As 2024 comes to a close, the housing market remains dynamic, with shifts in buyer behavior, inventory trends, and mortgage rates shaping the real estate landscape. In this blog, we’ll dive into the latest statistics and trends for the South Jersey Shore market, provide national insights, and discuss what to expect in 2025.

Key Trends in December 2024 Housing Market

- Mortgage Rates Are Easing

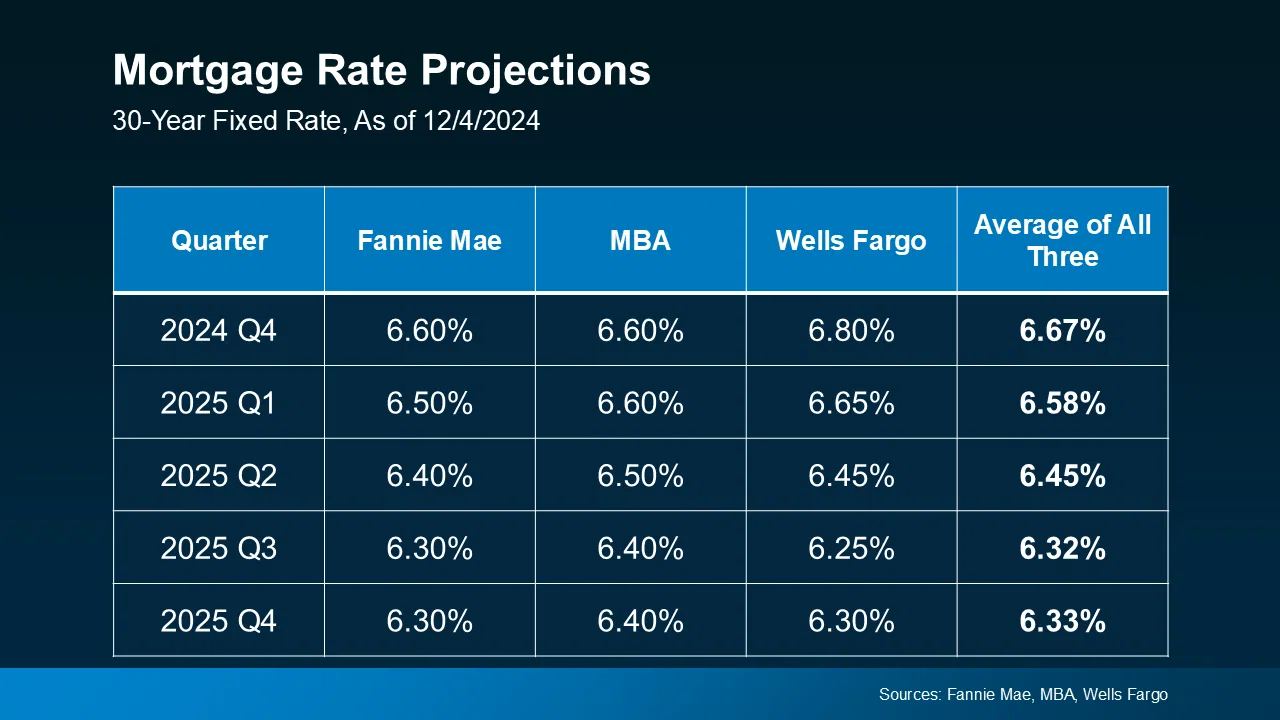

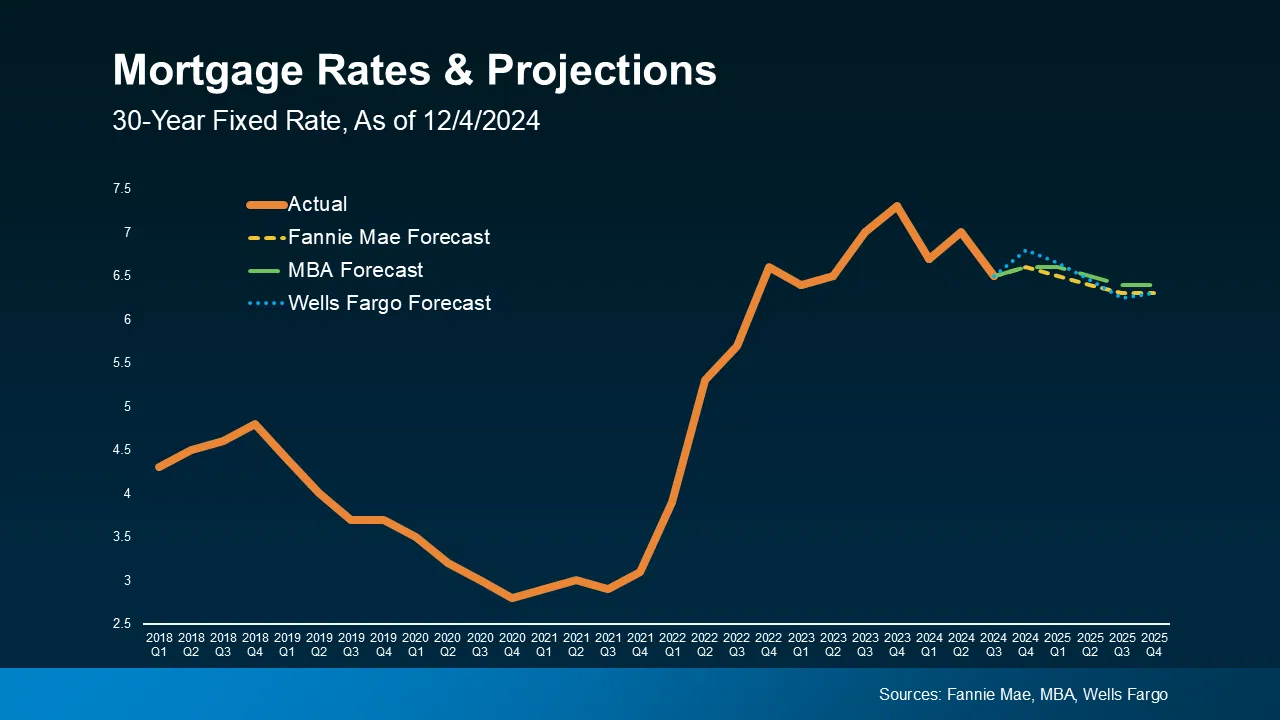

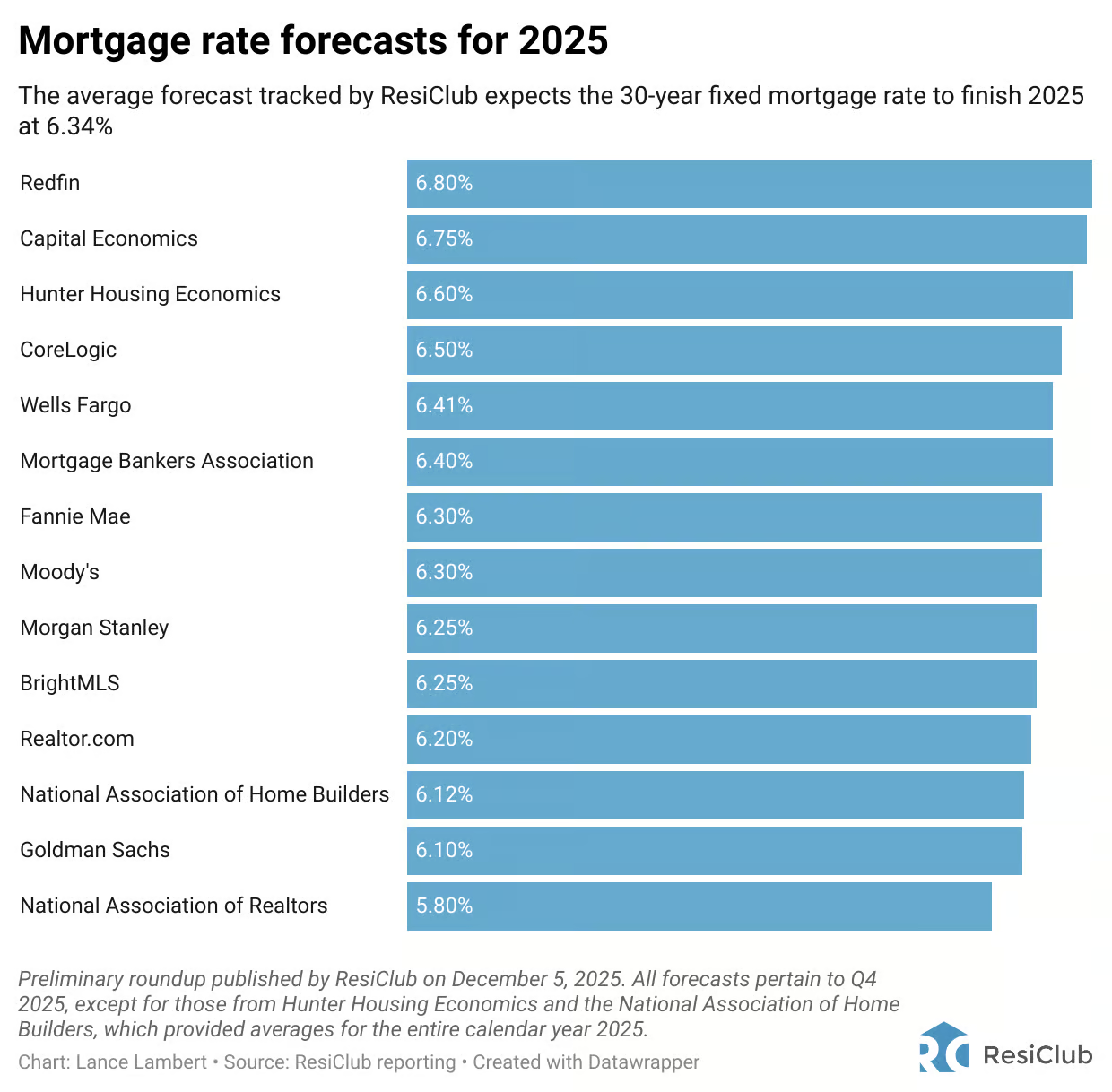

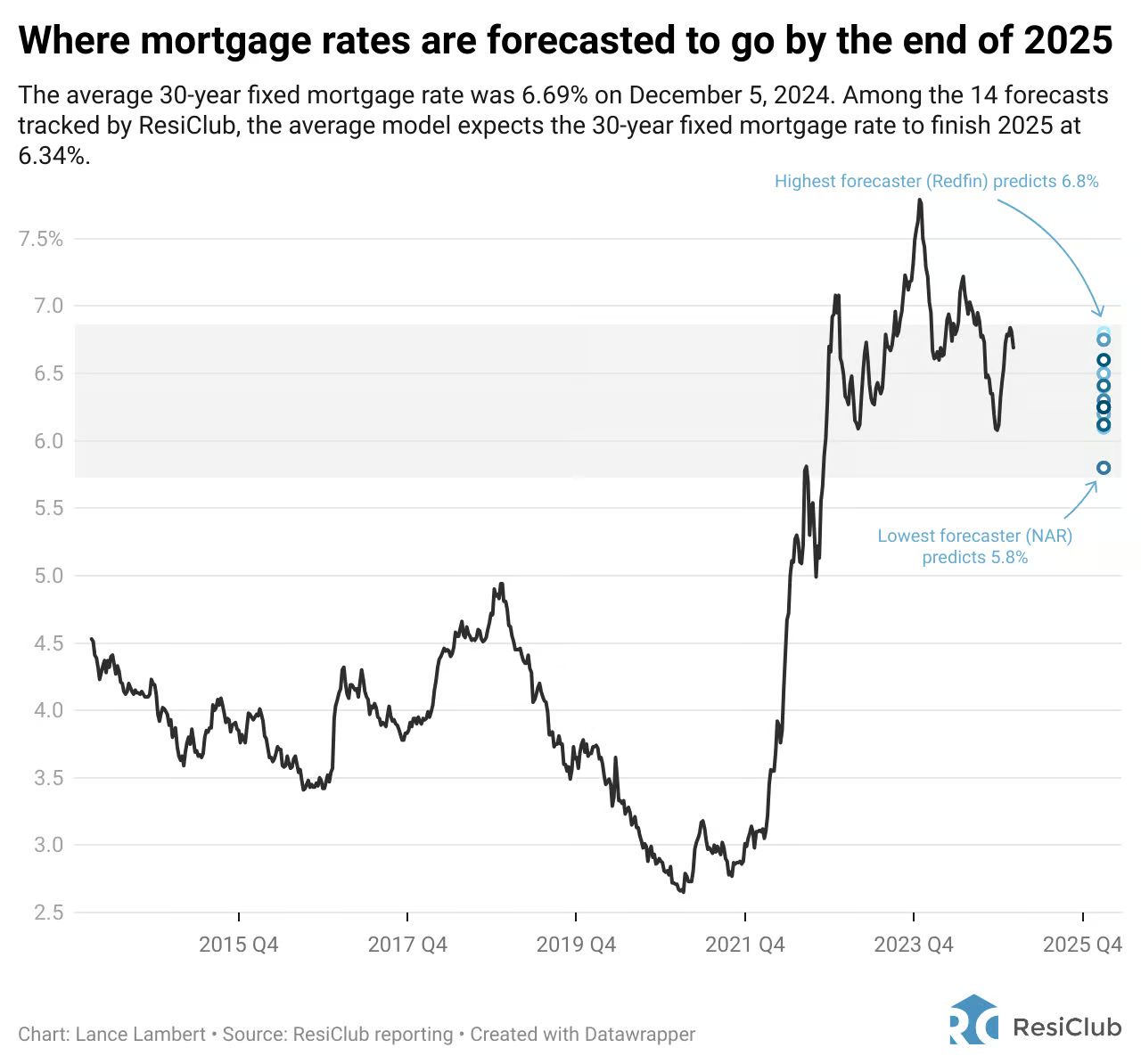

December 2024 marks the beginning of a slight decline in mortgage rates after years of elevated levels. Currently, 30-year fixed rates average around 6.69%, with projections suggesting they could fall to 6.34% by the end of 2025. This shift could open doors for more buyers, improving affordability and boosting activity. - Inventory Levels Are Improving—Slowly

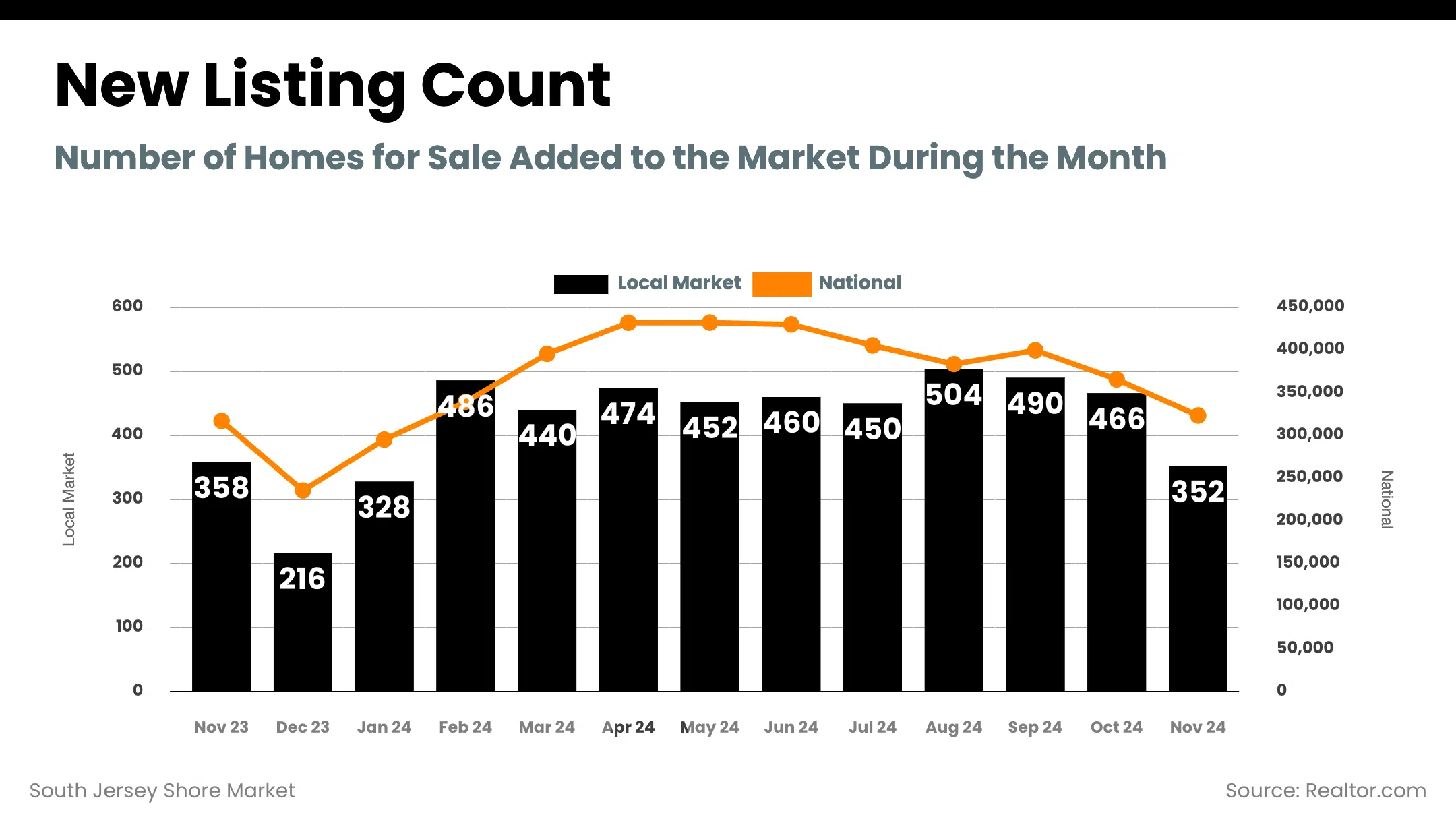

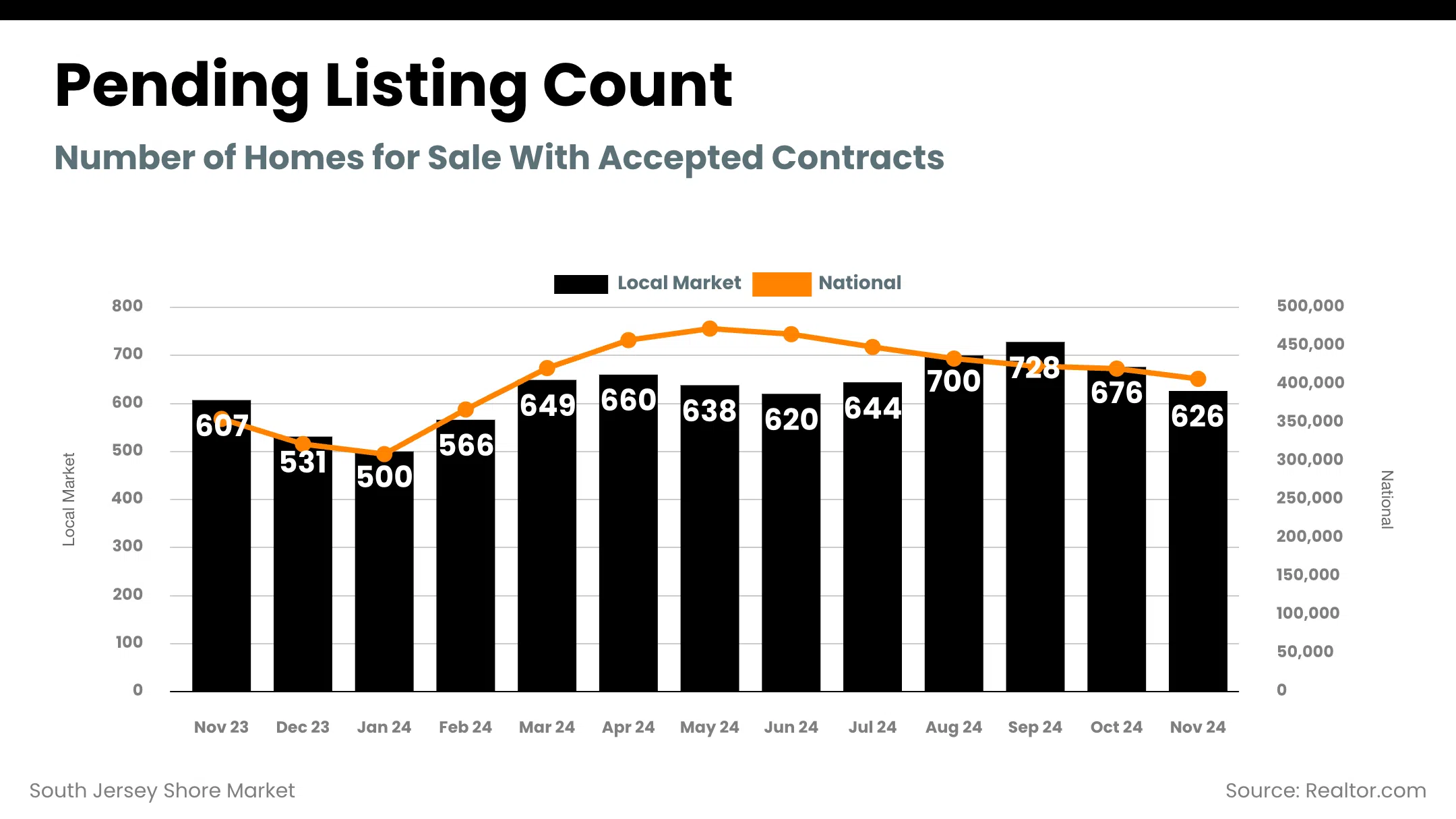

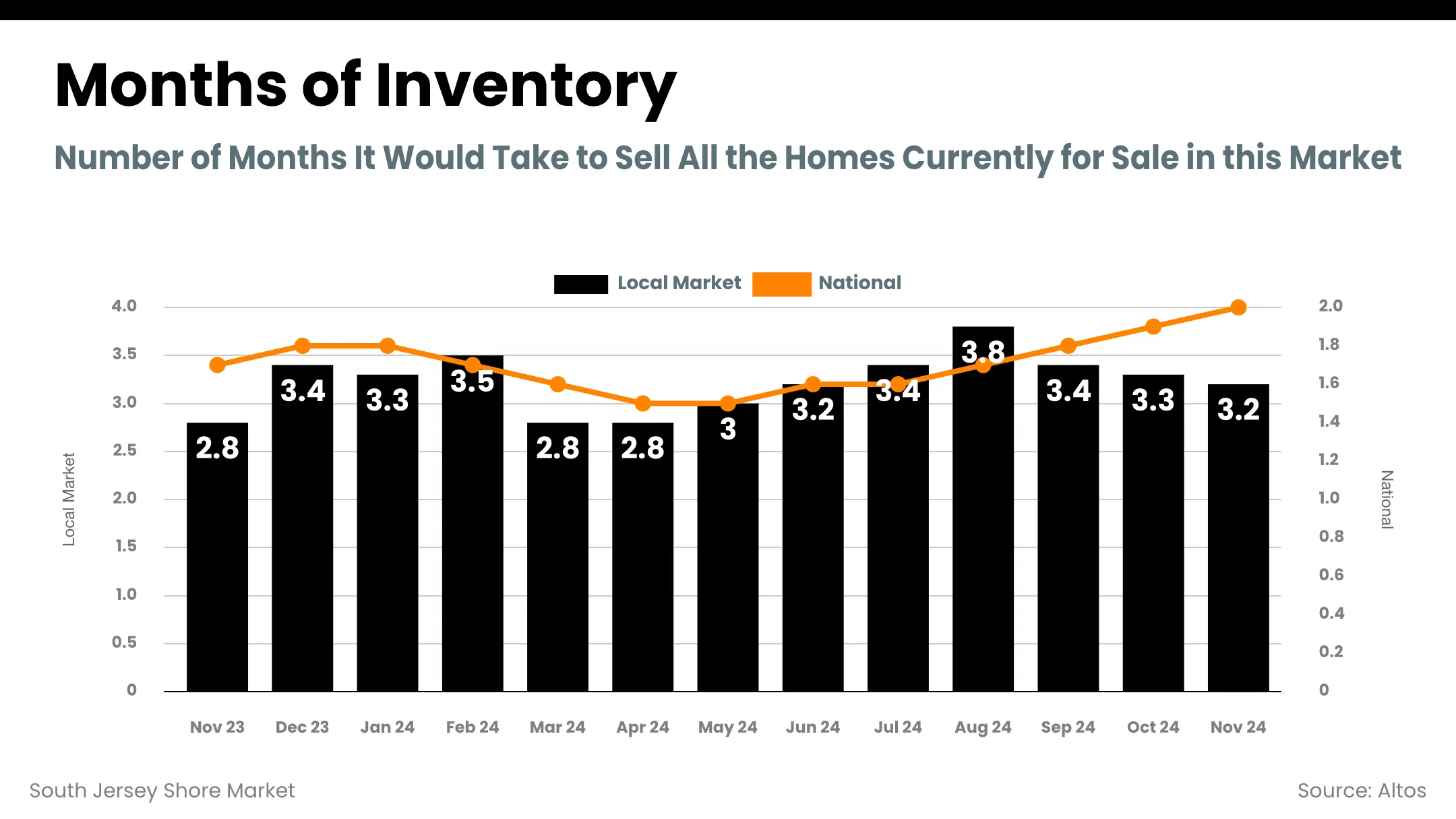

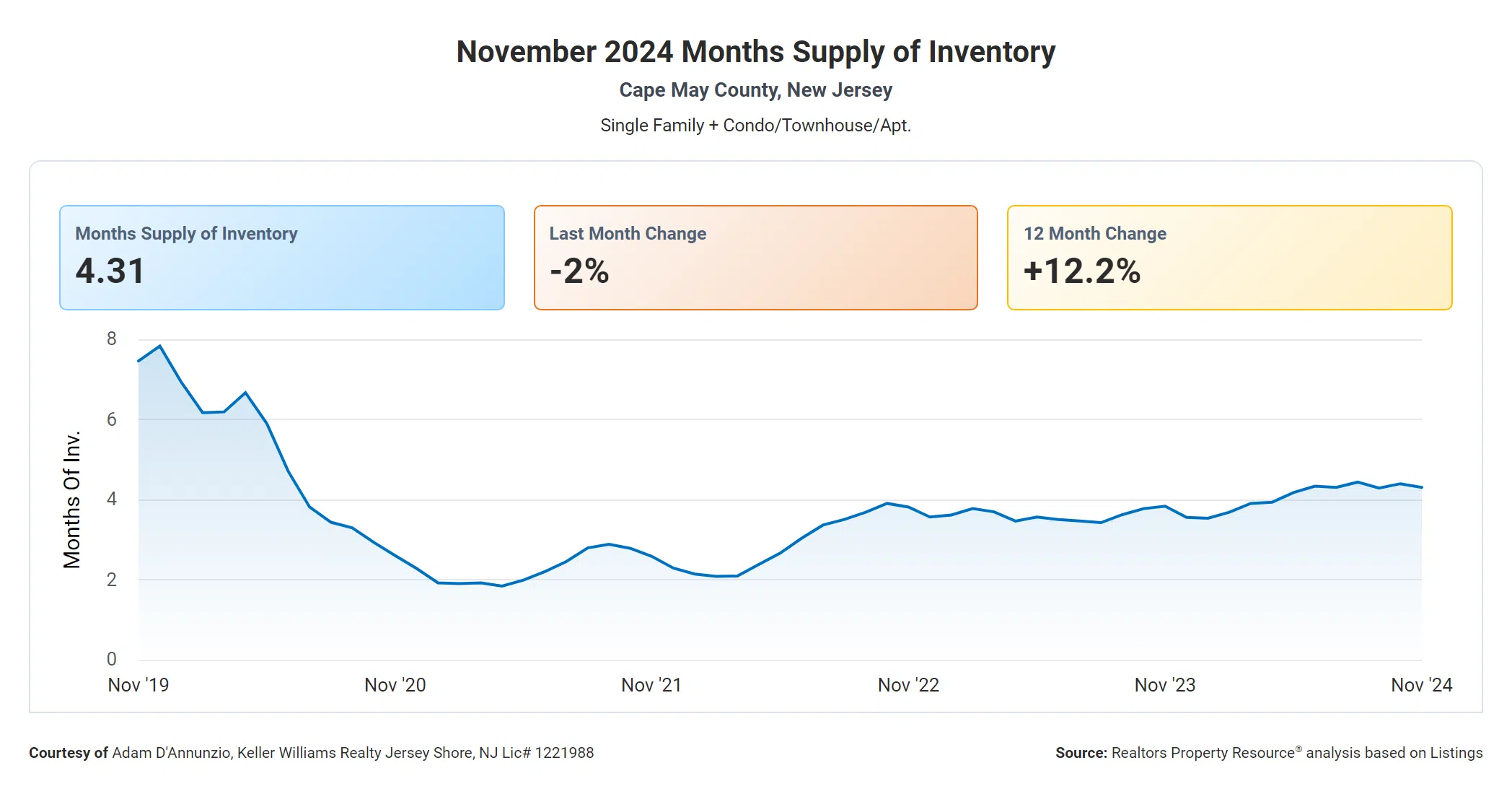

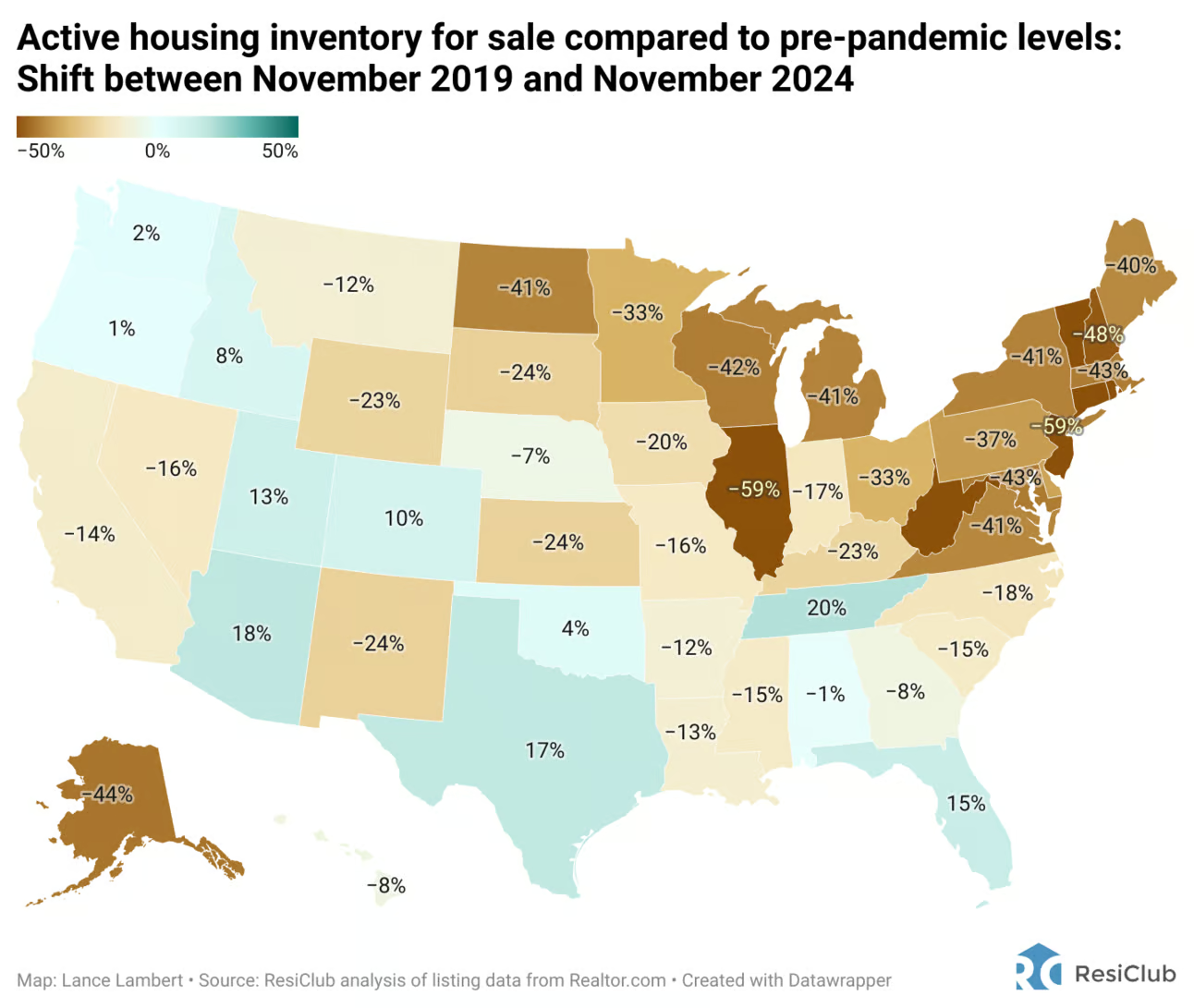

Nationally, inventory levels are modestly increasing but remain historically low in many regions. Locally, the South Jersey Shore market saw 3.2 months of inventory in November 2024, up from 2.8 months in November 2023. Cape May County also showed a 12.2% year-over-year increase in inventory, signaling more options for buyers. - Buyer Demand Remains Resilient

Despite high mortgage rates, pending contracts continue to rise. November 2024 saw 626 pending listings in the South Jersey Shore market compared to 607 in November 2023. Competitive markets like New Jersey continue to see multiple offers on well-priced homes. - Home Prices Continue to Appreciate

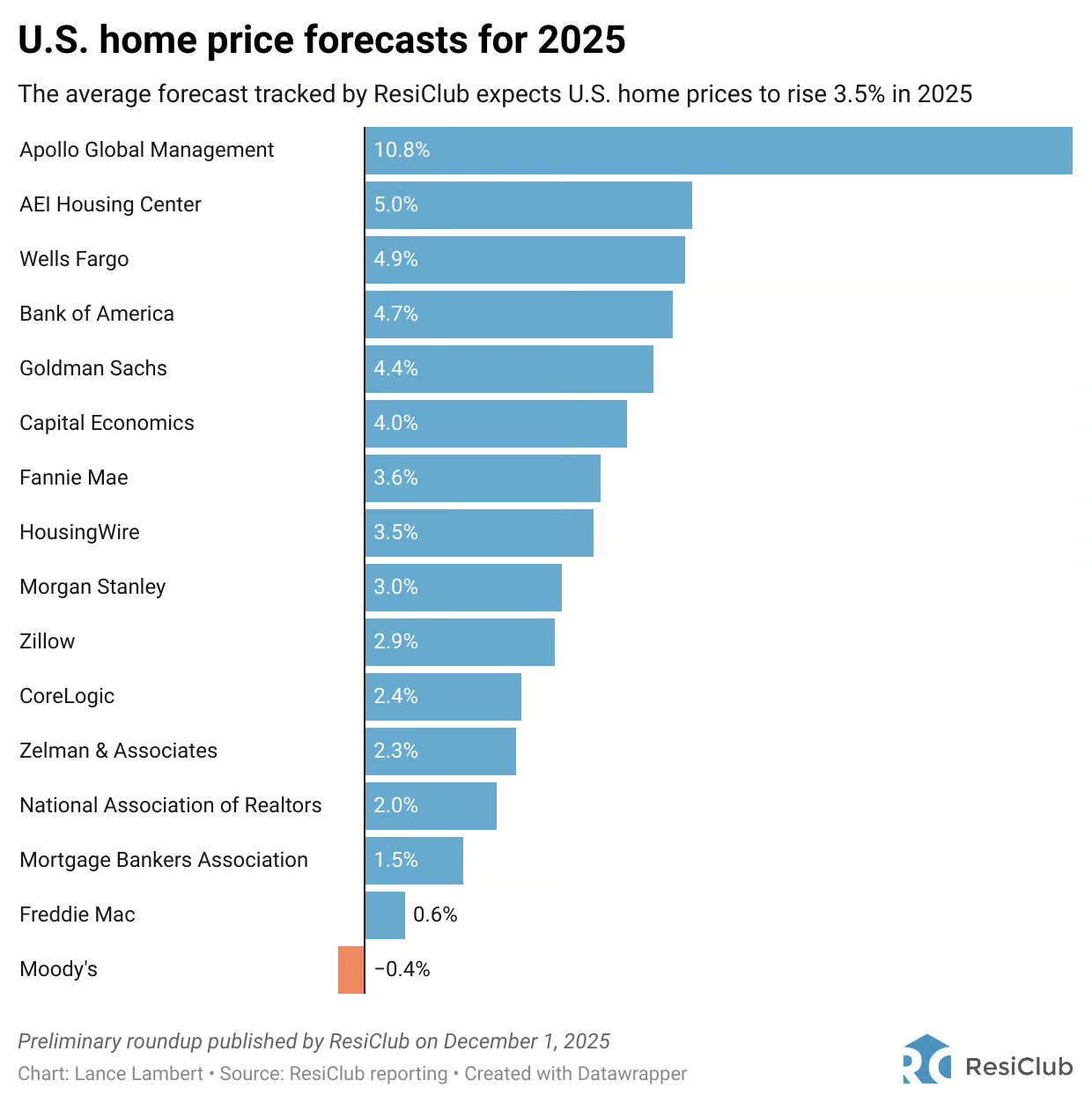

Median home prices have climbed 6.1% year-over-year to $383,460, reflecting steady growth even as sales slow. Nationally, experts forecast home prices to appreciate by an average of 3.5% in 2025, with only minor declines in select areas.

South Jersey Shore Market Insights

Here are some notable highlights for the South Jersey Shore real estate market in November 2024:

- New Listings: 352 new listings, closely aligned with November 2023's 358 listings.

- Pending Sales: 626 homes went under contract, a slight increase from 607 the previous year.

- Days on Market: Median days on market rose to 64, up from 51 in November 2023, reflecting a slightly slower sales pace.

National Housing Market Overview

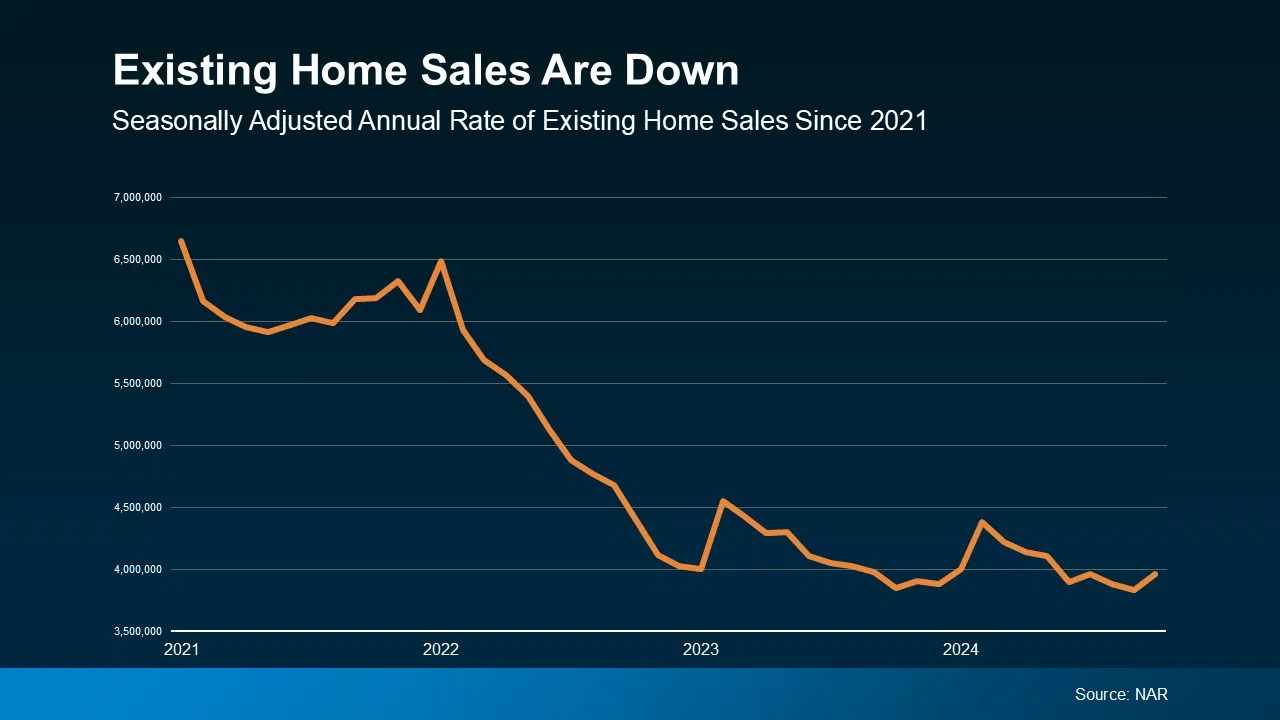

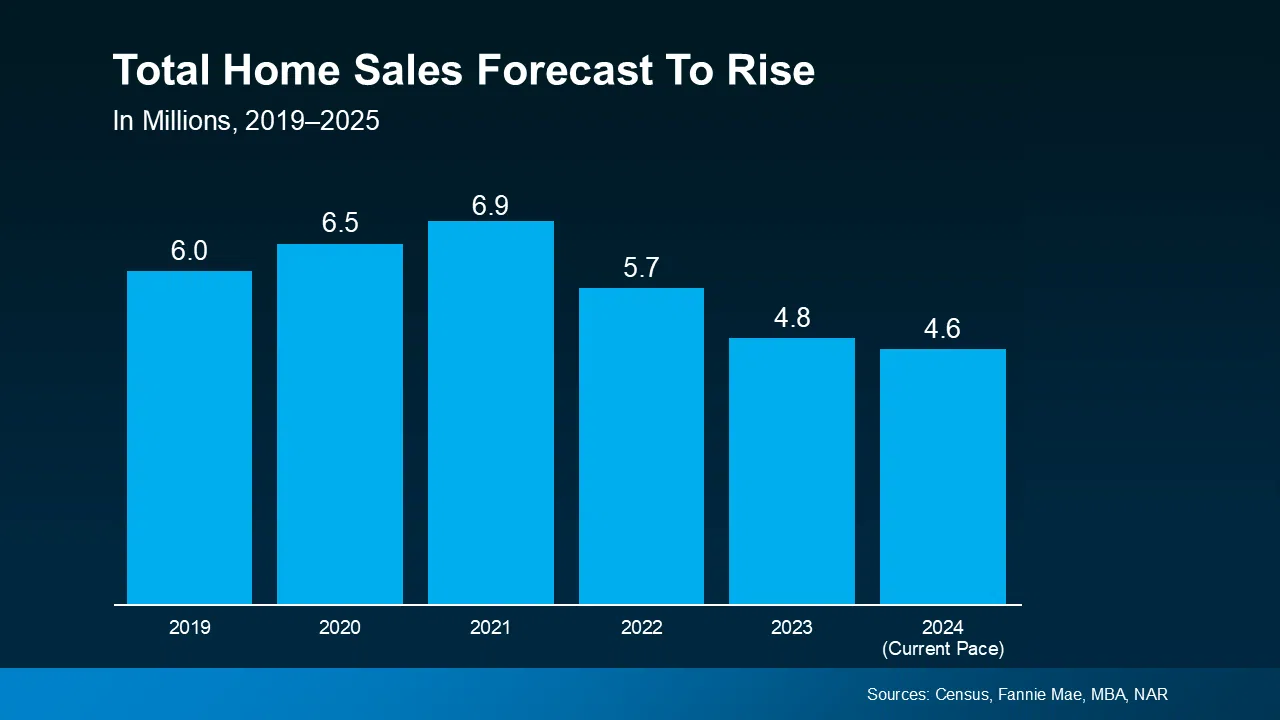

On a national scale, housing sales are projected to end 2024 at approximately 4.6 million units—among the lowest in recent years. However, experts anticipate a modest rebound in 2025 as rates decline and inventory grows.

Key statistics include:

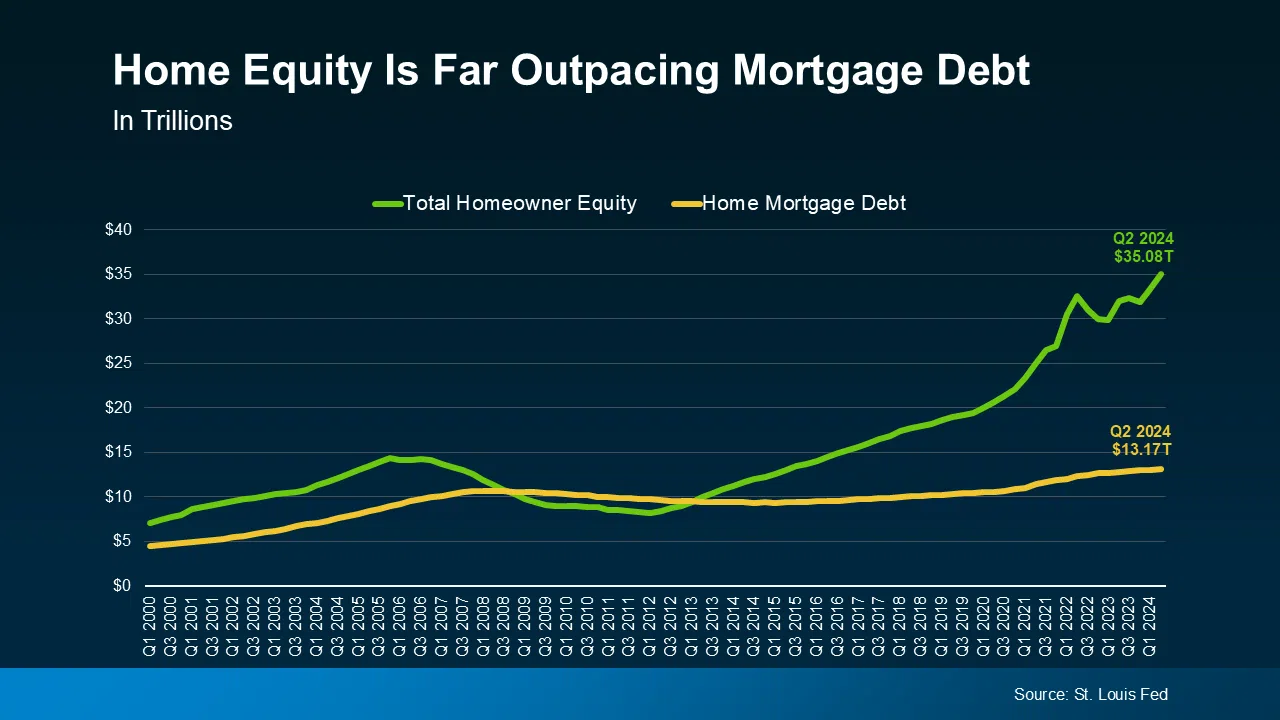

- Home Equity: Total U.S. homeowner equity reached $35.08 trillion in Q2 2024, far outpacing $13.17 trillion in mortgage debt.

- Inventory Trends: While improving in some regions, inventory remains 59% below pre-pandemic levels in states like New Jersey, contrasting with gains in places like Florida.

What to Expect in 2025

Looking ahead, 2025 is expected to bring modest improvements to the housing market. Here’s what experts predict:

- Mortgage Rates: Rates could drop to 6.34% by year-end, providing a gradual lift in affordability.

- Home Sales: Total home sales are projected to rise modestly, rebounding from the lows of 2024.

- Price Appreciation: Home prices are expected to appreciate by an average of 3.5%, continuing the trend of steady growth.

View the Slides

Above are key visuals from the December 2024 market update:

Final Thoughts

The December 2024 housing market is defined by resilience and adaptability. Buyers are finding opportunities despite higher rates, sellers are navigating competitive conditions, and inventory trends hint at a more balanced market ahead.

Stay tuned for next month’s update, where we’ll take a comprehensive look at 2024’s year-end statistics and what they mean for the coming year.

If you’re considering buying, selling, or investing in real estate, contact me today to discuss your goals.