South Jersey Shore Real Estate Market Update – April 2025

As we step into the heart of the spring real estate season, the South Jersey Shore market—encompassing Cape May and Atlantic Counties—continues to demonstrate resilience and steady activity amidst evolving economic conditions. From pricing trends to inventory dynamics and macroeconomic influences like tariffs and interest rates, here’s a comprehensive analysis of what’s shaping our local market.

March 2025 Recap: Market Snapshot

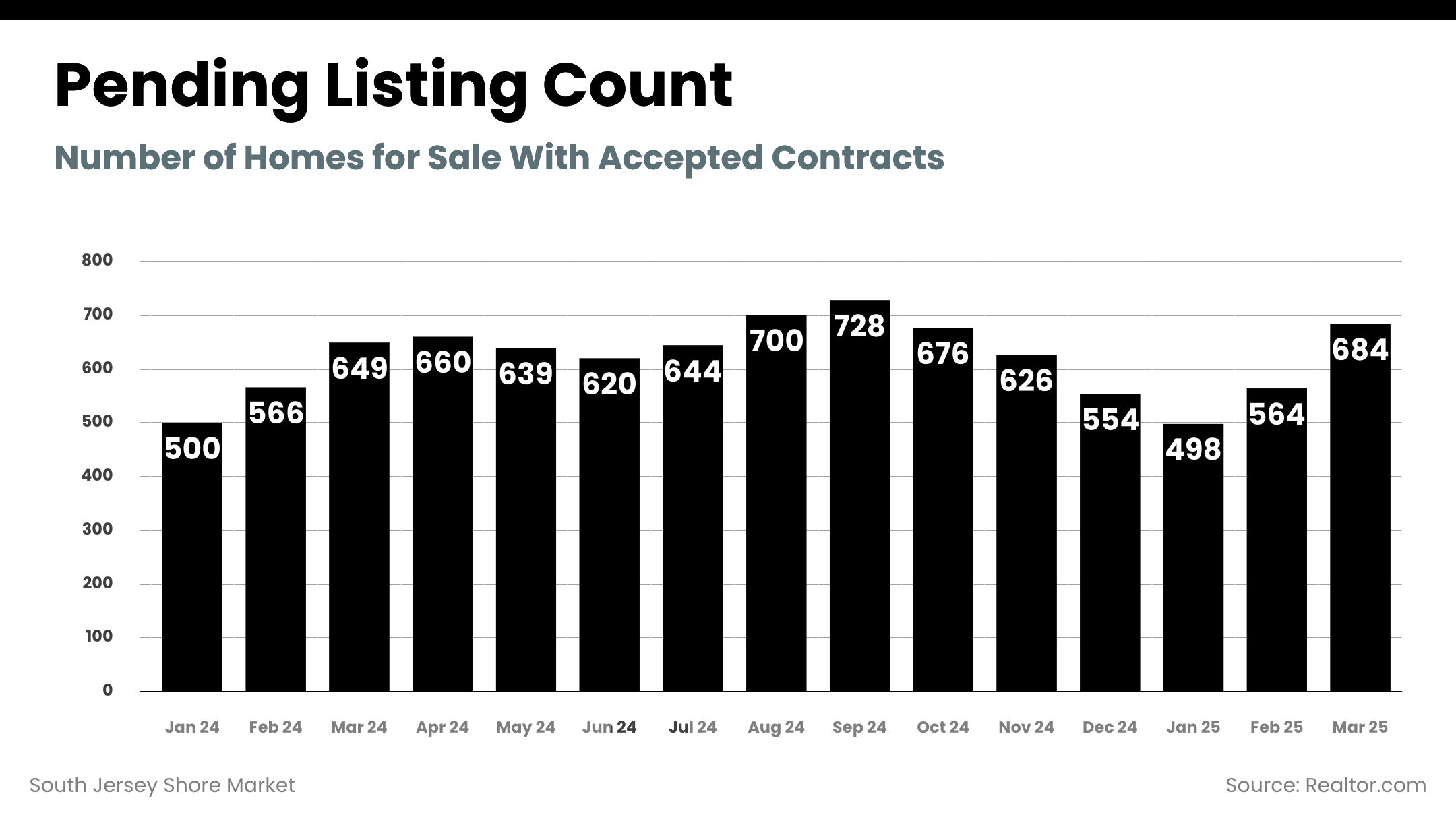

According to the latest combined regional report for Cape May and Atlantic Counties, the median listing price stood at $629,000 in March, with homes spending an average of 49 days on the market. Buyer activity was robust, reflected in a Hotness Score of 66.06—well above average. This aligns with the surge in pending sales across the region, which reached 684, the highest monthly count since last summer.

Key stats for March 2025:

- Active Listings: 1,905

- New Listings: 840

- Total Inventory: 2,839

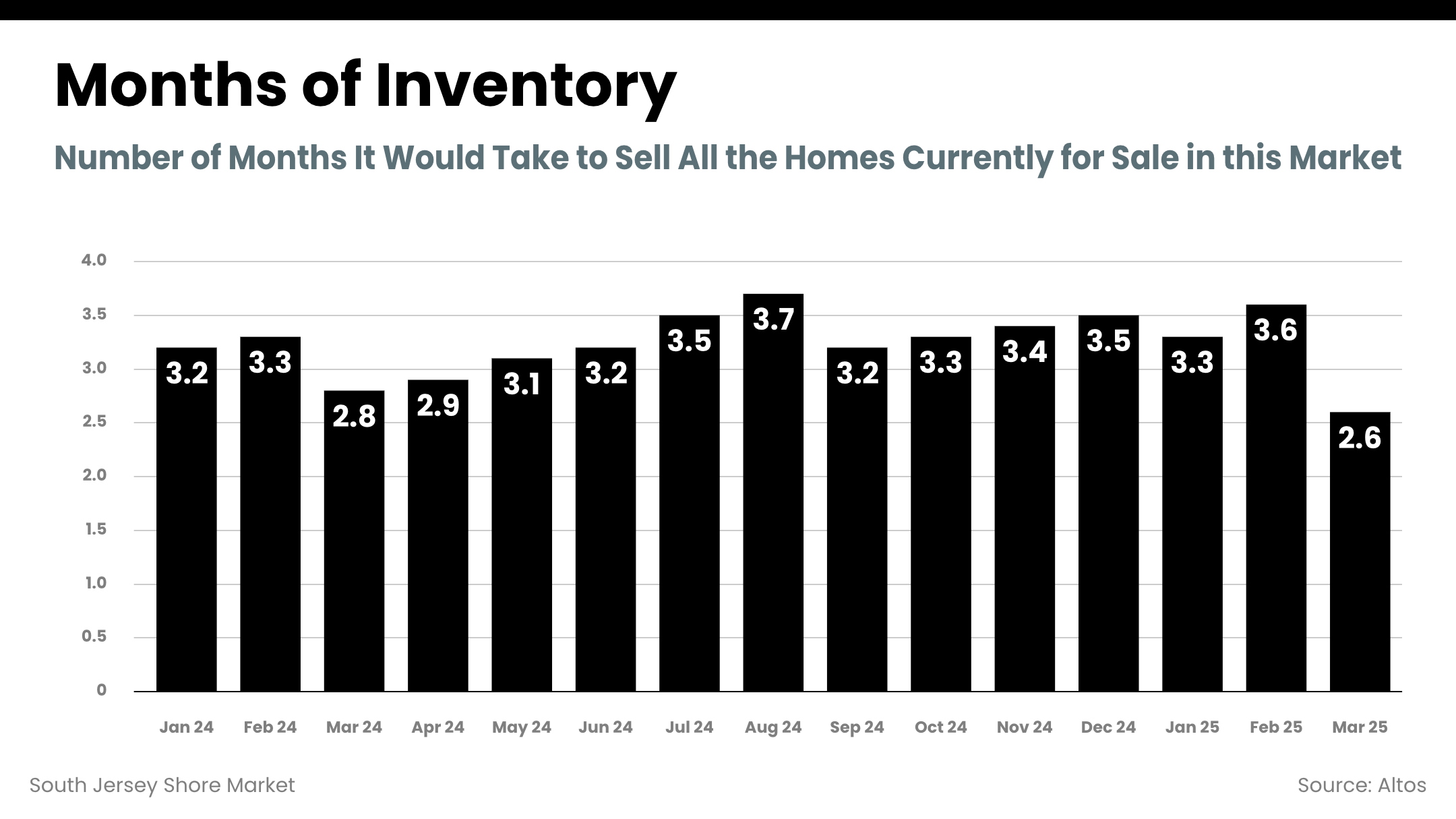

- Months of Inventory (MOI): 2.27 (seller’s market)

Inventory Trends: The Rebalancing Continues

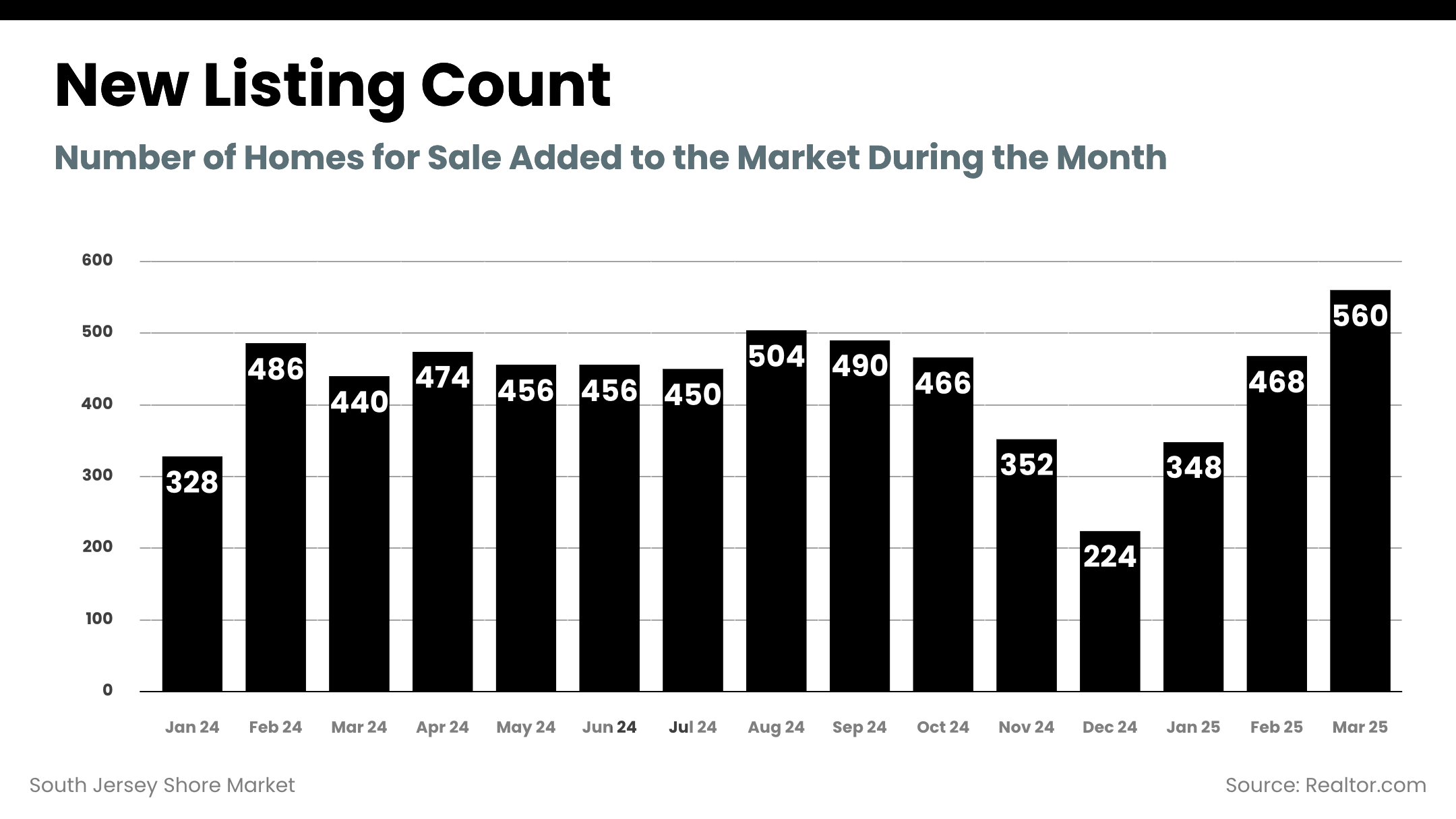

Inventory continues to grow across the South Jersey Shore, with March seeing 840 new listings, up from 716 in February. This influx helped bring MOI down slightly—a healthy sign of an active spring market. Compared to the same time last year, the South Jersey Shore’s inventory trend reflects:

- New Listings up ~27% YoY

- Pending Sales up ~5.4% YoY

- A tightening MOI, despite higher supply, due to strong buyer demand

Macro Trends: Tariffs, Rates & Economic Outlook

The Tariff Shock

A new set of tariffs announced in early April—including a 10% baseline on most imports and higher rates on countries with trade deficits—has rattled markets. The result? Increased uncertainty, potential input cost rises for builders, and a bond rally that’s pushing mortgage rates lower.

Fed Chair Jerome Powell commented that the effects of tariffs may lead to marginal increases in both inflation and unemployment, but the Fed is currently taking a wait-and-see approach.

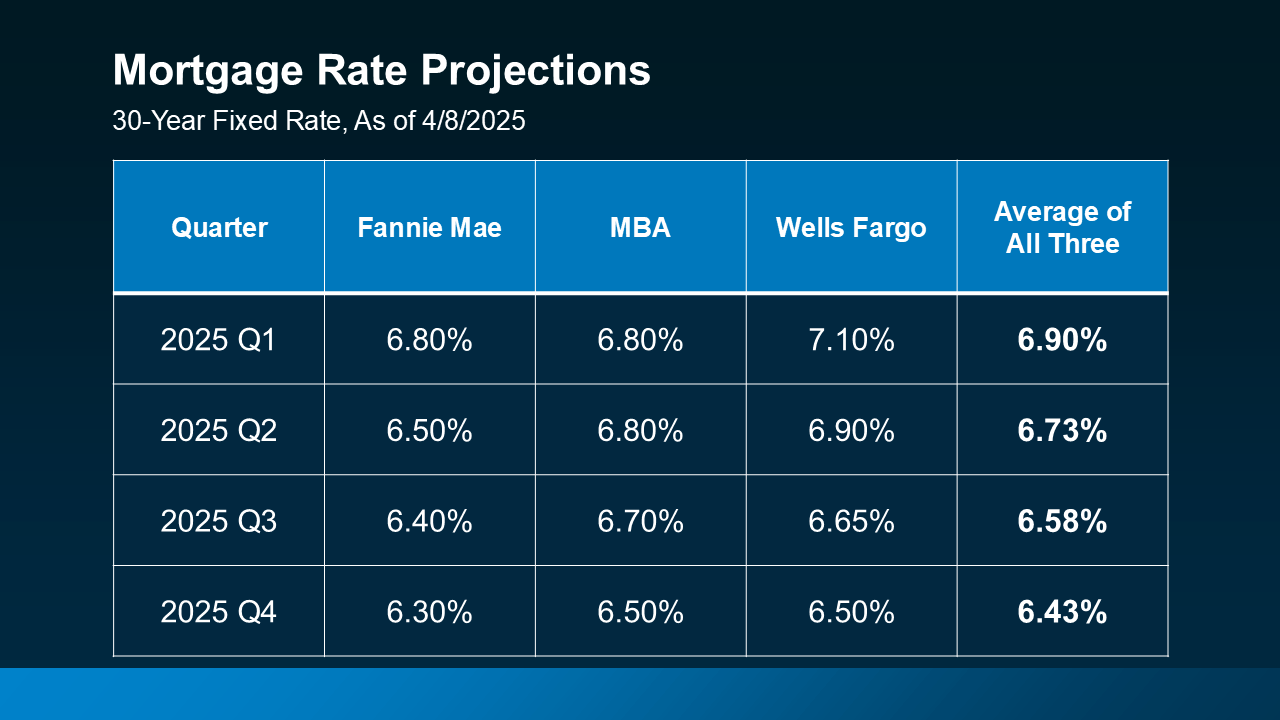

Mortgage Rates Outlook

Rates have hovered in the 6.6% to 6.7% range for over a month, but downward pressure is increasing due to economic uncertainty. Projections suggest:

- Q2 2025 Average Rate: ~6.73%

- Q4 2025 Average Rate: ~6.43%

This could ease the lock-in effect—currently, 82% of mortgage holders have a rate under 6%—and encourage more listings later this year.

What It Means for Buyers and Sellers

For Buyers:

- More inventory = more choices, especially compared to the ultra-tight pandemic years

- Lower mortgage rates may improve affordability in the coming months

- Cape May’s luxury segment continues to appreciate rapidly—potentially a time-sensitive opportunity

For Sellers:

- Homes are still selling quickly (49 DOM average), and close to asking price

- Pricing power remains solid, especially for well-maintained or turnkey properties

- Strategic timing is key: list now while inventory remains relatively low and demand high

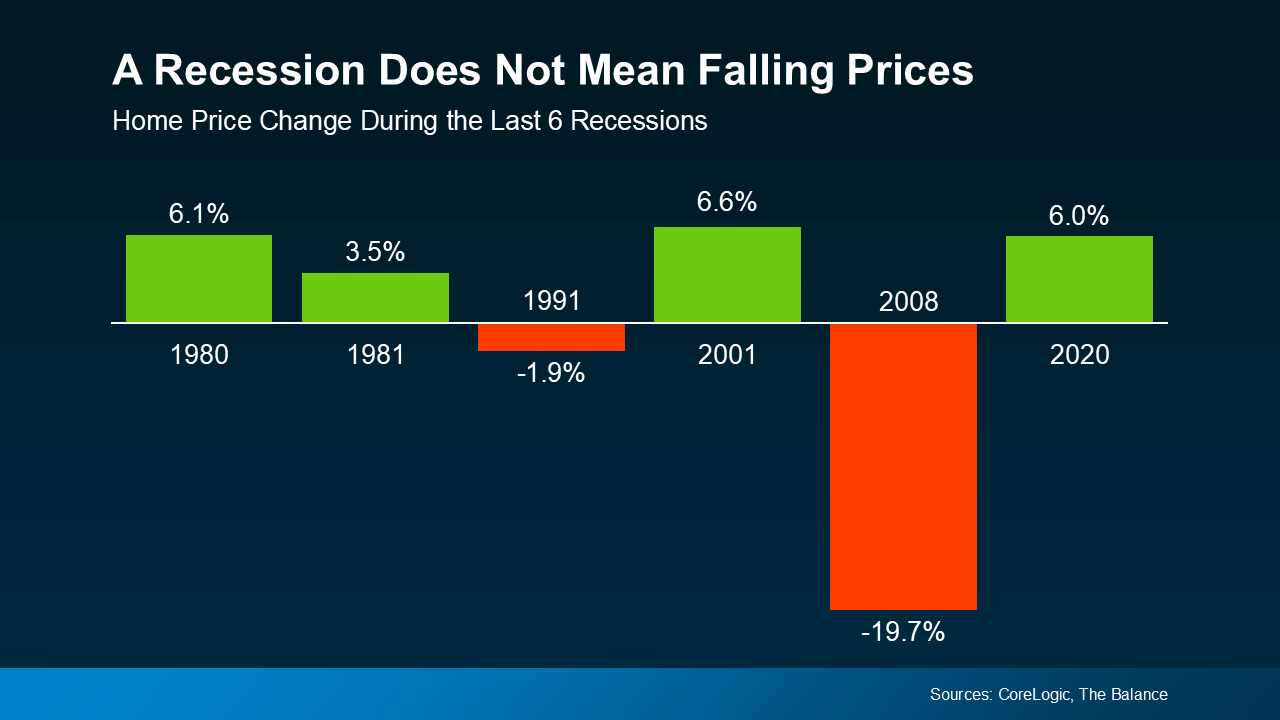

Final Thoughts: Opportunity Amid Uncertainty

Despite media narratives suggesting an economic slowdown, the data tells a more nuanced story. The South Jersey Shore market remains fundamentally strong, with ample equity, stable lending, and growing inventory that supports a more balanced and healthy environment.