Are you a homeowner in New Jersey aged 62 or older? If you plan to sell your house, you must be aware of potential tax exemptions that could significantly impact your settlement costs. In this blog post, we’ll explore the partial exemption for realty transfer tax for senior citizens in New Jersey, ensuring you take advantage of potential savings during the selling process.

Understanding Realty Transfer Tax:

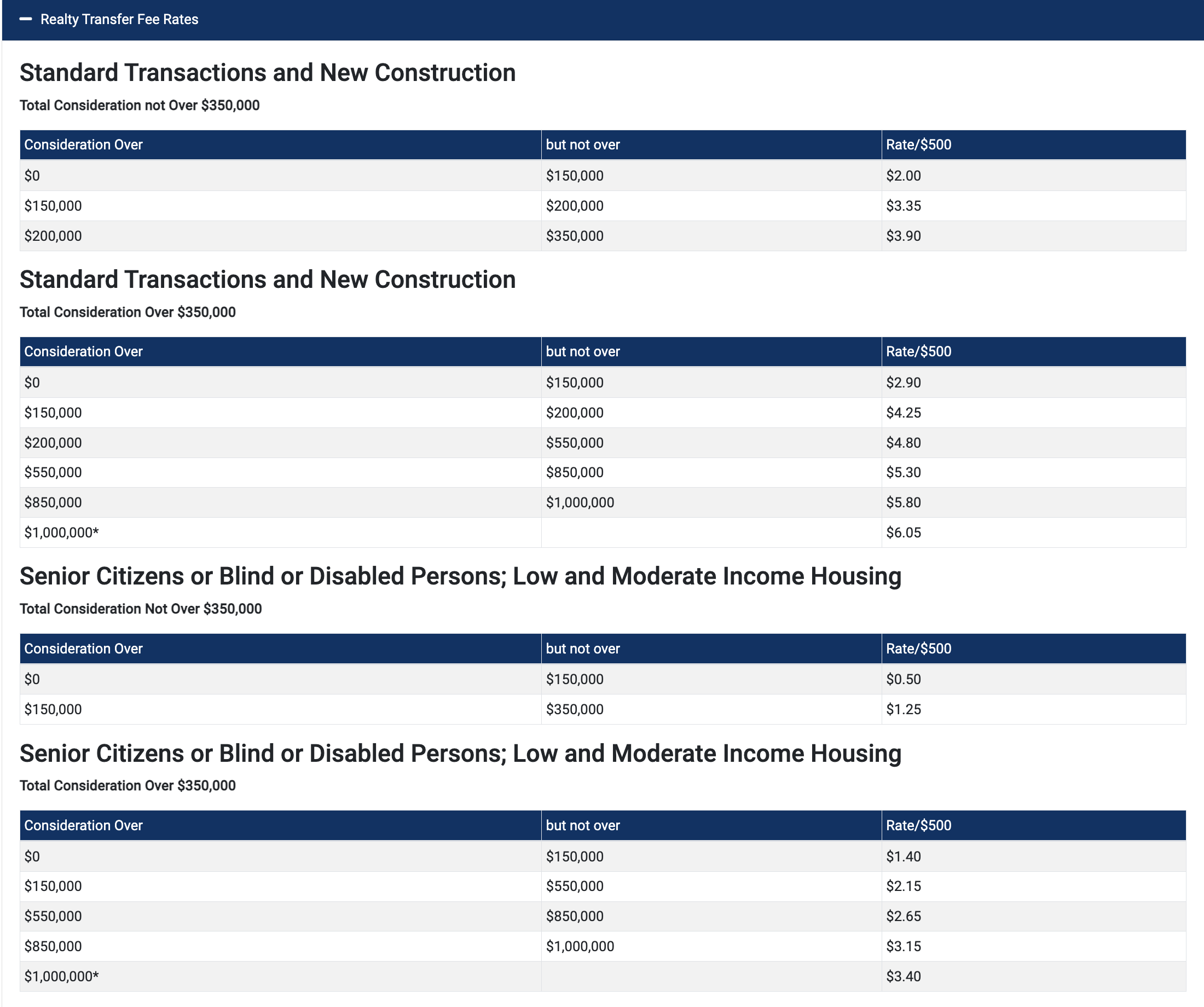

In New Jersey, residential real estate sales incur a realty transfer tax, a cost that most sellers expect to pay. However, there’s good news for homeowners aged 62 and above – a partial exemption exists for this tax. This exemption can result in substantial savings, often reducing the realty transfer tax by half. It’s a valuable benefit that can impact your overall settlement costs.

Potential Pitfalls:

Unfortunately, some sellers miss out on the savings despite this exemption. Issues arise when title companies overlook the seller’s age or fail to inquire about it until the day of settlement. To avoid this, it’s crucial for sellers to proactively communicate their eligibility for the partial exemption to the title company, real estate agent, and attorney well before the closing date.

Key Criteria for Exemption:

To qualify for the partial exemption from the realty transfer tax, sellers should meet certain criteria. If you’re married, only one spouse must be 62 or older. However, for unmarried property owners, all co-owners must meet the age requirement. Additionally, the property must be your primary residence, not a rental or investment property. Residency in New Jersey is a fundamental requirement for availing of this exemption.

Special Contemplations for Other Eligibilities:

While this blog primarily focuses on senior citizens, it’s worth mentioning that individuals who are blind or disabled may also be eligible for a similar partial exemption during a property sale. Sellers falling into these categories should inquire about their eligibility to ensure they maximize their benefits.

Consulting Professionals:

As a note of caution, it’s essential to recognize that this information is not legal or financial advice. Consulting with your accountant or tax attorney is highly recommended if you have complex tax-related questions. They can provide personalized guidance and clarify specific details about your situation.