Are you curious about what's happening in the real estate market for February 2023? In this video, I’m going to show you what’s going on this month at the Jersey Shore right before the Spring market. We’ll look at the numbers and find out what you can expect in the months to come.

A Competitive Market

One of the biggest questions we always get is, “How is the market?” Here we are in February 2023, right before the spring market. Every expert predicted the market was going to turn, and I just simply have not seen it happen yet.

Since the start of the year, we’re seeing competitive, multiple-offer situations once again. However, we’re not seeing the same amount of price increases or appreciation we saw before. Still, the market is very, very competitive. While it did slow down for a few months last year in October through December, I think we’ve seen some of the worst of the rate increases.

Inventory has actually decreased even further. Since there are fewer properties on the market, once again, many buyers are competing for a small select few properties. I’m going to jump into the numbers and show you exactly what that looks like. I’ll also touch a little bit more on where things ended last year.

Supply And Demand

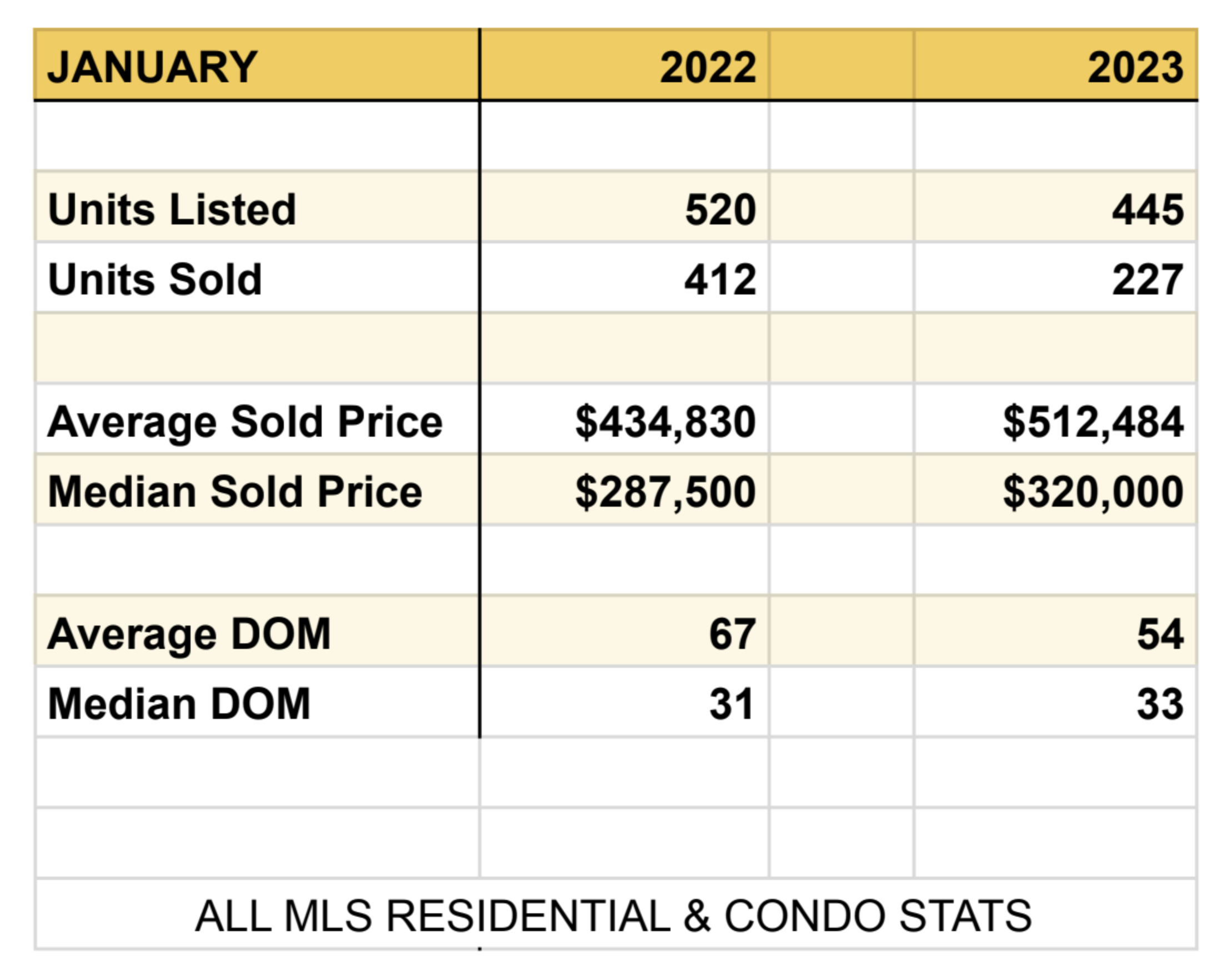

Just this past week, we’ve worked with multiple buyers and sellers in multiple offer situations. It’s just crazy to think that we’re still seeing this over three years now, but it’s really honestly the case. I don’t see it going anywhere anytime soon. Looking back on January, here’s a quick look at some of the MLS stats.

You’ll hear me say time and time again that the market is controlled by supply and demand. In real estate, this means inventory. How many houses are available is the supply, and the demand is how many buyers are available. If we look back at January 2022 compared to 2023, we will see that fewer homes have come onto the market and fewer homes have sold.

Sale Prices And Days On Market

At the end of 2022, we had far fewer transactions. All those sales in January had to go under contract in 2022 or late in the year. Here’s what’s interesting: prices have gone up pretty dramatically if you compare 2022 to 2023—both the average and median sale prices.

Additionally, this is for the entire MLS. Depending on the area, it might be a lot higher than this, particularly if you’re on one of the islands. For the most part, days on market are pretty similar. I like looking at the median days on market more so than the average, and it’s the same for sale prices. I think it’s a better indicator.

While they certainly haven’t gone up, they’re pretty close. It’s really not taking any longer for houses to sell right now in 2023 than it did in 2022.

Predictions For The Future

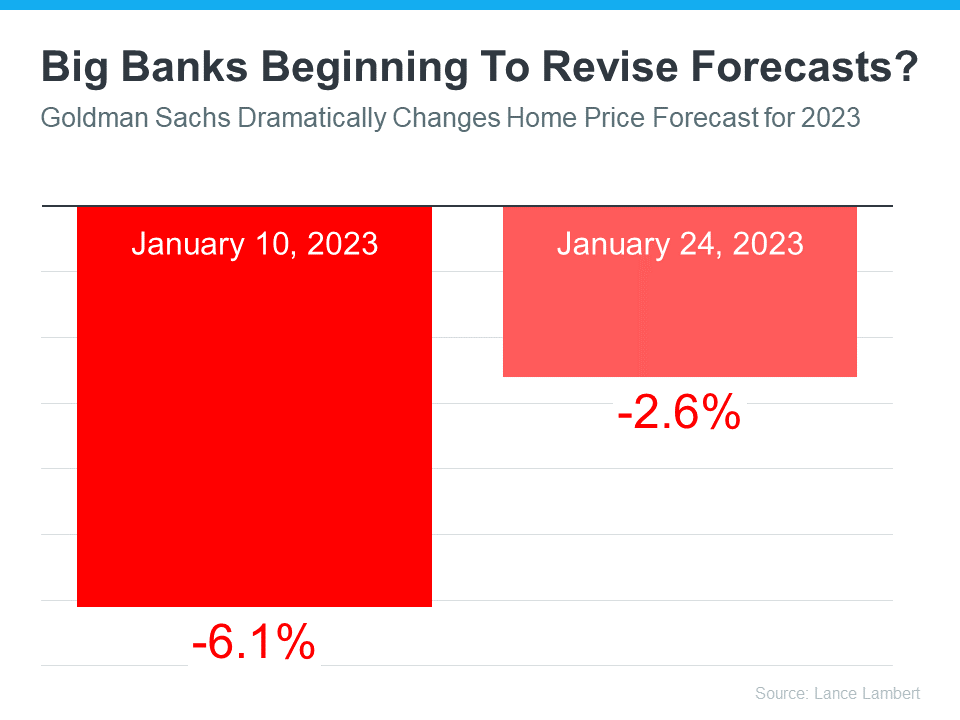

One of the big banks, Goldman Sachs, predicted on January 10th that we were going to see a 6% depreciation in home values. Just a couple of weeks later, on January 24, they came out and said they were revising this prediction.

They now think that prices are only going to depreciate by 2.6%, less than half of what they thought originally. I want to point out that even the experts are seeing that we might not see a price decline. They’re even backtracking on their predictions—and I am a little bit, too.

As of right now, I’m seeing that prices are going to be very competitive. They’re not going to go up at the same rate, but I’m not seeing any indication right now to tell me the prices are going to go down.

Inventory

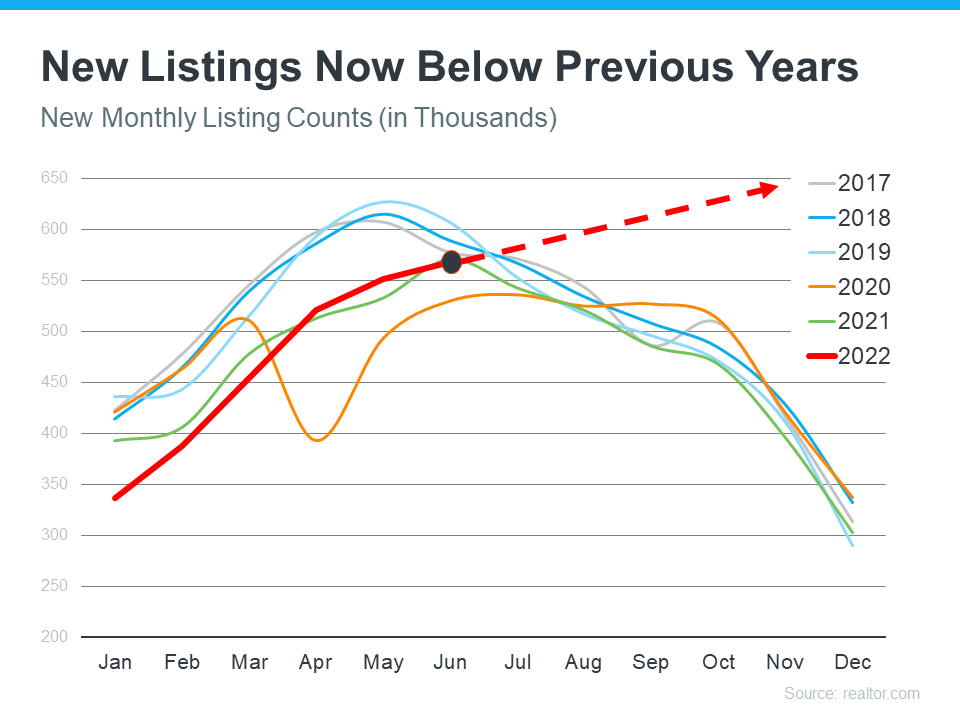

The reason prices are not going down is that inventory has gone down. This is for the entire US. However, you’ll see every January in the last few years that inventory has gone down. It’s very, very important because when they started increasing these interest rates, they thought it was going to bring down buyer demand.

Bringing down buyer demand was going to increase inventory—because there were not as many buyers. What they thought was going to happen was that inventory was just going to shoot up. What we actually saw happen is that inventory declined even further last year.

In 2022, we ended with inventory being weighed down. Again, how could we possibly see some type of price decline when inventory—or the supply—is so low and the demand hasn’t lowered by as much as they thought it would?

Interest Rates

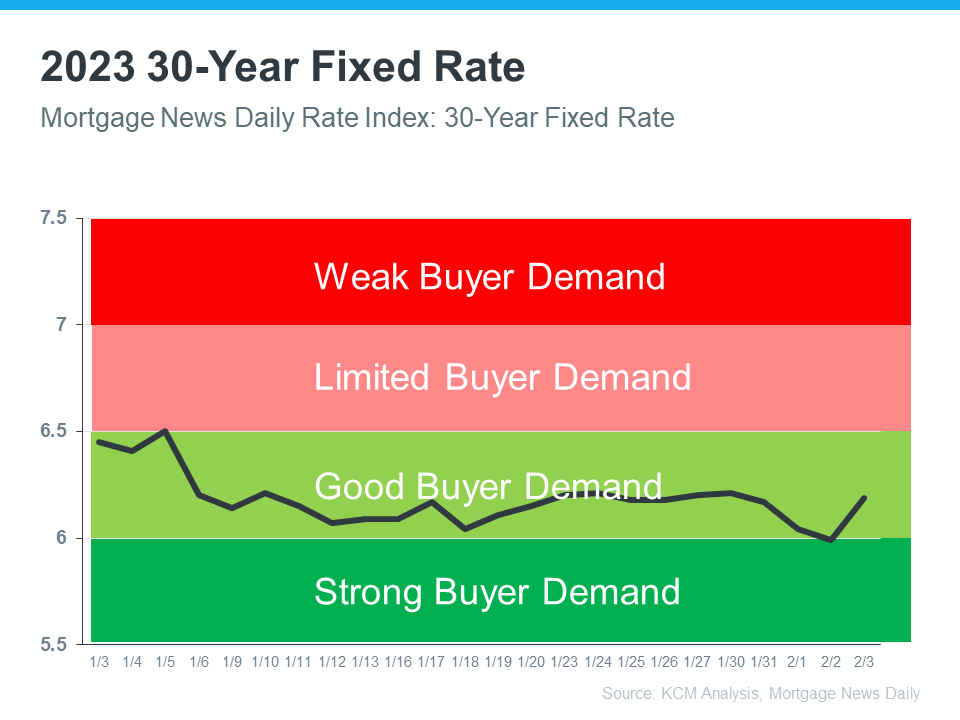

What we’ve been seeing with interest rates is that they’ve actually been trending down for a couple of weeks. Then, they’ve jumped back up and back down. There is enough data to say that maybe we have seen the worst of the rate increases, which might be settling around 6% or 6.5%. They may even go down to 5.5%.

I think we’ve seen some of the big surges, and we’re probably done with them. The point of increasing those interest rates was to bring down buyer demand—but we just haven’t seen it. We’re still at a level where we have really good demand, which means multiple offers and bidding wars.

That’s going to be even stronger when we have low inventory. Supply is very, very low and demand is still pretty strong despite the interest rates.

What’s Next?

I hope you enjoyed this look at the data and numbers so you can see exactly what’s happening in today’s real estate market—not only in the United States but also right here in the South Jersey Shore. If you have any questions, feel free to reach out to me and I’ll be happy to connect.

Thanks for watching this video. If you like what you’re seeing and the content you’re receiving, please make sure to subscribe. That way you’re alerted to all things Jersey Shore real estate. I’ll see you on the next one!