Are you curious to hear what’s happening in the real estate market here at the South Jersey Shore for December 2022? In this video, I’m going to tell you what’s actually happening here at the South Jersey Shore. We’ll look at everything from transaction numbers and home prices to rumors of a market crash to give you a good idea of exactly what to expect for the new year.

Now more than ever, people are asking, “how’s the market?” Since we’ve made it to December, the end of the year is the perfect time to reflect back on what’s happened. We’re going to examine the market data for 2022 compared to last year. And before I get to it, I hope that you and your family are having a very happy holiday and a prosperous new year.

December’s Real Estate Market

In today’s market, things have slowed down a little bit—as you’ve probably seen in the headlines in the news. However, I want to tell you what’s really happening. First, there are fewer transactions, fewer buyers, and fewer sellers in the market right now. I haven’t seen prices go down, and interest rates have reduced in the past three weeks or so. This is a good, encouraging trend.

We still have very low inventory levels. The nice condition properties that are priced correctly are still seeing a lot of activity from buyers, some even with multiple offers. In today’s market, the properties that need a lot of work, are priced too high, or are troublesome to get into are hanging around and sitting on the market longer than they were last year.

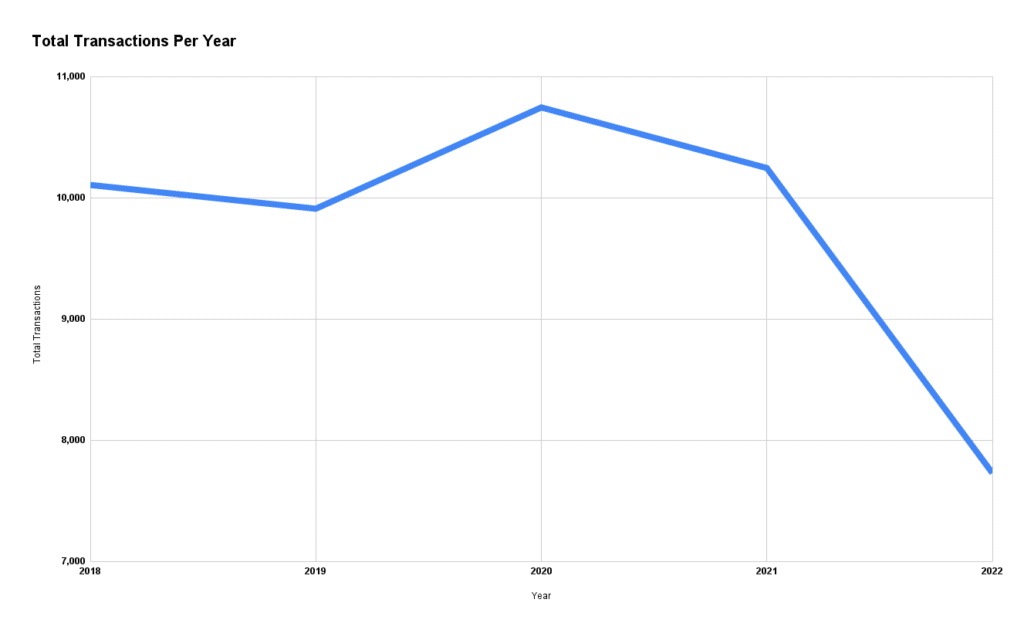

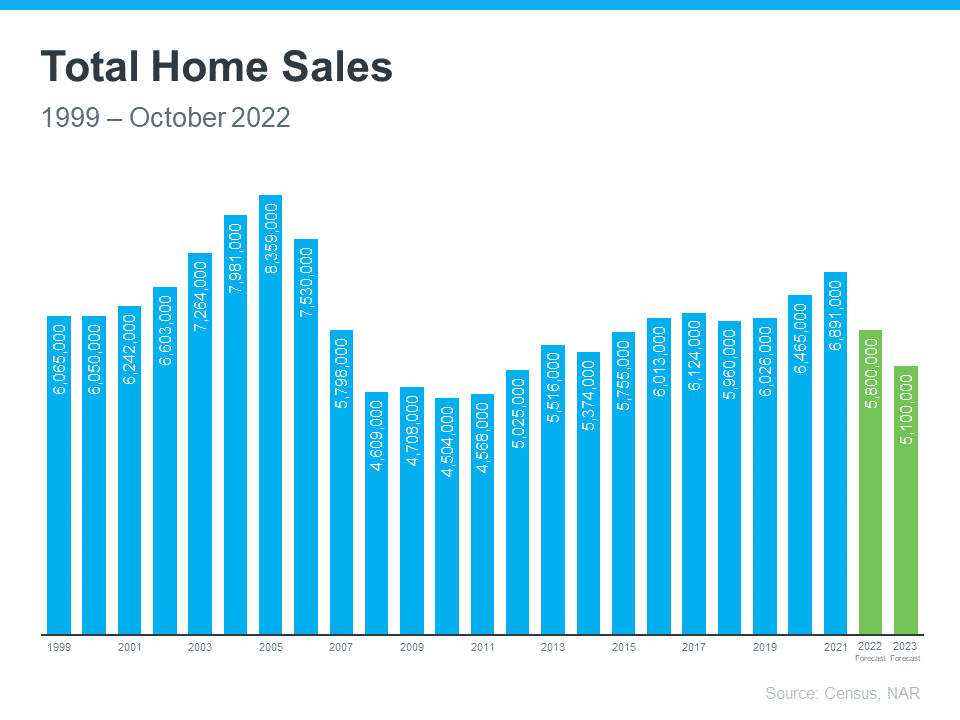

Lastly, our transaction count is down. This means there are going to be far fewer properties selling this year than last year. When you’re looking at the media or listening to the news, I want to make sure you’re paying attention to the correct facts. Having fewer transactions doesn’t necessarily mean a market crash.

Changing Mortgage Rates

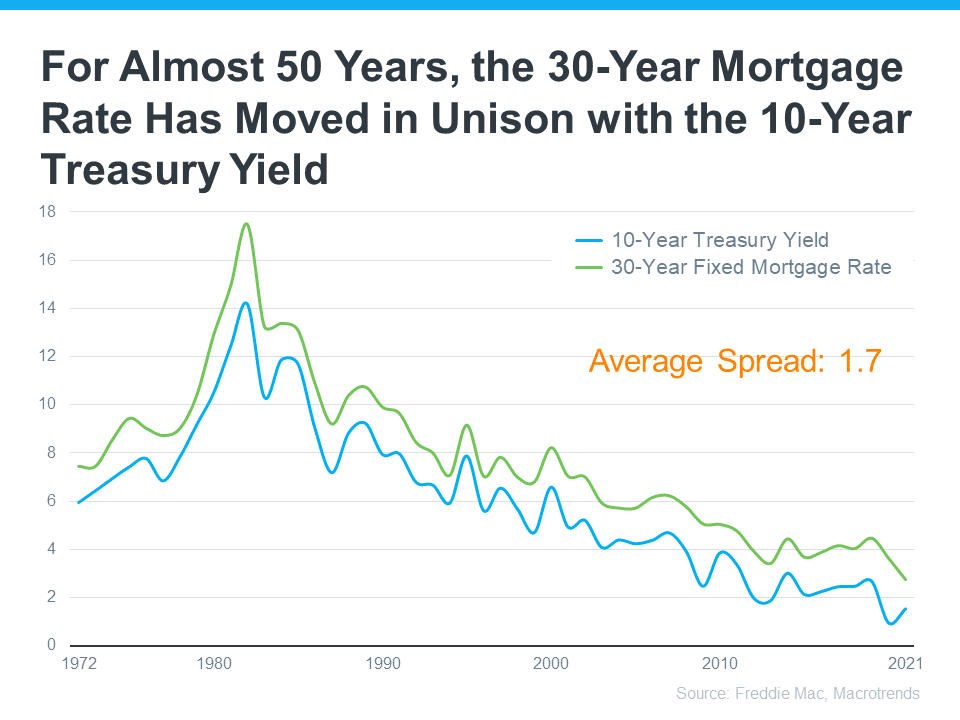

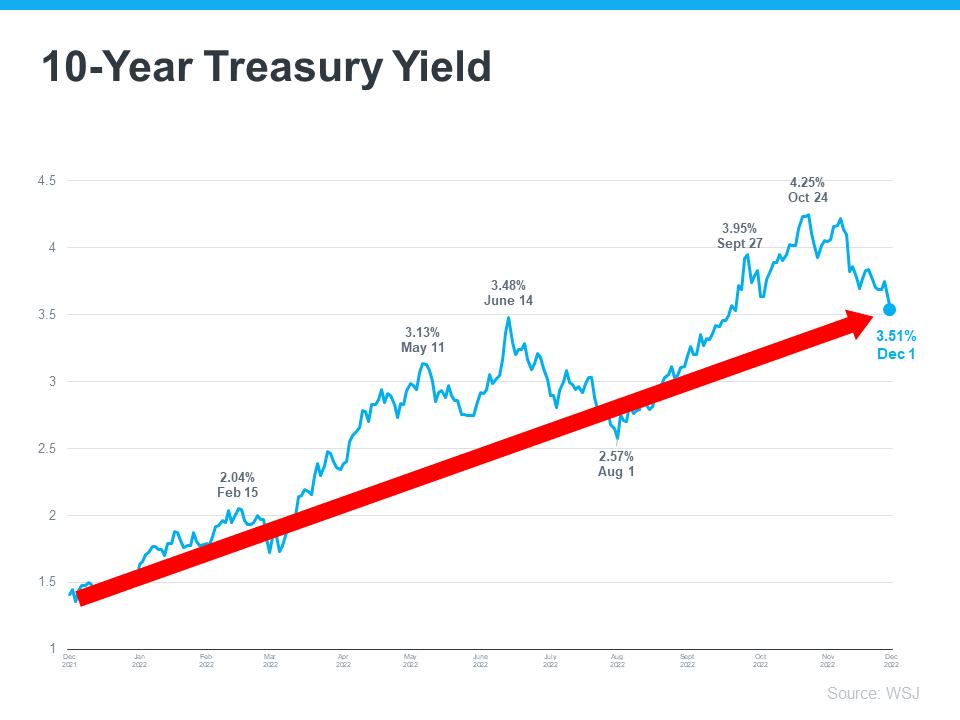

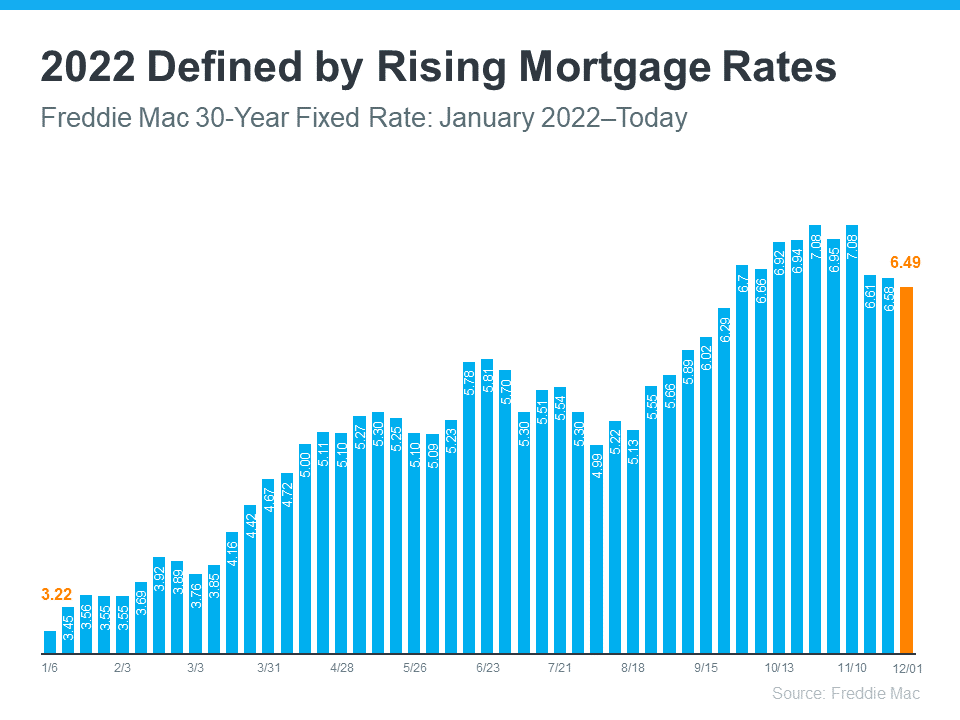

Now that we have an overview, let’s dive a little bit deeper into the actual numbers. Everybody’s heard about the Feds increasing rates, and therefore mortgage rates are going up. Remember that the Fed set the 10-year treasury, which mortgage rates often follow. However, the Feds don’t actually change the rates.

The purpose of doing all of this is to control inflation. The real estate market was going crazy, prices are going up, and inflation is out of control. The Feds want to try and temper that. While the media says there’s a slowdown, it’s really just fewer home sales. The inflation comparisons start to become more and more favorable, with inflation coming down a little bit.

Mortgage rates should move similarly. We’re on a downward trajectory, probably giving us rates around 5% or below within the next six months. The experts are predicting that mortgage interest rates are not going to continue going sky high, and they might continue to come down a little bit just like they have in the last three weeks or so.

Rumors Of A Crash

When you’re listening to the media or reading online about housing news, I want to make sure you’re using the proper context. A lot of this news is nationwide, where there are markets like Phoenix or Los Angeles that saw massive growth more than our market did over the last few years. They are seeing price declines, but it’s not something that we’re seeing right now.

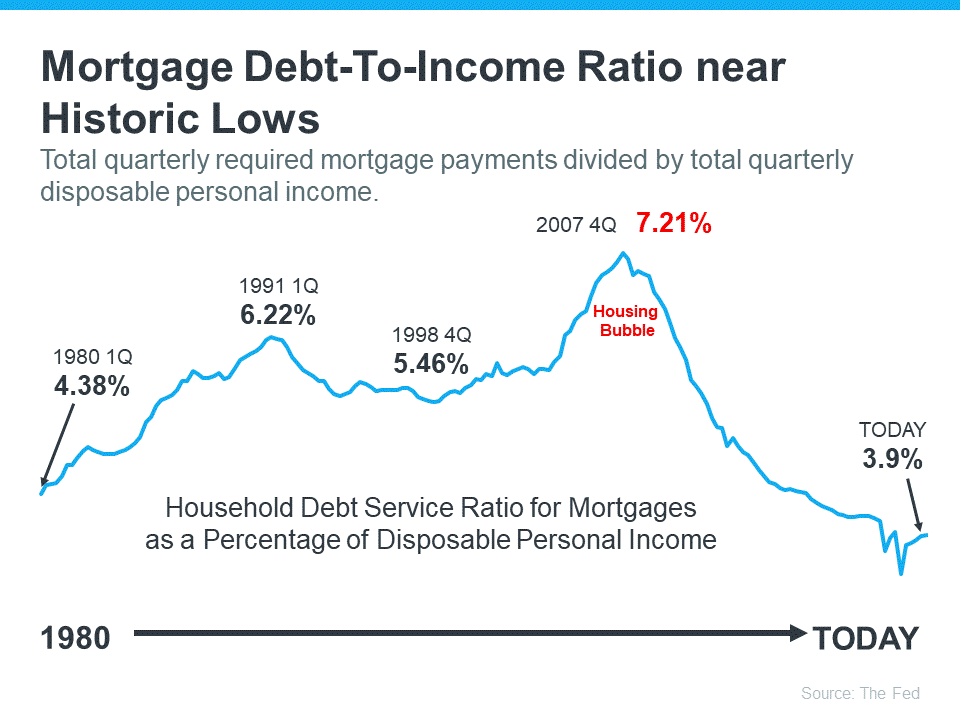

This is because we didn’t see as much of the extreme—believe it or not—that they did. One of the things we hear a lot about is housing crashes and Americans being in financial distress. However, when we look at the actual numbers, we’re at historic lows for debt-to-income ratios.

This means that people are making more money and have lower debt than in the housing crash of 2007 and 2008—which is really good news. Jerome Powell, the Chair of the Federal Reserve, said in June that if you’re a homebuyer, you want a bit of a market reset. We want to slow things down and get inflation under control, and then mortgage rates are probably going to be low again.

So whether you agree with their goal or not, we’re getting there. Things have slowed down, and there is a bit of a reset in the market. Interest rates caused everybody to take a step back for a moment and see what was happening with the market—and here we are.

2023 Projections

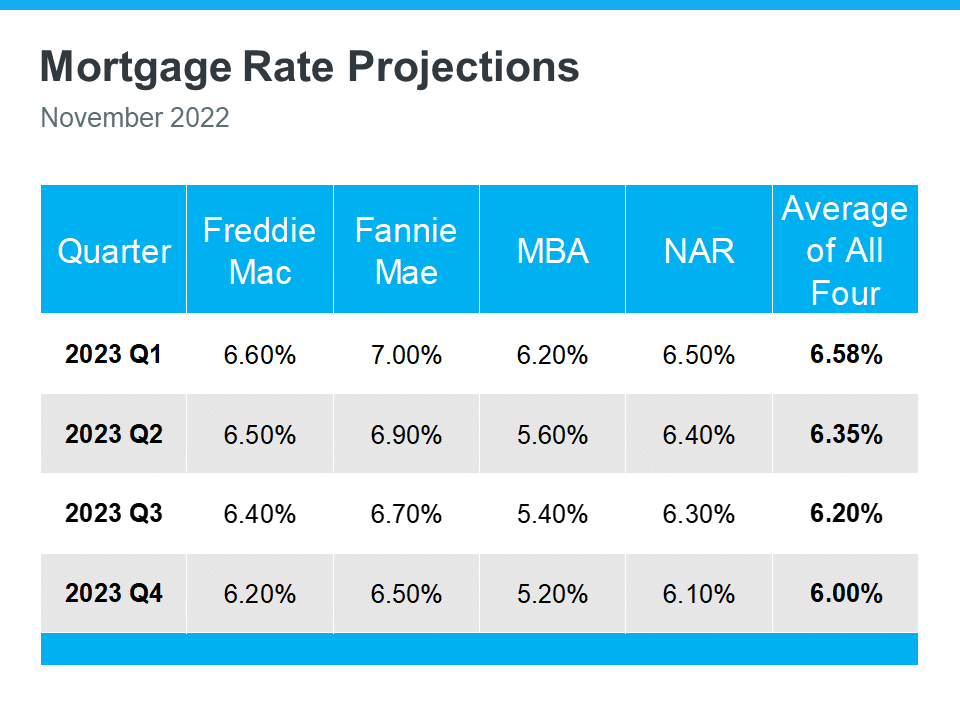

The experts are predicting that next year, we’re going to see slightly lower rates. We not going to see the 6-7% that we’ve seen even over the last few weeks. The expert projections for mortgage rates in 2023 show a lot of low 6s, while some of the other experts predict even lower. As inflation again eases, those mortgage interest rates will continue to pull back.

One of the big things I’m seeing this year in the industry is that fewer homes are selling this year than there have been in quite some time, at least according to national numbers. I think we’re going to see a little bit more certainty heading into next year. Some buyers that have removed themselves from the market due to mortgage interest rates are probably going to bounce back into the market.

Because the market hasn’t changed in the sense that it still has low inventory, there hasn’t been a market crash. There hasn’t been a bunch of other homes coming onto the market, so interest rates are going to come down a little bit more. Those buyers that have probably put things on pause—whether for interest rate reasons or seasonality—may be coming back into the market.

The Jersey Shore MLS

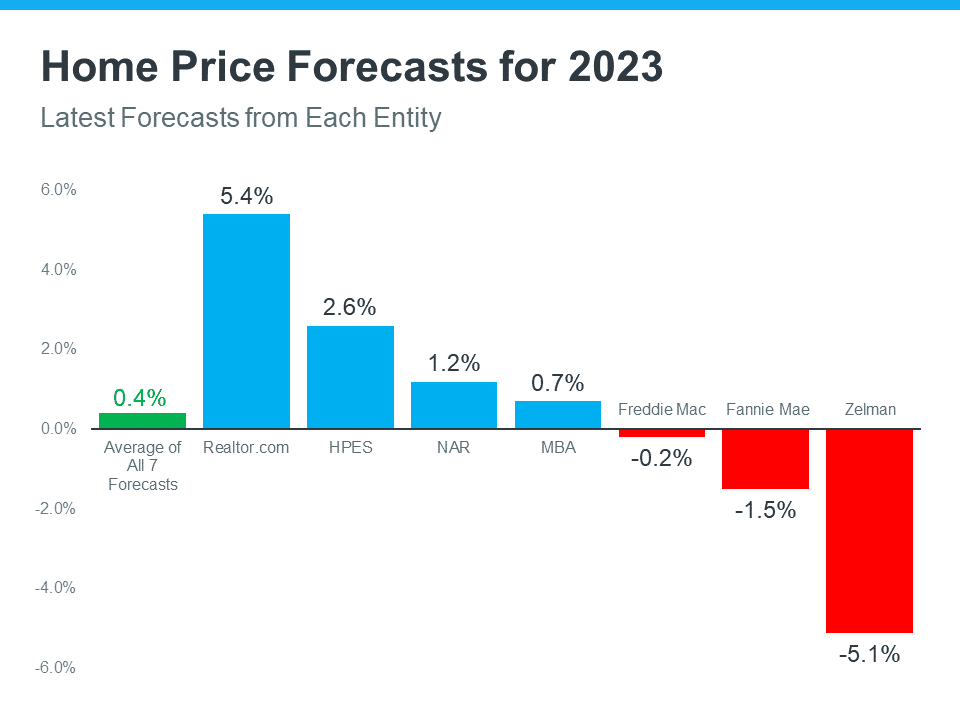

Everybody wants to know what’s going to happen to prices next year. Nobody knows for sure, but we’re looking at what all the different experts are saying. Some say there’s going to be appreciation, while some are saying depreciation. If you take all these experts and average them out, there’s probably not going to be a big swing in either direction.

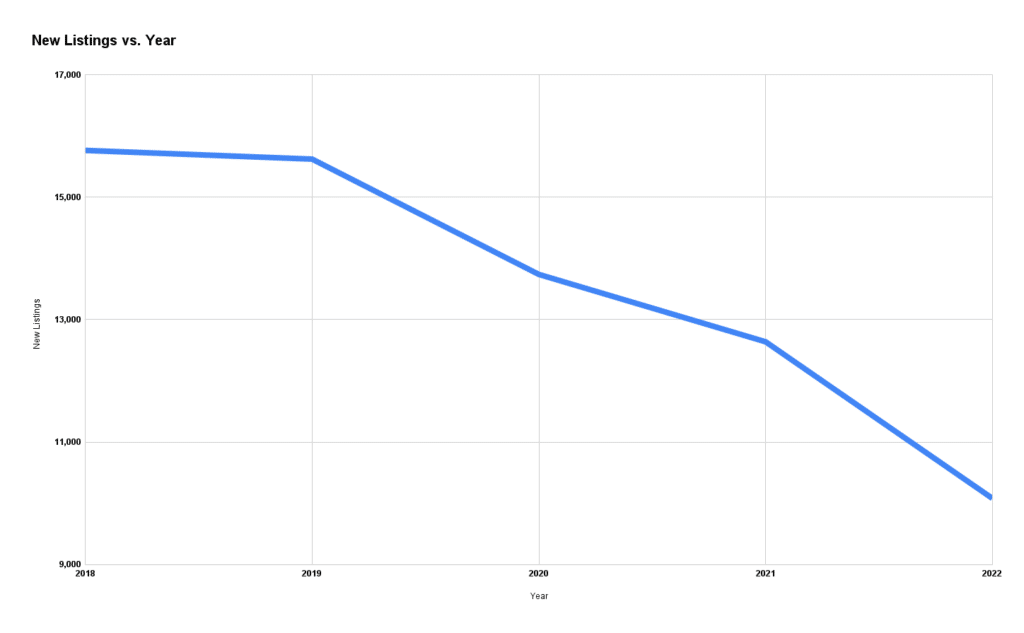

When it comes to our local MLS, new listings are coming onto the market, going under contract, and selling. It shows us that each of these things is following the other. When there’s going to be a market crash, there are a lot of new listings coming onto the market but they no longer are going under contract. This shows we’re still in a very healthy market.

Transactions And Inventory

With very low inventory, we’re going to continue to see prices where they are without a crash—unless we see a lot of new listings come on the market and they’re no longer going under contract. For our local Atlantic County and Cape May county MLS, one of the things you’ve heard me say a few times refers to total transactions declining. The expected closings for this year are about 7,700 properties that sold and closed. Compared to last year and the year before, there were over 10,000.

We’re seeing fewer transactions, but inventory remains low. I think that we’re going to see this continue into next year. We’re going to have fewer transactions, simply because the last couple of years were at an extreme market. Because of this, we’re probably going to balance out with a few years of fewer transactions.

When it comes to new listings coming onto the market—and looking back at data from 2018—even though there were fewer sales, fewer properties were coming on the market. That’s what’s preventing us from having a market crash.

Days On Market

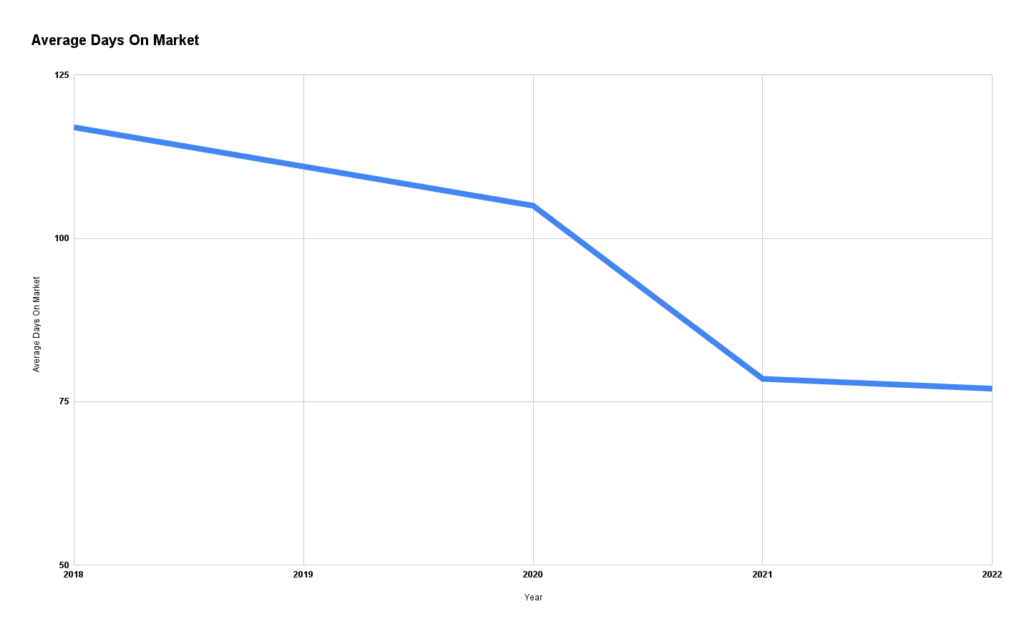

Another statistic to look at is days on market. Comparing the last few years, this number has remained relatively stable with no major changes. However, the market has been more competitive in the last few years, so the average days on market are lower.

We may trend back to more of a new normal neutral market where properties are taking three to six months to sell—unlike it taking a few days earlier in the year. Again, this isn’t a cause for concern. I’m not seeing any major changes to average days on market, so we’re still going to see a fairly normal market condition here.

Showings

The last thing to consider is showing time, which displays the number of buyers or showings that sellers are receiving. Essentially, this is buyers walking through the door to see a house for sale. We started tracking these numbers for COVID reasons, though it’s not really the reason now.

When comparing 2020, 2021, and 2022, we had fewer showings. This correlates to fewer transactions. The good news is, again, that this doesn’t show a market crash. We’ve moved up and down at the same pace we have in previous years; you’re just going to have a lower transaction count year.

Don’t let the media misconstrue this to be a market crash. All it’s saying is we had a more normal year than we did in the last two years as far as the number of transactions.

Looking Ahead

I hope this gave you a good idea of what’s actually happening in today’s market. We’ve seen what has happened over the last year or so compared to the past few years and how the market is changing—along with what we might see going into next year as we end 2022.

If you like what you’re seeing in these videos, please make sure to subscribe to hear all things about the real estate market here at the South Jersey Shore. I hope you and your family have a very happy holiday, and I look forward to talking to you soon in the next year!