Are you in the process of buying a new home, and considering one on a barrier island? It’s important to be aware of recent changes to flood insurance before making your purchase. Flood insurance is an essential part of owning property near a shoreline, and understanding some basics can help you make the best decision for you and your family. Let’s take a look at what you should know.

Flood Insurance Basics

Flood insurance has been available since 1968 through the FEMA. The program provides coverage for buildings and contents in participating communities, but it only covers up to $250,000 per building and $100,000 for its contents. If your home is valued over those amounts or if you wish to buy additional coverage, it will need to be done through private markets.

FEMA Risk Rating 2.0

In 2023, FEMA implemented their Risk Rating 2.0 system for flood insurance rates across the country. This system takes into account more factors than ever before when calculating rates – like building age and height above base flood elevation – making them more accurate than before. This is good news for homeowners because it means that rates are now tailored more accurately to their personal risk level rather than being based solely on ZIP codes as they have been in the past.

Two Ways To Get Flood Insurance

There are two ways to obtain flood insurance – either through the FEMA or through private markets. The FEMA provides subsidized policies that tend to be more budget-friendly than private markets; however, they also come with limitations regarding how much coverage can be purchased as well as certain restrictions related to who can qualify for coverage under this plan. Private market policies may cost more initially but offer broader coverage and do not require participation in FEMA programs or restrictions regarding who can qualify for such plans.

Two Major Changes In The Last Year

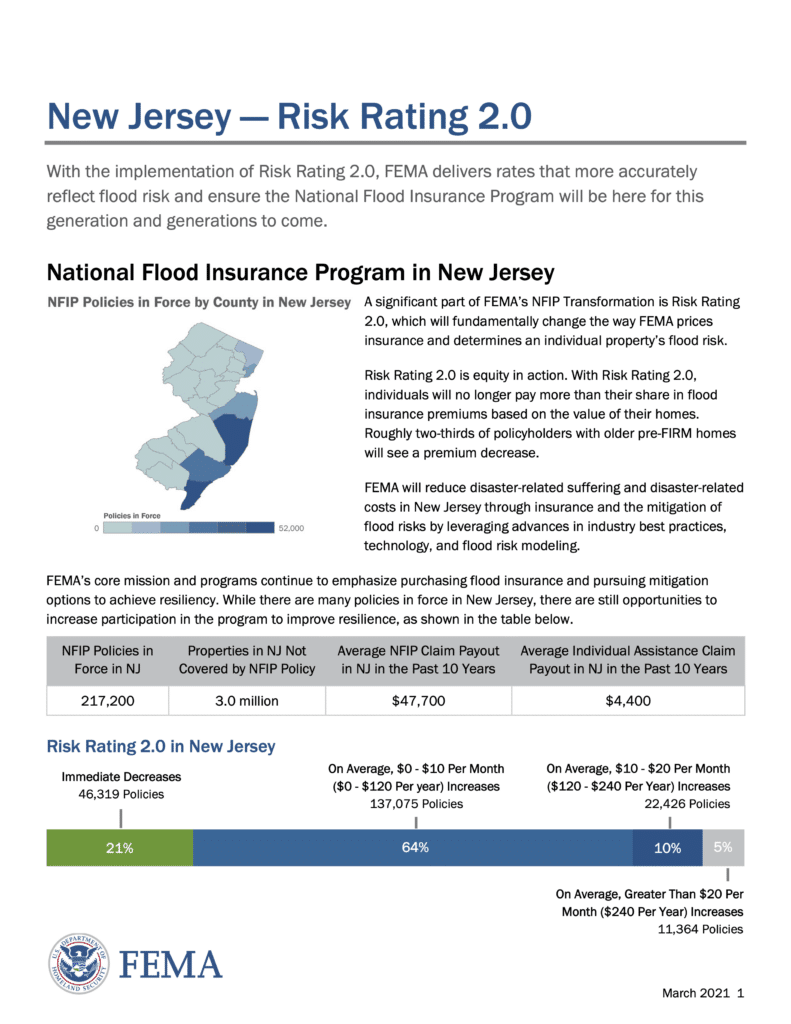

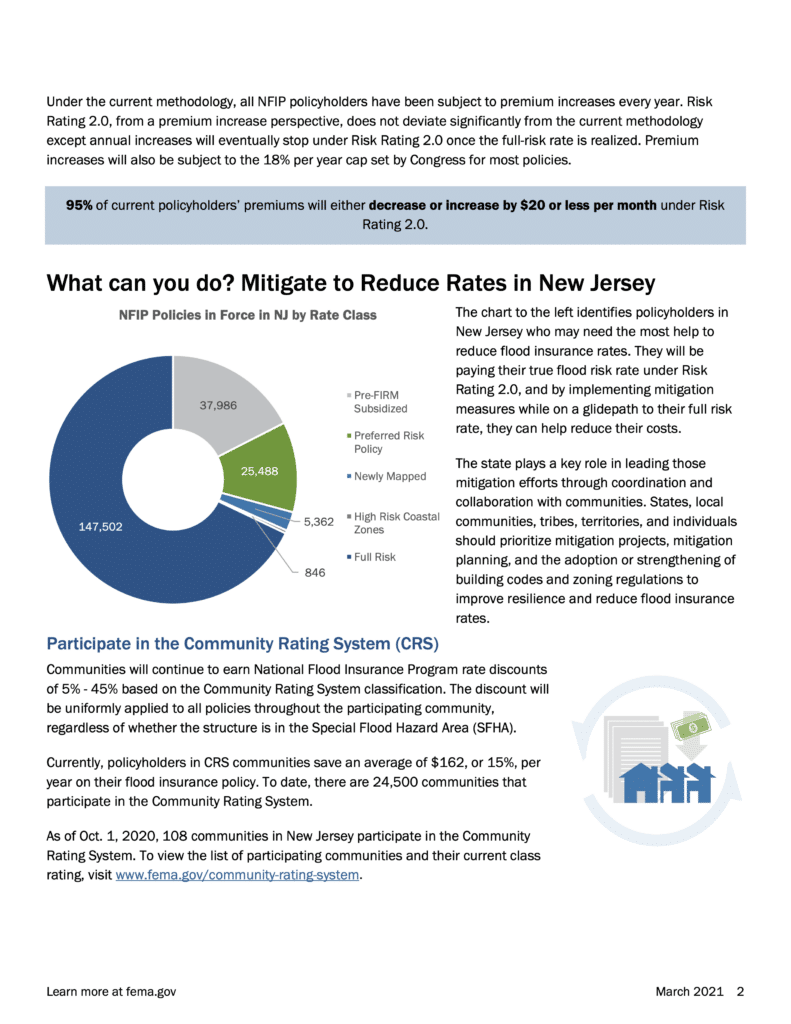

FEMA made changes to the flood insurance market last year that affected a lot of people. In total, 21% saw a decrease in rate and 64% only saw an increase of up to $10 per month – this was due to FEMA making use of aerial imaging technology and previous data. Switching to FEMA might be a good idea as there are several benefits; FEMA caps your rate increases at no more than 18% per year, so even if disaster strikes, they will not hike your insurance more than 18%. Additionally, second homeowners may be charged an additional $250 fee per year which primary residents don’t have to pay. Interestingly, FEMA policies cover $250,000 per unit for any flooding-related damage.

Do These Changes Affect You?

Knowing about recent changes in flood insurance is key when considering purchasing waterfront property, especially on barrier islands where flooding is common during storms and hurricanes. Understanding the basics of flood insurance – like what types of coverage are available and which one might work best for your situation – can help ensure that your new home purchase is protected if flooding should occur down the line. Being informed about these changes now will save time, money and stress later!