Mortgage & Economic Backdrop

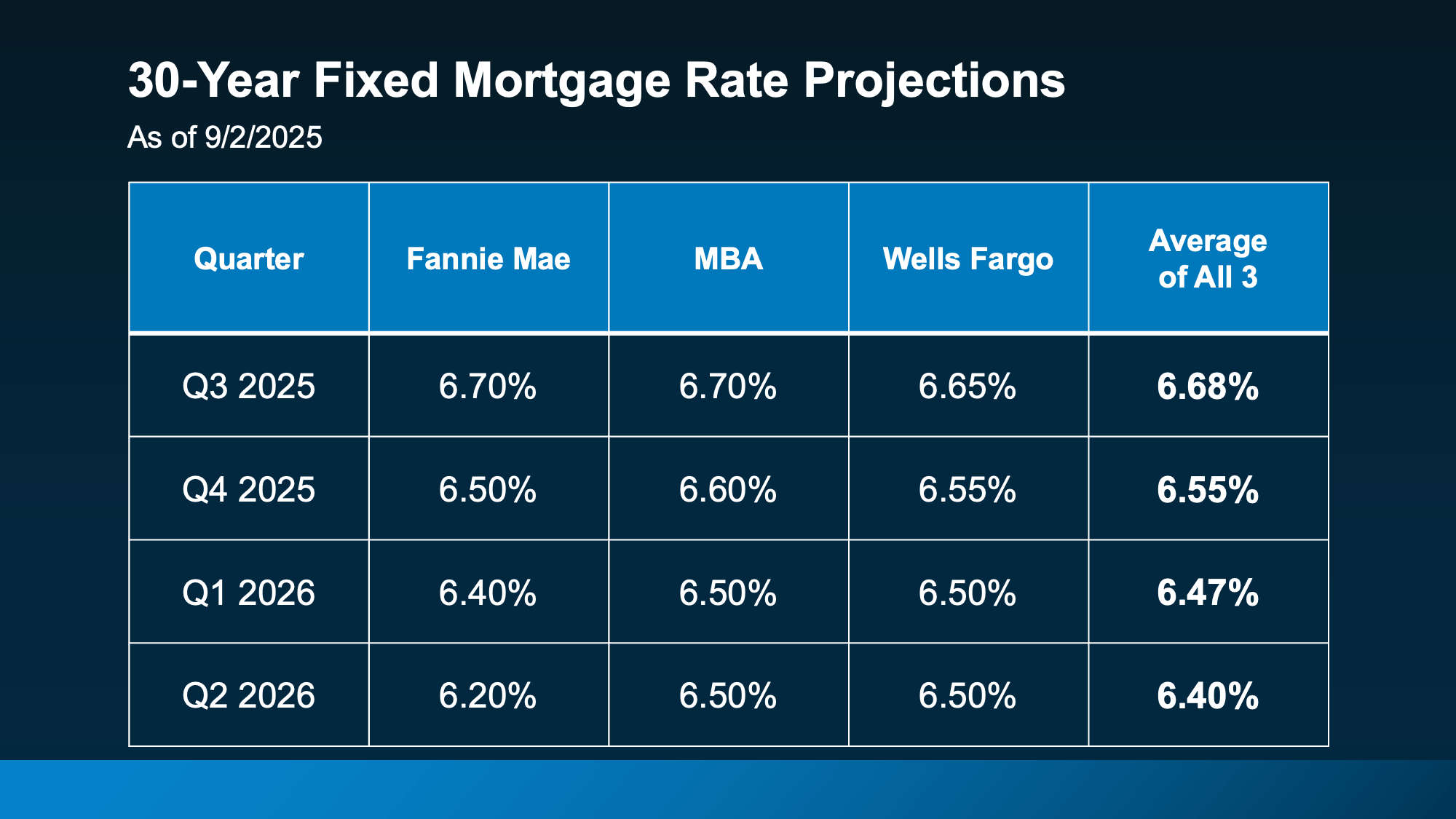

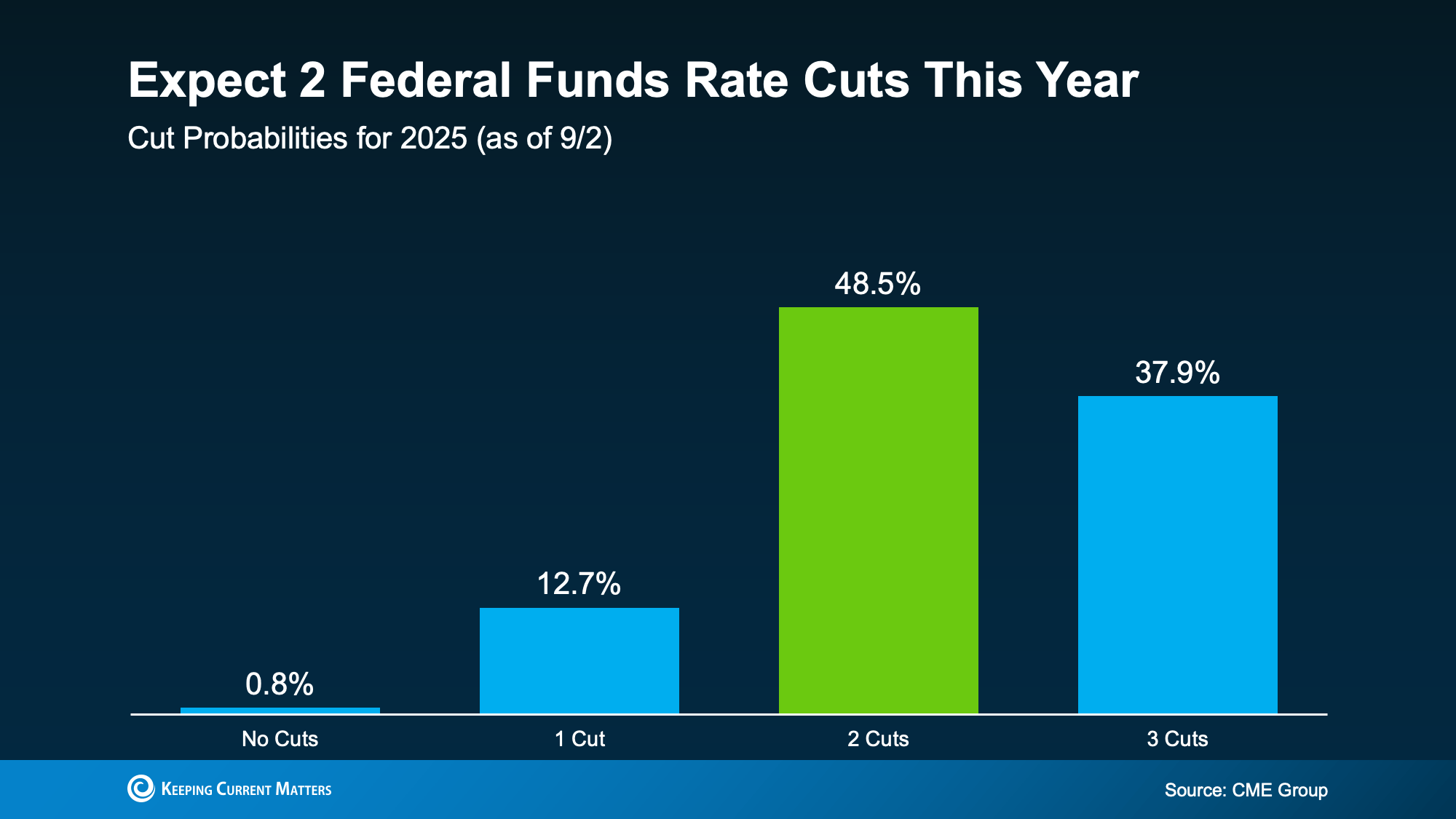

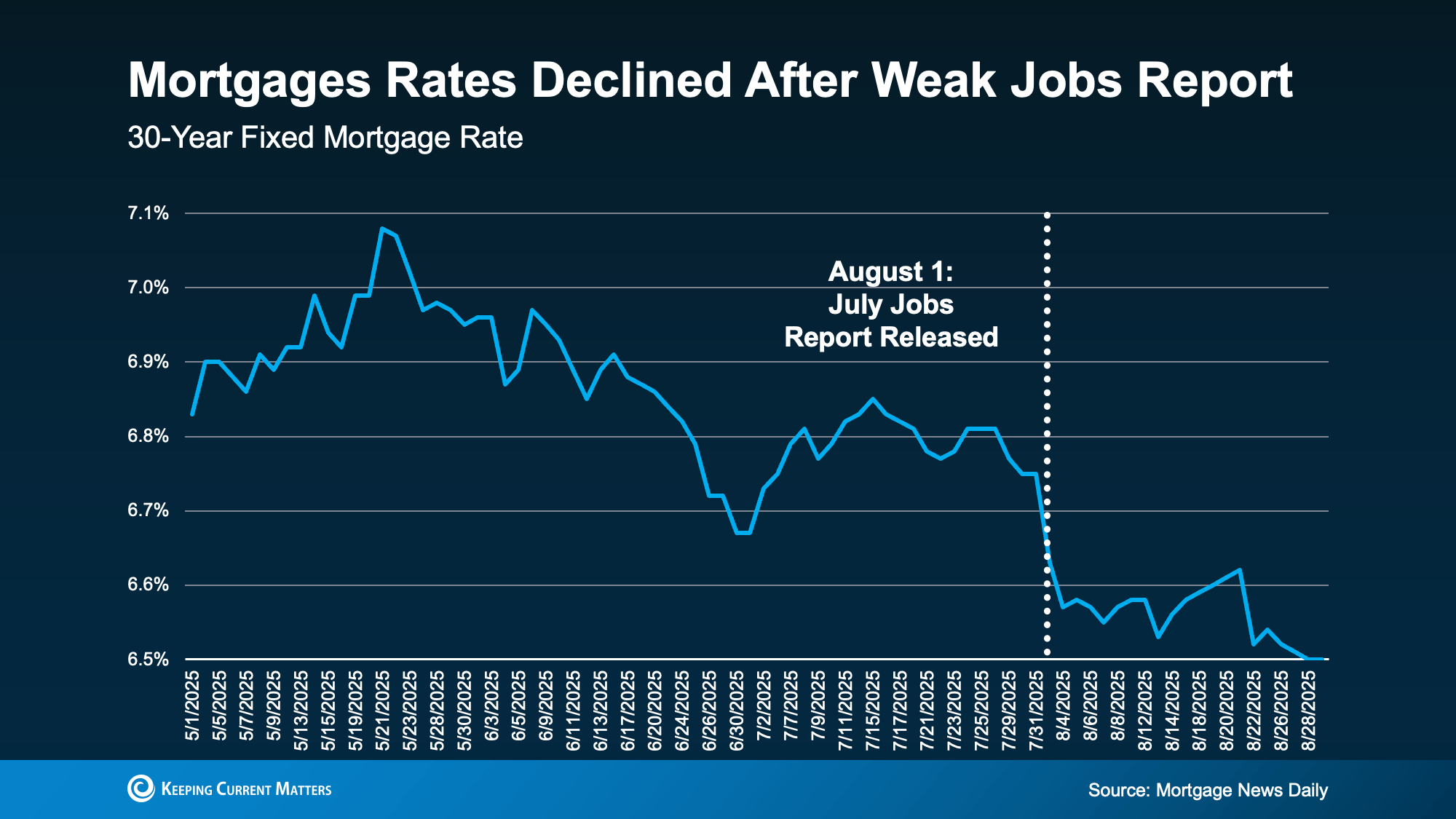

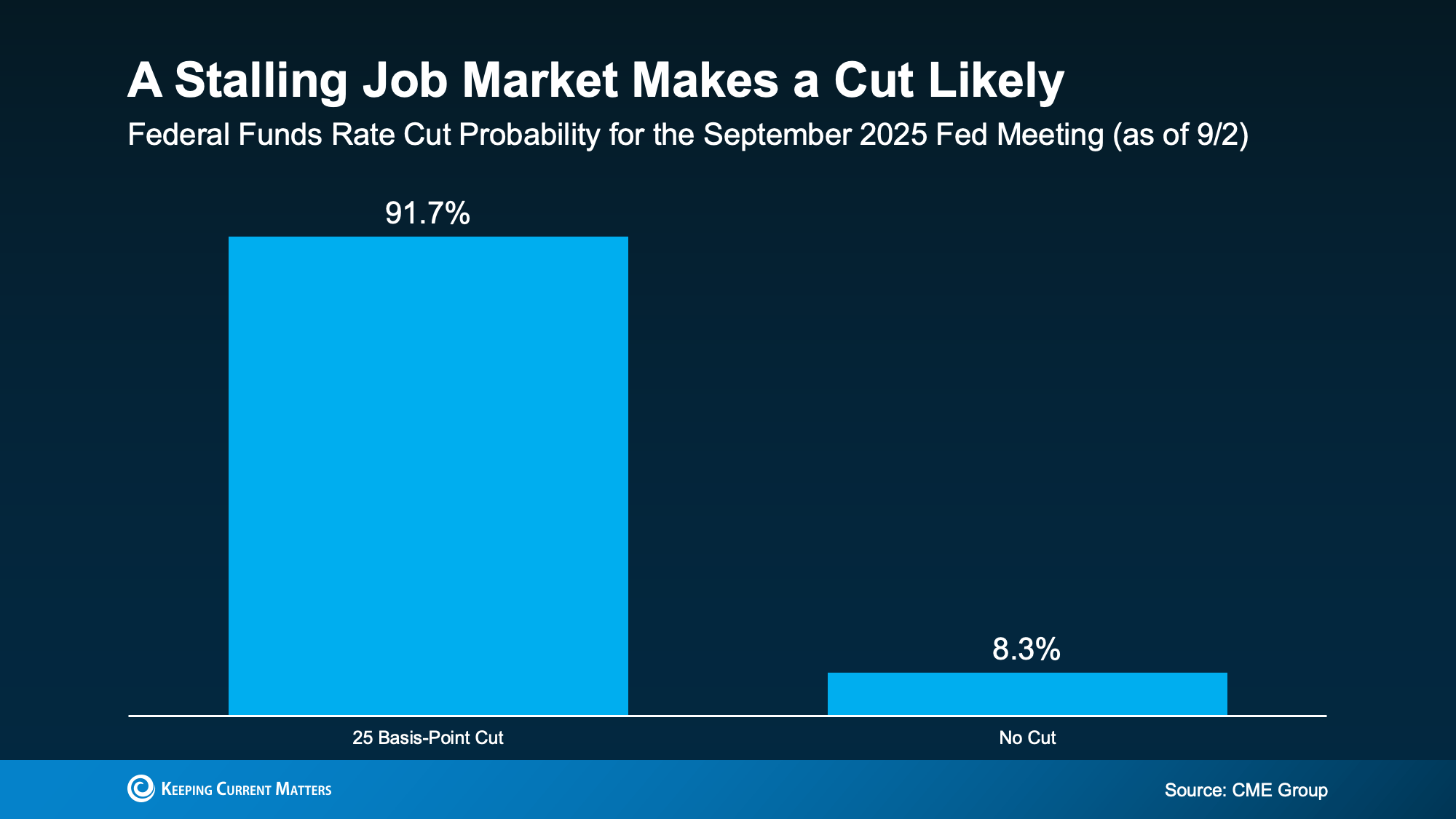

Mortgage rates are at their lowest level in a year (~6.6%) after a weak July jobs report. August inflation data landed largely as expected, with easing in “supercore” services, so bond markets were steady. The Federal Reserve is widely expected to cut rates in September, but that move is already priced in by markets. Most outlooks suggest mortgage rates hovering around 6.0%–6.5% into 2026—not a return to pre-pandemic lows, but an improvement over last year’s peaks.

Takeaway: Financing conditions are better than last year, but affordability still matters. Buyers gain some relief; sellers face a clear affordability ceiling.

U.S. Market at a Glance

- Inventory: up 20.9% YoY (22nd straight month of gains).

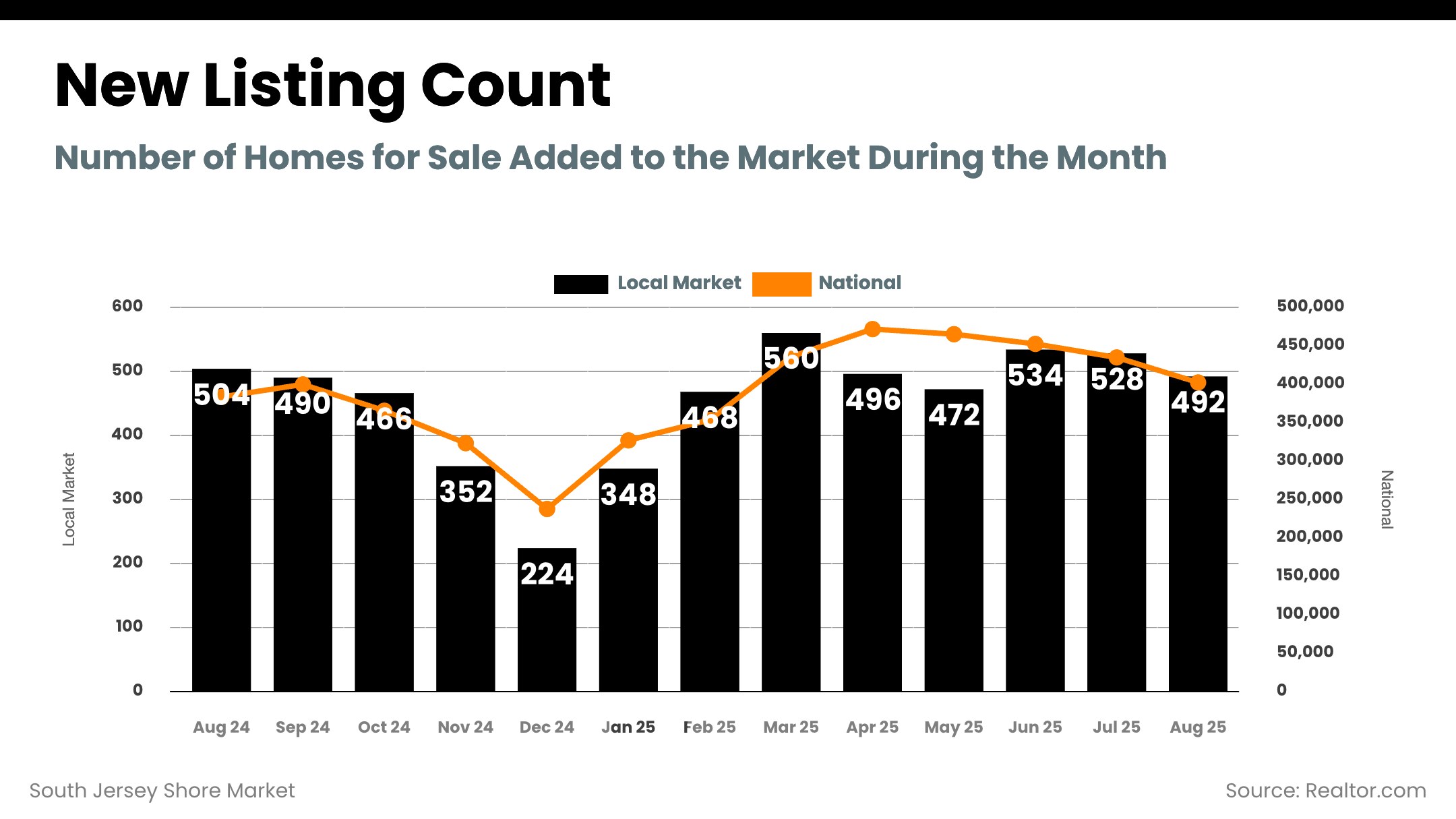

- New listings: up 4.9% YoY, a slower flow versus spring.

- Pending sales: down 1.3% YoY.

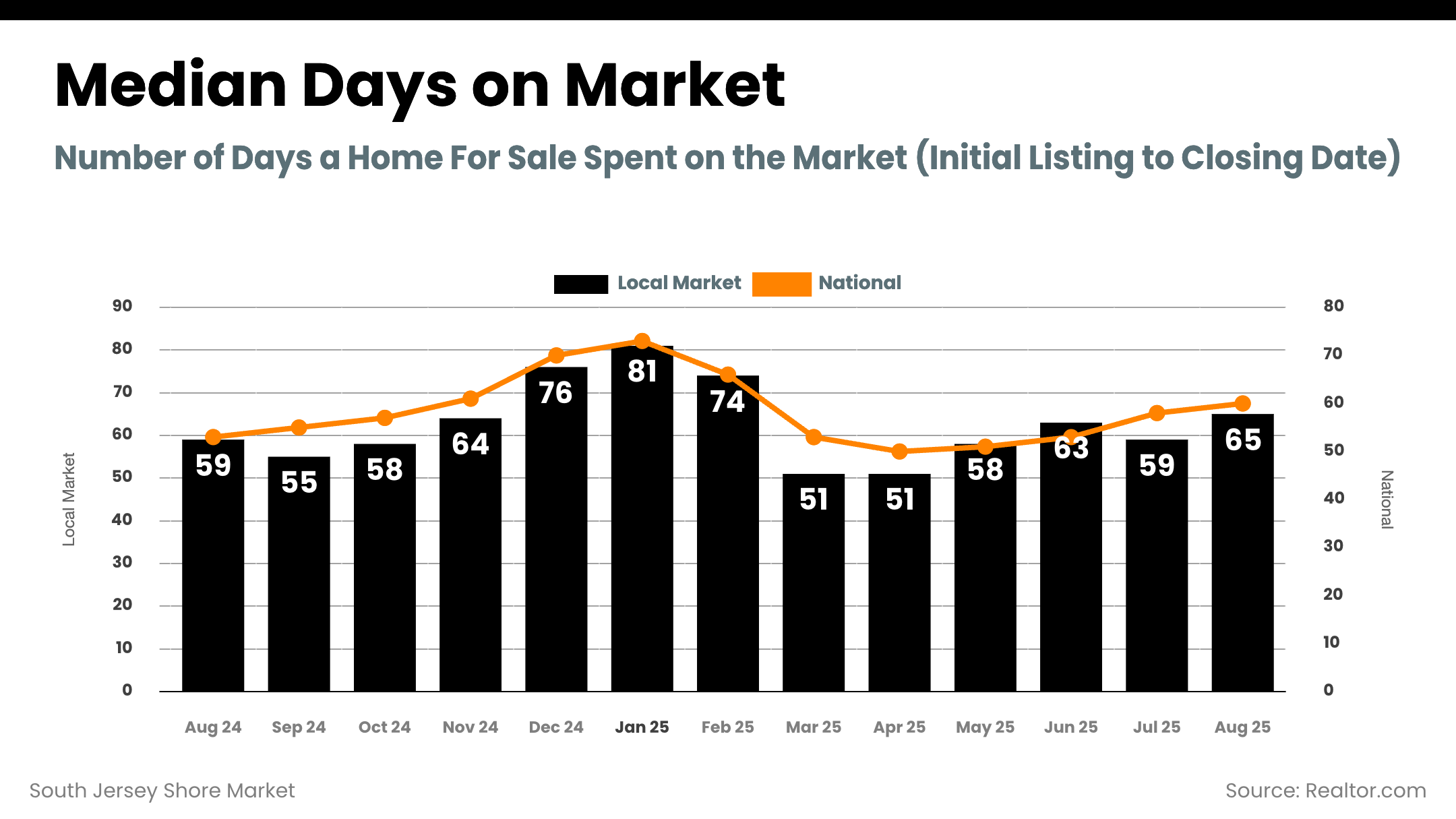

- Time on market: median 60 days (+7 YoY).

- Median list price: $429,990 (flat YoY).

- Balance: roughly 5 months of supply nationally (balanced).

Read: Buyers nationally are regaining leverage. Homes sit longer, price cuts are common, and the South & West are cooling faster than the Northeast.

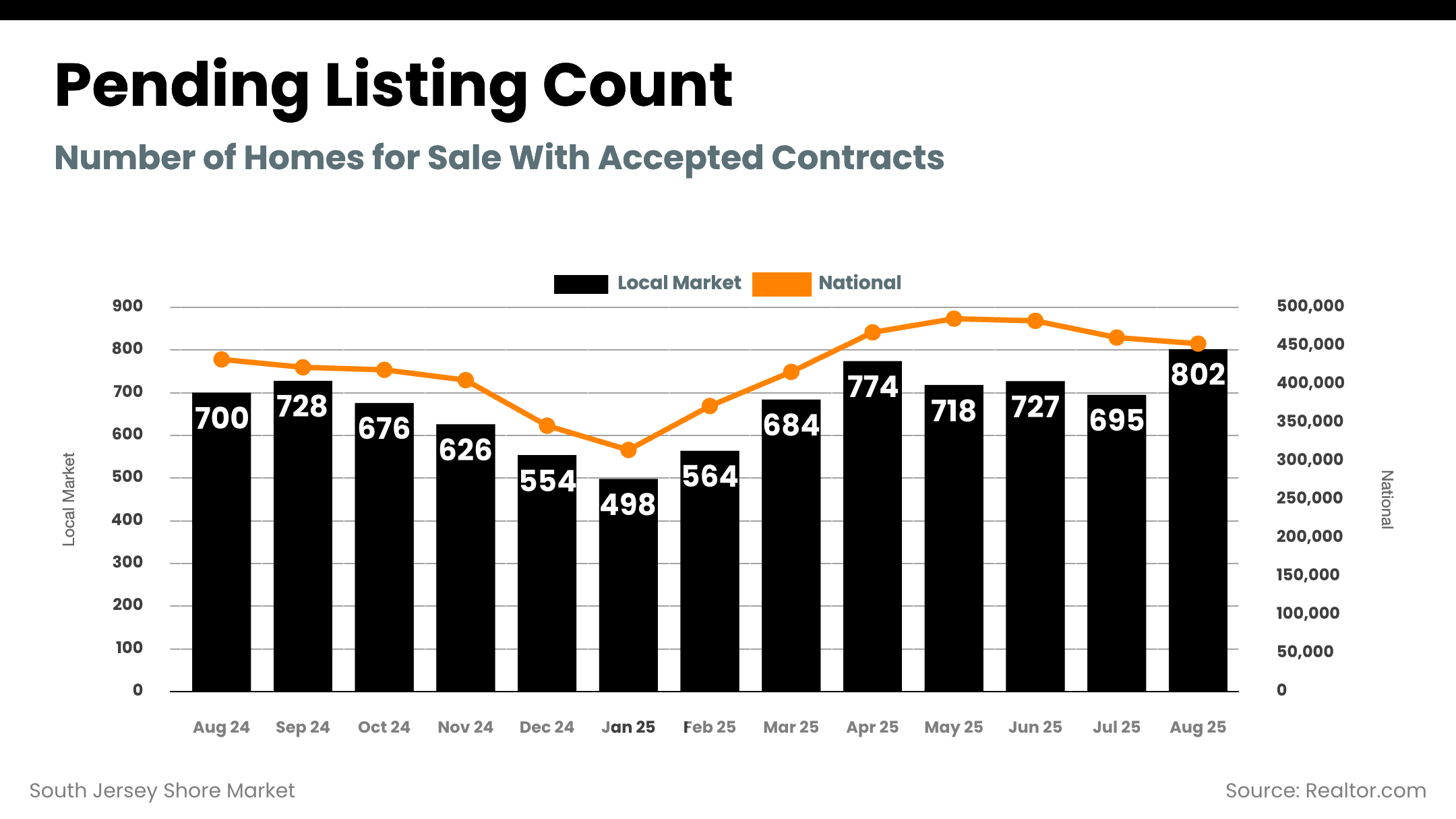

South Jersey Shore Snapshot (Combined: Atlantic & Cape May)

Locally, the market remains more competitive than the national picture. Inventory is tighter and homes sell faster.

- Median Days on Market: ~30 (vs. 60 nationally).

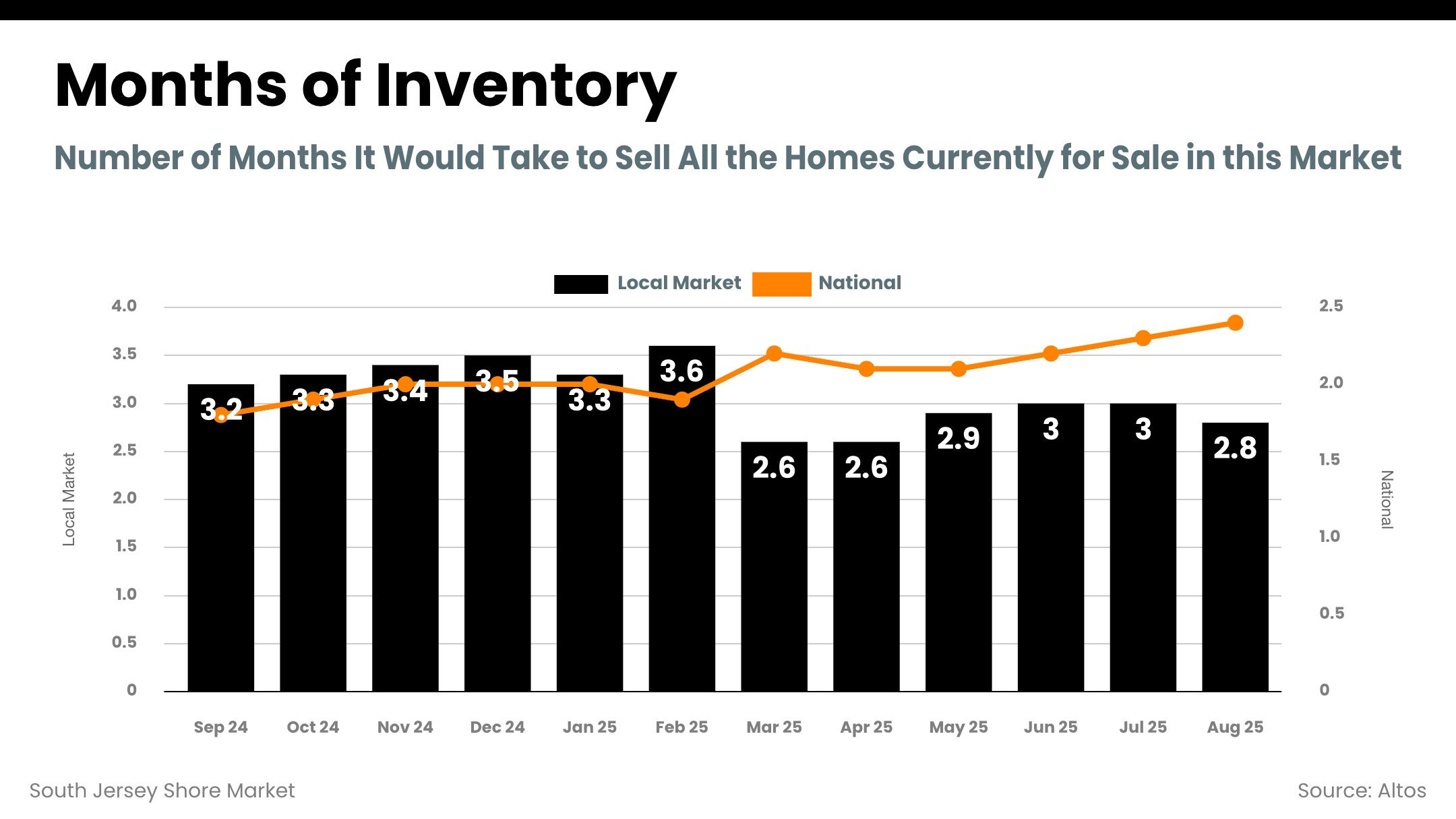

- Months of Inventory: ~2.6–3.6 (seller’s market).

- New Listings (Aug 2025): 352 (down from ~534 in June).

- Pending Listings (Aug 2025): ~626 (steady, below spring peaks).

What it means: Even as national buyers gain leverage, Shore buyers still need to move decisively; sellers retain solid negotiating power.

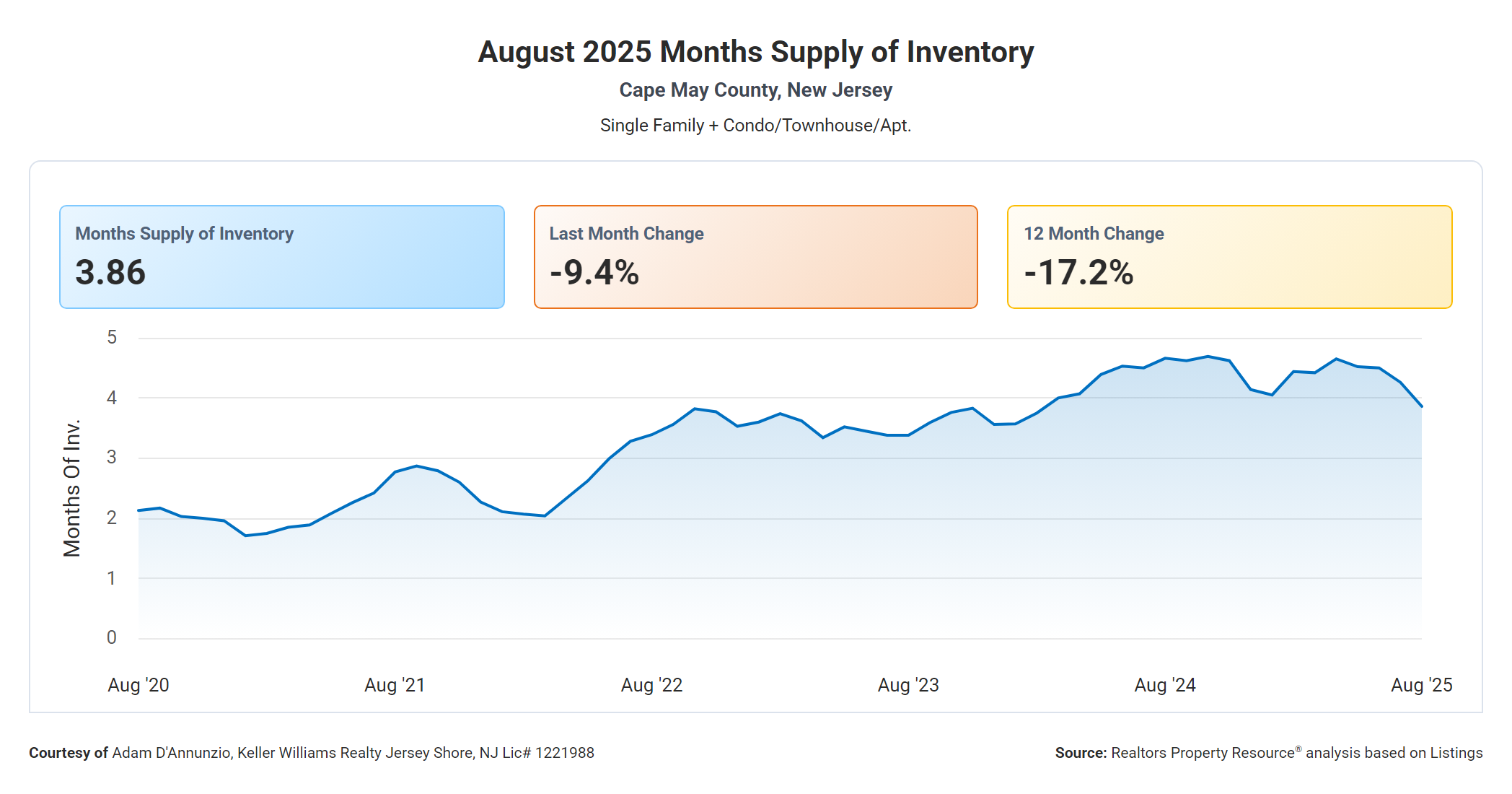

Cape May County

- Median Sold Price: $740,000 (+22.5% MoM)

- Median Days on Market: 40

- Sold-to-List Ratio: 97.5%

- Months of Inventory: 3.86 (down ~17% YoY)

Atlantic County

- Median Sold Price: $378,000 (about flat MoM)

- Median Days on Market: 23

- Sold-to-List Ratio: 98.1%

- Months of Inventory: 3.86 (up ~4% YoY)

Strategy for Fall 2025

For Buyers

- Capitalize on the year-low rate environment; don’t expect a major post-Fed drop.

- Be offer-ready (underwritten pre-approval, verified funds). Target listings at 14+ DOM for leverage.

For Sellers

- Price to today’s market; the first 10 days set the tone for showings and offers.

- Dial in presentation: pre-inspection, minor repairs, and Shore-specific tune-ups (salt-air maintenance).

Bottom line: Rates are improved but largely priced-in. The national market is balancing, while the South Jersey Shore remains competitively tight—especially in Cape May’s premium segment and Atlantic’s affordable tiers.

Local Area Specific Market Reports (these reports are updated every 48 hours)