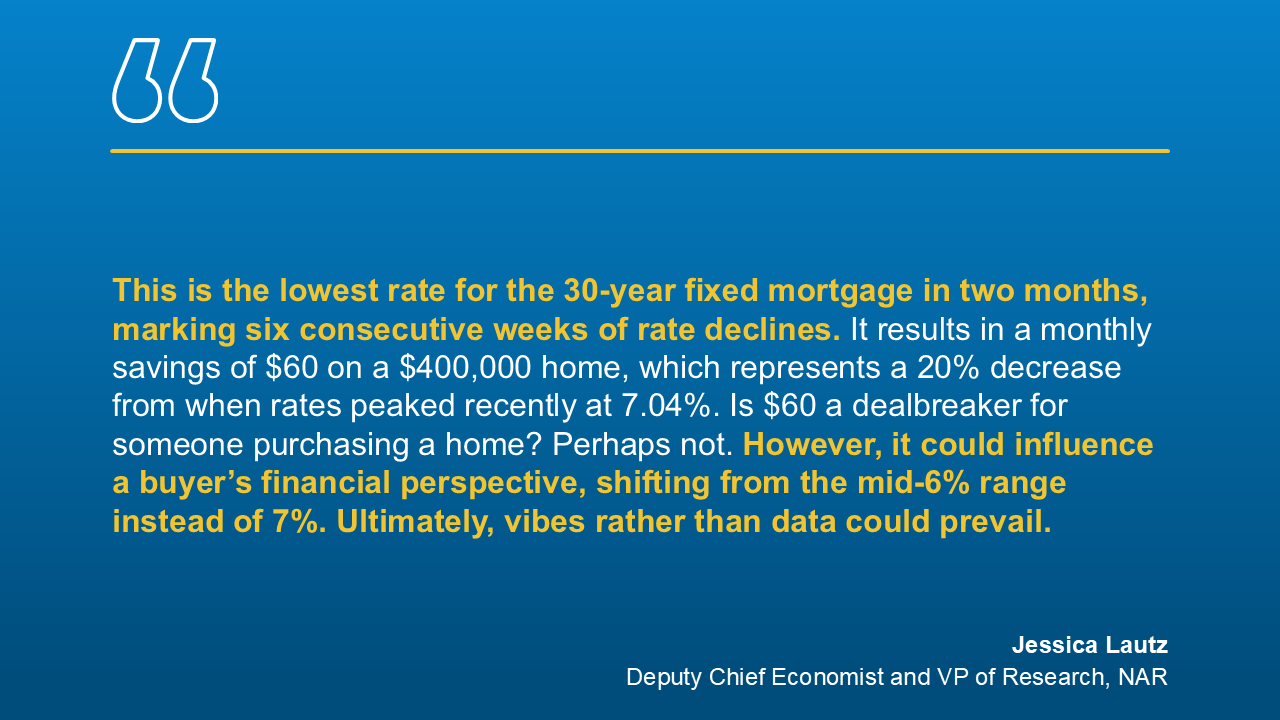

- Mortgage rates have declined for seven consecutive weeks, dropping to 6.63%—the lowest in nearly three months.

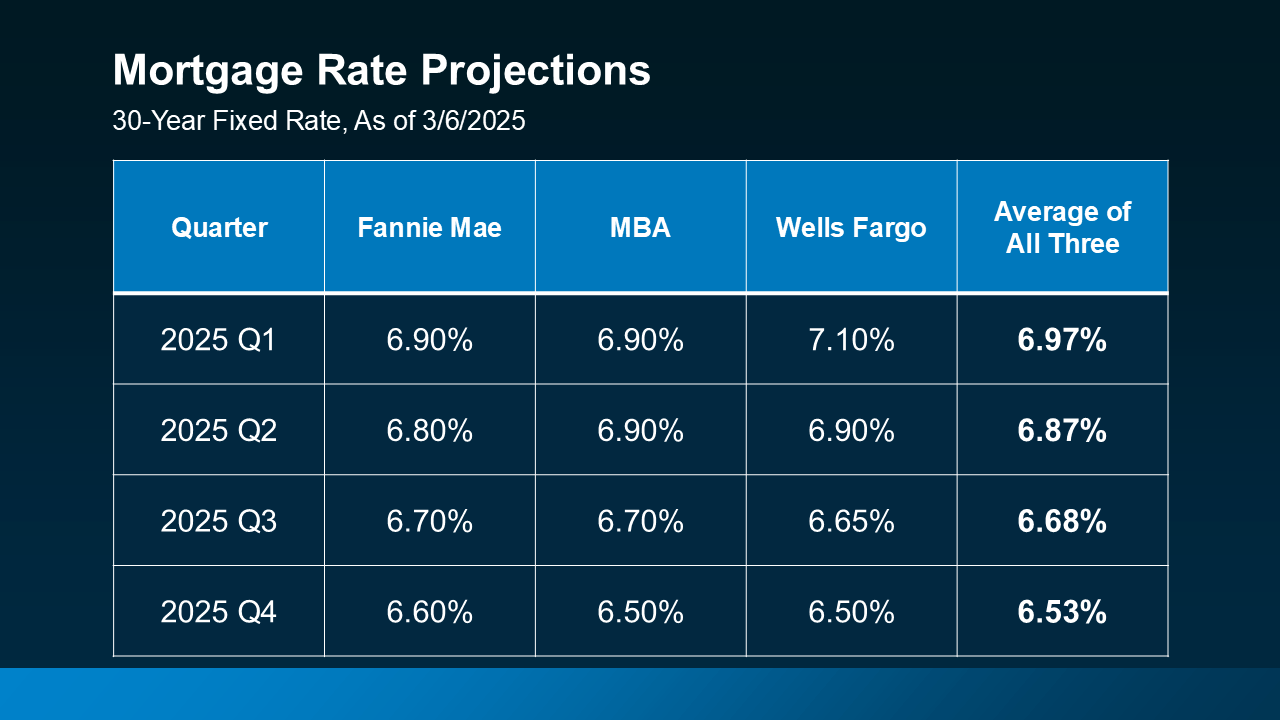

- Projections for 2025:

- Q1 2025: 6.97%

- Q2 2025: 6.87%

- Q3 2025: 6.68%

- Q4 2025: 6.53%

2. Housing Supply & Price Trends – How Much Inventory Is Available?

- The U.S. housing supply is still short by 3.8 million homes, though construction is increasing.

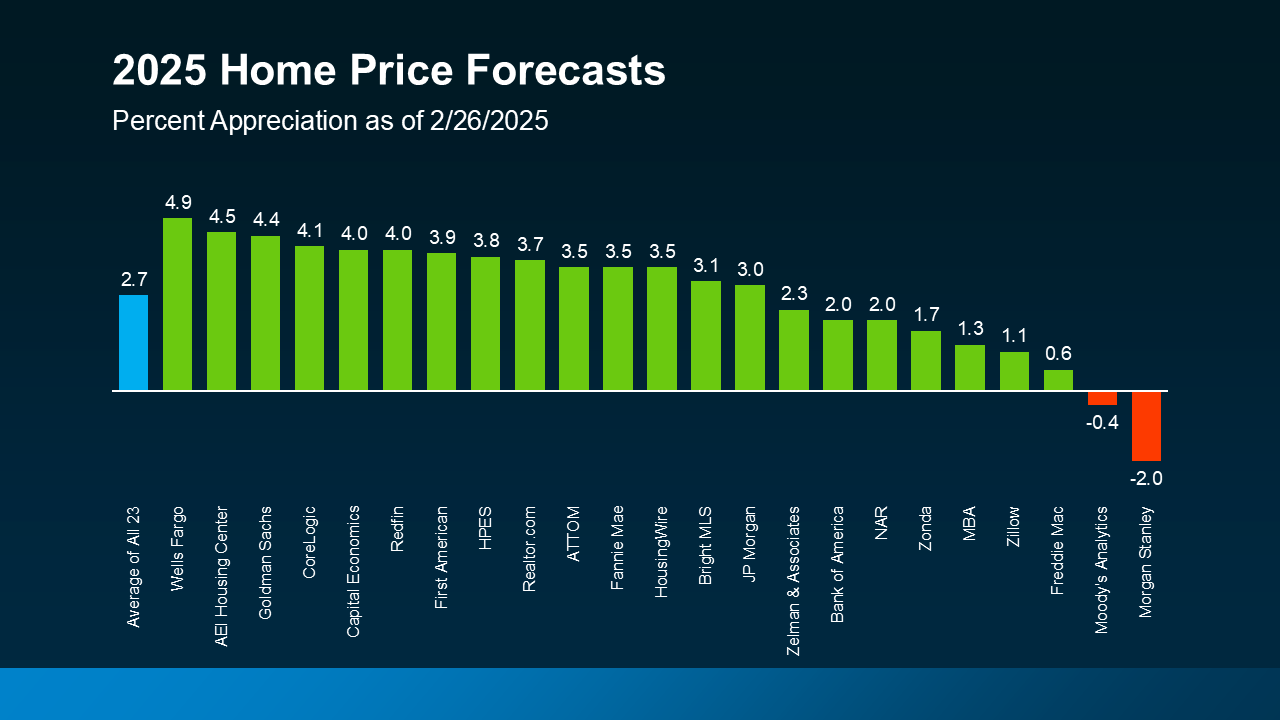

- Home price appreciation is stabilizing, with some areas experiencing slower growth or even slight declines.

- Pending home sales have dropped 6.4% YoY, but Southern California is seeing increased activity as mortgage rates decline.

- Expert Insight: Selma Hepp (CoreLogic) notes that home prices have been moving sideways since late 2024, and this trend is likely to continue in early 2025.

South Jersey Shore Real Estate Market Update

While national trends set the stage, our local market is experiencing its own shifts. Cape May and Atlantic Counties are showing signs of increased inventory and a stabilizing market, which is good news for both buyers and sellers.

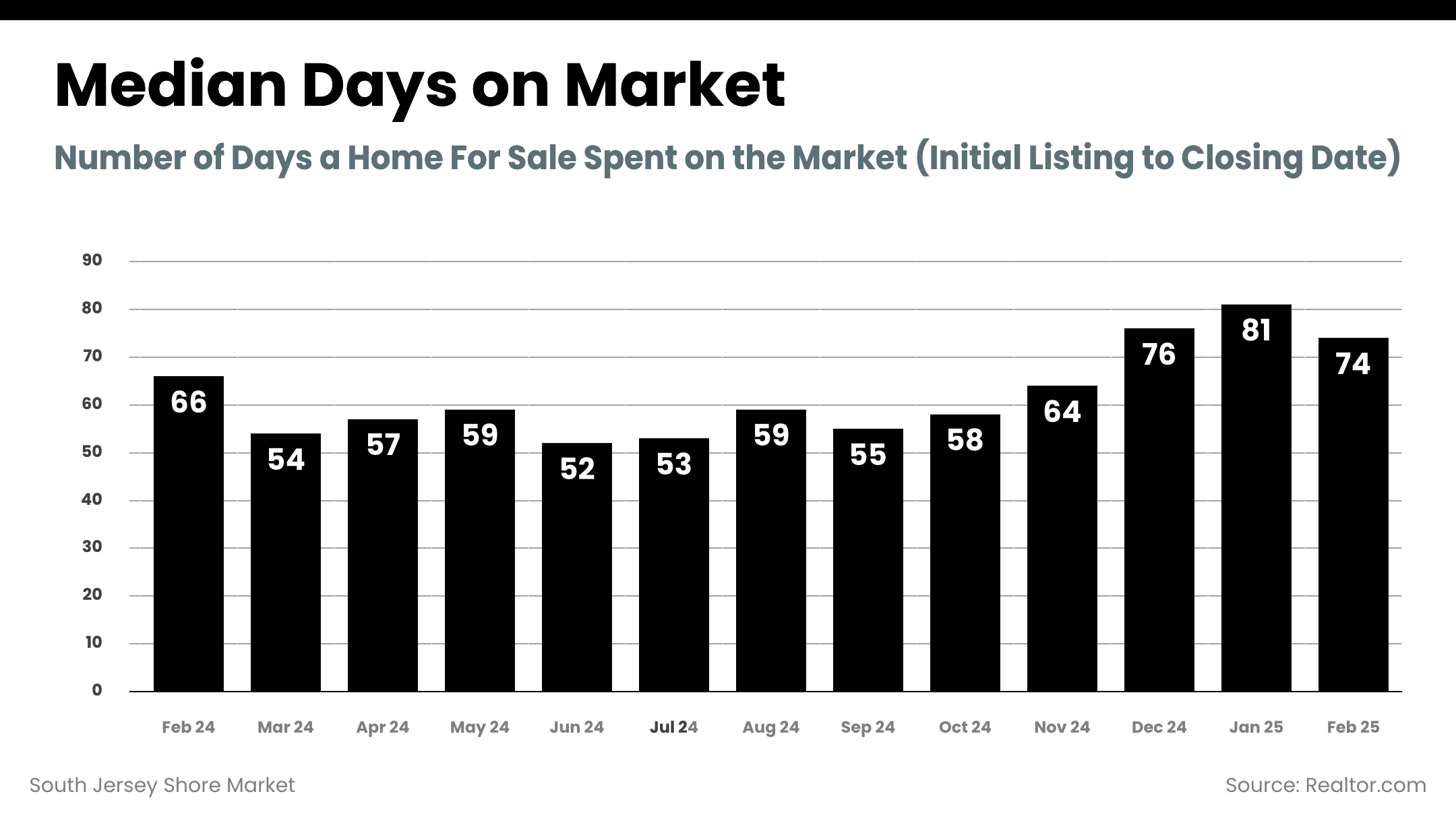

Median Days on Market

- February 2025: 74 days (down from 81 days in January 2025 but higher than mid-2024 levels).

- Homes are taking longer to sell compared to early 2024, giving buyers more negotiation leverage.

- The winter months saw the highest days on market, but we expect this to decline as we move into spring.

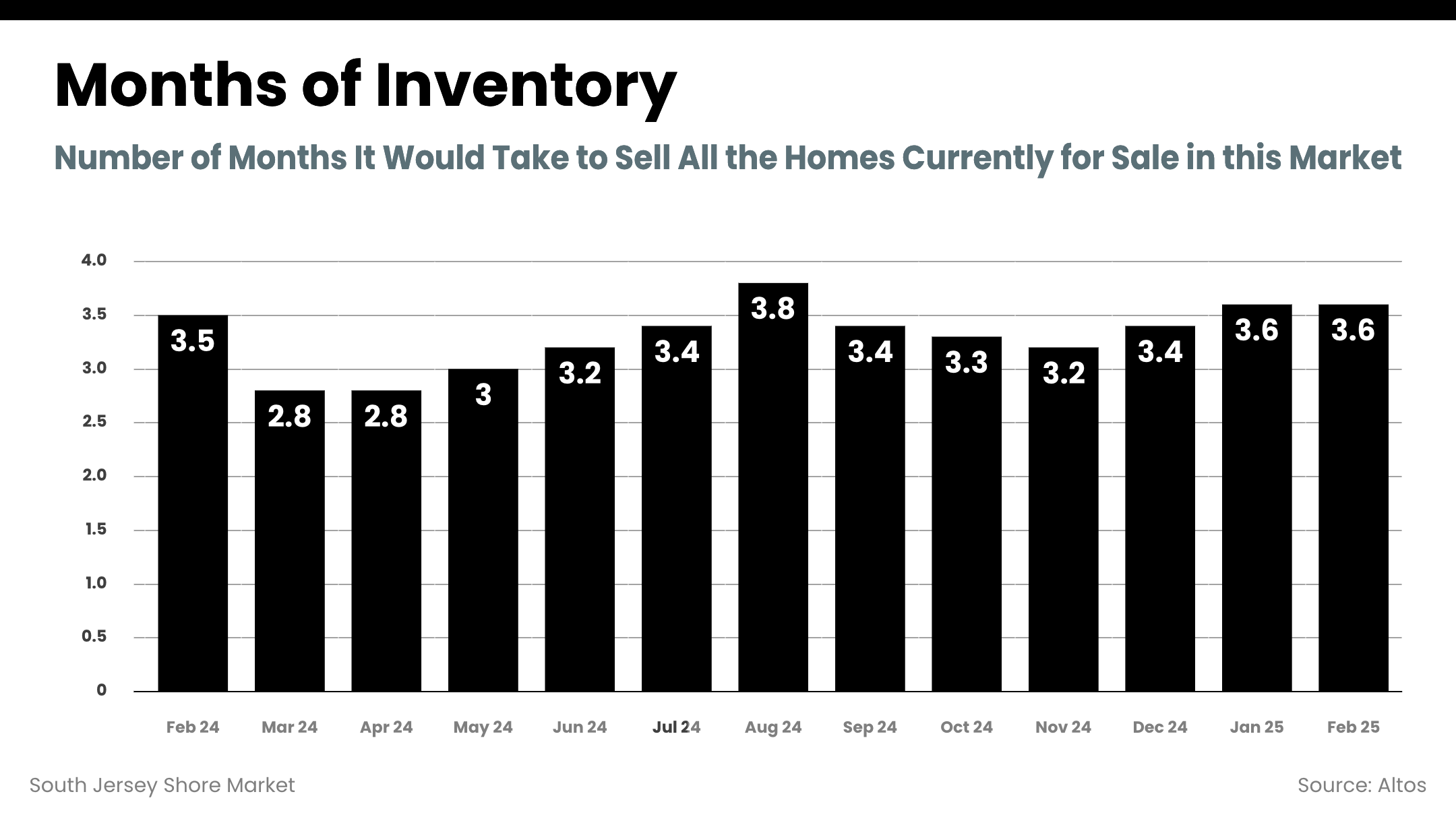

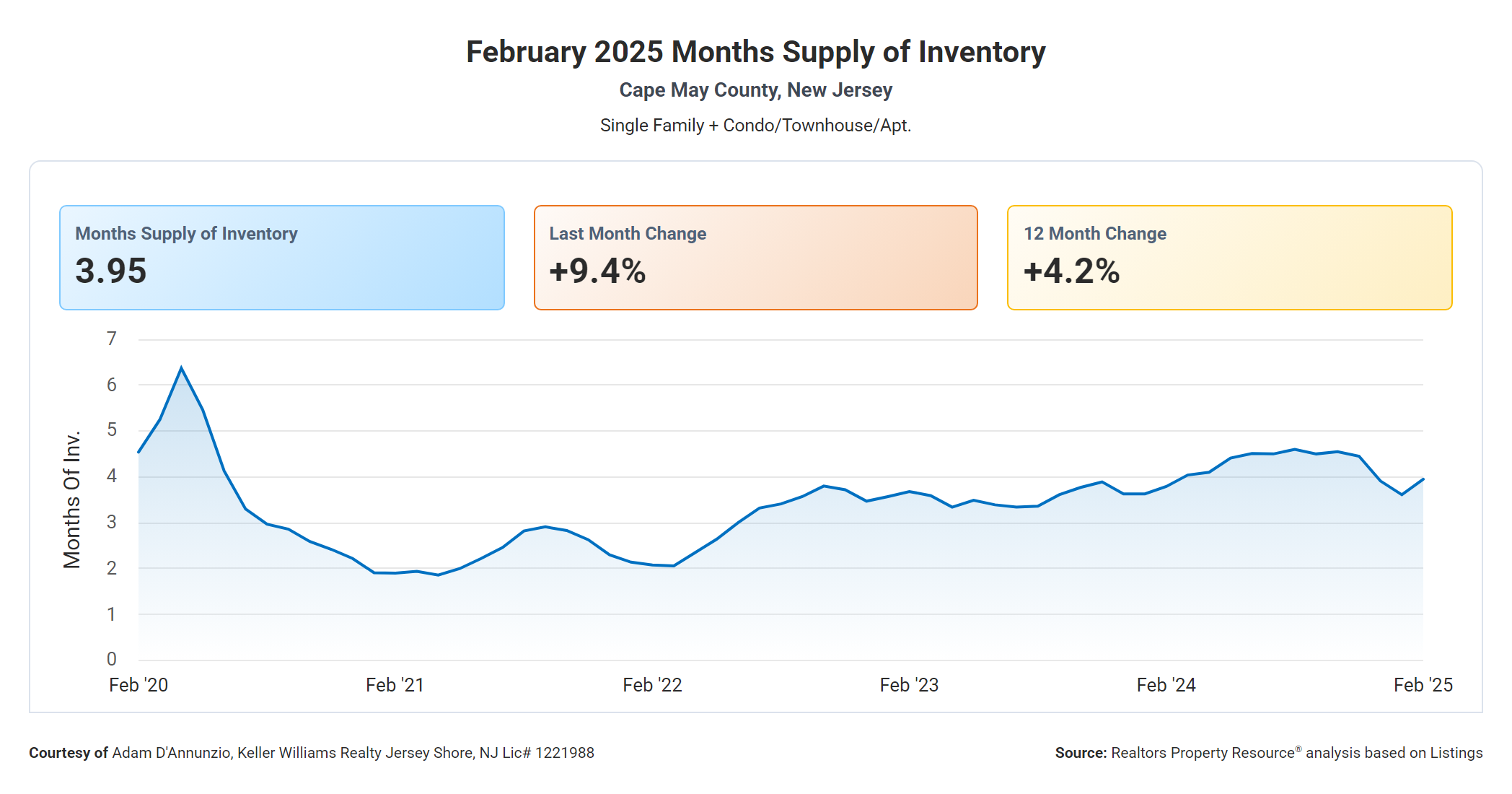

Months of Inventory

- February 2025: 3.6 months (up from 2.8 months in March-April 2024 but down from the peak of 3.8 months in August 2024).

- A gradual increase in inventory means more choices for buyers and a less competitive seller’s market.

- The market is shifting toward a more balanced environment between buyers and sellers.

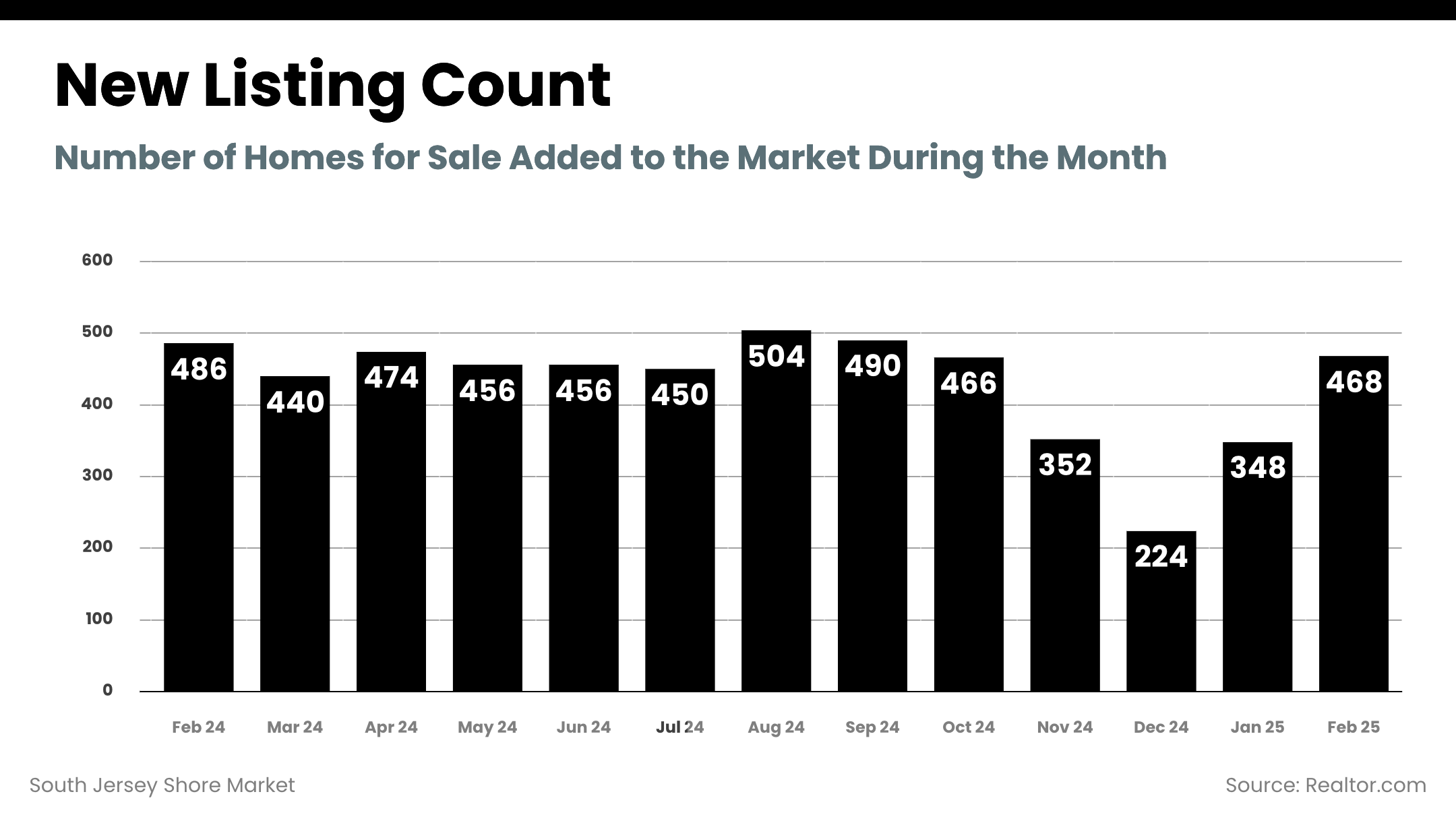

New Listing Count

- February 2025: 468 new listings, a rebound from December 2024’s low of 224 listings.

- The increase in listings signals that spring market activity is ramping up.

- More listings give buyers more options, but sellers will face higher competition.

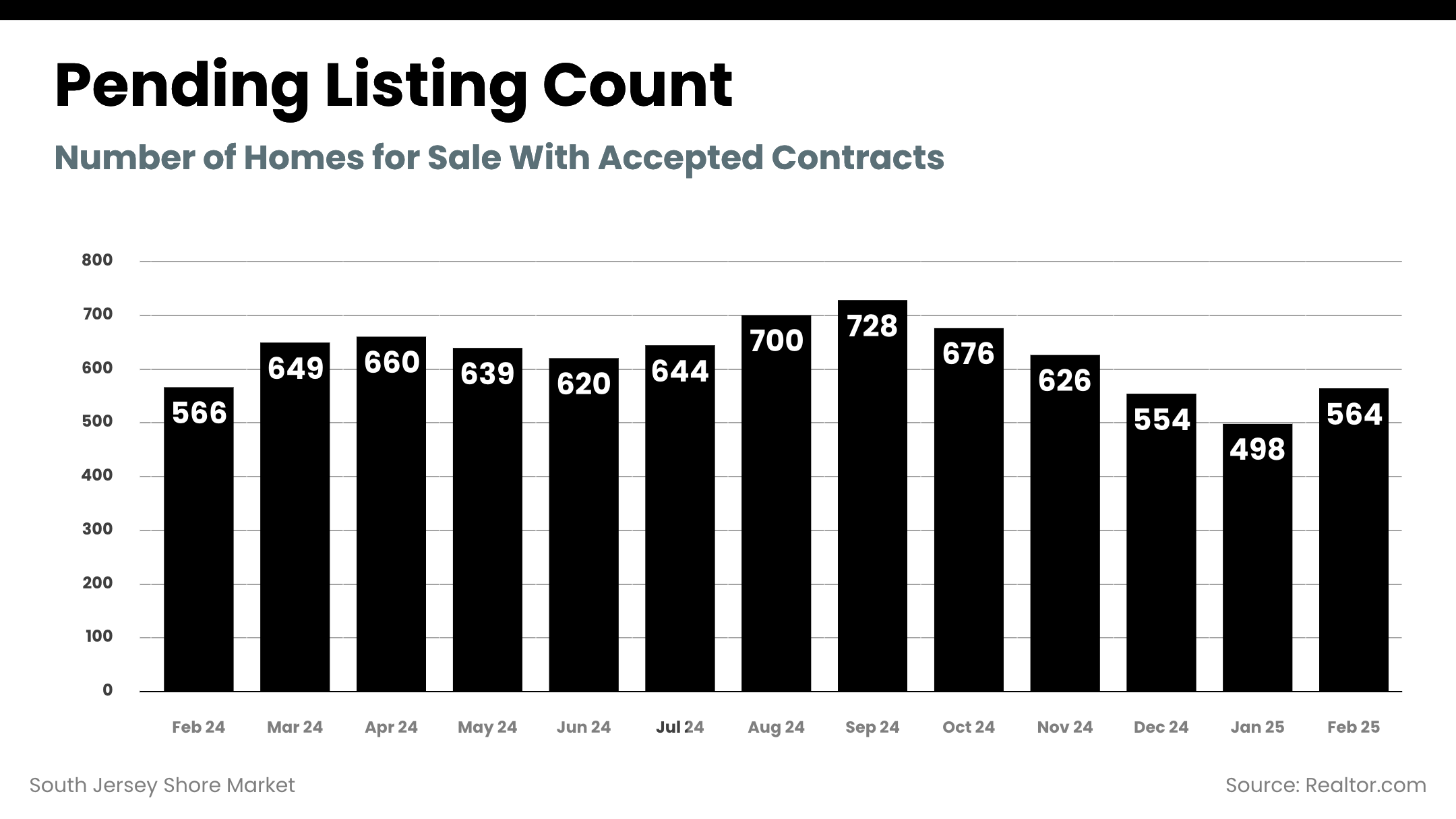

Pending Listing Count

- February 2025: 564 pending listings, up from 498 in January 2025.

- The peak was 728 pending listings in September 2024, followed by a winter slowdown.

- Rising pending sales suggest buyers are returning as mortgage rates ease and inventory levels increase.

How This Affects Buyers & Sellers

- For Buyers:

- Declining mortgage rates improve affordability—locking in rates soon could be a smart move.

- More inventory means more choices and less competition.

- Stabilizing prices allow buyers to make more strategic, data-driven decisions.

- For Sellers:

- Homes are still selling well, particularly in Atlantic County, where days on market is only 31 days.

- Correct pricing is critical—overpricing may lead to extended listing times.

- Spring and summer are peak selling seasons, making now a great time to list your home.

Final Thoughts

The March 2025 real estate market presents a dynamic environment with both opportunities and challenges. Lower mortgage rates and rising inventory are shifting conditions in favor of buyers, while sellers in competitive markets like the South Jersey Shore can still expect strong demand if they price strategically.

Frequently Asked Questions (FAQ) – South Jersey Shore Real Estate Market

1. What is the current real estate market trend in the South Jersey Shore?

The market is shifting towards a more balanced state with increasing inventory, stabilizing home prices, and declining mortgage rates. February 2025 data shows 3.6 months of inventory and a median 74 days on market, giving buyers more options.

2. Are home prices going up or down in Cape May and Atlantic County?

Home prices have remained relatively stable with some minor declines. The median sold price in Atlantic County is $325,000, while Cape May County's median price is $765,000. Prices may fluctuate as inventory rises and buyer demand shifts.

3. How long are homes staying on the market?

As of February 2025, the median days on market is 74 days, up from 66 days a year ago. However, this is expected to decrease as spring and summer bring more buyer activity.

4. Is now a good time to buy a home in South Jersey Shore?

Yes, with mortgage rates declining and more inventory available, buyers have better negotiating power. The increase in listings and slightly lower competition compared to last year make it an opportune time to purchase.

5. Should I sell my home now or wait?

Spring and summer are traditionally strong selling seasons. If you're considering selling, listing your home now can help you take advantage of increasing buyer activity as mortgage rates decline.

6. What are the mortgage rate projections for 2025?

Mortgage rates are projected to decline further, with estimates showing rates around 6.53% by Q4 2025. This could increase buyer demand and affordability.