Enter your zip code below for a custom market report for your area

Are you curious about what’s actually happening in the November 2022 real estate market here at the Jersey Shore? In this video, I’m going to tell you all about the current market and where it’s headed. We’ll look at everything from interest rates and home prices to inventory so you can make the best decisions for your future.

A Changing Market

Now more than ever, we’re getting asked how the market is. What’s happening with interest rates, prices, crashes, and inventory? Well, what we’re seeing right now is that buyers have pulled back a little bit. There are not as many buyers in the market but, at the same time, it’s still a seller’s market.

We’re still seeing some multiple-offer situations, but just not nearly as many. Inventory is down and there are fewer showings. However, the good news is that just last week, we saw the largest interest rate reduction in history. Yes, rates actually went down last week, believe it or not.

From there, we’re combating some of the headlines we’re seeing in the news and the media right now. I’m going to share the exact numbers with you so you can truly see what’s going to happen next year. We’ll look at possible recessions and whether values are going down or will stay the same.

A Drop In Interest Rates

One of the biggest headlines of November 2022 is that mortgage rates saw the single biggest day drop. This is very good news, as we actually saw a reduction in interest rates last week. One of the reasons why is that the Feds started to recognize that inflation may not be under control, but we’re starting to bring down inflation a little bit.

You can see that in a few different areas, especially in the way that they’re adjusting some of the bonds and T-bills. I don’t know if a drop in interest rates is the start of a trend, as they’ll probably trickle back up. However, we may have seen the end of drastic increases. This year, we’ve seen the largest increase in mortgage interest rates, which just about doubled this year.

Year to date, we were close to the low 3% or so at the beginning of the year. Now, we’re in the high 6s, depending on the banking and the institution in the program you go to. While the mortgage interest rates are probably going to continue to drift—and maybe a little bit higher—I think most of the rapid increase is likely behind us.

Recessions And Real Estate Values

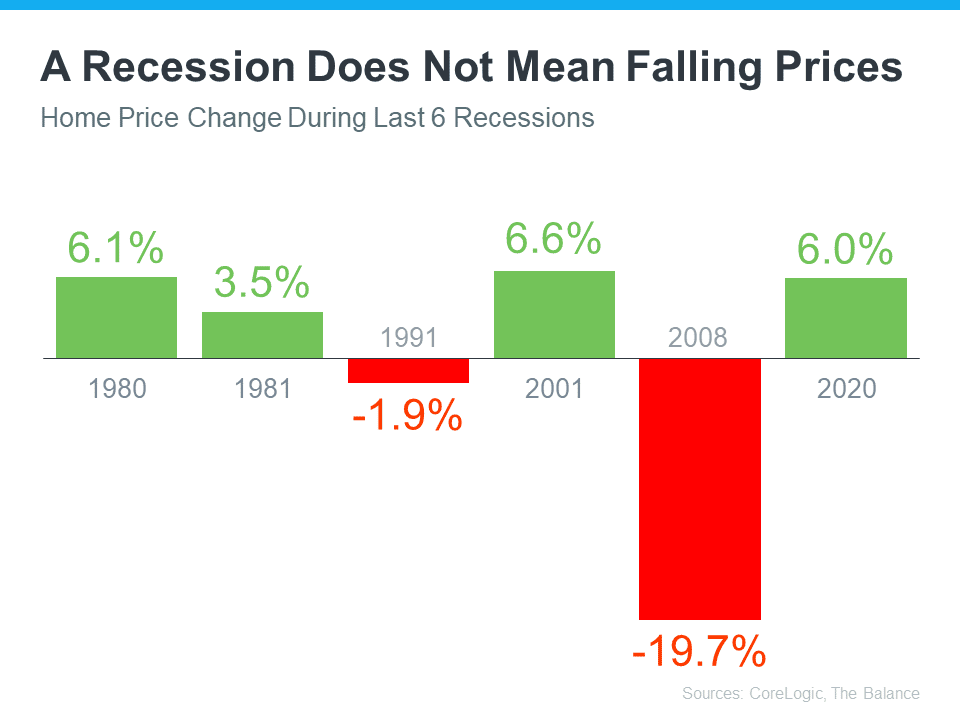

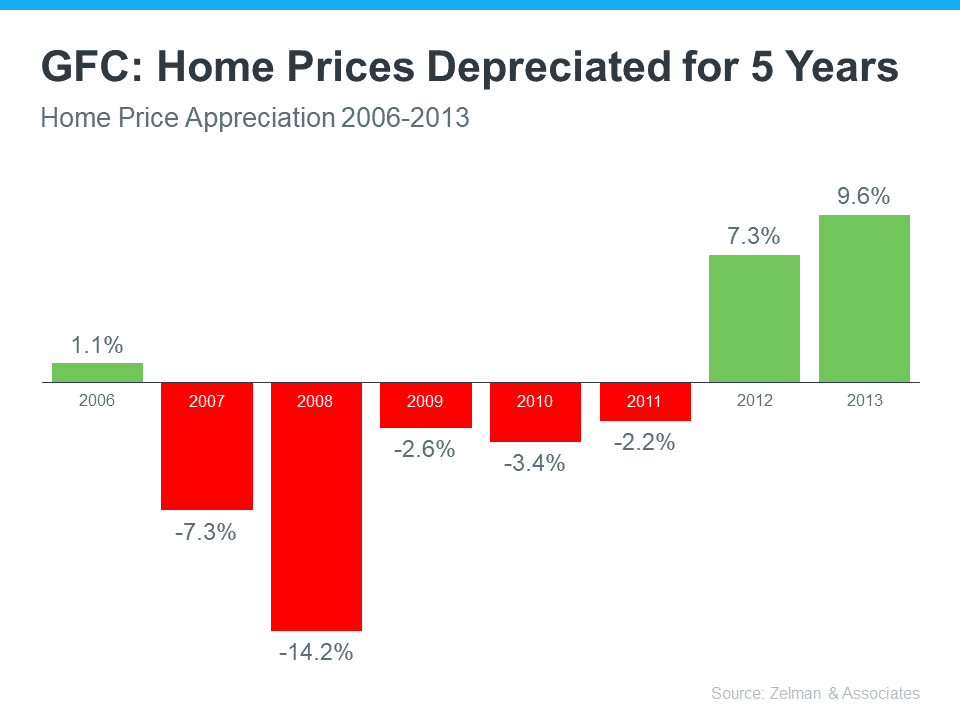

A lot of people out there are warning about a possible recession. However, we don’t know if a recession is actually going to happen or not. What we are concerned about is real estate values. Remember that, historically, only some recessions have included a drastic decrease in real estate values.

In fact, there were only two recessions where we saw a decrease in real estate or depreciation—and one of them wasn’t a big depreciation. We all remember the most recent recession in 2008, where we saw massive depreciation in real estate values. However, that’s just one time out of other recessions.

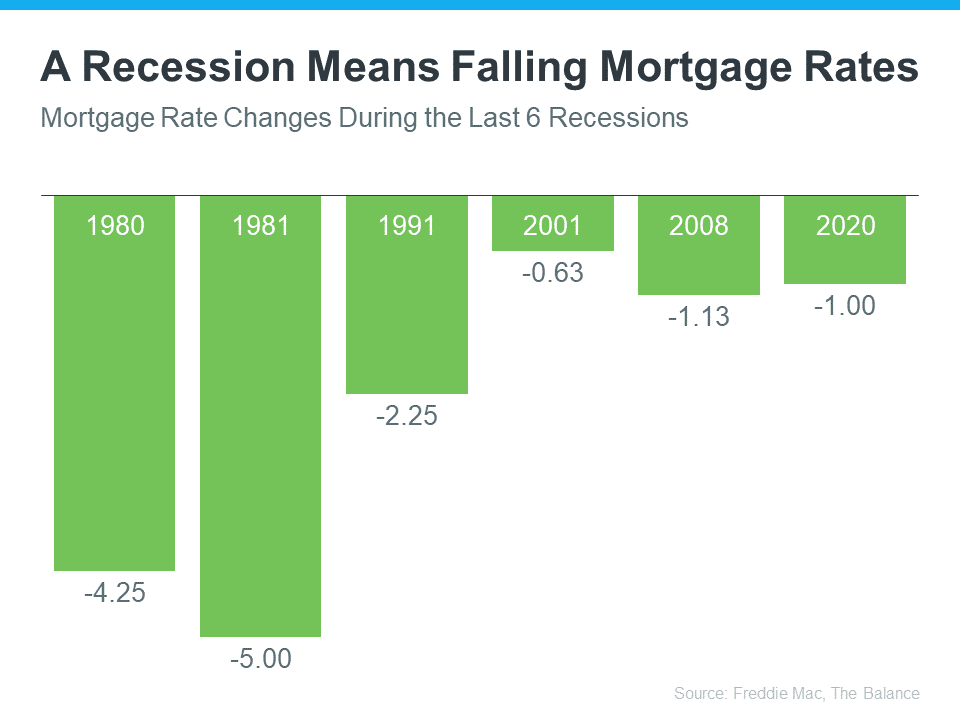

If we do see a recession, one of the good things is that typically mortgage rates will come down. If the Feds overcorrected and brought the economy to a halt by increasing rates, we’re going to have to do the exact opposite to get us out of the recession. This means they’re going to decrease rates.

Changes In Housing Costs

One of the things that I’m sharing with a lot of buyers right now is that there’s a difference between real estate values and cost. The value is how much equity you have in your house or what the purchase price is. The costs, though, are how much your monthly payment is going to be.

We may see a lot of changes in cost over the next year, and we already have this year. I don’t think that real estate values or purchase prices are going to change a whole lot. I think costs will continue to change, but values probably are not going to change much.

Supply, Demand, And Inventory

A lot of folks are waiting to buy a house because of the current market. However, for those eagerly awaiting home price crashes, you have to keep waiting as much as demand is pulling back. Supply is also reducing downward pressure on prices in the short run.

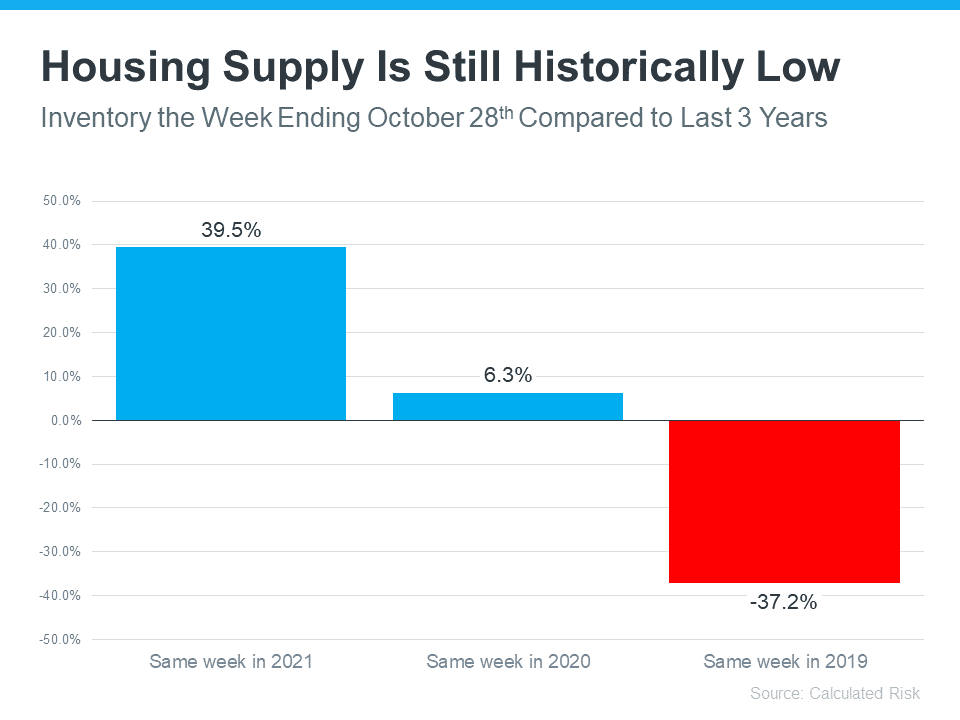

This means we’re still in a low inventory situation, and the number of homes for sale controls pricing. Because of this, we’re probably not going to see a big market crash or decline in values if inventory stays low.

Future Forecast

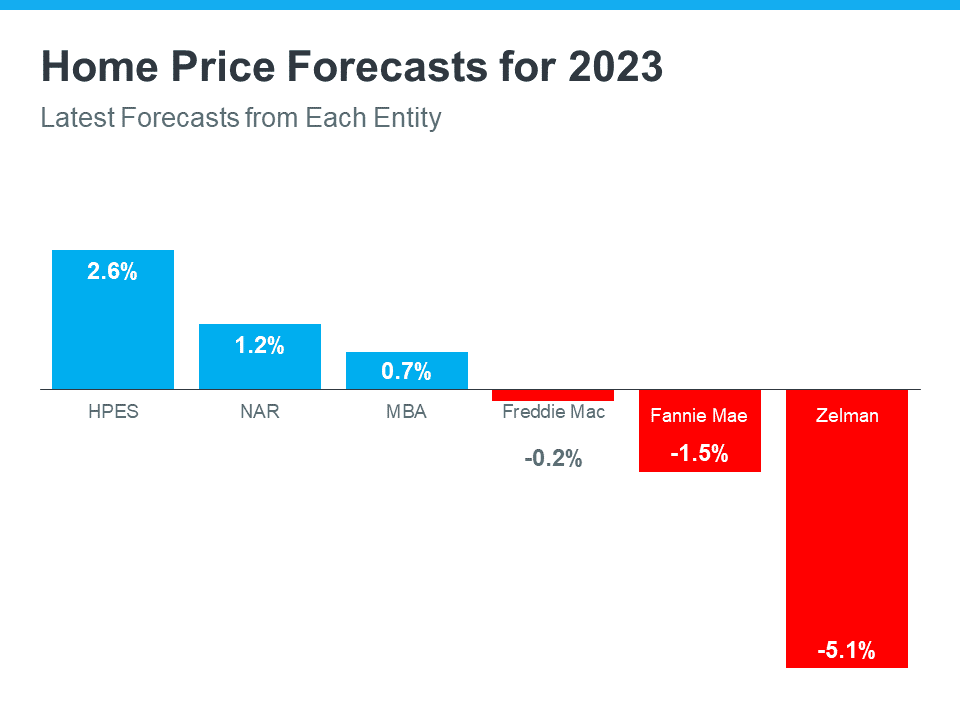

A few different entities are forecasting home prices next year across the US, looking at whether they’re going to be increasing or decreasing. While I think our market is going to be a little bit different, some institutions predict housing appreciation and some predict depreciation over the next year.

I think our area is going to be a little bit more protected. However, even if you took the average of these different institutions, you’re going to see a relatively neutral market. I don’t think we’re going to see the extreme ends of either of these spectrums, instead landing somewhere in the middle.

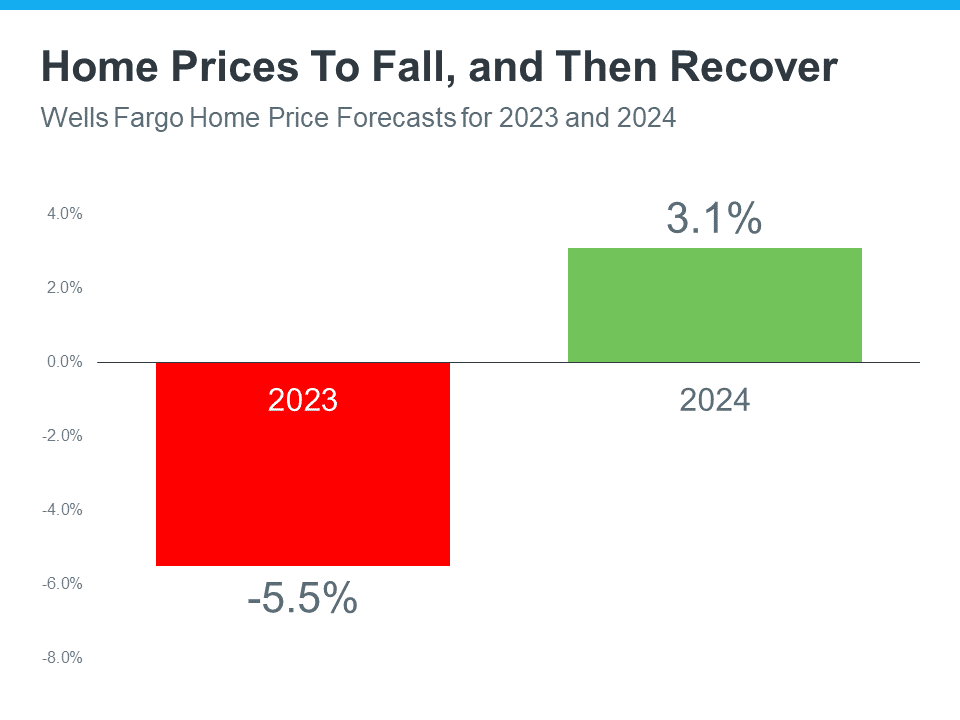

Wells Fargo predicts that home prices are going to dip down slightly in 2023 but go right back up in 2024. Also, you’re only talking about a couple of points here or there that we might see a swing in real estate values. This is nothing drastic like we saw in 2008, even if this were to happen. While I don’t agree with the 5.5%, I thought that it was an interesting prediction.

Examining The Data

The institutions that think values are going to come down also think they’re going to go right back up again. What is a big deal to me is that some of the numbers we’re looking at may be statistically small—such as a point or two of real estate values. However, they may have a huge impact on behavior, particularly when the media speaks up.

When there’s a 1% or 2% decline in home values, the media may make that look like a much bigger deal than it is. This is why it’s important to make sure that you’re getting your data from a trusted professional.

Will There Be Another Crash?

Even if properties depreciate again, they’re only predicting that for one year—not five consecutive years of depreciation like in 2008. I do not see any circumstance where that happens again. Again, this is because home prices and values are controlled by inventory.

As you’ve probably seen in the headlines, inventory is up. There are so many more houses for sale compared to extreme markets like the last year or two. This means we have far more inventory now than we did this time last year—though last year was some of the lowest inventory we’ve ever seen. We’re still far below a normal market like in 2019.

The inventory is still really low compared to a normal market when compared with 2021 and 2020—which weren’t normal. We’re still in a very, very low inventory condition and a seller’s market, believe it or not.

Deciding To Buy

One of the recommendations I make to a lot of people is that if you find a house, it meets your financial expectations, and you can afford it, you should probably buy it. If you’re going to wait for prices to fall but they never do, you may discover the hard way that the house you found a year ago—that you really loved and that you could have afforded but you passed up—is more expensive next year.

One of the things that are often said is the best time to buy a house was five years ago. A lot of people wait for lower prices, but it just never happens. In our local MLS, the number of properties for sale is much lower than it was in 2019. We’re still about half of that or less on the market. While it has increased from the beginning of the year, it’s still very low.

When comparing the number of buyers in New Jersey walking through the door to look at a house for sale now versus 2020 and 2021, we have fewer showings today than we had in the last two extreme years. This is still very good though I don’t know that we’re ever going to see the number of people walking through the door again as we saw in 2022, which was extremely high.

A Seller’s Market

Though the market has changed, there still are plenty of buyers walking through the door. If you’re a seller right now, it’s a great time to sell—but you will not be getting as many buyers as you did a year ago. It’s really important to make sure you price your home correctly, because you may not have 20 buyers walk through in a weekend. Instead, you may only have a handful.

If you’re a buyer, the same is true. You may not be competing with as many buyers, but it’s still a seller’s market. You just don’t have to compete with as many people. And while you might be paying a higher interest rate, you may also not have to go over asking price and beat out a bunch of other buyers.

I’m Here To Help

I hope this helps you understand what’s actually happening in the market right now. Just over the past couple of weeks, I’ve seen a little bit of everything. I’ve seen a multiple offer situation, something sell over asking price, something sell below asking price, and I’ve seen some sellers having a tough time selling because they haven’t priced correctly.

If you’re seller right now, it’s more important than ever to make sure you’re priced correctly. And if you’re a buyer, you have to be mindful of the situation you’re heading into. It may be more competitive than you think. Now is still a really good time in the market whether you’re a buyer or a seller, and the holidays can be a great time to actually see properties and be seen if you’re a seller. So if you need guidance, feel free to reach out to me and I’ll be happy to help.

If you like what you’re seeing in these videos, please make sure to subscribe to my channel for all things real estate here at the Jersey Shore. Stay tuned to see what I feature next!