*Since the recording of this video the Feds decided to pause rate hikes for the first time in more than year!

Despite some of the headlines you’re hearing, our market remains very competitive. Because of the inventory being low. If you’re searching for a home, you probably haven’t seen a whole surplus of houses coming onto the market, we’re still dealing with a lot of multiple offer situations.

However, I will say that some of these multiple offer situations are not getting bid up as high as they were before, but the ones that are getting multiple offers are still in nice condition properties, nice locations, the things that you don’t have to do a whole lot of work to, and the sellers that have picked unsupported price. They’re still hanging around a little bit and they’ve increased our days on market a bit. But overall, I wanted to dig into the numbers and look a little bit at mortgage interest rates too, because I’m getting a lot of questions and headlines sent to me about mortgages, and what’s happening with interest rates.

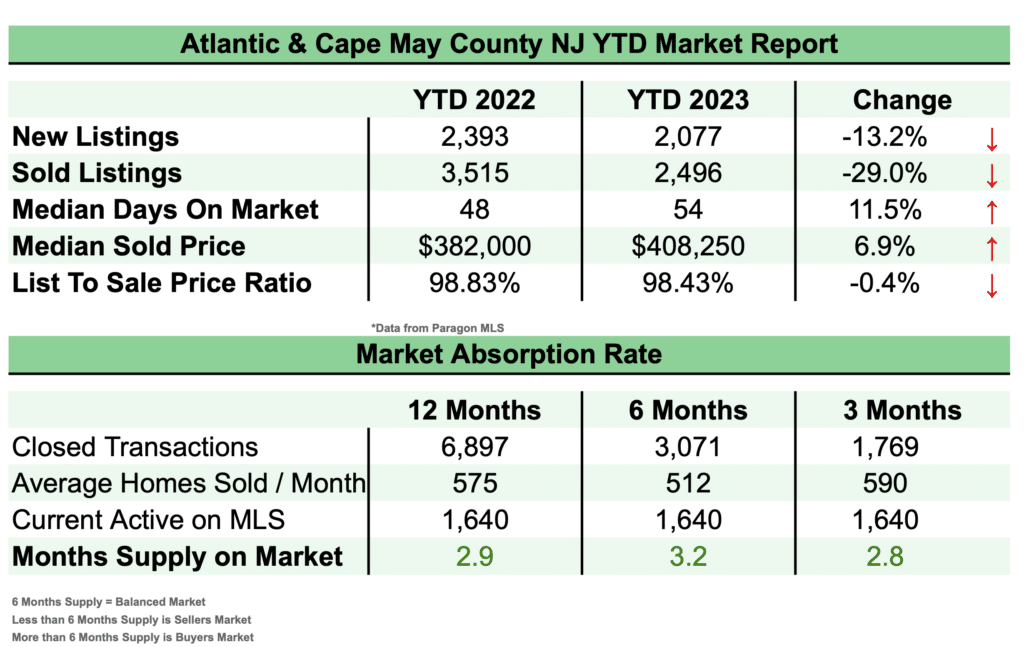

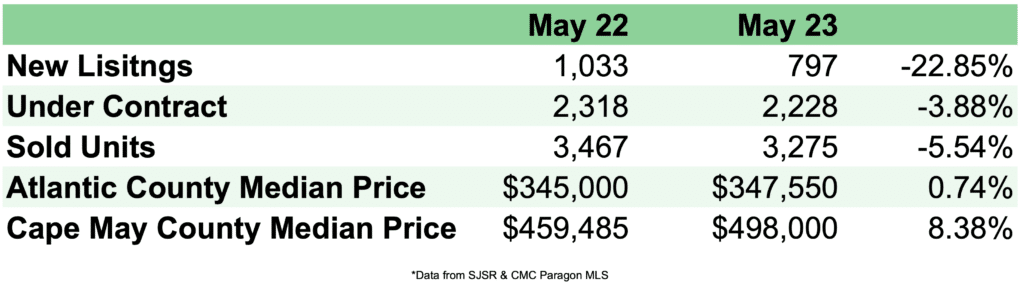

So we’re gonna take a deep dive on that and take a look at what actually might happen in the future with mortgage interest rates. This is May of last year, compared to May of this year. There’s fewer properties going under contract and fewer selling. But again, just like we talked last month, look at the disparity between the new listings coming onto the market, and the contracts and the sold units. There’s actually a lot of properties going under contract and selling relative to how few properties are coming onto the market, prices are still going up not nearly as much as they were before. Again, keep in mind, these are median prices, so they don’t tell the whole story.

Now, here’s some overall year to date numbers. So we’re going to compare 2022 to 2023. This is through the end of May, year to date, same thing we just looked at. Right where we have new listings are down sold listings are significantly down year to date. That’s why you see all the headlines about there’s fewer real estate transactions, it’s very real. That’s why a lot of mortgage companies and title companies are suffering right now, because there’s few transactions. They were sold two years ago, and property is still selling very close to the asking price. Those nice condition properties as we know, we’re still getting multiple offers in many cases, and the absorption rate or the number of homes for sale, how long would it take all that inventory to dry up if zero new homes came onto the market, we’re still just under three months for the entire area or our two MLS is Kate main Atlanta County, under three months is still very much a seller’s market. It has to get closer to six months for it to be a neutral or head into a buyers market.

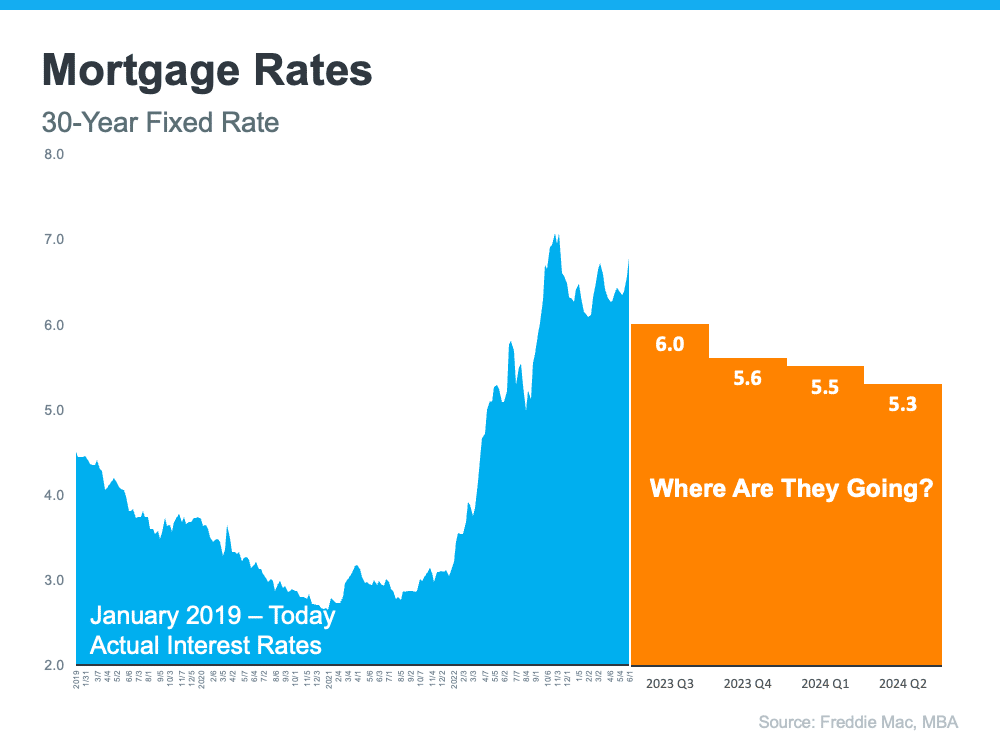

I wanted to talk more about interest rates, because most of the headlines right now have really been all about interest rates and what’s going on with mortgages. This is a look right now, just going back to April, the last couple of months of what’s happened with interest rates, and they definitely did go up as we went into late May. They went over 7% On an average. And the last couple of weeks now into early to mid June. They’ve leveled out fall and just a blow 7%. Again, these averages are going to change for every bar where we’re not seeing any significant changes, but they’re still pretty close to that 7% number.

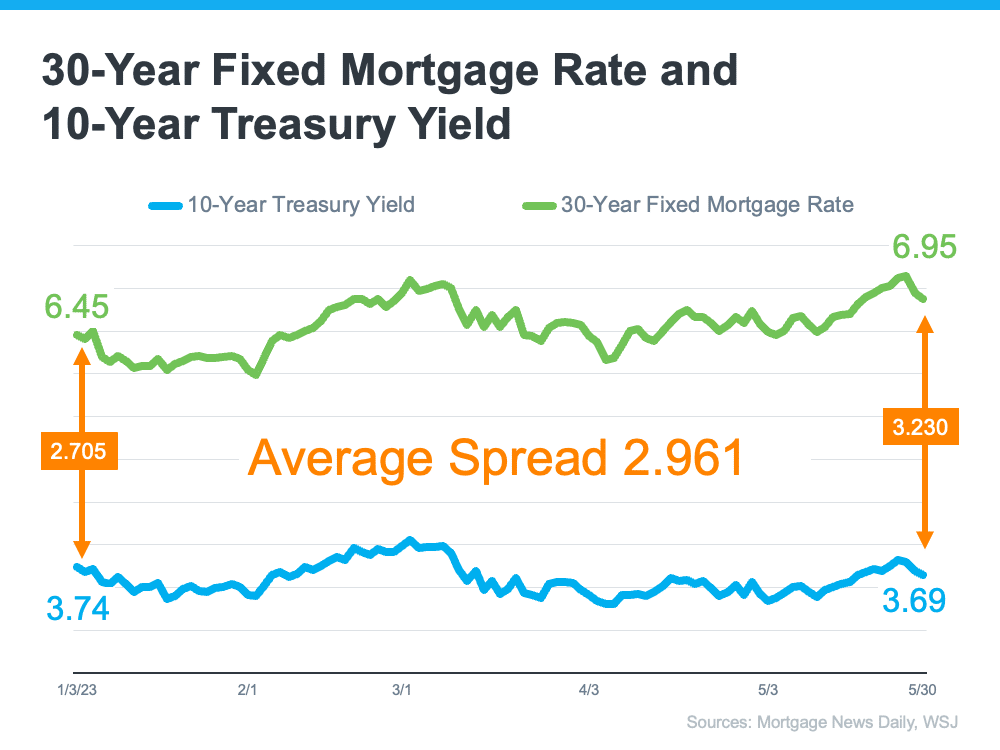

I wanted to dig into why everybody’s asked him why rates are so high. One of the things that I’ve been looking at is the spread. So the spread between what that mortgage interest rate is, and what the Treasury yield is. Usually those two things follow each other in a very consistent manner. However, right now that spread is significantly higher than it normally is. There’s only been a few times in history where it’s so different, right? You can see that a lot of times it’s at that 1.7-1.72 number on average. We’re about three almost right now for that spread between what the Treasury and the mortgage interest rate is right. This has only happened in the 2008 crash, Great Depression, you know, some very significant times in history. So it doesn’t happen often. Usually only happens in times of a lot of inflation, right, which we know that we’re dealing with, but seems like the Feds believe that has cooled off.

Now, because we have this spread that’s over 3%. Now this data is from a couple weeks ago, the beginning of June. So this may have changed. But here’s what’s really interesting: if the feds take their foot off the pedal here and this spread goes down not even to the average of 1.7 but maybe to 2.25 for example, interest rates are going to come down below 6%. We’ll look at this in a moment. I think that that causes a lot of buyers in this market to get even hotter again, and prices to go even further again, should that happen. Of course, that remains to be seen.

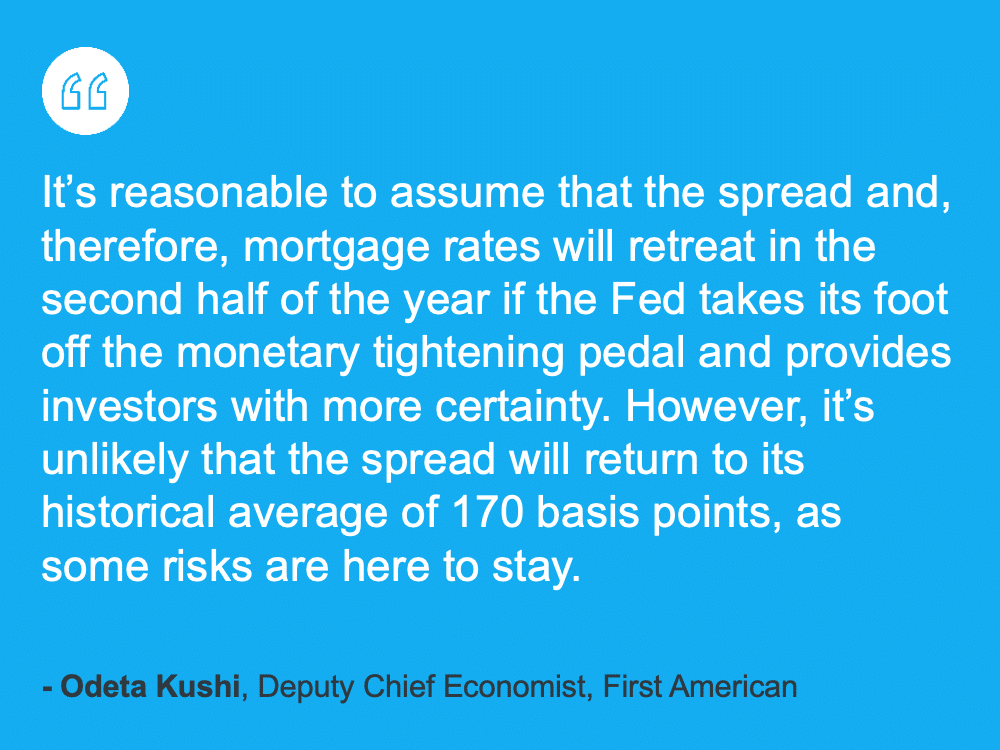

The Chief Economist for the first American said something similar, it’s reasonable to assume that the spread and therefore mortgage rates will retreat in the second half of the year, right. So they’re predicting the feds are going to take his foot off the pedal, and therefore that spreads are actually. going to go down, and therefore interest rates may go down later in the year. Now, I wouldn’t plan for this to happen. Because keep in mind, you can always refinance, we don’t know this is going to happen, for sure. The Mortgage Bankers Association thinks that interest rates are actually going to come down as we head into the end of the year or next year.

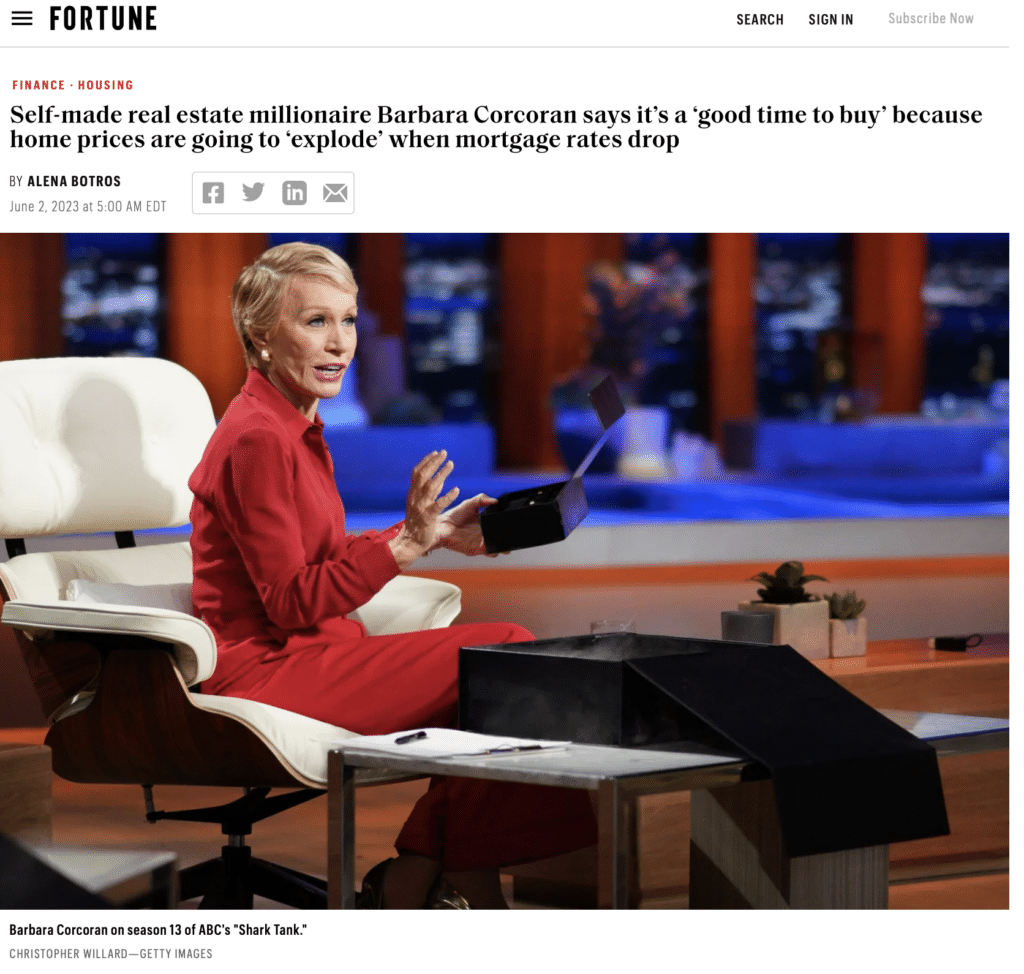

Most popular headline in real estate right now is Barbara Corcoran, right from Shark Tank. She says that it’s a great time to buy because home prices are going to explode when mortgage rates drop. And I may be biased. But if this happens, I don’t know for sure if it happens, I would agree. You know, if mortgage rates dropped to 5%, right now, there is going to be a surplus of buyers jumping into the market. Remember, we still have that very low inventory condition, rates drop, more buyers come into the market inventories still low, that is the perfect disaster of prices going even higher. So if you own a home, that’s great. If you’re thinking about buying, and you believe this to be true, then you might want to buy sooner than later if this were to happen.

Last thing I’m gonna take a look at as far as data is, if you’re a homeowner, and you’re thinking about selling or if you’re a buyer, you’re competing against other buyers. We look at this every so often. These are the buyers that are walking through the door looking at homes for sale right now in New Jersey. And this yellow line is 2023 this year, right? And so here’s what’s crazy, you can see that we are higher than every year, but 2020 Right now, in showings, there’s more showings. But if you go back to our market data we were looking at, there’s fewer homes on the market. So there’s more buyers walking through the door, more showings on fewer homes, and again, is what causes a very competitive market and even prices to increase. So I don’t think we’ll ever get to this 2020 number again, that was absolutely insane. It’s going to be an anomaly. Even the 2021 and 2022 numbers keep reflecting back on it. These are extraordinary times of real estate that we may never see again. And yet we think we’re in the midst of a slowdown, but the numbers tell otherwise. It actually may cause things to heat up even further later in the year. So we’ll keep a close eye on that.

I hope that gives you a look at the numbers and the actual data for what we’re seeing not only here locally in South Jersey, but also the rest of the United States. It’s very important to be monitoring the market right now. That being said, it’s still a great time to sell your house. And it may be an even better time to buy a house Believe it or not, if what some of these economists are predicting comes true. If you’d like these market updates and all of the real estate information that we’re putting out, please make sure to subscribe to the channel.