A Closer Look at Our Local Scene

One thing is clear as we step into March: the influx of new listings that many were hopeful for

has not materialized. Our inventory remains startlingly low, indicating we are still navigating a

housing shortage. The year kicked off slowly, not because demand waned but because the

houses weren’t there to sell. With a slight uptick in listings, we are witnessing multiple offer

situations become familiar once again, albeit with renewed vigor due to the pent-up demand

waiting on the sidelines.

However, this poses challenges and opportunities:

● For Buyers: Brace for the possibility of multiple offer scenarios, especially on properties

in prime condition.

● For Sellers: The current market underscores the importance of correct pricing. There is

a spread of properties lingering unsold and priced based on the 2022 market

expectations, and these properties are no longer viable.

Owners are clinging to their valuable equity and low-interest rates, further contributing to the low

inventory. Conversely, a legion of buyers remains in waiting -- for more houses to surface or for

interest rates to dip, which could invigorate the market dynamics.

What the Fed Says

With the Fed’s next meeting slated for March 20th, the consensus leans towards maintaining

the current federal rate. According to industry experts, the gap between the ten-year Treasury

rate and average mortgage rates suggests room for a downtrend in mortgage interest rates

throughout the year.

Data Deep-Dive

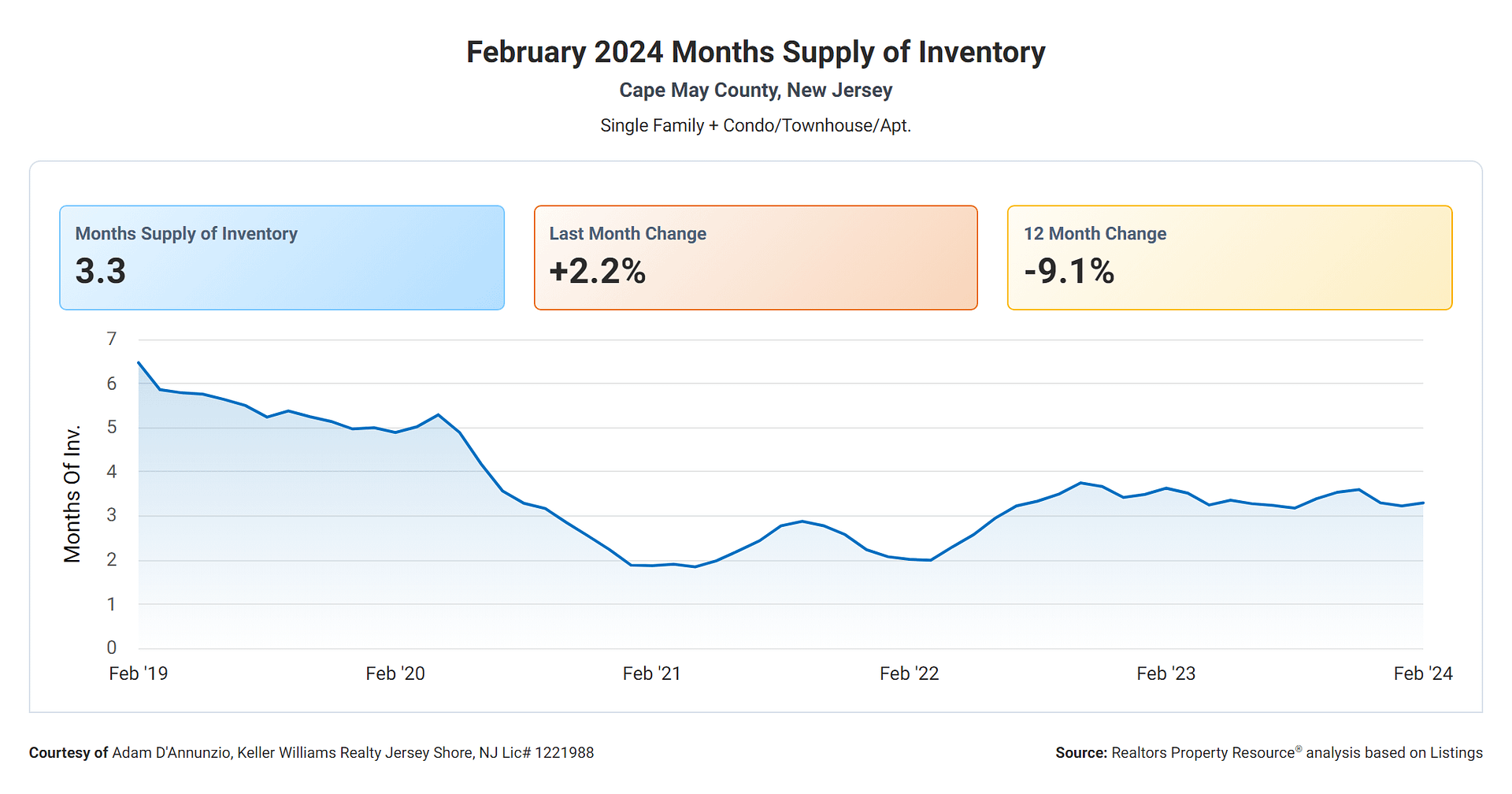

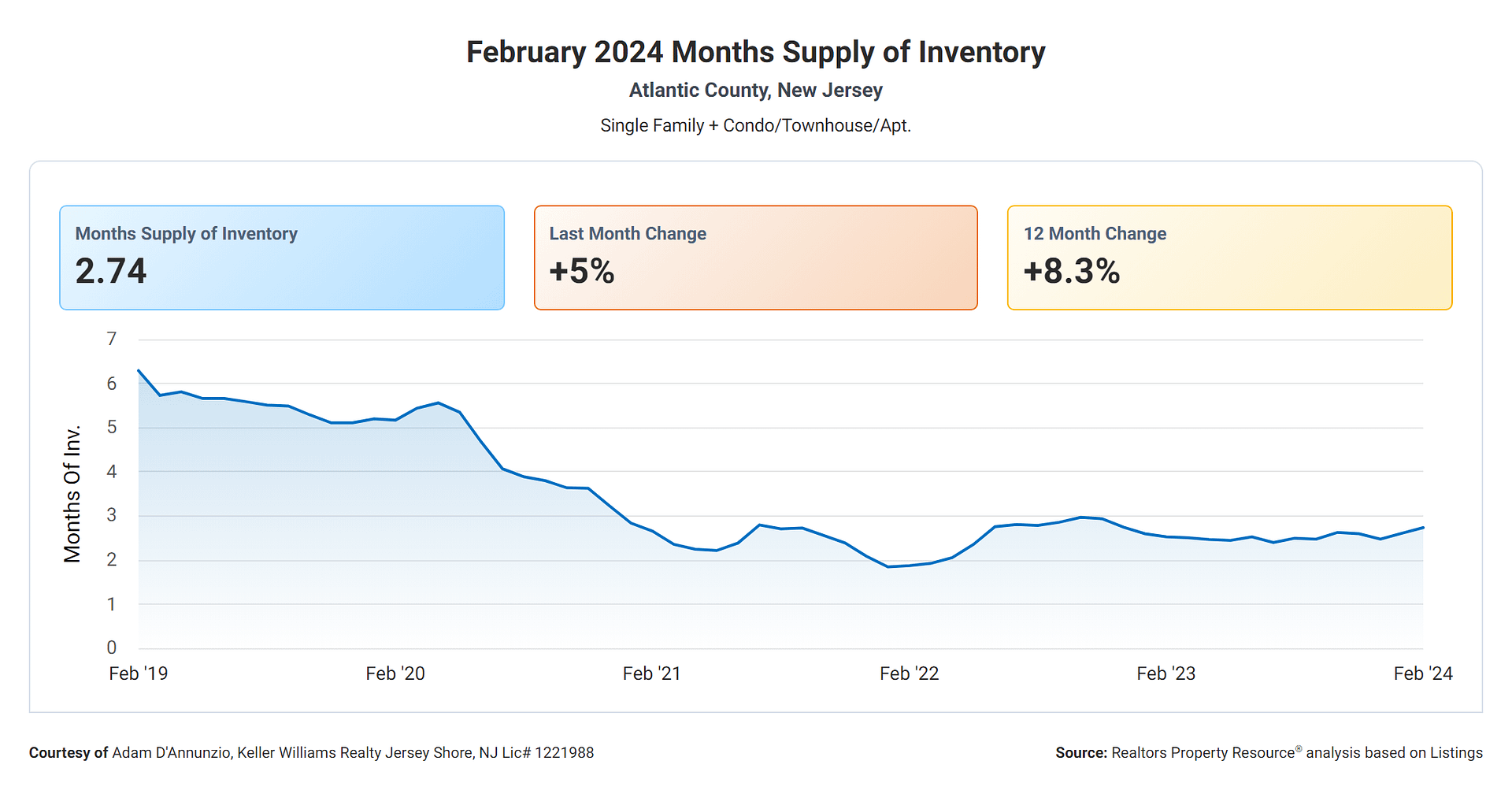

Inventory Trends: In Atlantic and Cape May counties, inventory levels persistently trail below

the national average, intensifying our uniquely competitive market. Despite a minor uptick, our

local inventory rates remain firmly within a seller’s market, defined by less than five months of

inventory.

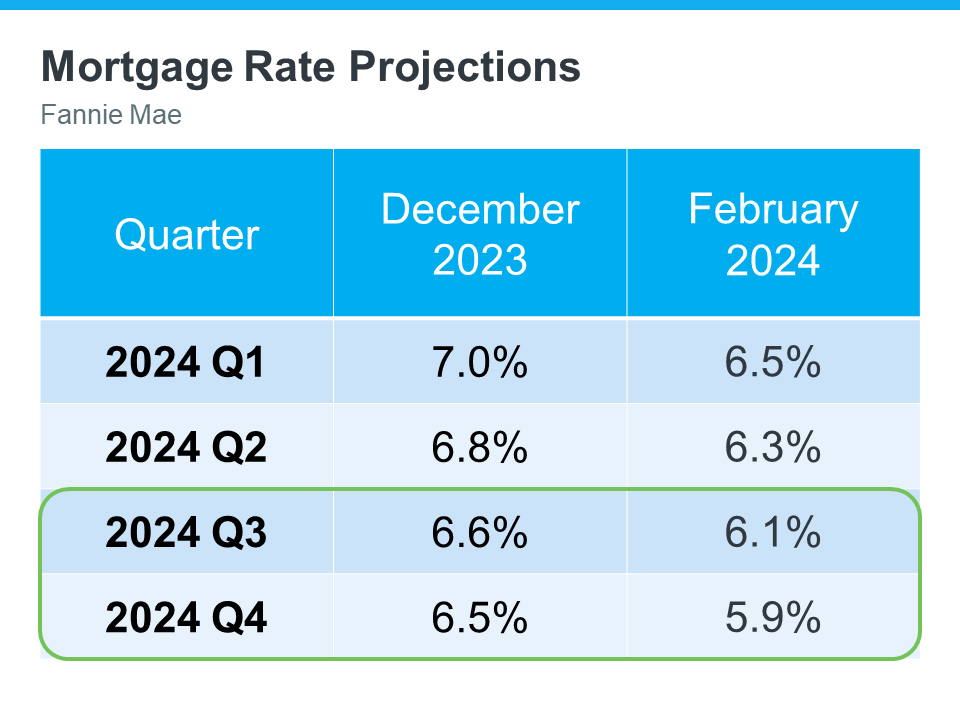

Interest Rate Projections: While exact figures remain speculative, there's optimism towards a

decrease in interest rates, possibly touching the high fives, influenced by the gap between the

ten-year Treasury and current average rates.

Showings and Buyer Interest: The number of showings in New Jersey for 2024, represented

by the orange line, demonstrates robust buyer interest, nearly paralleling the activity seen in

previous, busier years, despite the shortage of listings.

Economic Confidence and Market Resilience

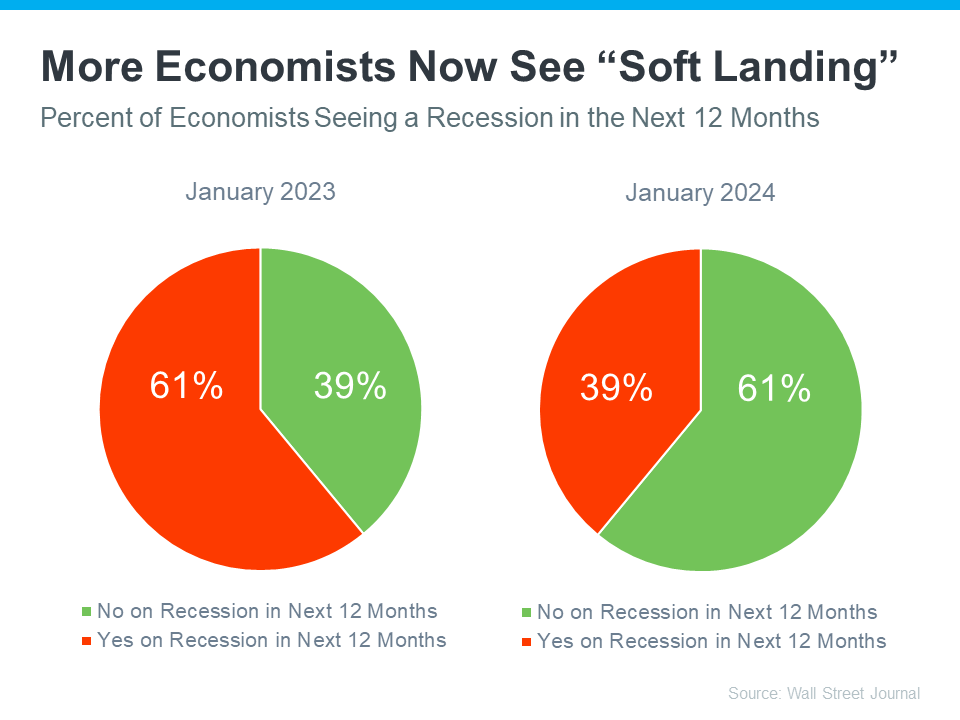

Economic sentiments have shifted positively compared to last year. The percentage of

economists predicting a recession in the next 12 months has dropped significantly, from 61% to

39%, marking an uptick in confidence among experts.

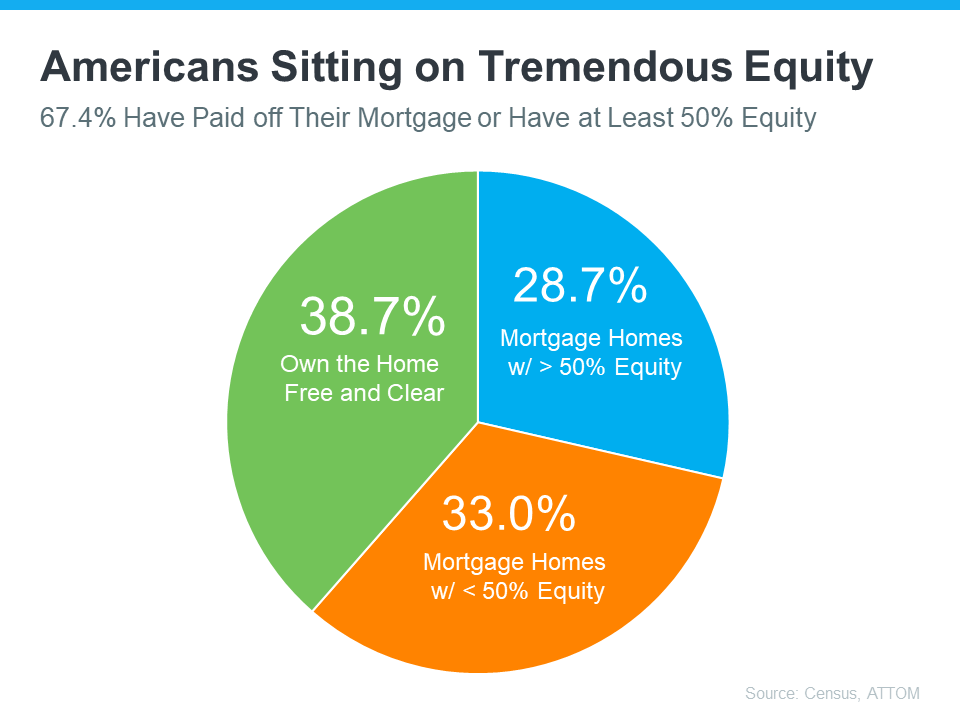

A Word on Home Equity

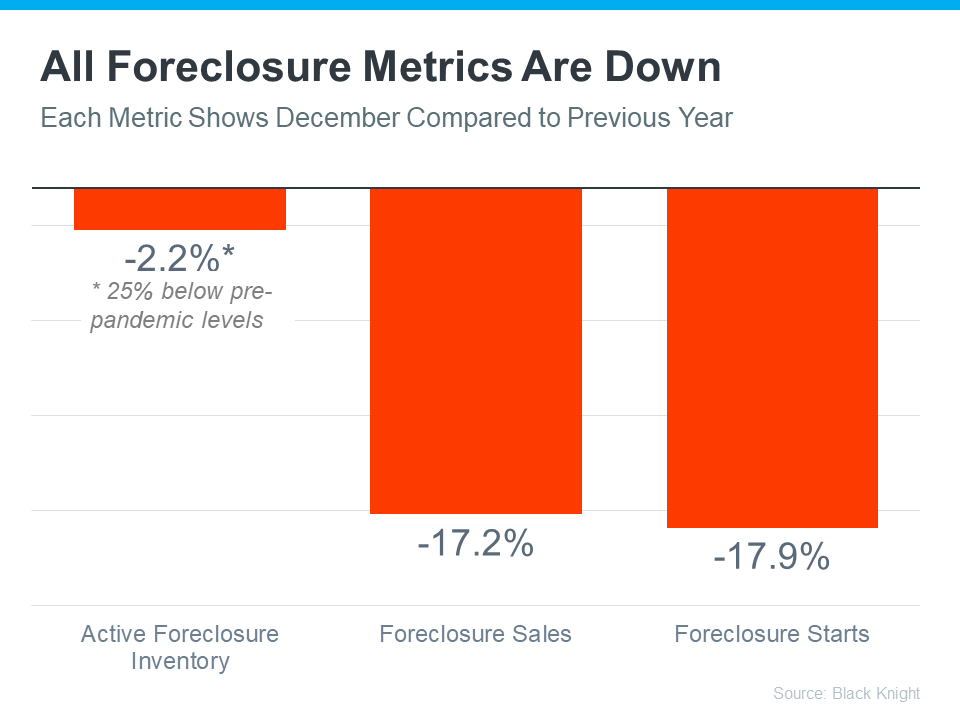

The wealth stored in homes across New Jersey is a buffer against financial uncertainties. A

significant portion of homeowners possess over 50% equity in their homes, offering resilience

through the capability to liquidate assets in financially tight situations.

Wrapping Up

March 2024 brings with it a careful blend of challenges and opportunities in the New Jersey real

estate market. Low inventory and high buyer demand are creating a dynamic environment,

while the possibility of decreasing interest rates and strong economic confidence provides a

hopeful backdrop.

Whether you're thinking of buying, selling, or simply staying informed, navigating the New

Jersey real estate landscape requires patience, perseverance, and an understanding of the

market mechanics at play.