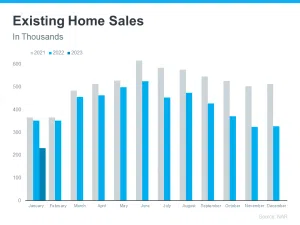

Are you in the market for a new home or thinking about selling the one you’re in? Maybe you just want to stay up to date on what’s going on in your neighborhood. Whatever your interest, it is important to be aware of current real estate trends and activity. The good news is that March 2023 could be an ideal time for both buyers and sellers who want to make a move within their local housing market. With prices increasing steadily over the past few months and more homes hitting the market, now might be a great time to explore the possibilities!

What I’ve Seen

The New Jersey housing market is going through an exciting time right now. In the past four transactions I’ve been involved in, there has been a multiple offer situation every single time, leading to some great competition amongst buyers! Despite the fact that news about interest rates potentially increasing has come up, inventory has stayed very low; this lack of homes for sale means buyers are willing to go far to find their potential dream homes – often competing with other potential buyers. Everyone is eagerly waiting for spring when we can expect a larger influx of homes, yet even with the current lower levels of available homes the competitive atmosphere is still thriving.

The Numbers

The New Jersey housing market is in an interesting place, given the events of 2008. In the 08 period, New Jersey had 10 plus months of inventory on the market, leading to a 4.4% average depreciation in prices. But as the inventory has decreased, the appreciation for New Jersey homes has increased. To really see prices dip once again, we need to see inventory get up over 6 months, and that number is currently closer to 2-3 months. It’s worth keeping this in mind as you consider your New Jersey real estate options!

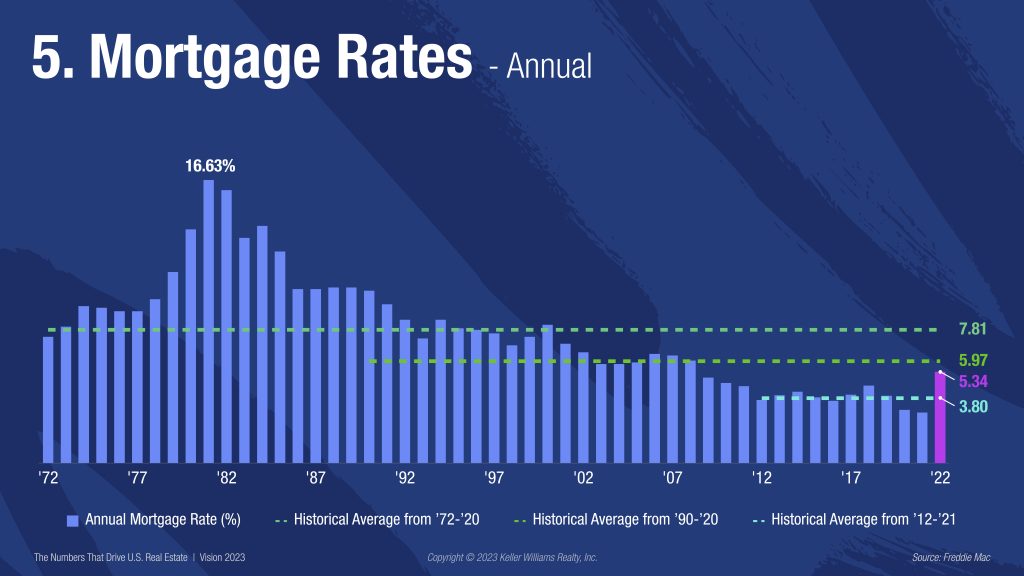

Historical Trends With Interest Rates

Interest rates are an important factor in the home buying process, and if we look at their historical trends, they aren’t as crazy high as they have been in the past. This graph reaches all the way back to 1972 and back then, the average mortgage rate was around 6%. It’s just a bit higher than that now, but it might creep a little bit more upwards and possibly get back to about 7.8%, which is the average going all the way back to 1972. The rates may not be at their prime-time levels like we saw two years ago at 2-3% anymore though – barring any major economic changes – so it’s important to keep realistic expectations when considering interest rates.

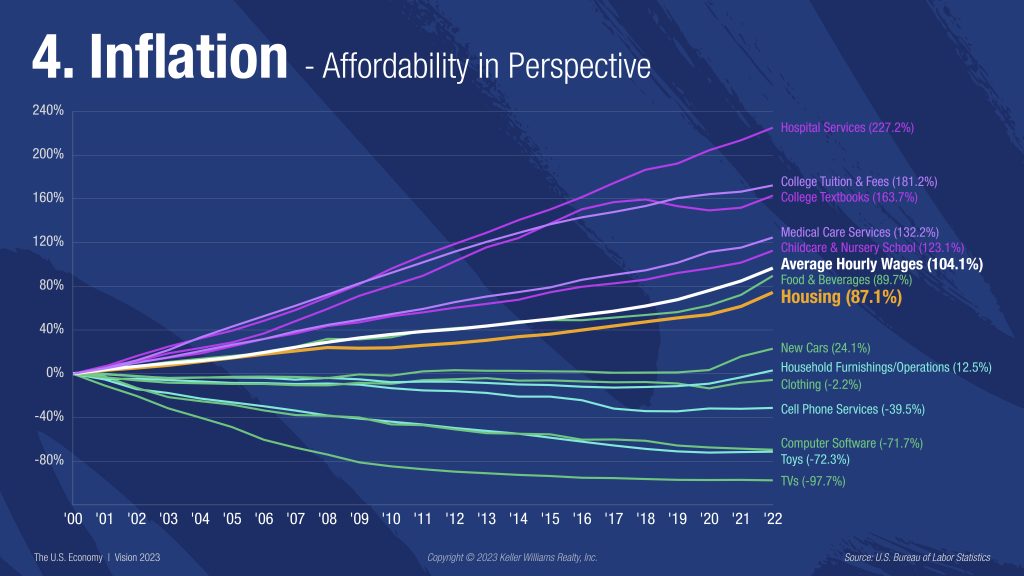

Inflation Matters!

Interest rates have been rising recently, a fact that many people attribute to inflation. But the truth is, not all areas are equally affected by inflation – in fact, some things experience higher increases than others! Food and beverage prices, hourly wages, medical care costs and child care expenses have all increased much faster than housing prices. On the other hand, technology has gone down in price – how much did you pay for your flat screen TV years ago? Prices of commodities like gas show the biggest differences in inflation rates – before 1989 a gallon was $2.38 but today it’s about 66% more expensive. Although mortgages have also gone up, the difference is much less drastic with a 3% increase in rate.

The Wrap Up Of March

So, the real estate market in New Jersey is looking good and prices are still at a reasonable level. Inflation has increased slightly but it still bodes well for prospective homeowners. We’ve seen a great jump in home values over the last year, with an even brighter future on the horizon. For those who have been on the fence about whether to buy or lease— there is no better time than now. If you are thinking about purchasing property in New Jersey, I can help you find what you need. Don’t forget to check out my YouTube Channel for more tips and advice from local real estate experts. With perseverance and understanding the needs of each individual buyer come together quickly, so make sure to reach out if you need assistance – we got your back!