The real estate market is constantly changing, and it’s important for buyers and sellers to stay up-to-date on the latest trends. In our area, the market in May 2023 is no exception. It’s still very competitive, with low inventory and multiple offer situations. For those wondering about foreclosure rates, there’s little concern of a market crash due to the high amount of equity in people’s homes. However, the low interest rates on current homes have caused many homeowners to sit tight instead of selling. In this post, we’ll take a closer look at the current state of the real estate market and what it means for buyers and sellers.

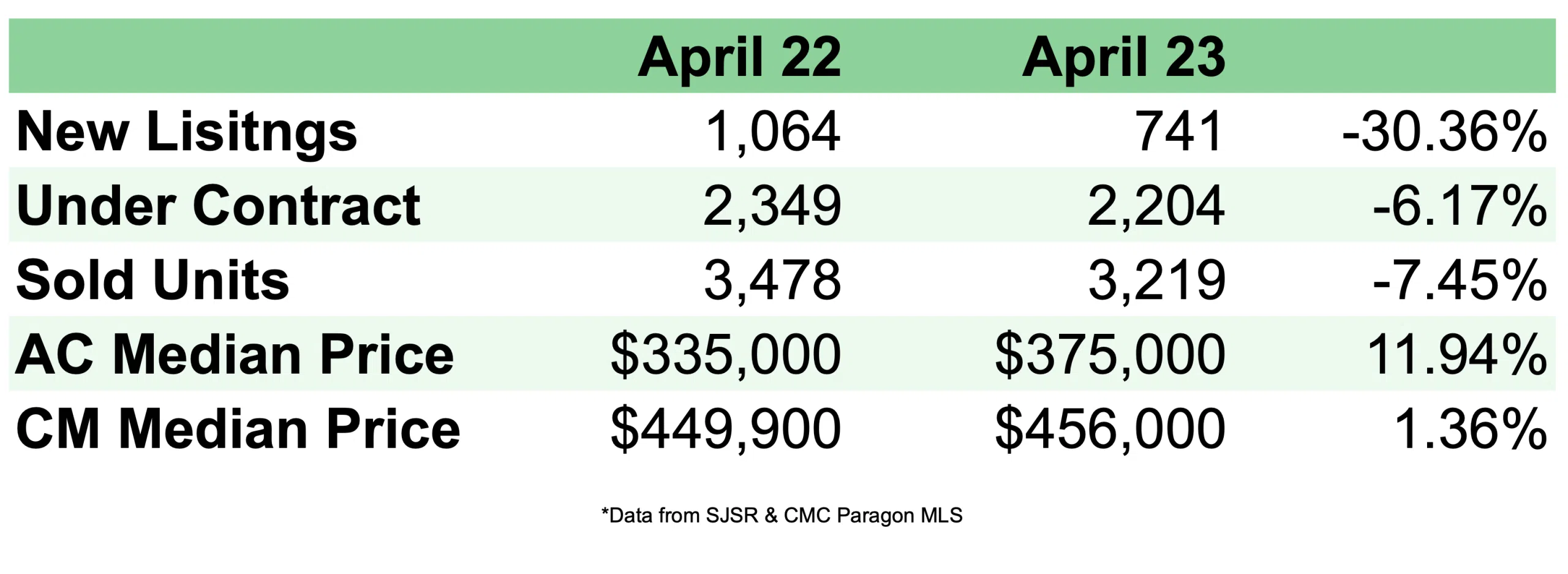

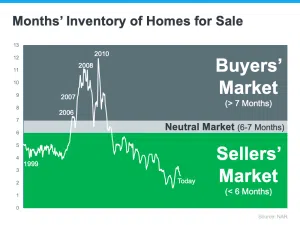

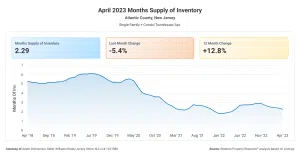

The real estate market, particularly in Atlantic and Cape May County, is still very competitive in May 2023. There’s a lack of inventory, making it difficult for buyers to find properties for sale. In fact, there were about 30% fewer new listings to come onto the market this month. Furthermore, local inventory levels sit at 2-3 month of supply. With such low inventory, it’s unlikely that the market will shift back to a buyer’s market anytime soon.

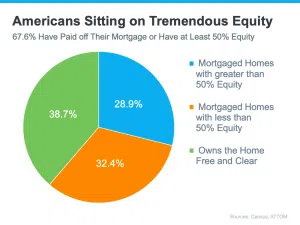

One of the reasons there’s little concern with a market crash or foreclosure rates is because there’s so much equity in people’s homes right now. Nearly 70% of homeowners in the United States have either 100% equity or more than 50% equity in their house. This means that even if the market takes a dip, homeowners are unlikely to have any issues with foreclosure or needing to sell their homes.

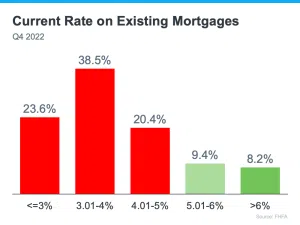

The low interest rate mortgage on current homes, however, have been a big contributor to the low inventory issue. Nearly 80% of people have a mortgage rate that’s less than 5%. If they were to sell their home and purchase a new one, they would likely end up with a rate that’s at least 6-7% or more, depending on their purchase. As a result, many homeowners are choosing to stay put instead of selling and potentially losing their low interest rate.

Another media headline to note is regarding loan level pricing adjustments. These fees are paid by buyers to the mortgage lender, and they’ve been raised for people with higher credit scores (I misspoke in the vide and said interest rates*).

The current state of the real estate market in New Jersey is still very competitive with low inventory and multiple offer situations. While there’s little concern about a market crash or foreclosure rates due to high equity in people’s homes, the low interest rates on current homes have caused many to stay put instead of selling. Buyers are also struggling with loan level pricing adjustments, which can make affordability more difficult. As the market continues evolve, it’s important for both buyers and sellers to stay up-to-date on the latest trends and make informed decisions when it comes to real estate transactions.