National Real Estate Market Overview

Inventory Surge Continues

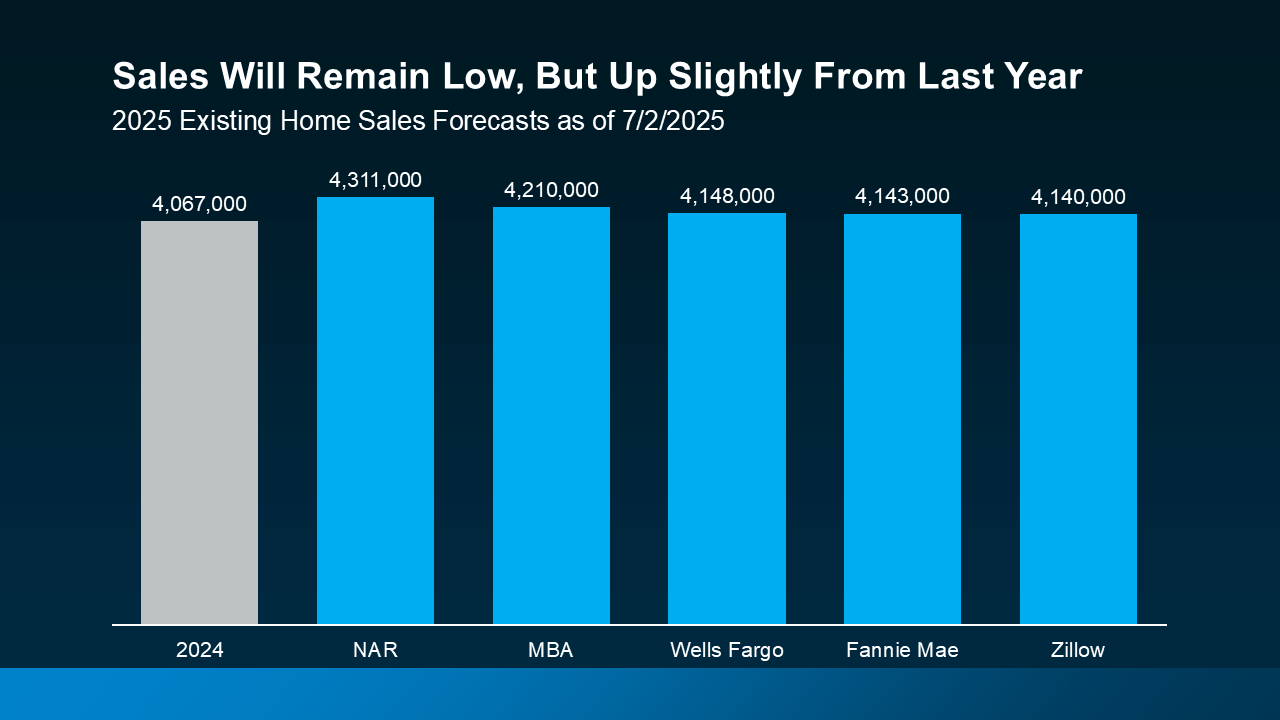

The national housing market posted its 20th consecutive month of inventory growth, with active listings up 28.9% year-over-year, reaching 1.08 million homes in June—the highest post-pandemic level yet. However, we’re still 12.9% below pre-pandemic norms, showing the market hasn’t fully normalized.

- New Listings: Up 6.2% YoY nationally

- Pending Sales: Down 1.6% YoY

- Median Days on Market: Increased to 53 days

- Price Reductions: 20.7% of listings had price cuts in June

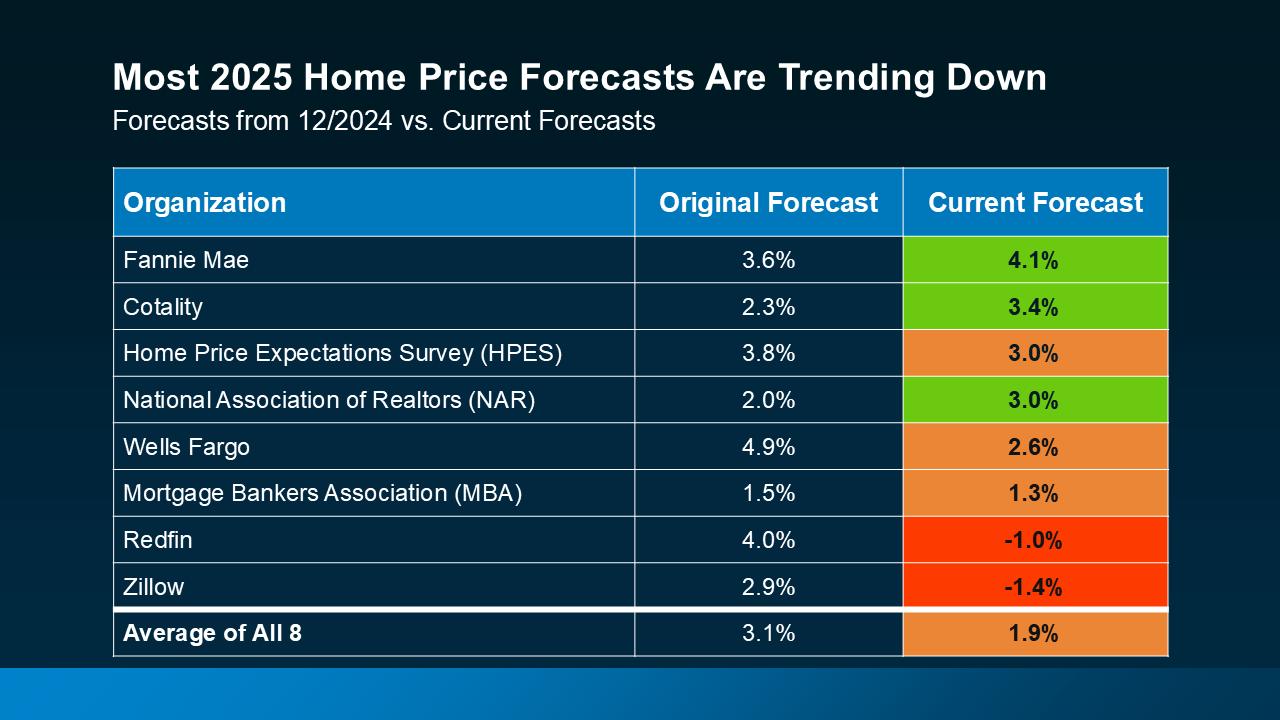

Despite the growing inventory, the national median list price held steady at $440,950, up just 0.2% from last year, suggesting sellers are reluctant to significantly lower their expectations.

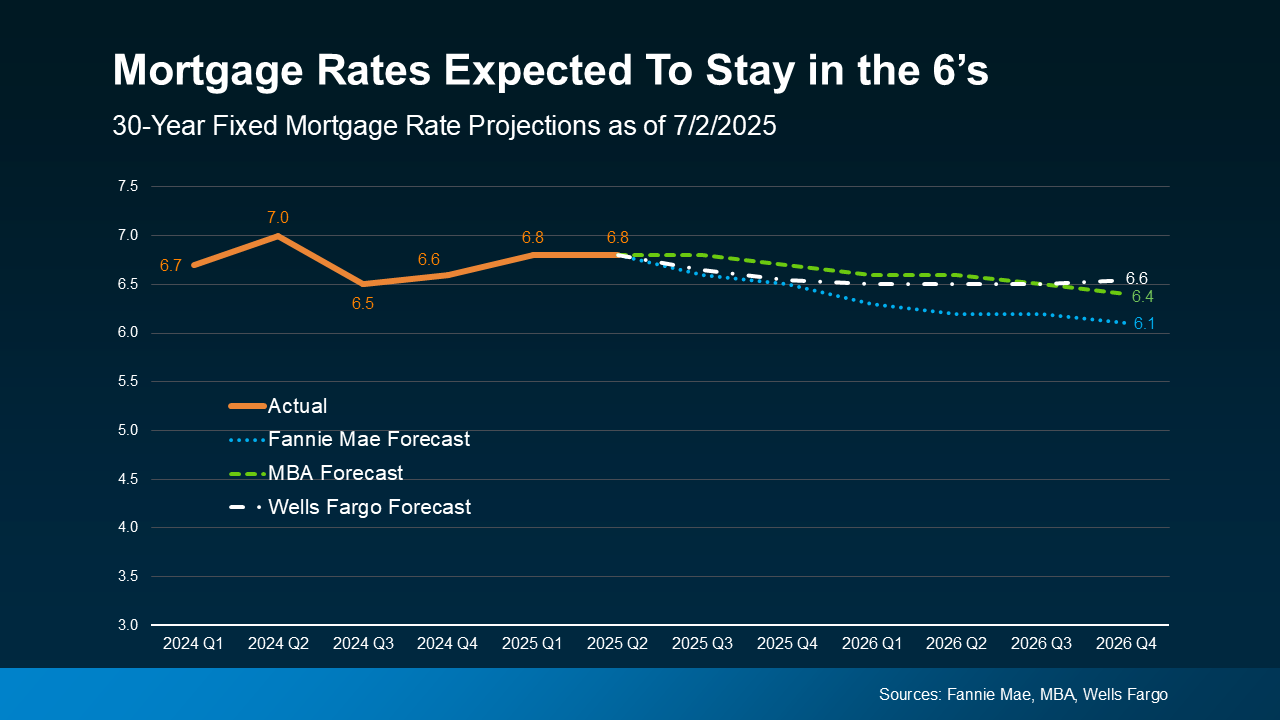

Fed Stays the Course on Rates

Following the June 17–18 Federal Reserve meeting, policymakers showed little support for a rate cut in July, despite pressure from President Trump. Most members signaled that cuts could come later in 2025, possibly in September and December, but remained cautious due to inflation concerns and uncertainty over tariffs. Expect mortgage rates to remain near 6.4% through mid-2026.

South Jersey Shore Market Snapshot (Atlantic & Cape May Counties)

Unlike many softening Sunbelt markets, the South Jersey Shore market remains relatively balanced, though early signs of transition are visible. Here's what the local data says:

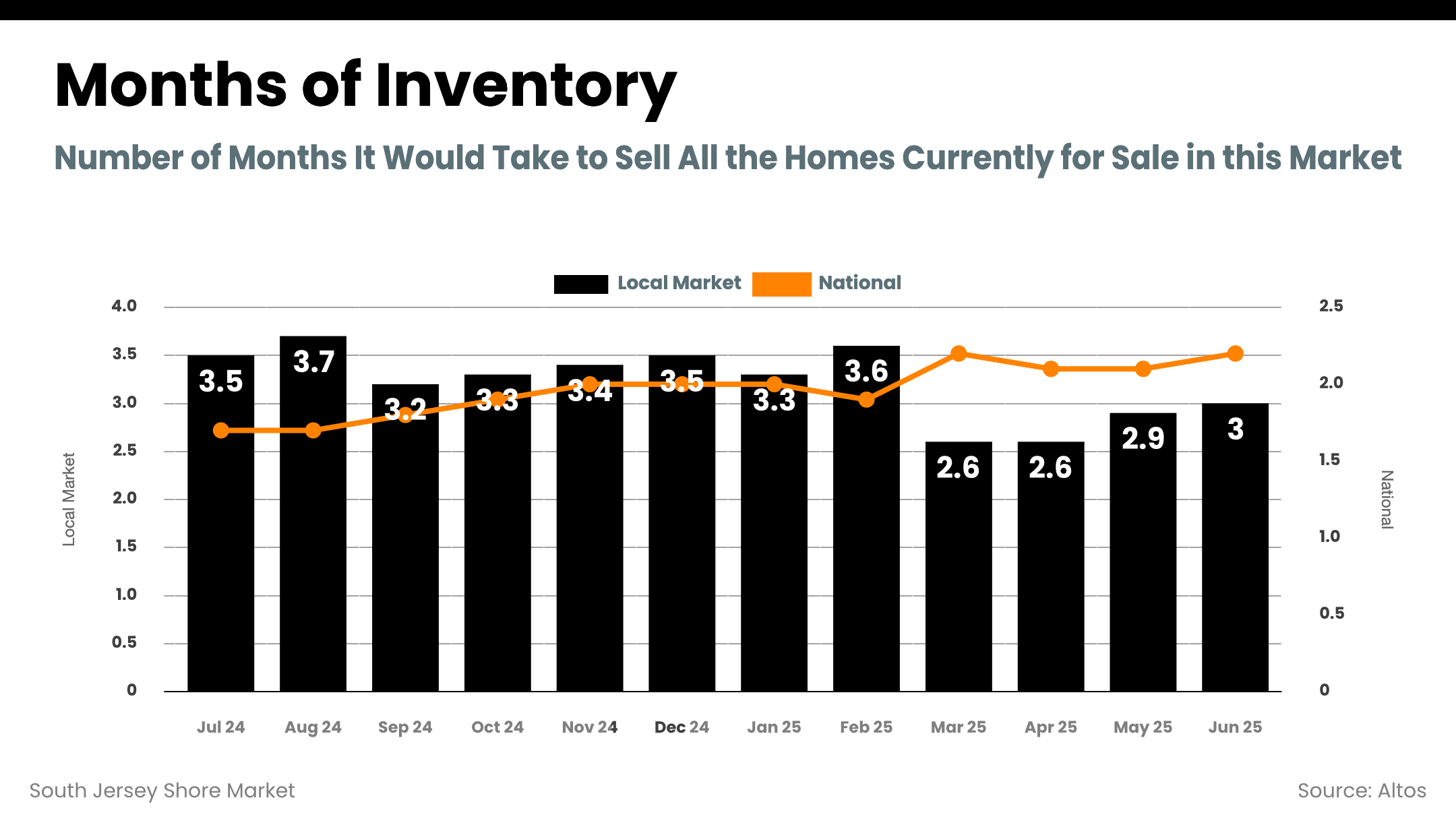

Inventory Levels

- Atlantic County: 4.02 months of supply (up 1.8% MoM, up 22.6% YoY)

- Cape May County: 4.51 months of supply (down 0.7% MoM, down 1.3% YoY)

This suggests a stable, balanced market, where neither side has clear leverage.

Median Sold Prices

- Cape May County: $652,500

- Atlantic County: $398,500

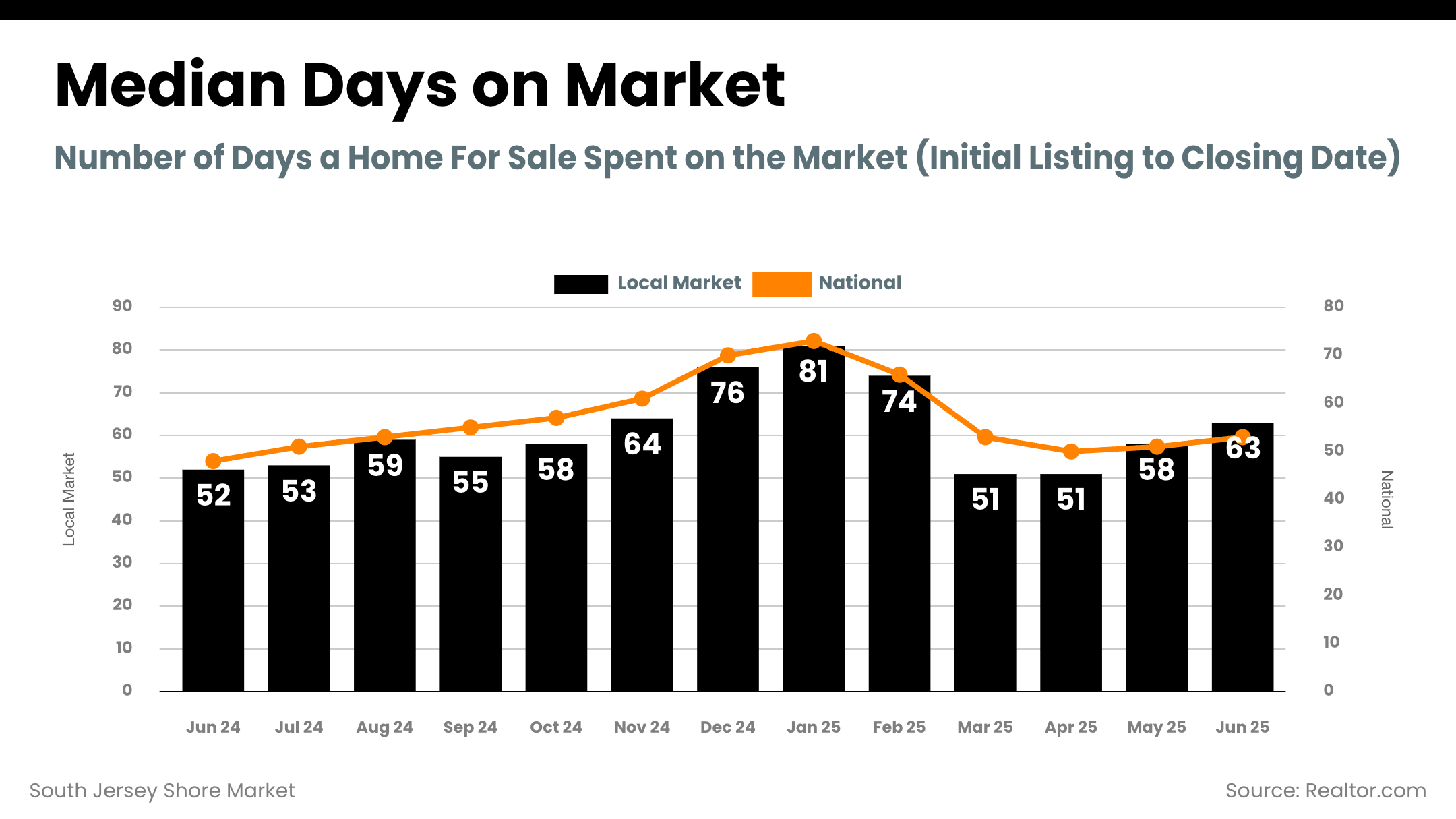

Days on Market

- Cape May: 32 days

- Atlantic: 26 days

- Regional Median: ~70 days

Sold-to-List Price Ratios

- Cape May County: 97%

- Atlantic County: 98%

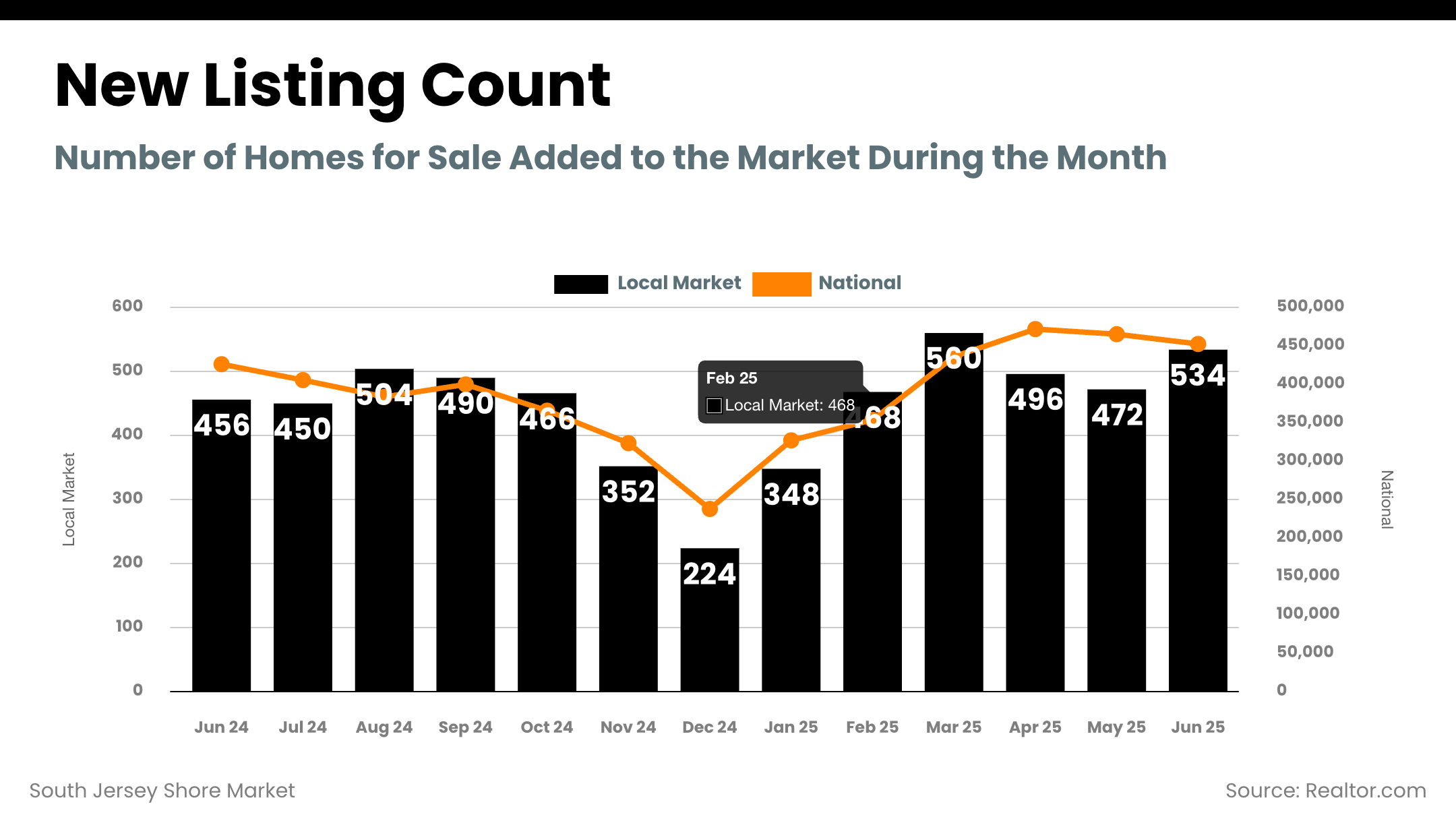

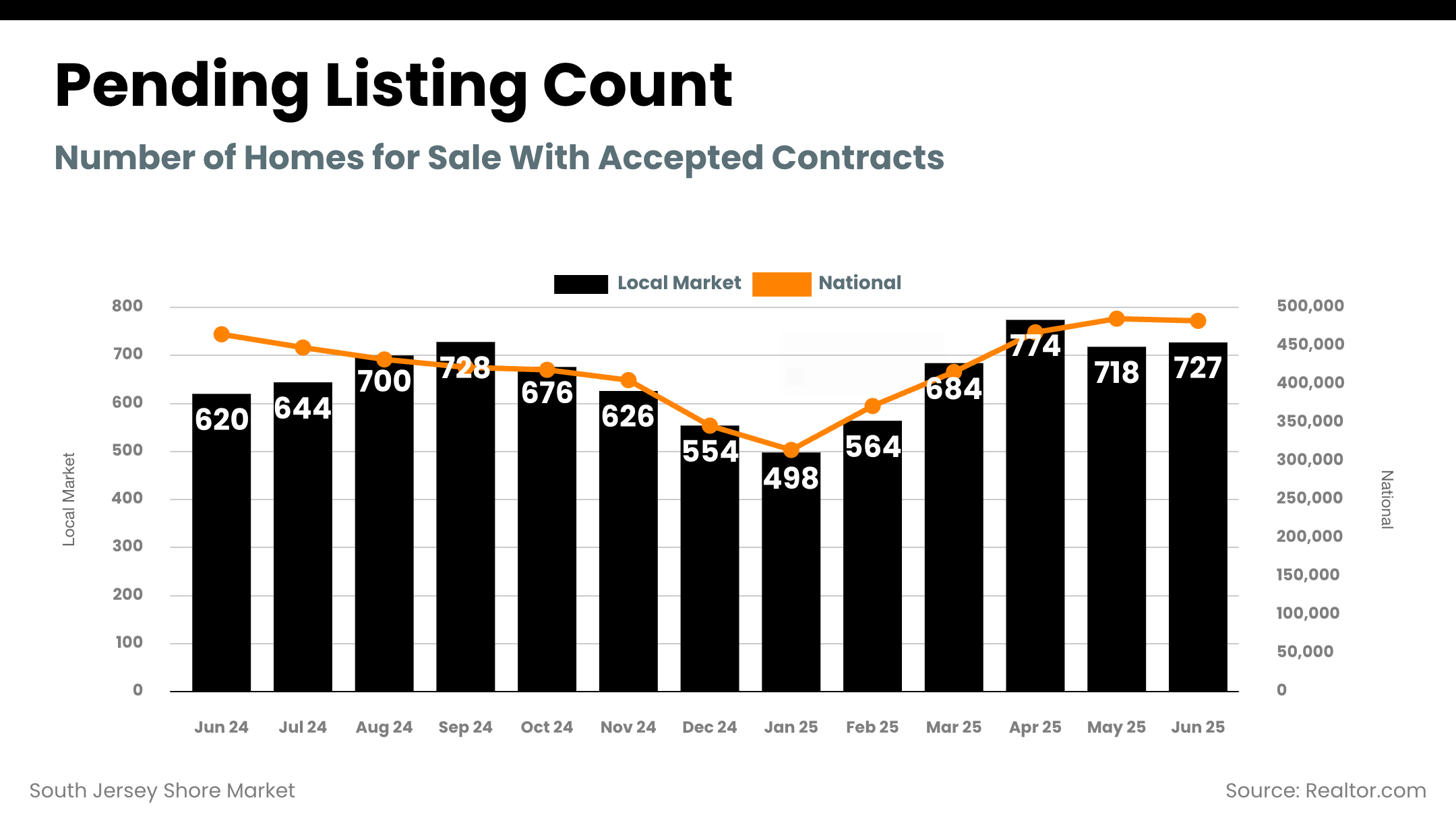

Pending Sales & New Listings

- Pending Listings: 676 in June

- New Listings: 468 in June

Policy Spotlight: Major Changes Reshaping Real Estate

Trump’s “One Big Beautiful Bill” (OBBBA) Passes

Signed into law on July 4, this sweeping tax reform delivers significant wins for real estate:

- Permanent mortgage interest deduction

- Permanent 20% QBI deduction for agents and small businesses

- SALT deduction cap quadrupled for 5 years

- Protection for 1031 exchanges

These changes solidify tax benefits that support homeownership, investment, and real estate professionals alike.

New NJ Mansion Tax Hits Luxury Sellers

| Sale Price Range | Seller-Paid Fee |

|---|---|

| $1M – $2M | 1% |

| $2M – $2.5M | 2% |

| $2.5M – $3M | 2.5% |

| $3M – $3.5M | 3% |

| $3.5M+ | 3.5% |

For example, a $4 million sale now includes a $140,000 supplemental fee, in addition to standard transfer taxes. Sellers must account for this in their pricing and net proceeds strategy.

What It All Means

For Sellers

- Strategic pricing is key. The market remains balanced but no longer overheated.

- Luxury sellers need to plan around the new mansion tax to protect profitability.

- Homes are still selling close to list, but price reductions are creeping up.

For Buyers

- There’s more inventory, less competition, and more negotiating power.

- Mortgage rates remain high, but new federal tax reforms may help long-term buyers.

For Investors & Agents

- This is a market of opportunity—knowledgeable buyers can find value.

- The new tax structure and macro environment favor long-term planning and professional guidance.

Final Thoughts

The South Jersey Shore real estate market stands apart from national trends. While much of the U.S. faces softening demand and falling prices, our market remains relatively balanced with stable pricing and active interest, especially in sought-after coastal towns. That said, both buyers and sellers need to be strategic—because affordability remains tight, luxury sales are more heavily taxed, and interest rate relief is still months away.