Enter your zip code below for a custom market report for your area

Are you curious about what’s happening in our current real estate market? In this video, I’m going to give you a market update for January 2023. We’ll look at the trends and the numbers so you know exactly how the year is starting.

Transactions And Inventory

If you’ve been watching my videos, we ended the year talking about the decline in transactions. One of the things I’m seeing already in January of this year is that the transaction count is up. We are far busier just in the first couple of weeks of January than when we were in December and November.

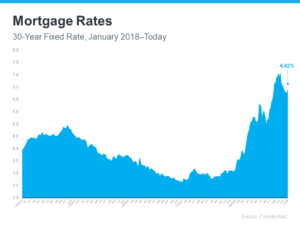

I think one of the reasons why is that interest rates have declined since October when they were at their peak. Interest rates have gradually been coming down since October, which will hopefully continue. The mortgage lenders have built in some buffer room for wage rate increases, which should alleviate things a bit.

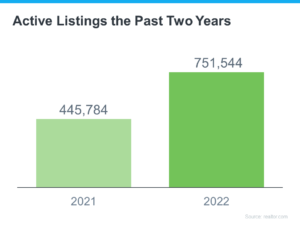

One thing that we have not seen is an increase in inventory. It seems like people are feeling a little bit more comfortable, as a market crash cannot happen without an increased inventory. While there are slightly more homes on the market than there were in the extreme market of 2021, we’re nowhere near a market crash like in 2008.

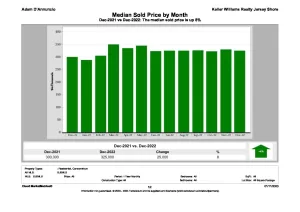

Home Sales

Now, let’s dig into the numbers a bit more. One of the things we talked about is our prices going down. The median sold price for the entire MLS in our local area has remained pretty flat month over month through the end of the year. It’s up overall, but we knew that there was some craziness going on at the beginning of the year.

Heading into 2023, prices are about the same, and there hasn’t been a whole lot of change. The other thing we’re looking at is sale price versus sold price. This lets you know if there’s going to be a big difference between what properties are asking for and what they’re selling for. So far, the numbers are keeping pace with each other.

There were some big changes earlier in the year where we saw properties sell for significantly more than the asking price. However, we’re not seeing as much of that anymore.

Properties On The Market

I’ve been telling you for a few months that the number of transactions declined significantly in 2022. Every month towards the end of the year over the last year, the number of sold properties went down. Fewer properties are selling, with under-contract properties down as well.

Usually, when this happens, there’s a significant increase in inventory. A significant increase in inventory would majorly change the market. However, when we look at new properties coming on the market, those went down as well. Because of fewer properties coming on the market, there are fewer going under contract and fewer selling.

Inventory has gone up a little bit overall, but it’s still very low historically. That’s why we haven’t seen a significant downtrend in pricing. For-sale properties have kind of remained around the same. This tells us that there’s some type of major change in inventory, which keeps prices the way they are.

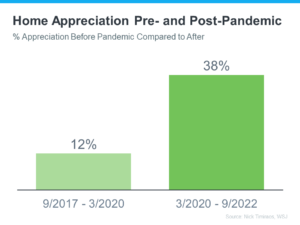

Pre-Covid

If we took the time frames of pre-Covid and post-Covid—a period of about two and a half years—we saw about a 12% appreciation pre-Covid. This is a very normal, healthy market, healthy market. In the most recent two and a half years during COVID, however, we saw a 38% appreciation.

That level of appreciation is extremely high, and we know that trend cannot continue. It doesn’t mean that there’s devastation to the market either, because things have bounced back to being normal. There are maybe only a couple of points of appreciation or depreciation in either direction, making it a normal, healthy market again.

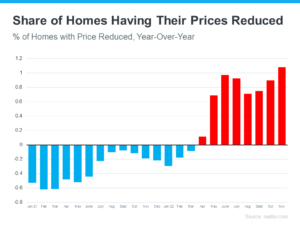

Price Reductions

A lot of people have told me that they’re seeing more and more homes with price reductions and that everybody’s reducing their prices. While this is slightly true, it’s not true by much. It’s only been about a 1% increase in homes that have their price reduced.

One of the things we are seeing is that sellers can’t price their houses in any way they want to any longer. Rather, they have to price it competitively and in line with the market to find a buyer. This is as of January 2023, but we’ll see what happens going forward. Still, a lot of the experts predicted this.

Mortgage Rates

Believe it or not, mortgage rates have been trending down. Again, we saw interest rates peak around October. While I’m not saying that they’re not going to go up again, we did predict that mortgage rates were going to level off. We’re probably going to hang around that same mortgage interest rate that we’ve been at without any major changes.

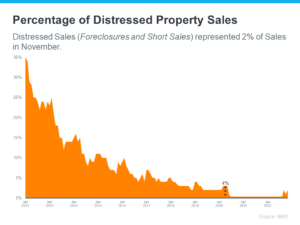

People keep waiting for the foreclosures to pop up, but they simply haven’t. There are very few distressed properties because everybody has a whole lot of equity in their house. Even if someone could not afford their mortgage, they can probably sell it right now so they’re not underwater.

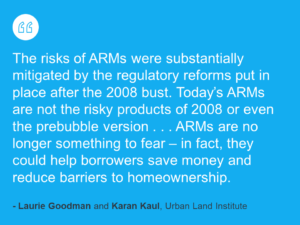

ARMs

Additionally, a lot of the buyers we’ve seen in the market today are taking advantage of adjustable-rate mortgages to bring their rates down a little bit. I know ARMs—or adjustable rate mortgages—can be scary. Talk to your mortgage lender, though, because they’re not the high-risk products that they used to be.

Things are much tighter now and much stricter. Additionally, everybody’s putting down a significant amount of money. People who are putting 20% or more down have equity in the house, and they can always refinance later. This means you have some options, and an ARM actually might be a very wise choice in today’s market.

Make sure you schedule a consultation with a lender and see if it makes sense for you.

A Busy Spring Market

Overall, there are more listings right now on the market than there were before. For a buyer, that’s good news. You might have a little bit more to pick from, though inventory is still low for traditional or historic norms.

I hope this gave you a good idea of what we’re seeing for January 2023. It looks like we’re going to be heading into a busy spring market once again. If you’d like to know when our next monthly market update comes out, be sure to subscribe to the channel so you never miss a new video. See you next time!