Market Trends Overview:

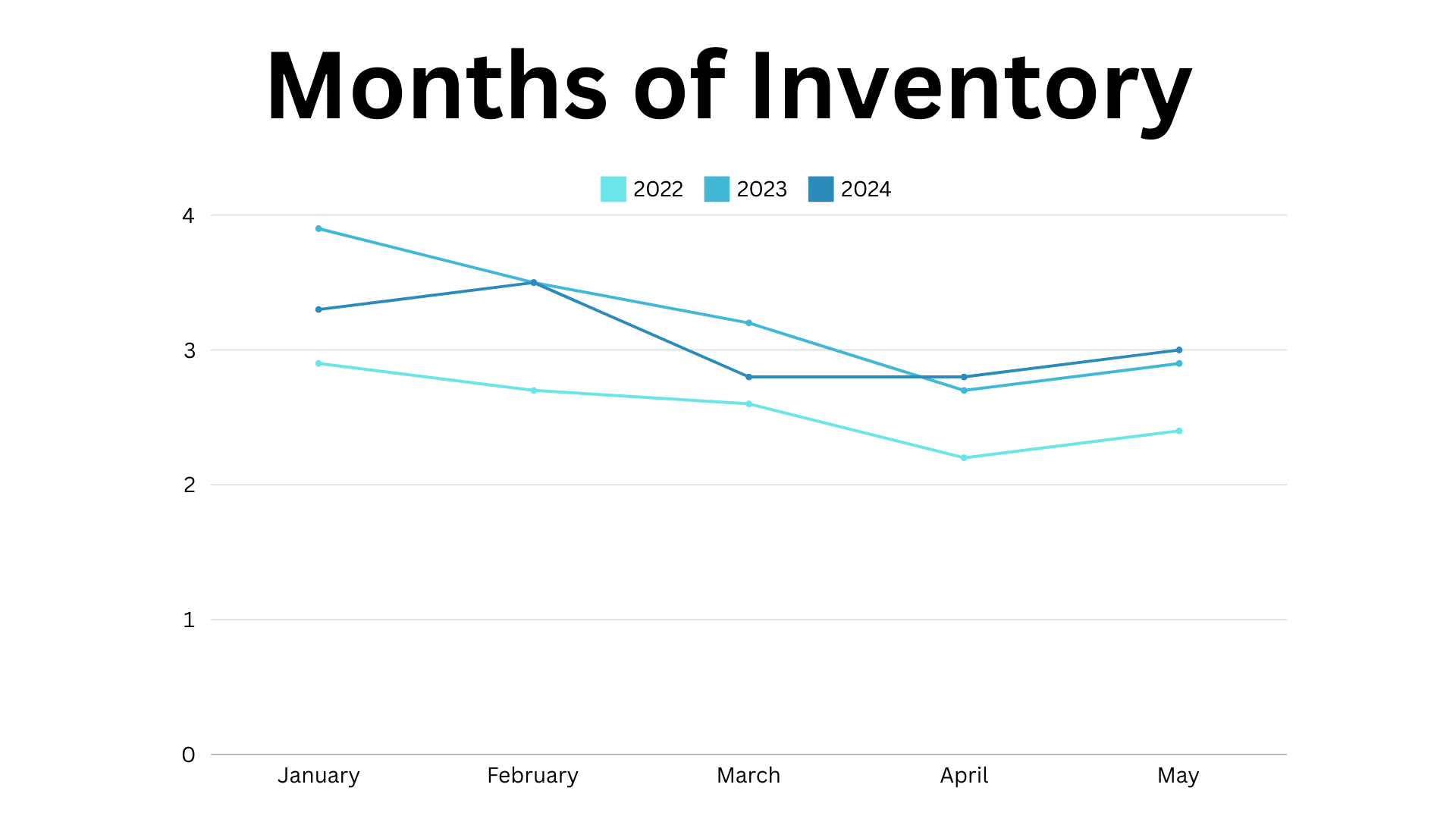

The market continues to experience fewer transactions, though inventory has slightly increased in many areas. The comparison to the "unicorn years" post-COVID is made with caution, as the current market is trending back to normalcy. An increase in inventory could signal a potential shift from a seller's to a buyer's market, although this shift is not yet widespread, particularly for affordable properties and condos.

Local Market Specifics:

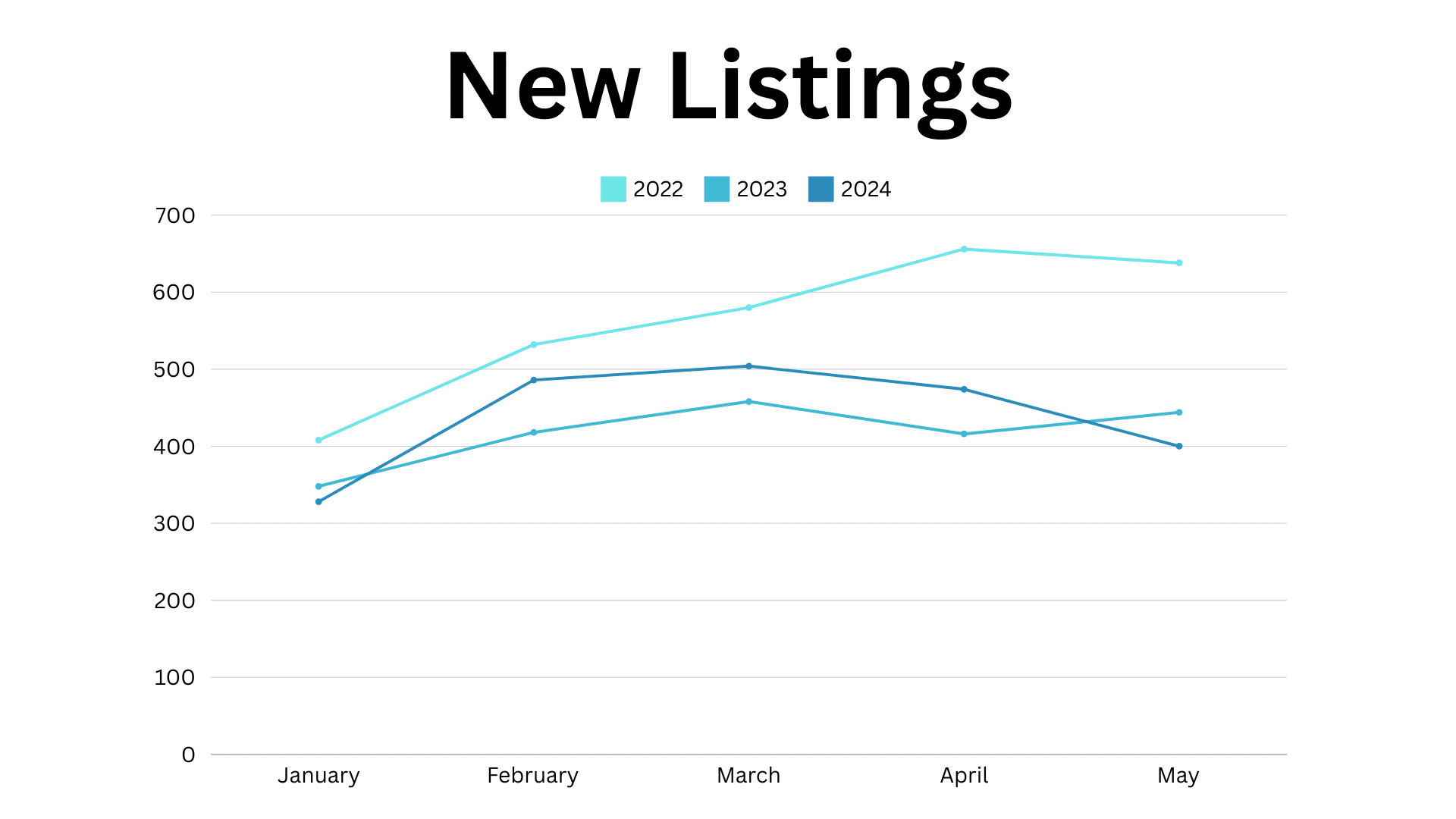

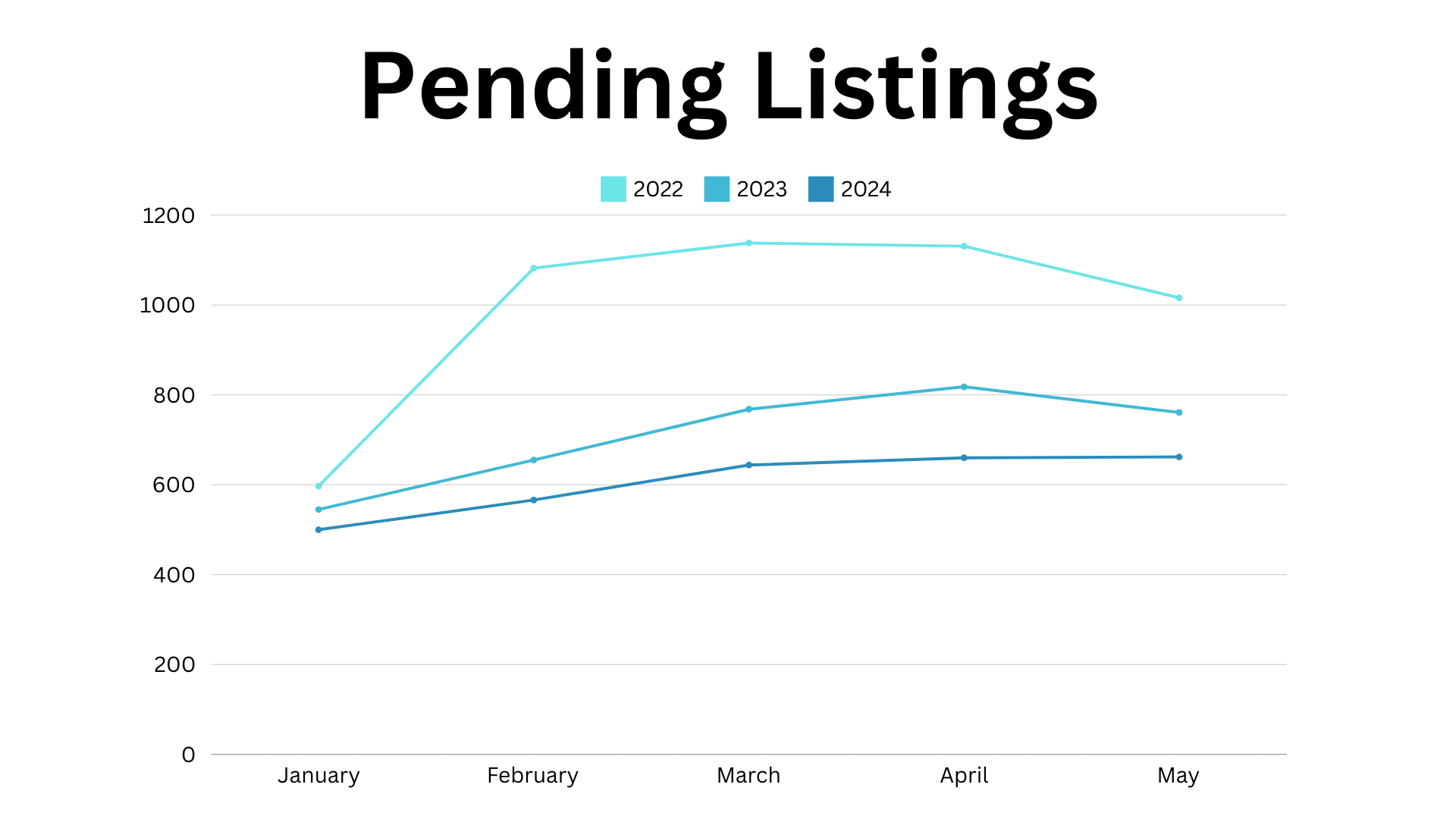

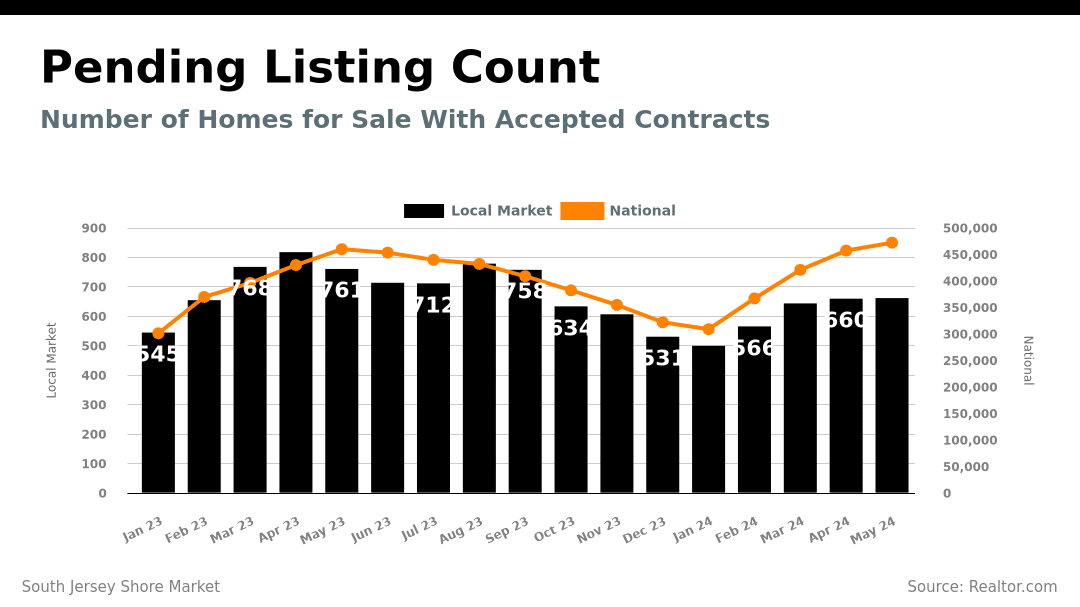

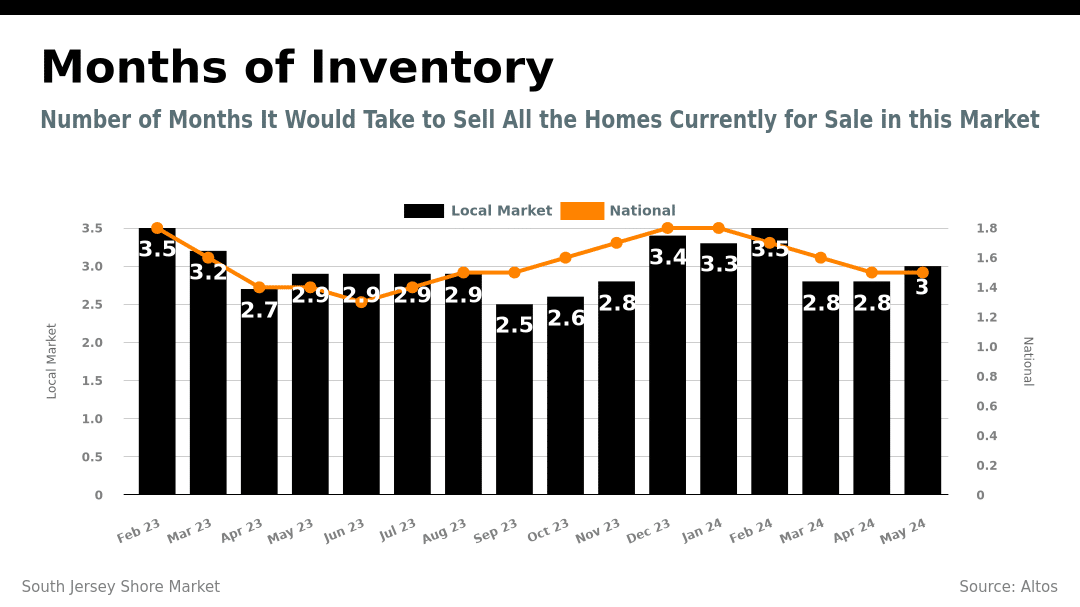

In South Jersey Shore, inventory has been on an upward trend, with a notable increase compared to the past two years. However, new listings are down slightly, and properties going under contract are significantly fewer. This aligns with the increase in inventory due to reduced transactions. Ocean City is highlighted as an outlier with a substantial rise in single-family home listings, especially in the luxury market, leading to higher inventory levels.

National Market Trends:

Nationally, housing inventory is up compared to recent years, although it hasn't returned to pre-pandemic levels. The local market trends in South Jersey Shore generally mirror national patterns, with some variations in new and pending listings.

Interest Rates and Predictions:

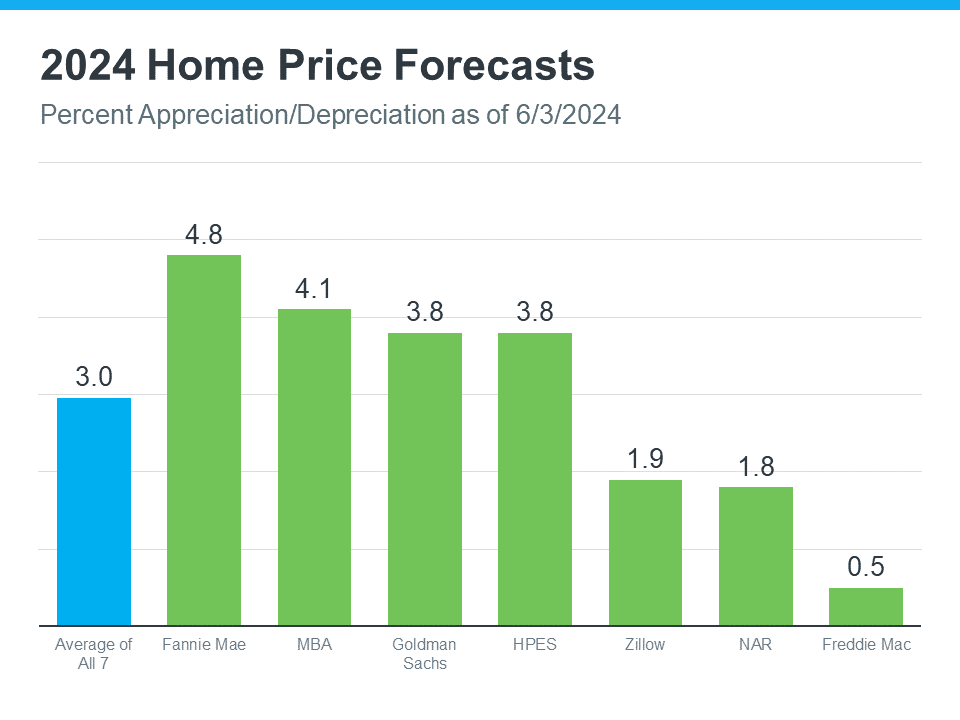

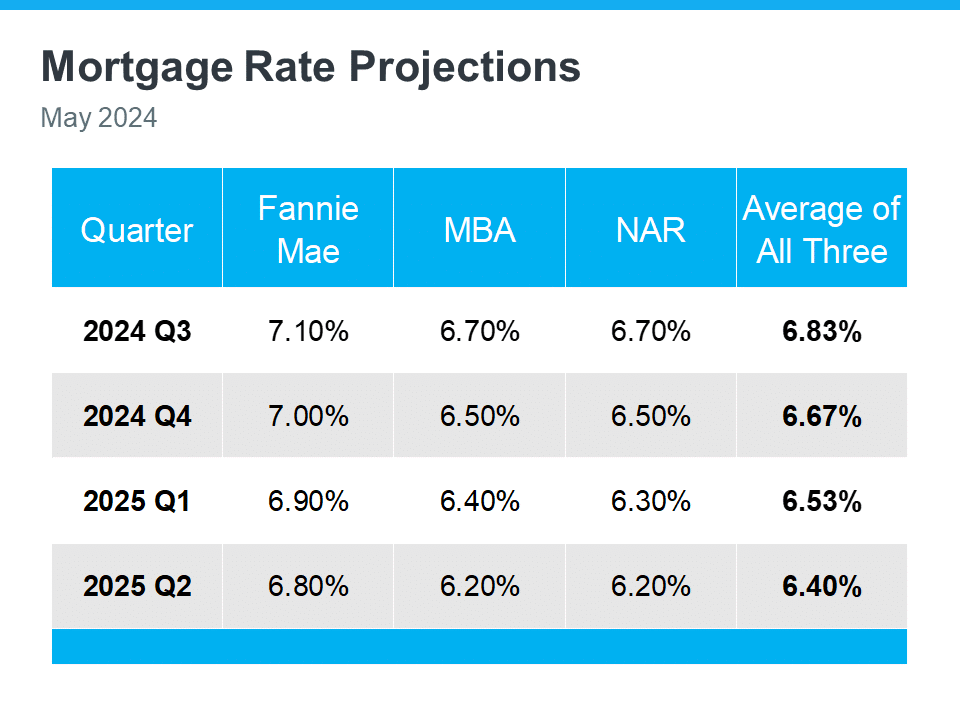

Interest rates have fluctuated, hovering just above 7%. There are predictions of a modest decline in rates towards the end of summer, but no significant changes are expected in the near future. Experts predict a continued appreciation in home prices, albeit at a slower rate than the double-digit increases seen in previous years.

Implications for Buyers and Sellers:

For sellers, understanding inventory levels is crucial as more competition could affect the best time to sell. For buyers, the current market remains competitive, with many buyers still actively searching for homes. Despite fewer available properties, there are still ample opportunities for buyers and sellers alike.

The market continues to experience fewer transactions, though inventory has slightly increased in many areas. The comparison to the "unicorn years" post-COVID is made with caution, as the current market is trending back to normalcy. An increase in inventory could signal a potential shift from a seller's to a buyer's market, although this shift is not yet widespread, particularly for affordable properties and condos.

Local Market Specifics:

In South Jersey Shore, inventory has been on an upward trend, with a notable increase compared to the past two years. However, new listings are down slightly, and properties going under contract are significantly fewer. This aligns with the increase in inventory due to reduced transactions. Ocean City is highlighted as an outlier with a substantial rise in single-family home listings, especially in the luxury market, leading to higher inventory levels.

National Market Trends:

Nationally, housing inventory is up compared to recent years, although it hasn't returned to pre-pandemic levels. The local market trends in South Jersey Shore generally mirror national patterns, with some variations in new and pending listings.

Interest Rates and Predictions:

Interest rates have fluctuated, hovering just above 7%. There are predictions of a modest decline in rates towards the end of summer, but no significant changes are expected in the near future. Experts predict a continued appreciation in home prices, albeit at a slower rate than the double-digit increases seen in previous years.

Implications for Buyers and Sellers:

For sellers, understanding inventory levels is crucial as more competition could affect the best time to sell. For buyers, the current market remains competitive, with many buyers still actively searching for homes. Despite fewer available properties, there are still ample opportunities for buyers and sellers alike.